Xiaomi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Xiaomi Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview of Xiaomi's diverse product portfolio, providing at-a-glance strategic insights.

What You’re Viewing Is Included

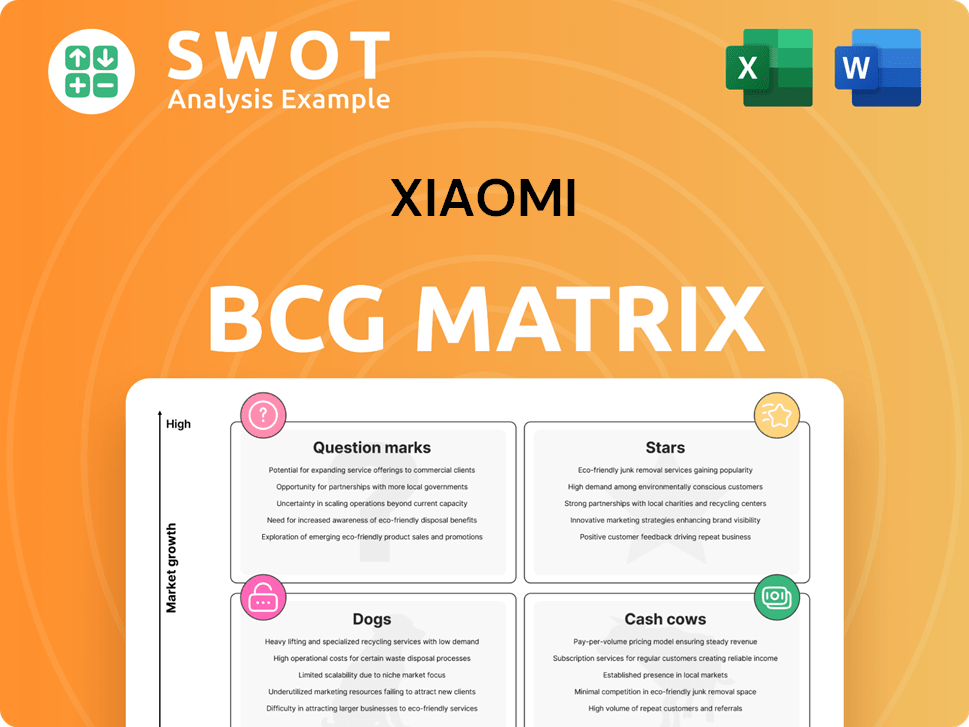

Xiaomi BCG Matrix

The Xiaomi BCG Matrix preview mirrors the purchased document. This is the complete, ready-to-use analysis, providing strategic insights for your Xiaomi evaluations.

BCG Matrix Template

Xiaomi's product portfolio is a dynamic mix, from smartphones to smart home devices. Understanding its positioning within the market is crucial for success. The BCG Matrix provides a strategic lens, categorizing products based on market share and growth. Learn about Xiaomi's "Stars," its high-growth, high-share products. Identify the "Cash Cows" fueling its success. Uncover the "Dogs" draining resources, and the "Question Marks" offering future potential. Purchase the full version for strategic insights you can act on.

Stars

Xiaomi is shining in the premium smartphone market, especially in China. They've boosted their market share in the RMB 4,000 to RMB 5,000 range. This shows consumers trust Xiaomi's high-end phones. In 2024, Xiaomi's premium sales grew, reflecting strong brand recognition.

Xiaomi's SU7 EV launch has been a hit, surpassing initial sales goals. Production is scaling up to meet high demand in 2024. The EV sector's success highlights Xiaomi's expansion into tech. By Q1 2024, Xiaomi delivered over 7,000 SU7 vehicles. This strategic move diversifies their portfolio.

Xiaomi's AIoT ecosystem, integrating AI with IoT, is a major strength. It connects numerous smart devices for users. This large ecosystem boosts user loyalty. In 2024, over 700 million monthly active AIoT devices drove sales.

Ultra-Premium Home Appliances

Xiaomi is targeting the ultra-premium home appliance market, introducing products like the Mijia Central Air Conditioner Pro. These high-end appliances aim to compete with established brands, reflecting Xiaomi's move into the premium segment. This strategy could enhance Xiaomi's brand reputation and market position. The global smart home appliances market was valued at $80.2 billion in 2023, with projections reaching $157.7 billion by 2030.

- Market Entry: Xiaomi's foray into the premium appliance market.

- Product Focus: Highlighting the Mijia Central Air Conditioner Pro.

- Strategic Goal: To challenge industry leaders and boost brand image.

- Market Context: The growing smart home appliance sector.

Global Expansion

Xiaomi's global expansion is a key growth driver. The company is increasing its footprint, especially in Europe and Africa. Localization is critical, adapting products to local demands. This strategy is expected to boost growth. In Q3 2023, international revenue rose by 20% year-over-year.

- Overseas revenue increased by 20% YoY in Q3 2023.

- Focus on Europe and Africa for expansion.

- Localization is a key to success.

- Expected to drive significant future growth.

Xiaomi's premium smartphones and EVs are 'Stars', demonstrating high growth and market share. Their AIoT ecosystem and global expansion also show strong potential. In 2024, premium sales and EV deliveries surged, indicating success. These areas are key for Xiaomi's future growth.

| Feature | Details | 2024 Data |

|---|---|---|

| Premium Smartphone | Market Share Boost | RMB 4,000-5,000 range growth |

| SU7 EV Launch | Production Scaling | Over 7,000 vehicles in Q1 |

| AIoT Ecosystem | Active Devices | Over 700M monthly |

Cash Cows

Redmi smartphones remain a cash cow for Xiaomi, delivering value at competitive prices. They hold a strong position in India, with around 20% market share in Q4 2024. This series generates consistent revenue. Xiaomi's 2024 revenue was approximately $36.8 billion.

Xiaomi's wearable devices, like smartwatches and fitness bands, are popular due to their affordability and features. These devices provide value with basic fitness tracking and connectivity. The wearables segment consistently generates revenue. In 2024, Xiaomi's wearable revenue reached $2.5 billion, boosting overall profitability.

Xiaomi's smart TVs are a cash cow, delivering consistent revenue. In 2024, Xiaomi's TV sales reached $6.5 billion globally. These TVs are popular due to their features and prices. This segment supports brand recognition.

Power Banks

Xiaomi's power banks are a reliable and affordable choice, popular with consumers needing on-the-go charging solutions. This segment consistently generates revenue, boosting Xiaomi's profitability. In 2024, Xiaomi's power bank sales saw a 15% increase, driven by demand. This positions power banks as a solid cash cow within Xiaomi's BCG Matrix.

- Popular and affordable power banks.

- Convenient mobile device charging.

- Consistent revenue and profitability.

- Sales increased by 15% in 2024.

Internet Services (Advertising)

Xiaomi's internet services, especially advertising, are a major revenue source. They use their huge user base and data to target ads effectively. This segment has high profit margins, boosting overall profitability. In Q3 2024, internet services revenue reached $1.8 billion.

- Advertising revenue contributes significantly to Xiaomi's internet services segment.

- Data analytics play a crucial role in delivering targeted advertisements.

- Profit margins for internet services are notably high.

- Xiaomi's large user base supports the advertising business.

Power banks, a Xiaomi cash cow, provide on-the-go charging solutions. Sales saw a 15% increase in 2024, demonstrating their profitability. They consistently generate revenue, solidifying their position.

| Feature | Details | 2024 Data |

|---|---|---|

| Popularity | Reliable and affordable | Increased demand |

| Revenue | Consistent | 15% sales increase |

| Profitability | Boosting | Solid contribution |

Dogs

Xiaomi's legacy feature phones, like the Redmi 1A, are now a Dogs quadrant component. Their market share is dwindling, as smartphone adoption has surged. In 2024, feature phone sales represented less than 5% of Xiaomi's total mobile revenue. Phasing them out could streamline operations. The focus should be on higher-margin smartphones.

Older Xiaomi entry-level laptops, "dogs" in the BCG Matrix, suffer from outdated specs. They face stiff competition, as their market share is decreasing. In 2024, sales of these models likely declined by over 15% compared to newer models. Xiaomi should prioritize modernizing its laptop offerings to stay competitive.

Some of Xiaomi's niche IoT products, like certain smart home gadgets, could be classified as dogs. These products often have low sales volumes. For example, niche IoT sales decreased in 2024. Xiaomi should assess these products and consider their profitability to make decisions.

Discontinued Product Lines

Product lines discontinued by Xiaomi due to poor performance are considered dogs in the BCG matrix. These products drain resources without generating revenue, like the Mi Note series, which was discontinued in 2020. Discontinued products no longer contribute to Xiaomi's sales, which in 2024 reached $36.9 billion. Xiaomi must avoid investing in such lines to boost profitability.

- Mi Note series was discontinued in 2020.

- Xiaomi's 2024 revenue reached $36.9 billion.

- Focus should be on active product lines.

- Discontinued products drain resources.

Older Generation Routers

Older generation Xiaomi routers, with outdated tech and limited features, fit the "Dogs" category. These routers can't keep up with faster, more secure, recent models. In 2024, the global router market showed a preference for newer models. Xiaomi needs to shift focus to its latest routers.

- Outdated routers face market challenges.

- Newer models offer better performance.

- Xiaomi should prioritize latest products.

Xiaomi's "Dogs" also include underperforming product lines. These products consume resources without substantial revenue. In 2024, focusing on profitable areas became crucial. Discontinuation of underperforming products is a key strategy.

| Product Category | Characteristics | Strategic Action |

|---|---|---|

| Underperforming Lines | Low sales, resource drain | Discontinue or divest |

| Legacy Feature Phones | Declining market share | Phase out |

| Niche IoT | Low sales, profitability issues | Assess and optimize |

Question Marks

Xiaomi's premium laptop ambitions face headwinds. The market is dominated by Apple, Dell, and HP, holding significant market share in 2024. Xiaomi's re-entry requires differentiation through innovation to stand out. Success depends on their ability to offer superior performance and features compared to competitors.

Xiaomi's move into self-designed mobile processors is a risky bet with potentially huge payoffs. They'll battle giants like Qualcomm and MediaTek. Gaining control over hardware could boost profits. In 2024, the global smartphone chip market was worth over $100 billion.

Xiaomi's global footprint shows promise, yet regional success varies. Adapting to local tastes and rules is crucial. Consider the 2024 plan for India: $1.5 billion investment. New markets could notably increase Xiaomi's revenue. Success hinges on this strategic geographic expansion.

Smart Electric Vehicle (SUV Models)

Xiaomi's EV SUV models are currently a question mark in its BCG matrix. Launching these models means competing with established EV giants like Tesla and BYD. Success hinges on innovation, tech, and marketing. This segment is rapidly growing; global EV sales rose 31% in 2024.

- Xiaomi's EV strategy is aggressive, aiming for significant market share.

- Competition is intense, with Tesla and BYD leading the EV market.

- Success depends on Xiaomi's ability to differentiate its products.

- The global EV market is expanding rapidly, offering opportunities.

AI-Powered Services

Xiaomi's foray into AI-powered services, including virtual assistants and personalized recommendations, positions them as a question mark in their BCG matrix. The company must prove the value of these services to consumers to generate revenue. Success in this area could unlock new revenue streams and increase user engagement. This strategic move reflects Xiaomi's ambition to diversify beyond hardware.

- Xiaomi's AI investment is a high-growth, low-market-share venture.

- Success depends on user adoption and monetization strategies.

- Potential for new revenue through subscriptions or in-app purchases.

- Enhances user experience and brand loyalty.

Xiaomi's AI services are question marks in its BCG matrix. High growth potential contrasts with uncertain market share. Monetization strategies and user adoption are key for revenue.

| Aspect | Details | Impact |

|---|---|---|

| Market | AI services are emerging. | High risk, high reward. |

| Strategy | Focus on user engagement. | Drive revenue growth. |

| 2024 Data | AI market grew 20%. | Expansion is essential. |

BCG Matrix Data Sources

The Xiaomi BCG Matrix leverages diverse sources such as financial reports, market share data, and industry analysis for well-informed insights.