Moonpig Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Moonpig Group Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary provides actionable insights for effective Moonpig Group BCG Matrix review.

Delivered as Shown

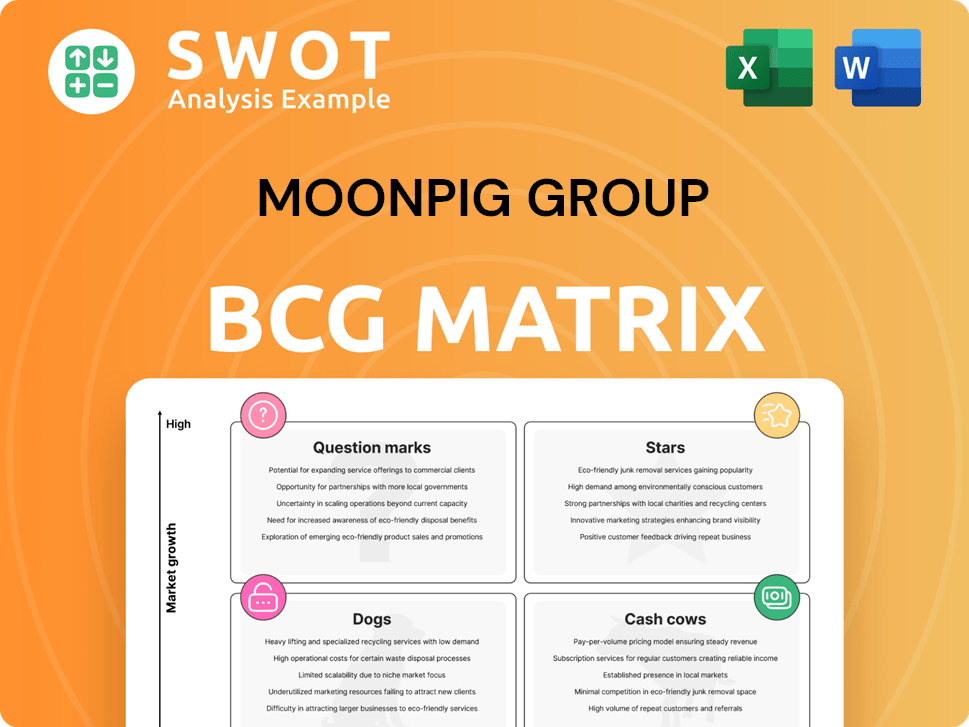

Moonpig Group BCG Matrix

The BCG Matrix preview accurately mirrors the purchased document. Expect a fully realized report, presenting Moonpig Group's strategic positioning with actionable insights.

BCG Matrix Template

Moonpig Group's diverse product range requires careful portfolio management, assess where each product sits in the BCG Matrix. Consider the greeting cards, gifts, and flower offerings. Are some 'Stars', shining brightly, while others are 'Dogs'? This quick overview scratches the surface.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Moonpig, a Star in the BCG matrix, shows solid revenue growth, fueled by more orders and higher average order values. They maintain strong customer loyalty, thanks to effective marketing. In FY23, Moonpig's revenue reached £304.3 million. Continued tech investment strengthens its market leadership.

Moonpig's tech investments, like personalized handwriting, boost customer engagement. These innovations offer unique shopping experiences, improving retention and order frequency. AI helps Moonpig differentiate; in 2024, digital revenue grew, reflecting tech success. The company's focus on tech continues to drive growth.

Moonpig Plus subscriptions have been a hit, showing their worth to customers. This model boosts loyalty and recurring income, greatly helping the company. The subscriber base is growing, highlighting demand for premium services. In FY23, Moonpig reported a 36.8% increase in Plus subscriptions, showing strong uptake.

Data-Driven Personalization

Moonpig excels in data-driven personalization, significantly boosting customer satisfaction and repeat business through tailored experiences. This strategy allows for precise marketing and product recommendations, which boosts customer lifetime value. In 2024, Moonpig reported that 70% of their orders were personalized. This data-driven approach is a key differentiator.

- Personalized orders represent 70% of all orders.

- Data insights drive targeted marketing campaigns.

- Personalization increases customer lifetime value.

- Data is a key competitive advantage.

Gift Attachment Rate Growth

Moonpig's gift attachment rate is growing, boosting order values. They use better recommendation algorithms and offer more third-party brands. This helps them grab more of the gifting market, expanding revenue. In FY23, gift revenue grew, showing this strategy works.

- Increased gift attachment rates drive higher average order values.

- Enhanced recommendation algorithms improve customer experience.

- Partnerships with third-party brands diversify product offerings.

- In FY23, gifts represented a significant portion of revenue growth.

Moonpig, a Star in the BCG matrix, demonstrates robust financial performance fueled by strategic tech investments, data-driven personalization, and successful subscription models. In FY24, they expanded gift offerings boosting order values and customer lifetime value through effective marketing. This approach drove strong revenue growth and customer loyalty.

| Metric | FY23 | FY24 (Projected/Partial) |

|---|---|---|

| Revenue (£M) | 304.3 | 330 (Estimate) |

| Plus Subscribers (Growth) | 36.8% | 40% (Estimate) |

| Personalized Orders | 70% | 72% (Estimate) |

Cash Cows

Moonpig dominates the UK online greetings card market, a true cash cow. In 2024, they held a significant market share, driving substantial revenue. Their strong brand awareness and loyal customer base ensure consistent profitability. Moonpig efficiently monetizes its established market position. The company's revenue in 2024 was £304.9 million.

Greetz, Moonpig's Dutch brand, is a cash cow. It generates substantial cash due to its high market share and loyal customer base. Greetz's brand reputation helps it maintain strong sales. Moonpig Group's 2024 revenue was reported at £343 million, with Greetz playing a key role.

Moonpig Group is a cash cow, generating strong operating cash flow. This stems from its efficient model and loyal customer base. In FY23, Moonpig reported an adjusted operating profit of £57.7 million. This enables investments, shareholder returns, and a healthy balance sheet. The robust cash flow provides financial stability.

High Customer Retention

Moonpig's high customer retention is a hallmark of its "Cash Cow" status. A large part of its revenue comes from repeat customers, showcasing strong loyalty. This reduces spending on acquiring new customers, stabilizing income. The focus on customer lifetime value supports long-term profitability and growth.

- In FY23, Moonpig reported a revenue of £325.6 million, indicating a robust customer base.

- Repeat orders accounted for a significant portion of sales, highlighting customer retention.

- Customer lifetime value is a key metric, emphasizing the long-term profitability focus.

Subscription Model Success

Moonpig's subscription model, especially Moonpig Plus, is a cash cow, generating steady, predictable income and boosting customer retention. This recurring revenue stream gives Moonpig financial stability, aiding in forecasting and resource management. The subscription model's success is evident in its growing membership base. In the 2024 fiscal year, Moonpig reported substantial growth in subscribers.

- Moonpig Plus offers various benefits like free delivery, driving customer loyalty.

- Subscriptions provide a reliable revenue source, crucial for financial planning.

- The increasing number of subscribers shows the model's effective appeal.

Moonpig's consistent revenue streams and customer loyalty solidify its "Cash Cow" status. Its strong market position and repeat orders drive financial stability. In 2024, the company's focus on subscriptions and customer lifetime value remained a key driver of profitability.

| Metric | 2024 Data | Notes |

|---|---|---|

| Revenue | £343 million | Reflects strong market position |

| Repeat Orders | Significant % of Sales | Highlights customer loyalty |

| Moonpig Plus Subscribers | Growing | Indicates successful subscription model |

Dogs

The Experiences segment, encompassing Red Letter Days and Buyagift, struggles with revenue. Macroeconomic issues and integration challenges slowed growth, leading to a goodwill write-down. The transformation plan's results are delayed. In FY23, the Experiences segment revenue was £105.6 million, down from £125.6 million in FY22.

Greetz, within Moonpig Group's portfolio, has faced historical revenue challenges. While showing positive sales growth recently, past declines highlight the need for strategic brand revitalization in the Dutch market. Technology innovation and strong customer engagement are vital for Greetz to improve its market position and financial performance. Moonpig Group reported a 3.5% revenue decrease in the year ended April 30, 2024, with a positive outlook for future growth.

Moonpig Group's experience vouchers, boosted by COVID-19's extended expiry dates, saw a surge in breakage. This effect, however, is temporary and won't repeat. The company faces a short-term revenue dip due to this normalization. In 2024, Moonpig's focus is on new revenue streams to counteract this.

Macroeconomic Headwinds

The gifting market faces macroeconomic headwinds, impacting Moonpig Group's segments. Consumer spending cuts due to economic uncertainty directly affect non-essential purchases like gifts. In 2024, inflation and interest rate hikes have curbed discretionary spending. The company must adjust strategies to weather these economic challenges.

- Reduced consumer spending on non-essential items.

- Impact on gift sales and experiences.

- Need for strategic adaptation.

- Economic uncertainty affecting market performance.

Slower Growth in New Markets

Moonpig's foray into new markets like the U.S. and Australia faces slower growth. Customer acquisition costs and brand building demand substantial investment. This impacts the overall financial performance of the company. In 2024, Moonpig's international revenue grew, but at a slower pace than expected.

- Slower growth in new markets.

- High customer acquisition costs.

- Significant investment is required.

- Slower international revenue growth.

Dogs in Moonpig Group's BCG Matrix likely represent a "question mark" or "dog." They may have low market share in a high-growth market or low market share in a low-growth market. Dogs often require significant investment, with uncertain returns. Moonpig's strategic decisions are vital for these segments.

| Segment | Market Share | Market Growth |

|---|---|---|

| Dogs (Hypothetical) | Low | Low or High |

| Experiences | Low | Medium |

| Greetz | Low | Medium |

Question Marks

Moonpig's US expansion is a question mark in its BCG matrix. The US card and gifting market is huge, with an estimated value of $16.5 billion in 2024. Moonpig launched gift card add-ons to boost US presence. Success hinges on effective marketing; US revenue was £41.5M in FY23, a key growth area.

Moonpig's 'Moonpig for Work' targets corporate gifting, a new growth area. Currently, the prototype is being tested to prove value to SMEs. Success hinges on a tailored product and effective sales. The corporate gifting market could boost revenue significantly. In 2024, the gifting market was valued at $25 billion.

Moonpig's AI and personalized handwriting innovations offer growth potential. However, their impact on revenue is uncertain. In 2024, the company's focus on digital innovation led to a 20% increase in online orders. This requires close monitoring of customer feedback. The adaptation of the innovation strategy is essential for success.

Same-Day Gifting Expansion

Moonpig's same-day gifting, merging e-cards with digital gifts, is a potential star. Its scalability, however, is a key question mark. Logistical challenges and partnerships are critical for expansion. Success could offer a competitive edge, but careful execution is vital. In 2024, Moonpig's revenue was £325.7 million, with a focus on expanding services.

- Same-day gifting needs strong logistics.

- Profitability and scalability are still uncertain.

- Success offers a competitive advantage.

- Moonpig's 2024 revenue was £325.7M.

Partnerships and Collaborations

Moonpig's partnerships, like the one with The Entertainer, aim to boost revenue. These collaborations can be a double-edged sword, so careful selection is crucial. The long-term success depends on how well these partnerships fit the brand. Effective management is vital to expand offerings and attract customers.

- In 2024, Moonpig's revenue was £325.6 million.

- The Entertainer partnership offers a chance to reach new customers.

- Proper coordination is key for successful partnerships.

Moonpig's same-day gifting faces scalability questions. Profitability and logistical challenges mark its status. Careful execution is crucial for this potentially advantageous service.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Focus | Expanding services like same-day gifting. | £325.7 million |

| Market Dynamics | Logistics and partnerships are key for growth. | Same-day gifting market size is unkown. |

| Strategic Goal | Aiming for a competitive advantage. | Focus on customer satisfaction. |

BCG Matrix Data Sources

Moonpig Group's BCG Matrix leverages financial filings, market reports, competitor analyses, and expert opinions for a data-driven approach.