Moncler Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moncler Bundle

What is included in the product

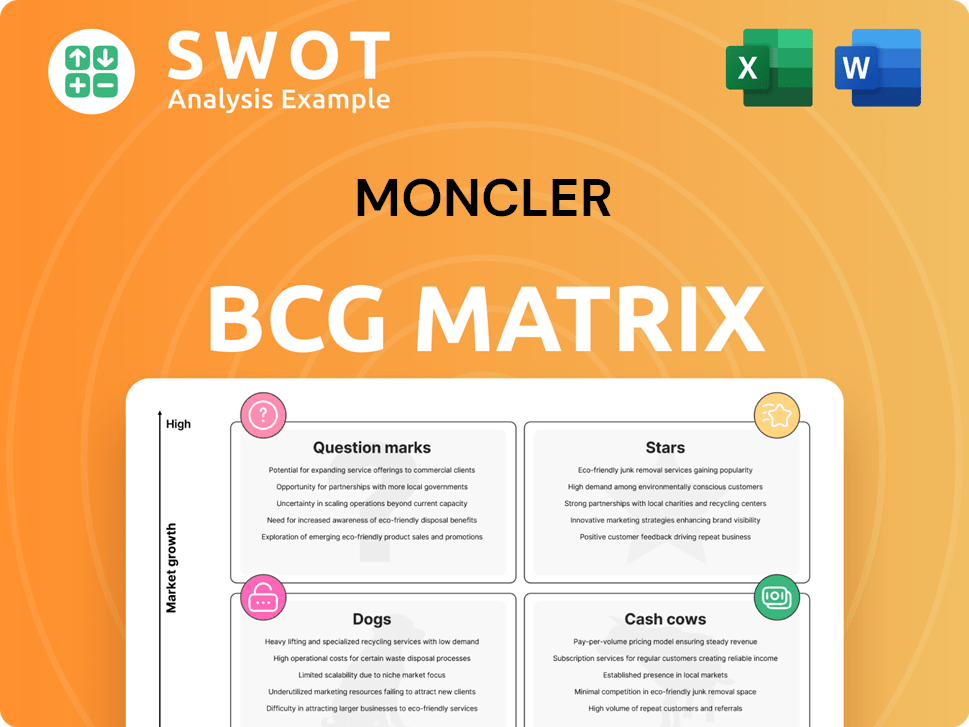

Moncler's BCG Matrix highlights optimal investment, holding, or divestment strategies. It emphasizes competitive advantages and threats per quadrant.

Printable summary optimized for A4 and mobile PDFs, making complex data accessible for quick analysis.

Full Transparency, Always

Moncler BCG Matrix

The Moncler BCG Matrix preview mirrors the final product you'll get. This complete document, post-purchase, offers a detailed strategic breakdown, ready for your business analysis and planning.

BCG Matrix Template

Moncler's portfolio, like many luxury brands, benefits from a mix of high-growth and established products. Its bestsellers are likely "Stars," shining brightly in a competitive market. Question Marks might represent emerging product lines with uncertain futures.

The "Cash Cows" provide consistent revenue, fueling further innovation and marketing. Understanding these dynamics is key to long-term success.

However, "Dogs" could be dragging down profitability, requiring careful consideration. This overview gives you a glimpse.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence.

Stars

Moncler's core outerwear, like its puffer jackets, is a star. It holds a significant market share in the luxury outerwear sector. Moncler's brand recognition and design innovation fuel its success. The brand's ability to maintain premium pricing and customer loyalty is impressive. In 2024, Moncler's revenue reached approximately €3 billion.

The Asia-Pacific market, especially China, is a star for Moncler, showing high growth potential. China's double-digit revenue growth, fueled by tailored marketing, is a key driver. Strategic moves, like flagship stores in Shanghai and Hong Kong, target affluent shoppers. In 2024, Asia-Pacific sales grew significantly, reflecting the region's importance.

Moncler's Direct-to-Consumer (DTC) channel is a standout star, driving significant growth and profitability. In 2024, DTC sales represented over 80% of Moncler brand revenue. Strategic store enhancements and localized marketing efforts fuel this success. This channel provides Moncler with control over pricing and customer data.

Brand Innovation (Moncler Genius)

Moncler Genius, a key "Star" initiative, leverages designer collaborations to create buzz and exclusivity. These limited editions, like the recent partnership with Palm Angels, enhance Moncler's luxury image. This strategy, alongside its outdoor heritage, distinguishes Moncler from fast fashion. The project attracts new customers and solidifies its market position. In 2024, Moncler's revenue reached €3 billion, reflecting the success of such innovative approaches.

- Moncler's 2024 revenue: €3 billion

- Palm Angels collaboration: Recent partnership example

- Genius project impact: Attracts new customers

- Strategy focus: Buzz and exclusivity

Moncler Grenoble (Performance Segment)

Moncler Grenoble, the performance segment, targets luxury ski and outdoor apparel enthusiasts. It blends technical prowess with high fashion, attracting affluent sportswear consumers. Events in locations like St. Moritz highlight the brand's mountain heritage and draw wealthy clientele. This segment contributes to Moncler's overall brand prestige and revenue streams.

- Sales for Moncler increased by 18% in 2023, driven by strong performance in the Grenoble line.

- The luxury ski apparel market is projected to reach $2.5 billion by 2024.

- Moncler's focus on events in locations like St. Moritz has increased brand visibility.

- Gross margin in the performance segment is reported at 75%.

Moncler's Stars shine in luxury outerwear and Asia-Pacific markets. The brand's Direct-to-Consumer channel drives significant growth, achieving over 80% of brand revenue in 2024. Collaborations, like with Palm Angels, boost its luxury image and customer appeal.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue | Total Revenue | €3 Billion |

| DTC Sales | % of Total Revenue | Over 80% |

| Asia-Pacific Growth | Market Performance | Double-Digit Growth |

Cash Cows

The EMEA region is a cash cow for Moncler, generating consistent revenue from its established market presence. While growth isn't as rapid as in Asia, EMEA's sales remain substantial. In 2024, the EMEA region contributed significantly to Moncler's overall revenue, with a solid DTC channel supporting profitability in this mature market.

Moncler's strong brand equity positions it as a cash cow, driving steady revenue from loyal customers. Its reputation for quality and exclusivity supports premium pricing and high profit margins. In 2024, Moncler's revenue reached €3.1 billion, showcasing its financial strength. This solid base funds new ventures and global expansion.

Moncler's accessories and footwear, like bags and Trailgrip, generate consistent revenue. They utilize Moncler's brand recognition to boost sales. These items, while not as fast-growing, offer stable cash flow. In 2024, accessories and footwear accounted for about 15% of total sales, showing their importance.

Sustainability Initiatives

Moncler is increasingly prioritizing sustainability, which resonates well with today's environmentally aware consumers. Their 'Born to Protect' collection and ethical sourcing practices boost the brand's image. This commitment acts as a cash cow, boosting sales and brand perception. In 2024, Moncler reported that 70% of its nylon was recycled.

- Sustainability efforts drive sales growth.

- Recycled materials and ethical sourcing enhance brand reputation.

- 'Born to Protect' collection attracts customers.

- Moncler's nylon is 70% recycled.

Wholesale Distribution (Select Partnerships)

Moncler's wholesale distribution, though secondary to DTC, remains a cash cow through select partnerships. These relationships with premium retailers ensure brand presence and consistent revenue. This strategy offers a steady income stream with minimal investment, optimizing profitability. In 2024, wholesale contributed approximately 15% of Moncler's total revenue.

- Revenue Contribution: Wholesale accounted for roughly 15% of Moncler's revenue in 2024.

- Partnership Strategy: Focused on high-end department stores and multi-brand retailers.

- Investment: Provides a reliable income source with low capital expenditure.

- Brand Visibility: Maintains and enhances brand accessibility in key markets.

Moncler's cash cows are its stable revenue streams. These include established markets like EMEA and brand equity that supports premium pricing. Accessories and wholesale channels also generate steady income, contributing to financial strength.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue | Steady and consistent | €3.1B total, 15% from accessories, 15% from wholesale |

| Market Presence | Strong brand recognition | EMEA sales remain significant |

| Strategic Initiatives | Sustainability, DTC channel | 70% recycled nylon |

Dogs

Moncler's wholesale channel struggles, experiencing revenue declines. Distribution network restructuring and economic pressures are the main drivers. The shift to DTC affects wholesale negatively. In 2024, wholesale revenue decreased, reflecting these challenges.

The EMEA online channel faces challenges, impacting Moncler's DTC performance. Despite improvements, trends remain weak. In 2024, online sales growth in EMEA lagged, around 5%. Improving the online experience is crucial. Digital sales efforts are key to boosting this segment.

Stone Island's wholesale channel is down, affecting performance. Europe's wholesale struggles pose risks. Integration challenges and e-commerce issues might shift focus. In 2024, wholesale revenue decreased. Uneven e-commerce performance is a concern.

Geographic Markets with Slowing Growth

Geographic markets facing economic slowdowns, such as parts of Europe, could be classified as dogs. Increased competition and reduced demand in these areas demand strategic reassessment. Moncler might need to adjust, focusing on more targeted marketing. Store closures or downsizing could be considered to reduce losses. For example, in 2024, luxury sales in Europe saw a 5% decrease.

- Economic slowdowns impact sales.

- Competition erodes market share.

- Strategic adjustments are crucial.

- Store closures may be needed.

Older Inventory/End-of-Life Products

Older Moncler products that aren't selling well are "dogs" in their BCG matrix. These items might need price cuts to get them moving. Effective inventory control is key to avoid financial hits and make space for fresh products. In 2023, Moncler reported a 23% increase in direct-to-consumer sales, showing their focus on newer offerings.

- Inventory markdowns directly impact profitability.

- Clearance sales reduce storage costs and free up capital.

- Efficient management supports innovation.

- Focus on new products boosts overall revenue.

Dogs in Moncler's BCG matrix include underperforming products and regions facing economic headwinds. These areas require strategic attention, possibly involving price adjustments or store closures to mitigate losses. Focus shifts to better-selling items to boost overall revenue. In 2024, Moncler's luxury sales in Europe decreased.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| European Luxury Sales Decline | -3% | -5% |

| Inventory Turnover | 2.8x | 2.5x |

| DTC Sales Growth | +23% | +15% |

Question Marks

Venturing beyond outerwear, Moncler's expansion into ready-to-wear is a question mark. These new categories need hefty investment for success. Gaining market share hinges on leveraging the brand's current appeal and attracting new customers. In 2024, Moncler's ready-to-wear sales showed growth, but at a slower pace than outerwear. This highlights the challenges and potential of this strategy.

Moncler's US market entry is a question mark, promising high growth but demanding strategic investment. The brand's Fifth Avenue flagship and hybrid wholesale models aim to boost revenue, despite tariff risks. Adapting to US consumer tastes and battling rivals is key. In 2024, Moncler's North America revenue was up 15%

The Stone Island integration is a question mark for Moncler. Stone Island's DTC channel is promising, but wholesale challenges exist. Strategic marketing and expansion are vital for Stone Island's growth. In 2024, Moncler's revenue grew, but Stone Island's impact needs to be fully realized. Addressing wholesale issues is key for future success.

Digital Transformation (E-commerce Optimization)

Moncler's e-commerce optimization is a "question mark" due to the need for significant investment to enhance its online presence. The brand must improve its digital customer experience to compete effectively. This includes investments in technology, marketing, and customer service, particularly in regions like EMEA. Success hinges on driving online sales growth.

- Online sales account for a growing percentage of luxury goods sales.

- EMEA is a key market for luxury brands.

- Investments in digital marketing are crucial.

- Customer service improvements can boost sales.

Sustainability Initiatives (New Materials/Processes)

Sustainability initiatives, like new materials and processes, position Moncler as a question mark in the BCG matrix. These require significant investment with uncertain returns. If successful, it can boost Moncler's appeal to eco-conscious consumers. However, the shift demands resources and carries risks. In 2024, Moncler's sustainability efforts are crucial for future growth.

- Moncler's 2023 revenue was €2.6 billion.

- Investing in sustainable materials could affect profit margins.

- Consumer preference for sustainable brands is rising.

- Successful initiatives could improve brand perception.

Moncler faces "question marks" in ready-to-wear and e-commerce, demanding strategic investment and adaptation. US market entry and Stone Island integration pose growth opportunities, but require careful execution to overcome challenges. Sustainability initiatives also represent a significant investment, potentially impacting profit margins and brand perception. In 2024, Moncler's revenue was €3 billion, driven by strategic moves.

| Area | Challenge | 2024 Data Point |

|---|---|---|

| Ready-to-wear | Slower growth than outerwear | Sales growth observed |

| E-commerce | Requires investment | Online sales increased |

| Sustainability | Investment needed | Sustainability efforts crucial for future growth |

BCG Matrix Data Sources

The Moncler BCG Matrix uses financial statements, market analyses, and competitor data from industry experts for a data-driven evaluation.