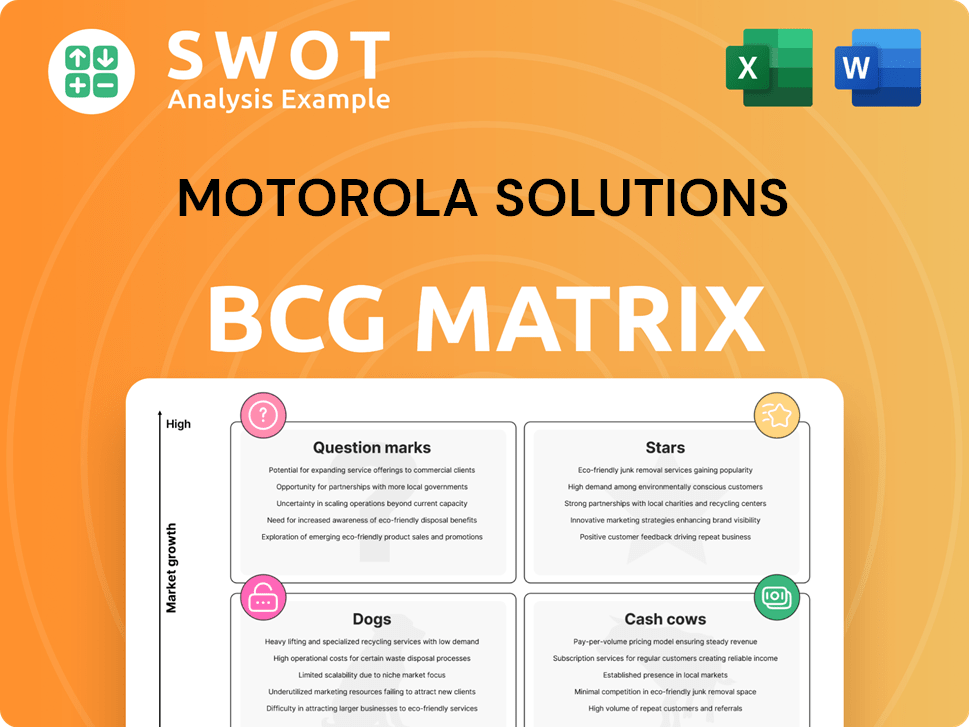

Motorola Solutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Motorola Solutions Bundle

What is included in the product

Tailored analysis for Motorola's product portfolio, revealing strategic options across quadrants.

Clear matrix provides an instant strategic overview, quickly identifying growth areas & potential divestitures.

Preview = Final Product

Motorola Solutions BCG Matrix

The preview is the complete Motorola Solutions BCG Matrix you'll receive after purchase. The downloadable version mirrors the content and formatting, offering immediate strategic insights. This ready-to-use document allows for swift integration into your analysis and presentations.

BCG Matrix Template

Motorola Solutions' BCG Matrix offers a snapshot of its diverse product portfolio. Understanding this matrix helps in strategic resource allocation and investment decisions. Analyzing the "Stars" can pinpoint growth drivers, while "Cash Cows" reveal revenue stabilizers. Identifying "Dogs" and "Question Marks" is crucial for optimizing returns and mitigating risks. This preview is just a taste of the strategic clarity offered by the full report. Purchase the full BCG Matrix for detailed quadrant analysis and actionable insights.

Stars

Motorola Solutions is a "Star" in the BCG Matrix, excelling in mission-critical communication. They lead in public safety solutions. In Q3 2024, they showed a 10% YoY revenue increase. The demand is high, supported by a record backlog, promising future growth.

Motorola Solutions' video security and analytics segment is thriving, fueled by AI analytics. Cloud and AI video solutions are becoming increasingly popular. In 2024, the video security market is projected to reach $44.6 billion, with a CAGR of 14.8% from 2024 to 2030. This growth highlights the segment's potential.

Motorola Solutions is boosting its command center software. They bought 3tc Software in 2024 for $22 million. This move strengthens their offerings in the "Star" quadrant. Expanding software capabilities is key for growth, as seen in their strategic investments. It aims to capture more market share with enhanced solutions.

North American Market Leadership

Motorola Solutions demonstrates robust market leadership in North America, fueled by significant growth in Land Mobile Radio (LMR), Video, and Command Center solutions. This expansion is a crucial factor behind the company's financial success, reflected in its strong revenue figures. For instance, in 2024, North American sales accounted for a large portion of their total revenue, indicating dominance in the region.

- 2024 North American sales are a major revenue driver.

- LMR, Video, and Command Center solutions are key growth areas.

- Strong financial performance is linked to North American success.

Strategic Acquisitions

Motorola Solutions strategically uses acquisitions to boost its portfolio and reach. In 2024, it bought Theatro, an AI communication software firm, and 3tc Software, a Command Center solutions provider. These moves aim to strengthen its position in public safety and enterprise markets. These acquisitions are expected to contribute to revenue growth.

- Theatro's AI tech enhances Motorola's communication tools.

- 3tc Software expands Command Center capabilities globally.

- Acquisitions support Motorola's strategic expansion.

- These deals drive revenue growth.

Motorola Solutions shines as a "Star," dominating mission-critical comms. Their video security market is set to hit $44.6B in 2024. North American sales are a significant revenue driver, key for their strong performance.

| Metric | Details |

|---|---|

| Q3 2024 Revenue Growth | 10% YoY |

| Video Security Market (2024) | $44.6 Billion |

| Video Security CAGR (2024-2030) | 14.8% |

Cash Cows

Land Mobile Radio (LMR) is a cash cow for Motorola Solutions, representing its core business. This segment, crucial for public safety, offers consistent cash flow. Motorola holds the largest market share in North America. In 2024, LMR continues to be a reliable revenue source.

Motorola Solutions is a Cash Cow in the BCG Matrix, highlighting its robust position in public safety. In 2022, the company commanded roughly a 29% market share. This dominance stems from key contracts with governmental bodies. This solidifies its status as a reliable revenue generator.

Motorola Solutions' sustained government contracts, like the extension with Victoria's emergency radio network, are a key strength. This deal, lasting until 2035, guarantees a steady revenue stream. Securing long-term contracts reinforces their market dominance. In 2024, Motorola's government solutions segment saw consistent growth, contributing significantly to their overall revenue.

High Profit Margins

Motorola Solutions' "Cash Cows" benefit from high profit margins, a hallmark of its established business segments. This profitability translates into substantial cash flow generation, fueling further investment and growth. For the full year of 2024, Motorola Solutions achieved a GAAP operating margin of 24.8% of sales.

- Strong profitability supports substantial cash flow.

- 2024 GAAP operating margin: 24.8%.

- Cash used for investments and growth.

Global LMR installed base

Motorola Solutions' Land Mobile Radio (LMR) business is a cash cow, projected to keep growing globally. This growth hinges on integrating broadband solutions, enhancing its value. The company focuses on expanding its LMR installed base, expecting it to fuel profitability. As of 2024, LMR continues to be a stable revenue source for Motorola Solutions.

- The global LMR market size was valued at USD 18.57 billion in 2023.

- It is projected to reach USD 24.85 billion by 2030.

- Motorola Solutions holds a significant market share in this sector.

- Broadband integration is key for future growth.

Motorola Solutions' LMR segment is a cash cow. This sector has high market share and strong profitability. In 2024, it provided a stable revenue.

| Key Feature | Details |

|---|---|

| Market Share | Dominant in North America. |

| Operating Margin (2024) | 24.8% of sales. |

| LMR Market Size (2023) | USD 18.57 billion. |

Dogs

The analog communication devices segment, a "Dog" in Motorola Solutions' BCG matrix, faces a shrinking market. Digital solutions have largely supplanted analog technology. The segment's stagnant growth reflects limited expansion prospects. Motorola Solutions' 2024 financial reports will likely show minimal revenue from this area, reflecting its declining relevance.

Motorola Solutions grapples with "Dogs" like outdated tech. Certain product lines struggle with shrinking market share, signaling decline. The analog communications sector, a key area, faced a projected CAGR of only 1.2% through 2025. This slow growth highlights the challenges. These segments need strategic attention.

Motorola Solutions faced a revenue dip in its international region, specifically in 2024. This was primarily due to reduced sales in Airwave services and the end of the Emergency Services Network contract. The decline highlights difficulties in certain geographic areas.

Low Growth Prospects

Dogs represent products with low market share in slow-growing markets. These offerings typically generate minimal cash flow, often hovering around break-even. Motorola Solutions might have faced this with some older product lines in 2024. They require careful management to avoid becoming a drain on resources.

- Low Growth, Low Share

- Minimal Cash Generation

- Require Careful Management

- Potential for Divestiture

Cash Traps

Dogs in the BCG matrix, like some Motorola Solutions units, often become cash traps. They consume resources without generating significant returns. These underperforming segments typically require more investment to survive. In 2024, divesting these units could free up capital for more promising areas.

- Low market share, low growth potential.

- Often require continuous financial support.

- Limited prospects for future profitability.

- Prime candidates for liquidation or divestiture.

Dogs in Motorola Solutions' BCG matrix are low-share, slow-growth segments. These units, like outdated analog tech, generated minimal cash flow in 2024. Divestiture can free up capital. Their 2024 revenue contribution was likely negligible, aligning with the slow projected 1.2% CAGR through 2025.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Market Share | Low | Analog communications. |

| Growth Rate | Slow | Projected 1.2% CAGR. |

| Cash Flow | Minimal | Near break-even. |

Question Marks

Motorola Solutions' smart public safety solutions likely fit within the "Star" quadrant of the BCG Matrix, given market projections. The market is expected to hit $23.7 billion by 2025. This growth is fueled by a 12.4% CAGR from 2020, indicating strong potential.

Cloud-based solutions are gaining traction in Motorola Solutions' BCG matrix. Adoption of cloud-based multi-factor authentication is rising, especially for access control. Governments and enterprises are adopting scalable cloud solutions for enhanced security. The global cloud security market is expected to reach $77.8 billion by 2024.

Motorola Solutions is strategically investing in integrating Land Mobile Radio (LMR), video, and command center technologies. This aims to create a unified safety and security ecosystem, fostering growth. In 2024, they reported a 7% increase in annual revenue. These integrated solutions are expected to generate new business opportunities.

AI-Powered Analytics

Motorola Solutions is leveraging AI-powered analytics within its Video technology, marking a strategic move in the BCG Matrix's question mark quadrant. This innovation boosts operational insights and strengthens security capabilities. The company's focus on AI aligns with market trends, aiming to capture growth. In 2024, the video security market is estimated to reach $25.8 billion.

- AI integration enhances security for customers.

- Focus on innovation to capture growth.

- Video security market is estimated to reach $25.8 billion.

NGCS Adoption

Motorola Solutions anticipates growth from its cloud-based solutions and the expanding adoption of Next Generation Core Services (NGCS). This includes a shift from on-premises solutions to cloud capabilities. The company is facilitating this transition for its customers. This strategic move is expected to increase the company's market presence. NGCS adoption is a key area of focus.

- Motorola Solutions is aiding customers in migrating from on-premises solutions to cloud-based systems.

- The company's portfolio includes native cloud, hybrid, and on-premises software solutions.

- NGCS adoption is a driver for growth.

- This migration strategy is designed to expand market presence.

Motorola Solutions strategically uses AI analytics in its video tech, putting it in the question mark quadrant. This boosts insights and strengthens security, aligning with market growth trends. The video security market is projected to hit $25.8 billion in 2024.

| Aspect | Details |

|---|---|

| Market Focus | AI-powered video analytics |

| Strategic Goal | Capture market growth and expand features |

| 2024 Market Size | $25.8 billion (video security) |

BCG Matrix Data Sources

The Motorola Solutions BCG Matrix uses financial filings, market analysis, and industry reports for data-driven strategic recommendations.