Murata Manufacturing Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Murata Manufacturing Bundle

What is included in the product

Strategic review of Murata's units, analyzing Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Export-ready design for quick drag-and-drop into PowerPoint, simplifying presentations of Murata's strategic business positions.

Delivered as Shown

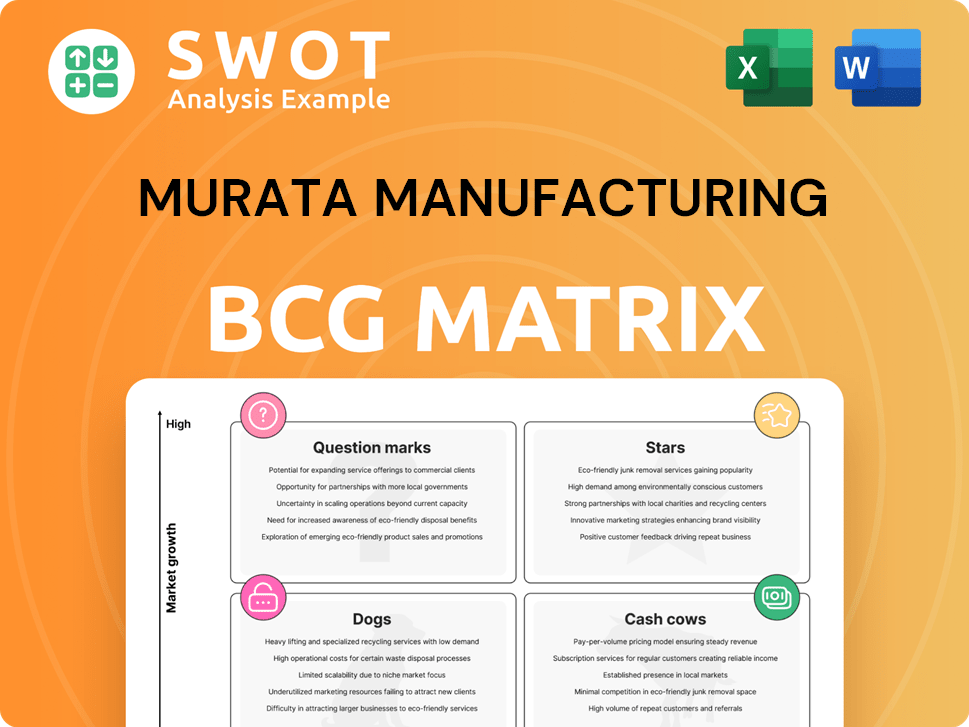

Murata Manufacturing BCG Matrix

This Murata Manufacturing BCG Matrix preview mirrors the complete document you receive. The purchased file is a ready-to-use strategic tool, offering clear insights for your analyses. Expect no differences between the preview and the downloaded version.

BCG Matrix Template

Murata Manufacturing’s BCG Matrix unveils its product portfolio dynamics. This analysis pinpoints market leaders (Stars) and cash generators (Cash Cows). We also identify products needing strategic attention (Question Marks) and those that may be divested (Dogs).

The matrix helps understand investment needs and growth potential. Gain clarity on Murata's competitive positioning and strategic priorities. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Murata's MLCCs are crucial for AI servers, a booming market. AI servers use many more MLCCs than standard servers, boosting demand. Murata is a leader in MLCCs, and this sector is a major growth area. In 2024, the AI server market grew significantly, driving MLCC demand. This trend makes MLCCs a Star for Murata.

Murata's automotive electronics segment, crucial for EVs and ADAS, shows robust growth. Electrification and system complexity boost demand for its components. This sector is a major revenue driver for Murata. They offer automotive timing devices with ±40ppm tolerance. In 2024, the automotive market share is expanding.

5G components are a Star for Murata. These components, including SAW filters and RF modules, are crucial for 5G. With the ongoing global 5G rollout, demand is rising. Murata holds a 40% share in the SAW filter market.

Miniaturized Components

Murata Manufacturing excels in miniaturized components, crucial for modern electronics. Their expertise, especially in the world's smallest MLCCs, gives them a competitive advantage. Demand for these components is driven by the growth of smartphones and wearables. In 2024, Murata released an MLCC measuring just 0.16 mm x 0.08 mm. This innovation secures their position as a Star.

- Miniaturization is key for modern devices, boosting Murata's market position.

- The trend toward smaller electronics fuels demand for Murata's components.

- Murata's 2024 innovation highlights their leadership in the field.

- This technological advancement ensures Murata remains a Star in the BCG Matrix.

Power Supply Modules for Specific Applications

Murata's power supply modules, particularly for data centers and medical devices, are promising. These modules are vital for sectors needing reliable, efficient power, fueling their growth. The medical power supply market is expected to hit $1.89 billion in 2024. This positions Murata well in a growing market.

- Focus on high-growth sectors.

- Meeting demand for efficient power.

- Strong market position.

- $1.89 billion market size.

Murata's stars include MLCCs for AI servers and automotive electronics. These sectors show robust growth, fueled by technological advancements. Miniaturized components and power supply modules are also key drivers. In 2024, Murata expanded in several high-growth markets.

| Star Component | Market Driver | 2024 Performance |

|---|---|---|

| AI Server MLCCs | AI Server Growth | Significant demand increase |

| Automotive Electronics | EVs, ADAS | Expanding Market Share |

| Miniaturized Components | Smartphones, Wearables | Released 0.16mm MLCC |

Cash Cows

Standard MLCCs are cash cows for Murata, benefiting from its strong market position and operational efficiency. These components, vital in electronics, ensure a steady revenue stream. Murata leads the passive components market, holding 40% of MLCC and SAW filter shares, generating consistent cash. Despite price competition, its scale enables profit. In 2024, MLCCs are essential for various electronic devices.

Murata Manufacturing's capacitors for mobile phones are a classic cash cow, generating steady revenue. Their strong position is due to the massive smartphone market, with billions of phones produced annually. In fiscal year 2024, revenue growth was notable in computers and mobility. Capacitors and RF modules significantly contributed to this growth.

SAW filters, crucial for signal processing in communication devices, are a steady income source for Murata. They're widely used in smartphones and wireless tech. Murata holds a 40% market share in SAW filters. This component is key for 5G and 4G. In 2024, the global SAW filter market was valued at approximately $3.5 billion.

Power Supply Modules for Industrial Applications

Murata's power supply modules are a cash cow, especially for industrial applications. These modules provide consistent revenue due to the continuous demand for reliable power in factory automation and industrial equipment. The market for industrial power supplies is expanding, fueled by automation and the need for energy-efficient solutions. This sector is expected to grow significantly in the coming years, reinforcing its cash cow status.

- The industrial power supply market was valued at $8.6 billion in 2023.

- It is projected to reach $11.2 billion by 2028.

- The market is growing at a CAGR of 5.4% from 2023 to 2028.

- Murata’s power supply modules have a strong market share.

Resistors and Inductors

Murata's resistors and inductors form a stable "Cash Cow" segment, vital for diverse electronics. These components generate reliable cash flow due to consistent demand. In 2024, strong revenue came from computers and mobility. Capacitors and inductors significantly boosted revenue.

- Steady cash flow.

- Essential electronic components.

- Revenue growth in computers and mobility.

- Capacitors and inductors boost revenue.

Murata’s cash cows include MLCCs, SAW filters, and power modules, providing consistent revenue. These components benefit from strong market positions and high demand. In 2024, MLCCs and SAW filters had substantial market shares, driving revenue.

| Component | Market Share | 2024 Revenue Source |

|---|---|---|

| MLCCs | 40% | Smartphones, electronics |

| SAW Filters | 40% | 5G, 4G devices |

| Power Modules | Significant | Industrial automation |

Dogs

Murata's cylindrical lithium-ion battery unit, inherited from Sony, grapples with reduced demand, especially in power tools. This segment is categorized as a Dog within the BCG Matrix. The company reported a substantial impairment loss of JPY49.5 billion (US$318.63 million) linked to this business. Turnaround strategies or divestiture are vital for this underperforming area in 2024.

Commodity components, like some MLCCs, face stiff price competition, especially from Asian manufacturers. These products often have low profit margins and limited growth prospects. Murata's 2024 mid-term plan focuses on increasing MLCC market share to combat this competition. In 2023, the MLCC market was valued at approximately $13 billion.

Outdated communication modules face declining demand due to lack of support for new wireless standards. To stay competitive, these modules need upgrades or replacement. The need is essential as older tech may suffer from market obsolescence. Murata's offerings, such as MetroCirc, may see sales boosted by the shift towards 6G systems. In 2024, Murata's net sales were ¥1.7 trillion, reflecting its market position.

Components for Declining Consumer Electronics

Components in consumer electronics, like those in older TVs or audio gear, face declining demand. This can lead to reduced sales and the need for diversification. Murata Manufacturing saw a revenue decrease in fiscal year 2023 due to lower demand in power tools, PCs, and industrial machinery. Despite strong growth in automotive and smartphones, declines in other areas impacted overall performance.

- Declining sales in consumer electronics affect component demand.

- Diversification or repositioning is crucial for these products.

- Murata's revenue decreased in fiscal year 2023.

- Demand decreased in power tools, PCs, and industrial machinery.

Niche Products with Limited Market

Highly specialized components for niche markets with limited growth could be seen as Dogs. These products might face low sales volumes, demanding careful management. Murata's positive outlook for the fiscal year ending March 31, 2025, suggests a focus on core markets. The company's strategy likely involves optimizing these areas.

- Niche products face low sales volumes.

- Requires careful management to avoid losses.

- Murata focuses on core markets and growth.

- Strategy includes optimizing these areas.

Dogs in Murata's BCG matrix include underperforming segments like cylindrical lithium-ion batteries and specialized components. These areas suffer from declining demand, stiff competition, or niche market limitations. In 2024, impairment losses and revenue decreases highlight the challenges.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| Cylindrical Li-ion | Reduced demand, power tools | JPY49.5B impairment loss |

| Commodity Components | Price competition, low profit | Focus on MLCC market share |

| Outdated Modules | Declining demand, older tech | Upgrade or replace needed |

Question Marks

Stretchable electronics, like Murata's SPCs, are question marks. The wearable medical device market, where these fit, is growing fast. The Asia Pacific region leads growth, with a high CAGR. Murata's tech, launched in November 2024, faces adoption challenges.

Murata Manufacturing's focus on 6G components highlights a growth opportunity as the wireless network evolves. The 6G market is still in its early stages, thus the success of these components depends on 6G's adoption. Murata's radio-frequency modules, such as MetroCirc, could boost sales and profits within 5-6 years. In 2024, the global 6G market is projected to reach USD 2.3 billion by 2030, growing at a CAGR of 57.3%.

Murata Manufacturing's wireless power transfer tech, vital for charging mobile devices and industrial equipment, is a potential star. The market is evolving, with a forecast to reach $19.5 billion by 2028. Murata's focus on advanced materials and modules supports this growth. In 2024, the wireless charging market grew by 15%.

Medical Device Components

Murata's medical device components, including those for implantable sensors, are in a growing market, but face regulatory hurdles and R&D costs. This sector leverages the surge in healthcare spending and tech advancements. For example, the global medical devices market was valued at $495.4 billion in 2023.

- Murata's medical components cater to advanced medical devices.

- The market's growth is fueled by healthcare expenditure.

- Regulatory approvals and R&D investments are crucial.

- The medical devices MLCC industry is seeing major growth.

New Materials for High-Frequency Applications

Murata Manufacturing's focus on new materials for high-frequency applications presents both opportunities and challenges within its BCG matrix. These materials are crucial for advanced radar systems and satellite communications, opening doors to potential growth. However, this market is highly competitive, demanding constant technological advancements and innovation. As the world's leading capacitor supplier, Murata is well-positioned to leverage its expertise.

- The global radar market was valued at USD 24.5 billion in 2023.

- The satellite communication market is projected to reach USD 63.8 billion by 2029.

- Murata's revenue for fiscal year 2024 was approximately JPY 1.8 trillion.

- R&D spending is a key factor, with companies investing heavily in new materials.

Murata's SPCs and 6G components are Question Marks, with growth potential but uncertain adoption rates. The wireless power transfer tech also presents a Question Mark, with an evolving market. Murata's medical device components are Question Marks, facing regulatory and R&D challenges.

| Product | Market Status | Challenges |

|---|---|---|

| SPCs | Growing, wearable tech | Adoption |

| 6G Components | Early stage | 6G adoption |

| Wireless Power | Evolving market | Competition |

| Medical Components | Growing, healthcare | Regulations, R&D |

BCG Matrix Data Sources

This BCG Matrix is sourced from market share data, revenue analyses, growth projections, and company financial reports for accurate insights.