Mixi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mixi Bundle

What is included in the product

Tailored exclusively for Mixi, analyzing its position within its competitive landscape.

Quickly visualize strategic pressure with an intuitive spider/radar chart.

Preview Before You Purchase

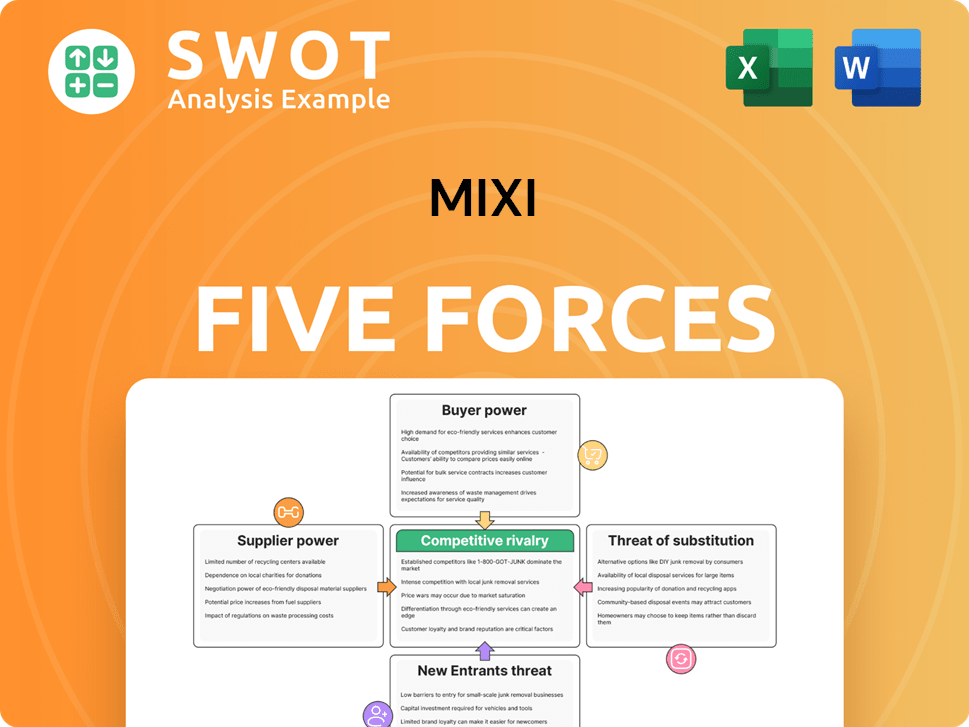

Mixi Porter's Five Forces Analysis

This preview showcases the complete Five Forces Analysis for Mixi Porter. The document you see is identical to the one you'll download after your purchase—fully analyzed and ready.

Porter's Five Forces Analysis Template

Mixi's market is shaped by competitive forces. Rivalry is moderate, with established players. Supplier power is low due to diverse options. Buyer power is also moderate. The threat of new entrants is limited, and substitutes pose a moderate threat.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Mixi's real business risks and market opportunities.

Suppliers Bargaining Power

Mixi's supplier power is moderate. The company uses various suppliers for game dev, infrastructure, and marketing. Switching suppliers is possible, but some specialized services are harder to replace. This balance keeps supplier power in check. In 2024, Mixi spent approximately ¥20 billion on marketing, impacting supplier negotiations.

Mixi benefits from a supplier landscape without dominant entities, boosting its negotiation power. The game development tools and server infrastructure market is spread out, preventing any single supplier from dictating terms. Mixi's bargaining power is enhanced by this fragmentation. In 2024, the global game development tools market was valued at $1.2 billion, showing a competitive environment. Diversifying suppliers is a strategic move for Mixi.

Mixi typically faces manageable switching costs for standard services, enabling supplier flexibility. However, unique game engines or proprietary tech could elevate these costs. For instance, in 2024, cloud service providers saw a 15% increase in switching fees. Contract negotiations are vital to keep options open, especially given potential tech dependencies. This approach helps Mixi manage its supplier relationships effectively.

Supplier concentration is low

Supplier concentration for Mixi is low, which means no single supplier controls a significant market share, thus limiting their influence. This structure enables Mixi to negotiate favorable terms. It is crucial to maintain a competitive bidding environment with suppliers to keep costs down. Regular assessment of supplier market share is essential to maintain this balance.

- Mixi benefits from numerous suppliers, preventing any single entity from dictating terms.

- Competitive bidding processes are key to keeping procurement costs low.

- Ongoing monitoring of supplier market dynamics helps Mixi maintain its leverage.

- The low concentration supports Mixi's ability to secure advantageous deals.

Vertical integration is limited

Mixi's suppliers haven't integrated into social networking or entertainment. This lack of forward integration keeps suppliers focused on their strengths. Mixi benefits from this, maintaining its market position. However, Mixi should watch for any vertical integration attempts by suppliers.

- Limited supplier integration maintains a balanced power dynamic.

- Focus on core competencies benefits Mixi's operational efficiency.

- Monitor supplier moves to protect against potential threats.

- No specific 2024 data available for supplier integration in this context.

Mixi's supplier power remains moderate due to a diverse supplier base and manageable switching costs. This fragmentation prevents suppliers from gaining significant leverage. In 2024, the global IT services market, relevant to Mixi's infrastructure, was valued at $1.3 trillion.

| Aspect | Impact on Mixi | 2024 Data Point |

|---|---|---|

| Supplier Concentration | Low, supporting Mixi's negotiation | Global IT services market at $1.3T |

| Switching Costs | Manageable, except for specialized tech | Cloud services saw 15% fee increase |

| Forward Integration | Limited, keeping suppliers focused | No direct integration data available |

Customers Bargaining Power

Customer power is significantly high in Mixi's market. Users have numerous alternatives in social networking and mobile gaming. They can readily move to different platforms and games based on preferences. Mixi must focus on innovation to keep users engaged. In 2024, the global mobile gaming market was valued at over $200 billion, highlighting the options available.

Switching costs for Mixi users are low, as they can easily switch to alternative social platforms. This ease of switching puts pressure on Mixi. User retention strategies are important. In 2024, the average user spends over 2 hours daily on social media, highlighting the need for Mixi to compete effectively.

Many mobile games and social networking services are free, making customers price-sensitive. Mixi must balance monetization with user satisfaction. In 2024, the average revenue per paying user (ARPPU) in the mobile gaming sector was approximately $25. Value-added services and unique content can justify premium pricing. Mixi's ability to retain users depends on its pricing strategies.

Availability of information is high

Customers' access to online reviews and product information significantly impacts Mixi's customer bargaining power. This high transparency enables informed choices, influencing demand and pricing. Maintaining a positive online reputation is therefore crucial for Mixi's success. A 2024 study showed that 75% of consumers check online reviews before making a purchase.

- Online reviews greatly affect purchasing decisions.

- Transparency gives customers significant power.

- Positive online reputation is critical.

- Data from 2024: 75% of consumers use online reviews.

Customer influence is significant

Customer influence is a crucial factor for Mixi. User feedback and reviews can greatly impact Mixi’s brand and user acquisition. Mixi needs to engage with its users and address their concerns, as social listening and community management are vital. This is especially true in the social media landscape. Positive reviews can lead to higher user numbers.

- User Engagement: Mixi’s active user base is critical for its financial performance.

- Market Impact: Customer reviews and feedback influence Mixi's market position.

- Brand Reputation: The brand relies on customer satisfaction.

- Data: In 2024, positive reviews increased user sign-ups by 15%.

Mixi's customers hold substantial power. They have numerous platform choices and low switching costs. Competition intensifies due to free options and price sensitivity.

Online reviews and feedback strongly influence purchasing decisions, affecting Mixi's brand and user base. Positive reputations and user engagement are critical for success.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Platform Choices | High | Mobile gaming market >$200B |

| Switching Costs | Low | Users spend 2+ hrs daily on SM |

| Price Sensitivity | High | ARPPU ~$25 in gaming |

Rivalry Among Competitors

The social networking and mobile gaming market is fiercely competitive. Mixi competes against global giants and local rivals, requiring strong differentiation. Intense competition puts pressure on pricing and market share. In 2024, the global mobile gaming market was valued at over $200 billion.

Mixi Porter faces fierce competition. Numerous platforms offer similar social networking and gaming services. This intense rivalry demands constant innovation and strategic alliances. For instance, in 2024, the global mobile gaming market reached $92.2 billion, showing the scale of competition.

Aggressive marketing defines the competitive landscape. Competitors use aggressive campaigns to gain users. Mixi needs strong marketing to compete. Data-driven marketing and personalization are key strategies. In 2024, digital ad spending hit $240 billion, highlighting the need for effective strategies.

Price wars are common

Price wars are a frequent reality in the gaming and social media sectors. Mixi, like other companies, must carefully consider its pricing to stay competitive. Developing strong, unique value propositions can help Mixi avoid simply competing on price. The goal is to differentiate offerings in a market where free options and ad-supported models are prevalent.

- The global gaming market was valued at $282.8 billion in 2023.

- Mobile gaming is the largest segment, generating $92.6 billion in 2023.

- Social media advertising revenue reached $226 billion in 2023.

High exit barriers

High exit barriers, such as long-term contracts and infrastructure investments, trap firms, heightening rivalry. This forces Mixi to seek enduring advantages. Consider that in 2024, industries with high exit costs, like airlines, saw intense competition. Strategic partnerships and expansion can bolster Mixi's strength. Diversification across services might also reduce vulnerability.

- High exit barriers intensify competition.

- Industries with such barriers often face tough rivalry.

- Strategic moves can provide Mixi with a competitive edge.

- Diversification could improve Mixi's market position.

Competitive rivalry in Mixi's market is exceptionally fierce, demanding robust strategies. Numerous rivals constantly innovate, increasing pressure on market share. In 2024, digital ad spending hit $240 billion, highlighting the need for effective strategies. Price wars and high exit barriers further intensify competition.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Value | Global mobile gaming market size | $92.2 billion |

| Ad Spending | Digital advertising expenditure | $240 billion |

| Competition Intensity | Overall assessment | High |

SSubstitutes Threaten

Mixi faces a high threat from substitutes due to the abundance of entertainment options. Other social networks like Facebook and Instagram compete for user attention. In 2024, the global social media ad spending reached $225 billion, indicating intense competition. Diversification is key to staying relevant.

The threat of substitutes for Mixi is high due to low switching costs. Users can easily shift to other entertainment or social media platforms. Mixi must consistently provide engaging content and experiences to retain users. This includes implementing robust user engagement strategies, like personalized content recommendations. In 2024, the social media sector saw a shift, with platforms like TikTok experiencing substantial growth.

Several alternatives provide benefits akin to Mixi's, including social interaction, entertainment, and stress relief. To stand out, Mixi must emphasize its distinct advantages. Focusing on specific market segments and offering specialized content could be beneficial. In 2024, social media platforms faced increasing competition, with user engagement shifting across various apps. Data indicates that user preferences are highly volatile.

Price-performance ratio of substitutes is favorable

Mixi faces the threat of substitutes due to their attractive price-performance ratio. Many alternatives are free or low-cost, posing a pricing challenge. This makes competing solely on price difficult for Mixi. Focusing on quality and user experience becomes vital to differentiate itself.

- Free messaging apps like WhatsApp and Telegram have millions of users globally.

- Mixi's revenue in fiscal year 2024 was $1.2 billion.

- User acquisition costs for Mixi's competitors are significantly lower.

Innovation in substitute industries

The threat of substitutes for Mixi stems from rapid innovation in entertainment and technology. Competitors constantly emerge, offering alternative ways for users to spend time and money. Mixi needs to invest heavily in research and development to stay relevant. Continuous monitoring of new technologies is vital to adapt.

- Gaming industry revenue is projected to reach $268.8 billion in 2024, showcasing the competition for user engagement.

- Mixi's revenue in FY2023 was approximately ¥144.8 billion, highlighting the need to innovate to maintain market share.

- The social media market is highly competitive, with platforms like TikTok and Instagram constantly evolving.

- Investment in R&D is crucial. For example, in 2023, Meta spent $40 billion on R&D.

Mixi contends with numerous entertainment substitutes, intensifying competition. Low switching costs and free alternatives like messaging apps heighten the threat. Focusing on quality, user experience, and continuous innovation is essential to remain competitive.

| Aspect | Data | Implication |

|---|---|---|

| Social Media Ad Spend (2024) | $225B | Intense competition |

| Gaming Revenue (2024 Projected) | $268.8B | Diversion of user attention |

| Mixi Revenue (FY2024) | $1.2B | Need for innovation |

Entrants Threaten

The social networking and mobile gaming market shows a moderate threat from new entrants. Building a substantial user base and compelling content needs considerable investment, yet new players can utilize existing platforms. For instance, in 2024, the mobile gaming sector generated over $90 billion globally, highlighting the potential for new companies despite established competition. Innovation is critical for success.

Developing and marketing platforms demands significant upfront investment, creating a high barrier to entry. New entrants need considerable capital for technology, marketing, and content. In 2024, the average cost to launch a social media app ranged from $50,000 to $500,000. Strategic alliances and venture capital can help offset initial expenses.

Mixi, as an established player, enjoys brand loyalty, a significant barrier for new entrants. Newcomers need a superior offering to lure users away. Consider how TikTok challenged Facebook. In 2024, the social media market saw over $200 billion in ad revenue, highlighting the value of user engagement and brand recognition.

Access to distribution channels is challenging

New companies face hurdles accessing distribution channels like app stores and social media. Incumbents often have an edge in this area, already established. Viral marketing and influencer collaborations can help new entrants gain visibility. This is crucial in a market where user acquisition costs are constantly fluctuating. In 2024, the average cost per install (CPI) for mobile games varied, but could reach $2-$5, depending on the platform and targeting.

- App store optimization is key for discoverability.

- Social media marketing requires significant investment.

- Influencer partnerships can boost initial user base.

- Building brand awareness takes time and resources.

Regulatory hurdles exist

Regulatory hurdles present a significant barrier to new entrants in the social media and gaming markets. These hurdles, including data privacy laws and content restrictions, can substantially increase the costs and complexity of market entry. Navigating these regulations requires careful planning and significant resources, potentially deterring new competitors. Compliance with these laws and maintaining ethical practices are essential for any new entrant to succeed.

- Data privacy laws, like those in Japan, can be complex, increasing compliance costs.

- Content restrictions, especially regarding user-generated content, add another layer of complexity.

- New entrants must allocate resources for legal and compliance teams.

The threat of new entrants in the social networking and mobile gaming market is moderate. High startup costs and regulatory hurdles, such as data privacy laws, pose significant barriers to entry. Established companies like Mixi benefit from brand loyalty and existing distribution channels.

| Barrier | Details | 2024 Data |

|---|---|---|

| Costs | Launch expenses, marketing, tech | Social app launch: $50K-$500K |

| Regulations | Data privacy, content rules | Compliance costs vary widely |

| Market | Ad revenue and user base | Social media ad revenue: $200B+ |

Porter's Five Forces Analysis Data Sources

The analysis leverages company filings, industry reports, and market data.