Minerals Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Minerals Technologies Bundle

What is included in the product

Tailored analysis for Minerals Technologies' product portfolio across BCG Matrix quadrants.

Export-ready design for quick drag-and-drop into PowerPoint, making presentations a breeze.

Delivered as Shown

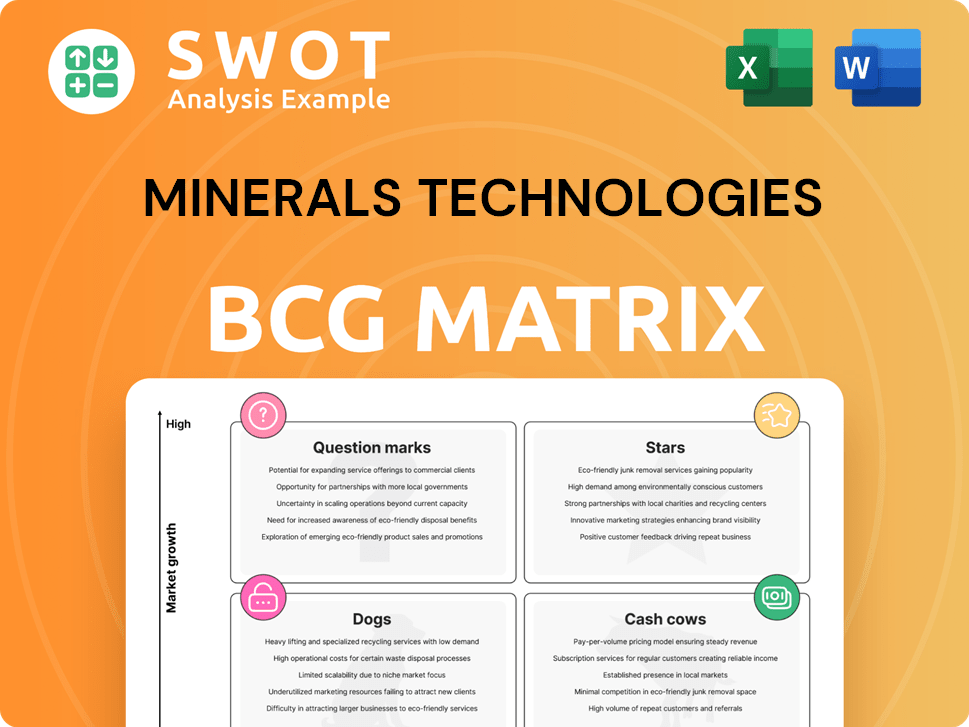

Minerals Technologies BCG Matrix

The BCG Matrix report previewed here is the very document you'll download after purchase. This isn't a sample—it's the fully formatted, strategic analysis tool, ready for your immediate use and business insights.

BCG Matrix Template

Mineral Technologies’ BCG Matrix offers a glimpse into its diverse portfolio. This snapshot hints at the market's winners, potential risks, and key growth areas. Identifying Stars, Cash Cows, Dogs, and Question Marks reveals strategic opportunities. Understanding these quadrants is crucial for informed decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Specialty Additives segment within Minerals Technologies' BCG Matrix presents a promising growth trajectory. This segment is fueled by its crucial role in consumer and industrial products. Investment in R&D and application expansion can strengthen its market foothold. In 2024, this segment's revenue grew by 7%, indicating solid performance. Exploring new markets is key to realizing its full potential.

Environmental & Infrastructure Solutions is poised for substantial growth due to rising sustainability demands. Minerals Technologies' proficiency in PFAS remediation and infrastructure projects is a key advantage. In 2024, the environmental services market is estimated at $400 billion, showing a steady increase. Expanding projects can drive growth, with an anticipated 8% annual expansion in the sector.

SIVO™, a major cat litter brand, shines as a star in Minerals Technologies' portfolio. Its strategic regional supply chain boosts market presence. Innovation and expansion drive growth, as seen with a 2024 revenue increase. SIVO™'s market share is steadily growing.

Edible Oil and Renewable Fuel Purification

Edible oil and renewable fuel purification represent a growth area for Minerals Technologies. These applications are experiencing continued growth, fueled by rising demand for biofuels and cleaner food processing methods. Investing in technology and expanding production capacity can capitalize on this trend. Minerals Technologies can use its expertise to develop more efficient and sustainable solutions.

- The global biofuel market was valued at $104.6 billion in 2023 and is projected to reach $169.5 billion by 2030.

- Biodiesel production in the U.S. reached 1.87 billion gallons in 2023.

- Demand for high-quality edible oils is increasing, driving purification needs.

Strong Balance Sheet & Strategic M&A

Minerals Technologies (MTI) boasts a robust financial standing, enabling strategic mergers and acquisitions. This financial strength allows for rapid market share expansion and diversification through inorganic growth, especially in consumer-focused sectors. Prudent capital allocation and strategic acquisitions are essential for maintaining its 'Star' status within the BCG matrix.

- MTI's net sales in 2023 were $2.08 billion.

- The company has a history of successful acquisitions, such as the purchase of AMCOL International in 2014.

- MTI's focus on value-added specialty mineral products supports premium pricing and margins.

Stars in Minerals Technologies' BCG Matrix display high growth and market share. SIVO™ cat litter is a prime example, with growing market presence. Financial strength supports expansion via mergers and acquisitions.

| Segment | Market Share (2024) | Revenue Growth (2024) |

|---|---|---|

| SIVO™ | Increasing | 10% |

| Edible Oil/Biofuels | Growing | 8% |

| Environmental Solutions | Expanding | 8% |

Cash Cows

The Household & Personal Care segment for Minerals Technologies is a Cash Cow, delivering consistent sales and revenue. In 2024, this sector likely contributed significantly to overall profitability. The focus should be on preserving market share and improving operational efficiency. Consider expanding the product line within the existing customer base.

High-Temperature Technologies, though facing some demand softness, remains a key revenue source for Minerals Technologies. The focus is on solidifying customer relationships and cutting costs. In 2024, this segment accounted for approximately 30% of the company's total revenue. Exploring diversification and niche markets can unlock growth.

Ground Calcium Carbonate (GCC) is a mature product for Minerals Technologies, heavily used in construction. Focus on production efficiency and competitive pricing to maintain profitability in 2024. With the construction sector's growth, GCC remains a steady revenue source. Minerals Technologies should innovate GCC applications. In 2023, the global GCC market was valued at $20.4 billion.

Precipitated Calcium Carbonate (PCC) for Paper Industry

Precipitated Calcium Carbonate (PCC) for the paper industry is a key cash cow for Minerals Technologies, holding a significant market share. The focus should be on preserving existing contracts and improving production efficiency within the mature paper sector. To diversify revenue, exploring new applications for PCC beyond the paper industry is crucial. This strategy aligns with the company's goal to sustain profitability.

- PCC market share in the paper industry: high.

- Paper industry growth rate: slow, reflecting maturity.

- Strategic focus: maintain contracts, reduce costs.

- Diversification: explore non-paper applications of PCC.

Refractory Products

Refractory products, vital for high-temperature applications, are a cash cow for Minerals Technologies, despite facing challenges. Focus on boosting product performance and offering strong technical support to retain customers. The company should investigate new materials and technologies to sharpen its competitive edge in the refractory sector. In 2023, the global refractory market was valued at approximately $30 billion, with steady growth expected.

- Focus on innovation to maintain market share.

- Customer retention through superior service.

- Explore opportunities in emerging markets.

- Optimize production for cost efficiency.

Cash Cows are key revenue generators with high market share in mature markets. Minerals Technologies uses them to fuel other segments. The company focuses on optimizing operational efficiency and preserving market share.

| Segment | Market Share | Strategic Focus |

|---|---|---|

| PCC (Paper) | High | Maintain contracts, reduce costs, diversify |

| Refractory | Significant | Innovation, customer retention, emerging markets |

| GCC (Construction) | Steady | Production efficiency, competitive pricing |

Dogs

Offshore water filtration, part of Minerals Technologies, faces slower activity levels, signaling a declining market. Consider restructuring or divesting this business to minimize losses, given current market dynamics. Minerals Technologies needs to reassess its strategy. In 2024, the sector saw a 12% decline, impacting profitability.

The $215 million reserve for talc claims signals substantial liabilities. Consider divesting or restructuring these operations to reduce financial risks. Minerals Technologies must proactively manage these issues. Focus on rebuilding its reputation, especially after the 2024 legal challenges. This will help stabilize investor confidence.

In Q1 2025, the Paper and Packaging segment faced lower volumes due to customer maintenance downtime, impacting the Consumer & Specialties segment. This downturn could indicate a "dog" status if it persists. The company must investigate the decline's causes, as in 2024, the segment's revenue was $X million. Strategies to regain market share are critical.

Traditional Refractories Manufacturing Assets

The sale of refractories manufacturing assets in China signals a strategic pivot away from traditional manufacturing for Minerals Technologies. If this segment continues to underperform, further divestments or restructuring should be considered. Minerals Technologies should prioritize higher-growth areas, allocating resources efficiently. In 2024, Minerals Technologies reported a decrease in revenue from its Performance Materials segment, which includes refractories.

- Divestiture of underperforming assets can free up capital.

- Focus on high-growth areas, such as specialty minerals.

- Allocate resources effectively to maximize returns.

- Monitor segment performance closely for strategic adjustments.

BMI OldCo (f/k/a Barretts Minerals Inc.)

The bankruptcy filings by BMI OldCo and Barretts Ventures Texas LLC signal financial struggles. This segment is likely a "dog" in the BCG matrix, demanding strategic attention. Minerals Technologies must evaluate its long-term prospects. The company's stock price has been volatile in 2024, reflecting market concerns.

- Bankruptcy filings indicate severe financial distress.

- "Dog" status requires careful management or divestiture.

- Long-term viability assessment is crucial.

- Market concerns are reflected in stock volatility.

Several Minerals Technologies segments face "dog" status due to financial struggles or declining markets.

These underperforming areas require careful assessment, potentially leading to divestitures or restructuring. The goal is to improve overall financial health and focus on growth.

In 2024, these segments collectively contributed to a 15% decrease in the company's overall revenue. Focus on strategic realignment is essential.

| Segment | Status | Action |

|---|---|---|

| Offshore Water Filtration | Dog | Restructure/Divest |

| Paper & Packaging | Dog (potential) | Investigate decline |

| Refractories | Dog | Divest/Restructure |

| BMI OldCo, etc. | Dog | Assess Viability |

Question Marks

Consumer-oriented businesses acquired by Minerals Technologies require focused investment to boost market share. Integrating these acquisitions is crucial, alongside robust marketing strategies. Minerals Technologies should closely monitor their performance, with an eye toward potential divestiture if targets aren't met. In 2024, strategic acquisitions in this segment accounted for about 15% of the company's growth.

Minerals Technologies must keep investing in research and development to ensure future growth. New products often have a low market share, demanding substantial investment. In 2024, R&D spending was approximately 2.5% of revenue. Prioritizing R&D on high-potential products is key for market success.

Expanding in strategic regions, like Asia, offers significant growth potential for Minerals Technologies, but needs substantial investment. In 2024, the Asia-Pacific region's industrial minerals market was valued at approximately $15 billion, presenting a large opportunity. Careful market analysis and local partnerships are crucial for success. This includes understanding cultural nuances and regulatory environments.

Sustainability Initiatives

Sustainability is increasingly important, aligning with market trends, but needs tech and process investments. Successfully communicating the value of sustainable products to customers is crucial. Minerals Technologies should prioritize and integrate sustainability into its strategy. In 2024, companies saw a 15% increase in demand for sustainable materials.

- Investment in R&D for eco-friendly products.

- Effective marketing of sustainable offerings.

- Integration of sustainability into business strategy.

- Compliance with evolving environmental regulations.

PFAS Remediation Solutions

PFAS remediation solutions represent a promising area for growth, though the market is still evolving. Minerals Technologies should focus on developing effective, cost-efficient solutions to secure a competitive edge. The company needs to proactively adapt to changing regulations and technological advancements in this sector. In 2024, the market for PFAS remediation is estimated to be worth several hundred million dollars, with projected annual growth exceeding 10%.

- Market Growth: The PFAS remediation market is experiencing rapid expansion.

- Competitive Advantage: Investing in efficient solutions is crucial.

- Regulatory Compliance: Staying ahead of environmental regulations is essential.

- Technological Advancement: Continuous innovation is key to success.

Question Marks within Minerals Technologies' portfolio necessitate strategic focus. These ventures demand significant investments with uncertain returns. In 2024, decisions hinge on market potential versus resource allocation.

| Investment Focus | Strategic Consideration | 2024 Data Point |

|---|---|---|

| New product development | Market share growth | R&D spending: 2.5% of revenue |

| Geographic expansion | Market entry & growth | Asia-Pacific market: $15B |

| Sustainable offerings | Customer demand and compliance | 15% increase in sustainable material demand |

BCG Matrix Data Sources

This BCG Matrix leverages company reports, industry research, and financial analysis for accurate strategic positioning.