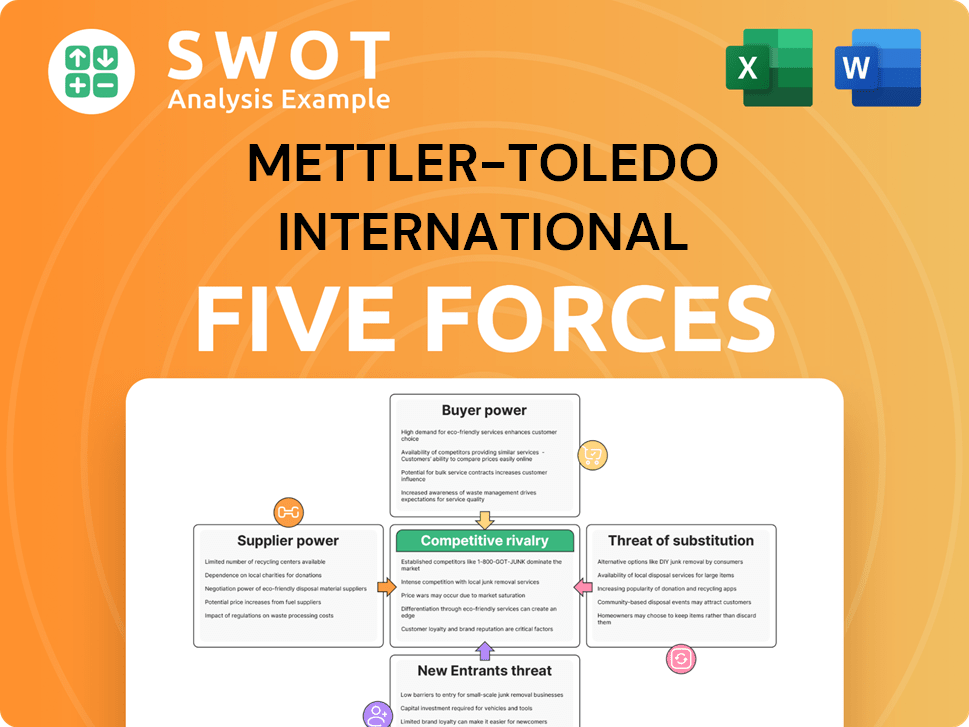

Mettler-Toledo International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mettler-Toledo International Bundle

What is included in the product

Examines competitive dynamics impacting Mettler-Toledo, from suppliers to new entrants, to assess its market position.

Instantly spot competitive threats with an interactive and dynamic visualization of forces.

Same Document Delivered

Mettler-Toledo International Porter's Five Forces Analysis

This preview presents the complete Mettler-Toledo International Porter's Five Forces Analysis. It details competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. This is the comprehensive, ready-to-use analysis file. What you're previewing is what you get.

Porter's Five Forces Analysis Template

Mettler-Toledo International operates in a competitive environment, facing pressures from various forces. Buyer power, particularly from large pharmaceutical companies, influences pricing. The threat of new entrants remains moderate, considering the industry's capital intensity and regulatory hurdles. Intense rivalry among established players necessitates constant innovation and efficiency. Substitute products, like analytical instruments from competitors, pose a moderate threat. Supplier power is relatively low, with a diversified supply chain.

Ready to move beyond the basics? Get a full strategic breakdown of Mettler-Toledo International’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts Mettler-Toledo. If few suppliers control critical components, they gain pricing power. This can increase Mettler-Toledo's costs. For example, in 2024, the cost of specialized materials rose by 5%, impacting profit margins.

Mettler-Toledo's ability to switch suppliers significantly impacts supplier power. High switching costs, driven by specialized components or long-term contracts, increase supplier control. For example, in 2024, Mettler-Toledo's reliance on specific sensor technologies might create high switching costs. Conversely, lower switching costs, perhaps through readily available components, reduce supplier power. The company's strong supplier relationships, as of late 2024, also influence this dynamic.

Suppliers with strong brand reputations or unique tech, like those providing specialized components, wield more power. Mettler-Toledo, if dependent on such suppliers, faces potential premium pricing. In 2024, rising material costs, impacting gross profit margins, highlight this. This affects the overall cost structure of Mettler-Toledo's offerings.

Impact of Inputs on Quality

Supplier inputs significantly affect Mettler-Toledo's product quality. Critical components from a supplier, essential for instrument accuracy, increase the supplier's bargaining power. High-quality inputs justify higher prices, impacting Mettler-Toledo's cost structure. In 2024, Mettler-Toledo's cost of revenue was approximately $1.9 billion, reflecting input costs.

- High-quality inputs can lead to premium pricing for Mettler-Toledo's products.

- The precision of inputs directly affects the reliability of the final product.

- Supplier concentration can amplify bargaining power.

- Mettler-Toledo's R&D spending in 2024 was around $160 million, partly focused on input material quality.

Forward Integration Threat

Suppliers might gain power by integrating forward into Mettler-Toledo's market. This means they could start making and selling similar products. Such a move could pressure Mettler-Toledo to offer better deals to keep suppliers happy. This potential forward integration is a key factor in Mettler-Toledo's strategic planning.

- Forward integration by suppliers could lead to increased competition.

- This threat can influence pricing and contract negotiations.

- Mettler-Toledo must assess supplier capabilities.

- The company's R&D and innovation are critical defenses.

Mettler-Toledo faces supplier power, influenced by concentration and switching costs. Specialized components or long-term contracts increase supplier control, impacting costs. The company's 2024 R&D spending of $160 million partly focused on materials, reflecting supplier influence.

| Factor | Impact | 2024 Example |

|---|---|---|

| Supplier Concentration | Increases bargaining power | Cost of specialized materials rose by 5% |

| Switching Costs | High costs boost supplier control | Reliance on specific sensor technologies |

| Input Quality | Affects product pricing | Cost of revenue approximately $1.9 billion |

Customers Bargaining Power

Buyer concentration significantly influences Mettler-Toledo's bargaining power of customers. If a few large customers make up a significant portion of revenue, their influence grows. These customers can push for lower prices and better terms. For example, in 2023, the top 10 customers represented approximately 15% of total sales, which impacts profitability.

Customer price sensitivity significantly influences their bargaining power. When customers show high price sensitivity, and switching costs are low, their power rises. Mettler-Toledo competes in diverse markets, with some segments more price-sensitive than others. For example, in 2024, the company's sales in the Americas were $1.7 billion, indicating a large customer base.

Switching costs significantly influence customer power. Low costs allow customers to switch easily, increasing their bargaining power. For Mettler-Toledo, specialized equipment can have high switching costs. This is because of the initial investments in equipment and training. In 2024, the company's robust service revenue reflects the stickiness of their customer base.

Product Differentiation

Product differentiation significantly influences customer power in the context of Mettler-Toledo. If Mettler-Toledo’s analytical instruments and services are unique, customers have limited alternatives, thus less power. However, if competitors offer similar products, customers can easily switch. This increases their bargaining power, potentially impacting pricing and service demands.

- In 2023, Mettler-Toledo's sales were $3.93 billion, highlighting its market presence.

- The company's focus on innovation and specialized products aims to maintain differentiation.

- Competition from firms like Agilent Technologies can pressure differentiation strategies.

- Customer power varies across different product segments within Mettler-Toledo's portfolio.

Information Availability

The bargaining power of Mettler-Toledo's customers is significantly shaped by information availability. Customers with access to comprehensive data on product specifications and pricing can easily compare offerings. This transparency allows for informed decisions, potentially leading to tougher negotiations for Mettler-Toledo. This is particularly relevant in 2024, as digital platforms enhance access to competitive information.

- Customers can compare prices and features.

- Increased transparency empowers informed choices.

- Negotiation leverage is enhanced by data access.

Customer bargaining power varies based on factors like concentration and price sensitivity. High buyer concentration and low switching costs amplify customer influence. Mettler-Toledo's differentiation strategy and data transparency also affect this power.

| Aspect | Impact | Example (2024 Data) |

|---|---|---|

| Buyer Concentration | High concentration increases customer power. | Top 10 customers accounted for ~15% of sales. |

| Price Sensitivity | High sensitivity boosts customer power. | Americas sales: $1.7 billion, indicating a broad customer base. |

| Switching Costs | Low costs increase customer power. | Service revenue reflects customer stickiness. |

Rivalry Among Competitors

The intensity of competitive rivalry increases with the number of competitors. A greater number of firms in the market intensifies competition, potentially leading to price wars. This can increase marketing spending, impacting profitability. For example, in 2024, Mettler-Toledo faces competition from several firms.

Industry growth significantly shapes competitive rivalry. Slow growth often leads to intense competition, as companies battle for a smaller customer base. Conversely, rapid industry expansion eases rivalry, providing more opportunities for all. Mettler-Toledo benefits from moderate industry growth, fostering manageable competition. In 2024, the analytical instruments market saw steady growth, with projections of continued expansion.

Product differentiation significantly impacts competitive rivalry. If products are similar, price wars erupt; if unique, rivalry lessens. Mettler-Toledo, with its specialized scales and analytical instruments, benefits from strong product differentiation. In 2024, the company's diverse offerings helped maintain a gross profit margin of around 60%, showcasing its ability to compete effectively.

Switching Costs

Switching costs significantly influence competitive intensity in Mettler-Toledo's market. High costs, such as specialized training or system integration, decrease rivalry because customers are less likely to change vendors. Conversely, low switching costs make it easier for customers to move to competitors, increasing competition. Mettler-Toledo's focus on high-value, integrated solutions may create higher switching costs. This strategic approach helps to reduce rivalry, as seen with its 2024 revenue of $3.9 billion.

- High switching costs reduce competitive rivalry.

- Low switching costs increase competition.

- Mettler-Toledo's solutions may have higher switching costs.

- 2024 revenue of $3.9 billion reflects market dynamics.

Exit Barriers

High exit barriers intensify competitive rivalry. If firms find it tough to leave the industry, they keep fighting, even if profits are low. This can cause excess capacity and price wars, making the market tougher. Mettler-Toledo, with its specialized equipment, faces such challenges. These barriers include significant capital investments and long-term service agreements.

- Specialized assets make it hard to sell off parts of the business.

- Contractual obligations, like service agreements, keep companies tied to the market.

- High exit costs can lead to continued competition.

- Mettler-Toledo's market position is affected by these factors.

Competitive rivalry in Mettler-Toledo's market hinges on factors like competition, industry growth, product differentiation, switching costs, and exit barriers. Mettler-Toledo benefits from product differentiation and potentially high switching costs, which mitigates rivalry. However, the specialized nature of the industry presents challenges like high exit barriers. Mettler-Toledo's 2024 performance reflected these dynamics, with a focus on profitability and market positioning.

| Factor | Impact on Rivalry | Mettler-Toledo's Position |

|---|---|---|

| Product Differentiation | Reduces Rivalry | Strong, ~60% Gross Margin (2024) |

| Switching Costs | Can Reduce Rivalry | Potentially High, due to integrated solutions |

| Exit Barriers | Intensifies Rivalry | High, due to specialized assets & contracts |

SSubstitutes Threaten

The availability of substitutes heavily influences the threat of substitution for Mettler-Toledo. If there are many alternatives that satisfy the same customer need, the threat is high. This can limit Mettler-Toledo's pricing power. For instance, in 2024, the company faced competition from various suppliers, impacting its ability to raise prices.

The price-performance ratio of substitutes significantly impacts their appeal. If alternatives provide comparable functionality at a lower cost, the threat to Mettler-Toledo grows. Competitors like Sartorius and Waters offer advanced analytical instruments. For instance, Sartorius's 2023 revenue was approximately €3.5 billion, showing their market presence. Mettler-Toledo must innovate to maintain its premium pricing.

Switching costs significantly impact the threat of substitutes. If customers face low switching costs, like with basic scales, the threat is high, as they can easily choose competitors. Conversely, high switching costs, such as those linked to integrated lab systems, reduce the threat. For instance, Mettler-Toledo's lab instruments have high switching costs due to software and training, which makes it harder for customers to switch. In 2024, the company's focus on integrated solutions helped to maintain customer loyalty, thus lowering the threat from substitutes.

Customer Propensity to Substitute

The threat from substitutes for Mettler-Toledo (MTD) hinges on how easily customers switch. If alternatives are readily available, the threat increases. MTD must assess customer views to maintain its competitive edge. For instance, the adoption of digital lab equipment can reduce demand for older models. Understanding this shift is crucial.

- Customer loyalty programs can reduce substitution.

- Innovation and new product development are key.

- Market research helps understand customer needs.

- Focus on value-added services to differentiate.

Relative Quality

The threat of substitutes for Mettler-Toledo International hinges on the perceived quality of alternatives. If substitutes offer similar or better quality, the threat escalates. Mettler-Toledo's focus on premium products, like its lab balances, helps counter this. Maintaining a strong reputation for quality and reliability is vital. This helps to fend off competitors.

- Mettler-Toledo's revenue in 2023 was approximately $3.9 billion.

- The company spends significantly on R&D to improve product quality.

- Strong brand recognition supports customer loyalty.

- The company's gross margin was around 60% in 2023.

The threat of substitutes depends on alternative product availability, which impacts pricing power. Competitors like Sartorius, with approximately €3.5 billion revenue in 2023, present a challenge. High switching costs, such as those tied to integrated lab systems, help reduce this threat. Mettler-Toledo's innovation and focus on customer loyalty programs mitigate the impact of substitutes.

| Factor | Impact | Example |

|---|---|---|

| Availability of Alternatives | Higher threat if many exist | Sartorius, Waters |

| Switching Costs | Lower threat with high costs | Integrated lab systems |

| Customer Loyalty | Reduced substitution | Loyalty programs |

Entrants Threaten

High barriers to entry protect Mettler-Toledo from new competitors. Significant capital is needed to compete, like the $100+ million R&D spend. Economies of scale, proprietary tech, and regulatory hurdles such as ISO 9001 certification also act as barriers. These factors shield Mettler-Toledo, which had a revenue of $3.9 billion in 2023, from new market entrants.

Economies of scale give Mettler-Toledo a cost edge. Newcomers face high initial costs to match this. Mettler-Toledo's size deters new competition. For example, Mettler-Toledo's revenue in 2023 was $3.99 billion, showcasing its scale.

Mettler-Toledo's strong brand loyalty presents a significant barrier to new competitors. Customers trust and recognize Mettler-Toledo's established reputation. New entrants face substantial marketing and branding costs to gain market share. Mettler-Toledo's 2024 revenue of $3.9 billion reflects its strong brand.

Capital Requirements

High capital requirements pose a significant threat to new entrants in the weighing and measurement equipment industry. Substantial investment in research and development, along with manufacturing facilities, is essential. Mettler-Toledo's robust infrastructure and resources provide a considerable competitive edge. These factors make it difficult for newcomers to challenge established players.

- R&D spending for Mettler-Toledo was approximately $180 million in 2023.

- The cost to establish a comparable manufacturing facility can range from $50 million to $200 million.

- Distribution network setup costs could add another $20 million to $50 million.

- Mettler-Toledo's market capitalization was around $35 billion in early 2024.

Government Regulations

Government regulations significantly influence market entry, acting as a barrier for new firms. Mettler-Toledo, with its established compliance and industry experience, holds a competitive advantage. New entrants face challenges due to stringent regulations, licensing, and industry standards. These factors increase the cost and complexity for potential competitors.

- Compliance with regulations demands significant investment.

- Mettler-Toledo's expertise eases navigation of regulatory hurdles.

- Regulations can limit the number of competitors in the market.

- These barriers protect established firms like Mettler-Toledo.

The threat of new entrants for Mettler-Toledo is low. High initial costs, including R&D, manufacturing, and distribution, act as barriers. Brand loyalty and regulatory compliance further protect Mettler-Toledo. In 2023, R&D spending was roughly $180 million.

| Barrier | Details | Impact |

|---|---|---|

| Capital Needs | R&D, manufacturing, distribution setup. | High barriers to entry. |

| Brand Loyalty | Established reputation and trust. | Deters new competitors. |

| Regulations | Compliance costs and expertise. | Limits market entry. |

Porter's Five Forces Analysis Data Sources

This analysis uses data from Mettler-Toledo's financials, industry reports, market research, and competitor analyses to inform the Five Forces.