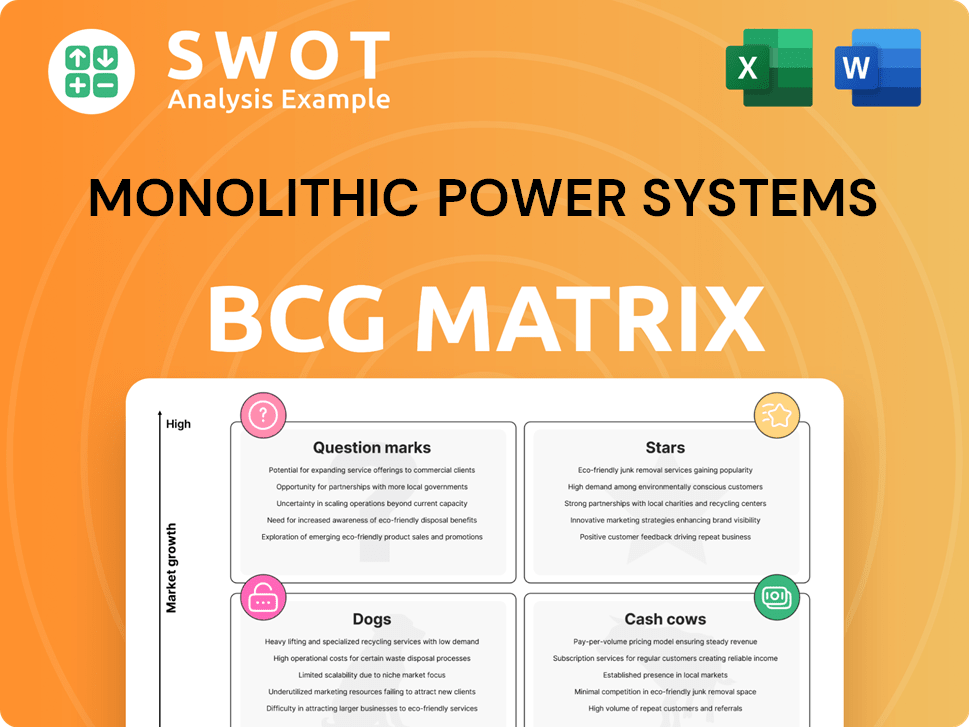

Monolithic Power Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Monolithic Power Systems Bundle

What is included in the product

BCG Matrix analysis of Monolithic Power Systems' business units.

Clean and optimized layout for sharing or printing to make a BCG Matrix accessible to all.

What You’re Viewing Is Included

Monolithic Power Systems BCG Matrix

The preview provides the identical Monolithic Power Systems BCG Matrix you'll obtain upon purchase. This comprehensive, professionally designed report allows for immediate analysis and strategic planning without any hidden content.

BCG Matrix Template

Monolithic Power Systems (MPS) operates in a dynamic semiconductor market. Their product portfolio spans diverse applications, from automotive to consumer electronics. Understanding where each product falls in the BCG Matrix is crucial. Are they Stars, poised for growth, or Dogs, requiring careful management? This overview barely scratches the surface. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Monolithic Power Systems' Enterprise Data Solutions, especially for AI and servers, saw remarkable growth. In 2024, this segment's revenue jumped by 121.7%, showcasing strong market presence. This significant increase reflects MPS's ability to capitalize on the expanding AI and server markets. Future investments could transform this into a Cash Cow as the market stabilizes.

Monolithic Power Systems (MPS) is making significant strides in automotive power management ICs, a star in its BCG matrix. The automotive segment is a key growth driver, with revenue expanding due to the integration of MPS components in ADAS and EV battery systems. In 2024, MPS reported strong growth in automotive, fueled by demand for its power solutions. Strategic partnerships and innovative product development will be vital for maintaining this momentum.

Silicon Carbide (SiC) inverters are a key innovation for high-power clean energy. Revenue is projected to increase by late 2025. If successful, SiC inverters could gain significant market share. Investments and partnerships are vital, with the global SiC market expected to reach $6.5 billion by 2024.

High-Efficiency Power Modules

Monolithic Power Systems (MPS) excels with its high-efficiency power modules, integrating multiple components into single packages. These modules offer exceptional power density and efficiency, crucial for modern applications. MPS's innovation drives growth in cloud computing and industrial sectors. Continuous expansion of these modules solidifies MPS's market position.

- MPS's revenue in Q3 2024 was $511.6 million, a 12.5% increase year-over-year, driven by power module sales.

- Power modules are a key component in data centers, with the global data center power supply market valued at $2.8 billion in 2024.

- MPS has invested heavily in R&D, allocating $56.8 million in Q3 2024 to enhance power module technology.

DC-DC Converter ICs

Monolithic Power Systems (MPS) offers DC-DC converter ICs, crucial for energy efficiency in electronics. These ICs are found in computers and wireless LAN access points, reflecting a growing market need. The demand for energy-efficient solutions is driving growth in this sector. To maintain its 'Star' status, MPS must innovate and adapt to changing market requirements.

- In 2023, the global DC-DC converter market was valued at $22.8 billion.

- MPS's revenue in Q3 2024 was $491.4 million, showing strong growth.

- The company's focus on advanced technologies, such as GaN-based converters, is key.

Monolithic Power Systems has several "Stars" in its BCG matrix, including automotive power management and DC-DC converters. Revenue growth in both segments is strong, with automotive driven by ADAS and EV systems. Innovation and strategic partnerships are key for these segments to maintain their leading positions.

| Star Segment | 2024 Revenue Growth | Key Drivers |

|---|---|---|

| Automotive | Strong | ADAS, EV systems |

| DC-DC Converters | Strong | Energy efficiency, computers |

| Enterprise Data | 121.7% | AI, Servers |

Cash Cows

Monolithic Power Systems' (MPS) DC/DC power converters are a cash cow, providing reliable revenue. These converters are vital in sectors like industrial automation and automotive, ensuring efficient power conversion. MPS emphasizes quality and efficiency, supporting strong cash generation from this product. In 2024, the power management IC market was valued at $45.5 billion, reflecting strong demand.

Lighting control ICs, crucial for LCD backlighting, consistently generate revenue for Monolithic Power Systems. Despite some consumer market softness, these ICs hold a stable market share. MPS can maintain this "Cash Cow" status by refining production and targeting niche applications. In 2024, the market for display drivers is estimated at $2.5 billion.

MPS produces Class D Audio Amplifiers, a product in a mature market. This segment consistently generates revenue, a key factor for cash cows. In 2024, the audio amplifier market saw steady growth, with Class D leading in efficiency. MPS leverages this by focusing on quality and operational excellence. This strategy ensures continued profitability from this established product line.

Power Management Solutions for Consumer Electronics

Monolithic Power Systems (MPS) offers power management solutions for consumer electronics like smart TVs and gaming consoles, fitting into the Cash Cow quadrant of the BCG Matrix. Despite some market softness in 2024, MPS leverages its established presence to generate stable revenue. Cost optimization strategies and focusing on popular products are crucial for maintaining this product line's profitability. MPS reported a revenue of $490 million in Q3 2024, showcasing its continued strength in this area.

- Solutions for devices like smart TVs and gaming consoles.

- Consumer market weakness, but MPS maintains steady revenue.

- Focus on cost optimization.

- Catering to high-demand products.

Power Management Integrated Circuits (PMICs)

Power Management Integrated Circuits (PMICs) are a significant segment for Monolithic Power Systems (MPS), where the company holds a strong market position. These circuits are essential in a wide array of applications, from consumer electronics to automotive systems. Focusing on cost optimization and meeting the needs of high-demand products will sustain PMICs as a Cash Cow. Securing long-term contracts ensures consistent revenue.

- In 2024, the PMIC market is valued at approximately $20 billion.

- MPS's revenue from PMICs in 2023 was roughly $1.5 billion.

- The automotive sector accounts for about 30% of PMIC demand.

- Cost reduction strategies can boost profit margins by up to 10%.

Monolithic Power Systems' (MPS) Cash Cows, including DC/DC converters and PMICs, provide stable revenue streams, essential for financial health. These mature product lines, like lighting control ICs and Class D Audio Amplifiers, consistently generate cash. Focusing on cost optimization and high-demand products like smart TVs ensures sustained profitability. MPS's Q3 2024 revenue reached $490 million.

| Product Category | 2024 Market Size | MPS Revenue (Estimate) |

|---|---|---|

| DC/DC Converters | $45.5 Billion (Power Management IC Market) | $1.5 Billion |

| PMICs | $20 Billion | $600 Million |

| Lighting Control ICs | $2.5 Billion (Display Drivers) | $200 Million |

Dogs

The industrial segment saw a revenue decline in 2024, reflecting broader market challenges. Specific product lines within this segment are under scrutiny. A detailed review is crucial to decide their future, potentially involving divestiture or revitalization. Monolithic Power Systems' 2024 revenue was $1.5 billion, a decrease from $1.6 billion in 2023.

In 2024, Monolithic Power Systems' consumer segment faced a revenue decline due to overall market challenges. Products for home appliances and gaming solutions, might be considered "Dogs." These products may need strategic adjustments or be sold off if they don't improve. For example, the consumer segment saw a 7% revenue decrease in Q3 2024, compared to Q3 2023.

Monolithic Power Systems' networking solutions segment faces challenges. Sales in this area have seen declines, indicating a weakening position. In 2024, revenue from networking solutions dropped by 7%, signaling a need for strategic action. Options include significant investment for market share gains or divestiture.

Legacy Automotive Products

Legacy Automotive Products within Monolithic Power Systems' portfolio face challenges, potentially becoming "Dogs" in the BCG Matrix as they lose market share. These older product lines, like those supporting traditional combustion engines, are increasingly replaced by advanced electric vehicle (EV) components. In 2024, the EV market grew significantly, with sales up over 30% globally. To remain competitive, MPS should consider strategic decisions for these products.

- Market Share Decline: Older automotive products may experience declining market share.

- Technological Shift: Products are being replaced by newer technologies.

- Strategic Options: Consider heavy investment or divestiture.

- Financial Impact: Evaluate profitability and contribution to overall revenue.

Specific Older Generation Components

Older components at Monolithic Power Systems (MPS) might struggle against new tech. These outdated parts could be a drag on profits. MPS needs to decide: pour money into them to compete or sell them off. In 2024, MPS saw a revenue increase, but certain segments may not have kept pace.

- Declining Revenue: Older product lines show decreasing sales.

- Investment Needs: Significant capital might be required to update these components.

- Market Share: MPS could lose ground if these aren't competitive.

- Strategic Choice: Decide whether to invest or divest these specific products.

Dogs represent products with low market share in a slow-growing market, facing challenges. These products often require restructuring or divestiture. In 2024, Monolithic Power Systems considered strategic actions for underperforming segments. The consumer segment saw a 7% revenue decrease in Q3 2024.

| Segment | 2023 Revenue | 2024 Revenue |

|---|---|---|

| Consumer | $300M | $279M |

| Networking | $200M | $186M |

| Industrial | $400M | $380M |

Question Marks

Battery management solutions are vital for today's electronics. Monolithic Power Systems released a solution for enterprise notebooks. This move aims for a bigger market share. To become a Star, strategic investments and marketing are crucial. In 2024, the battery management systems market was valued at billions of dollars.

Monolithic Power Systems (MPS) is venturing into high-accuracy 24-bit converters, slated for a 2H 2025 launch. The success hinges on market adoption and competitive positioning. MPS must invest in marketing to capture market share. In 2024, the precision converter market saw a $1.2B revenue.

Monolithic Power Systems (MPS) entered the automotive audio market with products leveraging Axign's DSP technology. These offerings, aiming for high quality and cost efficiency, currently sit in the Question Mark quadrant of the BCG Matrix. Their success hinges on market acceptance and performance; in 2024, the automotive audio market was valued at $27.8 billion globally. Strategic partnerships and marketing are vital to propel these products toward the Star quadrant.

Power over Ethernet (PoE) Solutions

Monolithic Power Systems' (MPS) Power over Ethernet (PoE) solutions are currently a Question Mark in their BCG Matrix. The growing demand for PoE in applications like IP cameras and IoT devices presents an opportunity. MPS could potentially transform this into a Star by expanding its product line and targeting specific market segments. Strategic focus on innovation and partnerships will be crucial for success.

- PoE market size was valued at USD 1.06 billion in 2023.

- It is projected to reach USD 2.09 billion by 2029.

- MPS's revenue in 2023 was around USD 1.7 billion.

E-fuse and Load Switches

E-fuses and load switches are vital for protecting circuits, and MPS's involvement in this area positions it as a potential Question Mark in the BCG Matrix. Success hinges on innovation and strategic partnerships. Investing in R&D and targeted marketing is crucial to boost market share. The goal is to turn these products into Stars.

- Market growth in power management ICs is projected.

- Strategic partnerships can expand reach.

- R&D spending must be prioritized.

- Effective marketing is key.

Question Marks represent high-growth market potential but low market share for MPS. These products require significant investment in marketing and strategic partnerships to gain traction. Their success hinges on market acceptance and effective execution, aiming to transition into Stars. In 2024, markets show substantial growth opportunities for products in this category.

| Product Category | Market Status (2024) | Strategic Focus |

|---|---|---|

| Automotive Audio | $27.8B global market | Partnerships, Marketing |

| PoE Solutions | $1.06B (2023), growing to $2.09B (2029) | Innovation, Partnerships |

| E-fuses/Load Switches | Projected growth | R&D, Marketing |

BCG Matrix Data Sources

The BCG Matrix leverages reliable data sources like company financial statements, industry analysis, and market growth predictions.