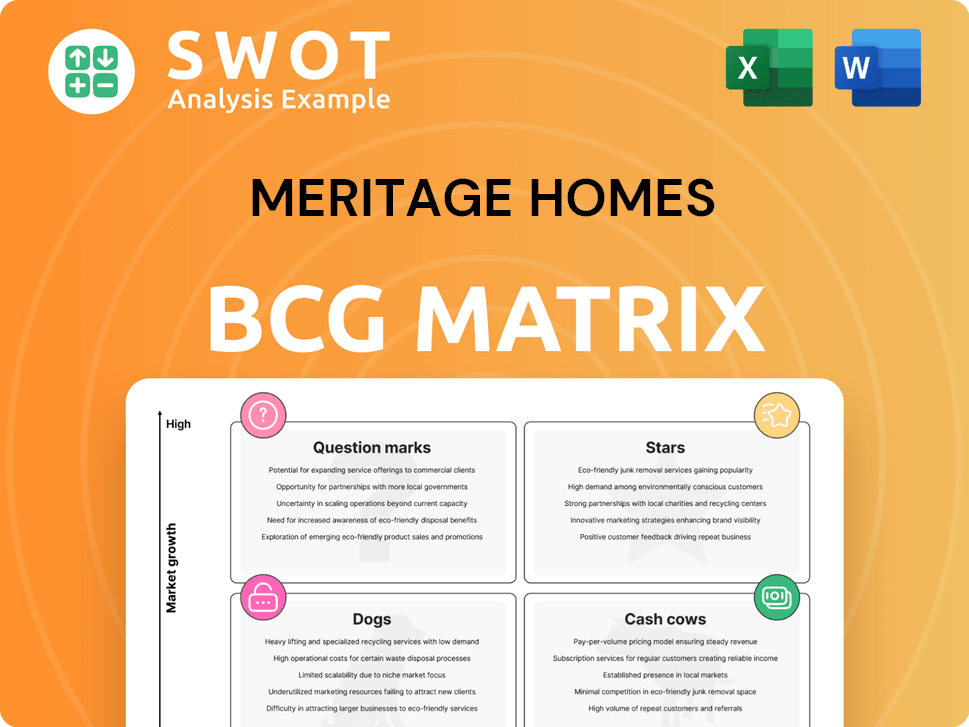

Meritage Homes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Meritage Homes Bundle

What is included in the product

Tailored analysis for Meritage Homes' product portfolio across the BCG matrix.

Easily switch color palettes for brand alignment across departments.

Delivered as Shown

Meritage Homes BCG Matrix

The BCG Matrix previewed is the identical file you'll receive from Meritage Homes after your purchase. This comprehensive report, without alterations, offers strategic insights and immediate usability for your analyses.

BCG Matrix Template

Meritage Homes likely has a diverse portfolio of home types, ranging from entry-level to luxury. Understanding where each product falls within the BCG Matrix is vital for resource allocation. Stars could be rapidly growing home styles in high-demand areas. Cash Cows might be established models in stable markets, providing steady profits. Are there any potential Dogs that need to be re-evaluated or divested? Knowing this is key to success. Purchase the full BCG Matrix for a comprehensive view.

Stars

Meritage Homes' emphasis on move-in ready homes is a strategic win. This strategy allows them to quickly meet buyer needs. Having a strong inventory of completed homes lets Meritage capitalize on market opportunities. In Q3 2024, Meritage reported a 3% increase in homes closed compared to the prior year, validating this approach.

Meritage Homes strategically targets entry-level homes, a segment with strong demand and constrained supply. This focus enables them to capture a large share of the first-time homebuyer market. In 2024, this segment saw robust activity. Such as 2024 Q1, Meritage's home closings rose to 2,801 from 2,600 in 2023 Q1. This approach secures a consistent flow of sales and revenue, which is beneficial.

Meritage Homes' land acquisition is a strategic move, ensuring a robust development pipeline. In 2024, they invested heavily in land and lot control, a key driver for long-term growth. This strategy is vital for expanding market share. In Q3 2024, Meritage held approximately 75,000 lots owned or controlled, signaling their commitment.

Energy-Efficient Homebuilding

Meritage Homes shines as a "Star" in the BCG matrix, primarily due to its strong focus on energy-efficient homebuilding. This dedication has earned them accolades, setting them apart in the competitive market. Their eco-friendly homes attract buyers concerned about the environment and offer long-term cost savings. This strategy boosts their brand image and captures a specific customer segment.

- Meritage Homes has won numerous awards for its energy-efficient designs.

- Energy-efficient features can reduce homeowner utility bills by up to 30%.

- In 2024, the demand for sustainable homes increased by 15%.

- Meritage Homes' stock saw a 10% rise in Q3 2024 due to positive market trends.

Strong Backlog Conversion Rate

Meritage Homes excels in converting its backlog into closed sales, a sign of effective sales strategies. This efficiency highlights Meritage's ability to meet customer demand and manage its sales pipeline effectively. The strong conversion rate reflects positively on operational excellence and customer satisfaction, crucial for sustainable growth. In 2024, Meritage Homes reported a backlog conversion rate of approximately 80%.

- High conversion rates show efficient sales and order fulfillment.

- It indicates strong customer demand and satisfaction with Meritage's offerings.

- The company's ability to turn backlogs into sales is a key strength.

- This efficiency contributes to sustained revenue and profitability.

Meritage Homes' energy-efficient designs and sustainable building practices position it favorably in the "Star" quadrant. These features attract environmentally conscious buyers. This focus contributes to strong brand recognition and customer loyalty, as evidenced by rising stock value.

| Aspect | Details | 2024 Data |

|---|---|---|

| Awards | Energy-efficient designs | Won numerous awards |

| Efficiency | Utility bill savings | Reduces utility bills by up to 30% |

| Demand | Sustainable homes | Demand increased by 15% |

Cash Cows

Meritage Homes boasts a strong presence in key U.S. markets, fueling stable revenue. Their established footprint allows for consistent operations and sales. This market expertise helps maintain steady performance and navigate economic shifts. In 2024, Meritage reported revenues of $6.7 billion.

Meritage Homes' financial services, including mortgage and title operations, generate extra revenue and boost home sales. These services improve the customer experience and offer more profit opportunities. This integrated strategy can boost customer satisfaction and loyalty. In 2024, Meritage Homes reported a gross margin of 23.9%. Their focus on financial services supports this profitability.

Meritage Homes' active adult communities are designed for a specific demographic, meeting their unique housing demands. These communities generate consistent revenue, supporting the company's financial health. With a focus on stability, this market segment offers growth potential, as seen in the 2024 revenue. In Q1 2024, Meritage's active adult communities saw a 10% increase in sales. The company's strategic investment in these communities reflects their importance.

Share Repurchase Program

Meritage Homes' share repurchase program is a key indicator of its financial strength. This program boosts shareholder value and signals stability. It shows Meritage's commitment to returning capital, which can attract investors. The company's strategy includes this initiative to manage its capital effectively.

- In 2024, Meritage Homes repurchased shares, reflecting confidence.

- Share repurchases can boost earnings per share (EPS).

- This action highlights Meritage's robust financial position.

Dividend Payments

Meritage Homes' consistent dividend payments are a hallmark of a Cash Cow, offering shareholders a reliable income stream. These payments signal financial health and a dedication to shareholder value, attracting a diverse investor base. In 2024, the company's dividend yield was approximately 1.5%. This strategy bolsters Meritage Homes' attractiveness in the market.

- Dividend payments provide a stable return for shareholders.

- They reflect the company's financial stability.

- Attracts income-focused investors.

- Enhances overall investor appeal.

Meritage Homes, a Cash Cow, demonstrates strong profitability and steady cash flow. They focus on mature markets and financial services to ensure stable returns. In 2024, their financial health was evident through consistent dividends and share repurchases.

| Financial Metric | 2024 Performance | Significance |

|---|---|---|

| Revenue | $6.7 billion | Indicates stable market position |

| Gross Margin | 23.9% | Reflects operational efficiency |

| Dividend Yield | Approx. 1.5% | Attracts income investors |

Dogs

Meritage Homes faces a challenge as the effective income tax rate rose in Q1 2024 due to fewer homes qualifying for energy tax credits. This increase, from 23.6% in Q1 2023 to 24.8% in Q1 2024, directly impacts net earnings. Reduced profitability could lead to negative investor reactions. This situation underscores the importance of adjusting to evolving regulations and incentives to maintain financial health.

Meritage Homes faces a "Dog" situation due to declining average sales prices. In Q4 2023, the average sales price decreased, likely due to incentives. This drop, impacting revenue and margins, indicates pricing pressure. Cost management and strategic adjustments are vital in this competitive environment.

Meritage Homes' Q1 2025 home closing volume saw a decrease, signaling slower sales. This downturn, possibly due to market shifts or competition, needs attention. Sales and marketing efforts should be ramped up to stimulate demand. For instance, in Q4 2024, Meritage reported 1,746 homes closed, a decrease from 2,365 in Q4 2023.

Shrinking Order Backlog

Meritage Homes' shrinking order backlog is a key concern, reflecting potentially lower future demand. This decline directly impacts future revenue streams and profitability projections. It necessitates proactive measures to boost sales and rebuild the backlog. In Q3 2024, Meritage Homes' net orders decreased by 29% year-over-year, highlighting the urgency.

- Lower future demand signals potential revenue declines.

- Profitability may be at risk due to reduced sales volume.

- Strategies are needed to increase sales and replenish the backlog.

- Q3 2024 net orders decreased by 29% year-over-year.

Increased Debt-to-Capital Ratio

A rising debt-to-capital ratio for Meritage Homes, categorized as a "Dog" in the BCG matrix, signals heightened financial leverage. This can amplify financial risk, potentially restricting the company's flexibility and increasing borrowing expenses. Prudent debt management becomes crucial in such scenarios. For instance, in Q3 2023, Meritage Homes reported a debt-to-capital ratio of 42.1%, up from 36.6% the previous year, reflecting increased reliance on debt financing.

- Increased financial leverage elevates financial risk.

- Reduced financial flexibility and potential higher borrowing costs.

- Necessitates careful debt management strategies.

- Example: Meritage Homes' debt-to-capital ratio rose to 42.1% in Q3 2023.

Meritage Homes is classified as a "Dog" in the BCG matrix, indicating low market share and low growth. This status is reflected in several financial challenges, like declining sales. The company's high debt-to-capital ratio, which reached 42.1% in Q3 2023, reinforces this assessment.

| Metric | Status | Impact |

|---|---|---|

| Average Sales Price (Q4 2023) | Decreasing | Reduced revenue and margins. |

| Net Orders (Q3 2024) | Down 29% YoY | Lower future revenue. |

| Debt-to-Capital Ratio (Q3 2023) | 42.1% | Heightened financial risk. |

Question Marks

Meritage Homes' expansion into new markets, like the Gulf Coast, is a question mark in the BCG matrix. These expansions demand substantial upfront investments, potentially delaying profitability. Success hinges on meticulous market analysis and effective management strategies. In 2024, Meritage Homes' revenue was approximately $7.7 billion, with a net income of around $580 million, reflecting the financial stakes involved in these ventures.

Meritage Homes' financial services segment experiences modest growth, yet its impact on total revenue remains limited, presenting an uncertain future. In 2024, this segment contributed approximately 2% to the company's overall revenue. Strategic investment and development could boost value. Evaluating market demand and competition is crucial for any growth strategy.

Meritage Homes' move towards affordable housing targets first-time buyers, potentially boosting sales volume. This strategic shift could squeeze profit margins if construction expenses rise faster than home prices. A key challenge is balancing affordability with profitability, necessitating careful cost control. In Q3 2024, Meritage reported a gross margin of 21.9%, reflecting these pressures.

Technology Investments

Meritage Homes' investments in technology are classified as question marks within the BCG matrix, representing high-growth potential but uncertain returns. Increased tech spending aims to boost operational efficiency and enhance customer experiences. Assessing the return on investment and ensuring alignment with business goals is critical for success. In 2024, Meritage Homes allocated a significant portion of its capital towards technological advancements.

- Focus on digital tools for home design and sales.

- Investments in smart home technologies to attract buyers.

- Implementation of data analytics for improved decision-making.

- Emphasis on cybersecurity to protect customer data.

Spec Building Strategy

Meritage Homes' spec building strategy falls into the "Question Mark" quadrant of the BCG Matrix. This approach, where homes are built without a pre-sold contract, can be lucrative in a strong market, allowing quick sales and capitalizing on demand. However, it also exposes Meritage to significant risk if market conditions deteriorate, potentially leading to unsold inventory and reduced profitability. The success of this strategy hinges on accurate market analysis and flexible production adjustments.

- Spec building allows quick responses to market demand.

- Overbuilding can lead to financial losses.

- Careful market monitoring is essential.

- Flexible production planning is crucial.

Meritage Homes' initiatives in new markets and technological advancements are "Question Marks," requiring significant investments. These strategies carry high growth potential but uncertain returns. Spec building also falls into this category, posing risks alongside opportunities. In 2024, Meritage allocated a large portion of capital to tech with Q3 gross margin at 21.9%.

| Strategy | Risk | Reward |

|---|---|---|

| New Markets | High upfront costs. | Revenue Growth |

| Technology | Uncertain ROI. | Increased Efficiency |

| Spec Building | Market downturns. | Quick sales, profit |

BCG Matrix Data Sources

The Meritage Homes BCG Matrix leverages public financial filings, market share analyses, and industry reports for data accuracy.