Fawry Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fawry Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, providing a quick view of business performance.

Preview = Final Product

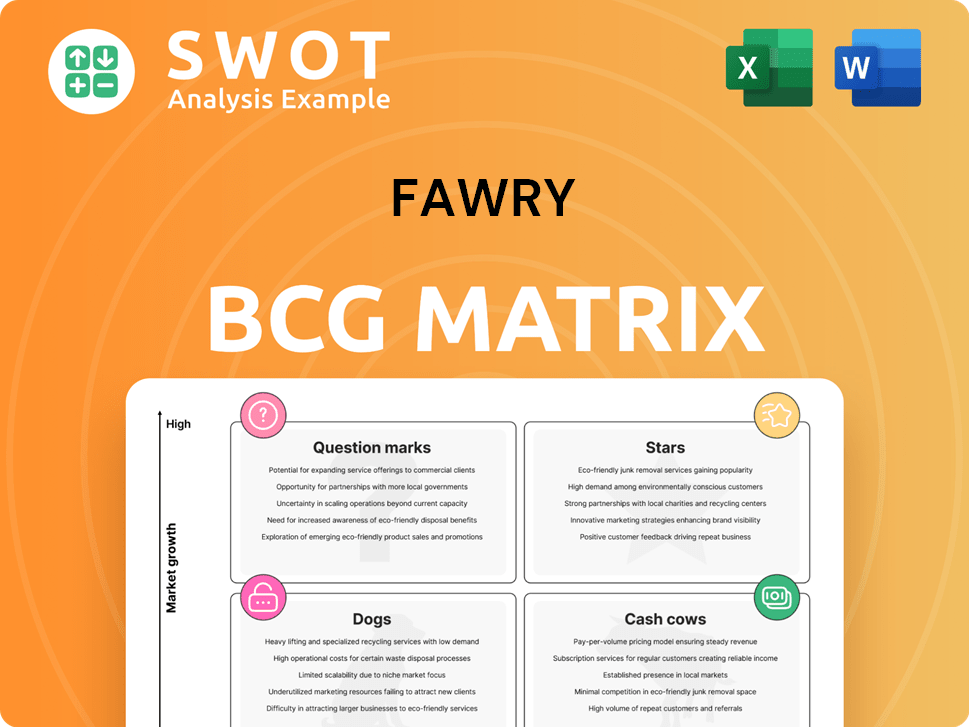

Fawry BCG Matrix

The preview showcases the exact Fawry BCG Matrix you'll receive post-purchase. This document provides a detailed strategic overview, ready to use for market analysis and business planning. Download the full, fully editable report for instant insight and actionable takeaways. The same comprehensive matrix you are viewing is what you get, ready to boost your strategies.

BCG Matrix Template

Fawry's BCG Matrix unveils a snapshot of its diverse offerings. Analyzing its portfolio reveals high-growth "Stars," steady "Cash Cows," potential "Question Marks," and "Dogs." This sneak peek hints at strategic moves. Purchase the full BCG Matrix to unlock detailed quadrant breakdowns, competitive positioning, and actionable insights for Fawry.

Stars

Fawry dominates Egypt's digital payments market. Its wide network and services give it a significant edge. Fawry's revenue in 2023 reached EGP 3.1 billion, a 40% increase. Continuous innovation strengthens its leadership.

Fawry showcases strong financial health, marked by substantial revenue and profit increases. Its capacity to boost both revenue and net profit underscores its financial resilience. In 2024, Fawry's revenue reached EGP 4.4 billion, with a net profit of EGP 681.9 million. Diversification and cost controls boost its profitability.

Fawry's strategic move into financial services, including banking, has fueled significant growth. The financial services segment showed strong revenue increases in 2024, with a 40% rise. Its ability to serve SMEs and consumers solidifies its fintech leadership. In Q1 2024, Fawry processed 1.3 billion transactions.

Innovative Payment Solutions

Fawry's innovative payment solutions are a key strength, attracting a broad customer base. Their user-friendly platform and secure options improve the customer experience. Fawry invests in technology to stay ahead of market trends. In 2024, Fawry processed over 4 billion transactions, demonstrating its market leadership.

- User-friendly platform and secure payment options improve customer experience.

- Fawry invests in technology to stay ahead of market trends.

- In 2024, Fawry processed over 4 billion transactions.

Strategic Partnerships and Acquisitions

Fawry's "Stars" status is reinforced by strategic partnerships and acquisitions. These moves broaden its ecosystem and service offerings, providing integrated solutions. This approach creates a significant barrier against competitors in the digital business arena. Fawry's investments, like the acquisition of e-payment firm, Masary, in 2024, solidify its market position.

- Masary acquisition in 2024 expanded Fawry's e-payment capabilities.

- Partnerships enhance Fawry's integrated digital solutions.

- Strategic investments boost market competitiveness.

- These actions support Fawry's growth trajectory.

Fawry's "Stars" status in the BCG Matrix is evident due to its market dominance and rapid growth. Its strategic partnerships and acquisitions expand its reach and services, creating strong barriers to entry. The acquisition of Masary in 2024 shows its commitment to growth.

| Aspect | Details |

|---|---|

| Market Position | Dominant in Egypt's digital payments. |

| Growth | Revenue increased by 40% in 2023 and 2024. |

| Strategic Moves | Acquisition of Masary in 2024. |

Cash Cows

Fawry's alternative digital payments (ADP), including POS and merchant networks, is a cash cow. It still significantly boosts revenue, though its relative contribution has slightly declined. The ADP segment consistently grows, ensuring a steady income stream. In 2024, ADP is expected to bring in $150 million in revenue.

Fawry's vast network of point-of-sale (POS) terminals across Egypt is a significant strength, ensuring easy access for users. This extensive reach allows Fawry to serve a large customer base effectively. In 2024, Fawry processed over 1.5 billion transactions. The company's ability to broaden its retail network further boosts its market penetration. The wide service point network gives Fawry a key advantage.

Fawry's mobile wallet transactions solidify its cash cow status. Digital payments are booming in Egypt, with mobile wallet usage soaring. Fawry's platform is key in this shift, facilitating these transactions. In 2024, mobile wallet transactions via Fawry grew significantly, reflecting its strong market position.

Bill Payment Services

Fawry's bill payment services are a cash cow, providing consistent revenue because these payments are essential. They offer a broad selection of payment choices to meet diverse consumer needs. The dependability of Fawry's bill payment services strengthens its stable income. In 2024, bill payments accounted for a significant portion of Fawry's transactions, with a steady growth rate.

- Bill payment transactions are critical for consistent revenue.

- Fawry provides a wide range of payment options.

- Reliable services ensure a stable income.

- Bill payments represented a large part of transactions in 2024.

Established Brand Recognition

Fawry's robust brand recognition in Egypt cultivates customer trust and loyalty. The company's reputation for reliability and integrity distinguishes it from rivals, supporting its ability to sustain a high market share. This is crucial in a market where trust in digital transactions is paramount. Fawry's established brand helps it maintain its dominant position.

- Fawry processed over 4.3 billion transactions in 2023.

- Fawry's revenue increased by 45.2% in 2023.

- Fawry's brand is associated with 74% of all digital payments in Egypt.

- Fawry's market share is estimated at around 80%.

Fawry's Cash Cows, including ADP, POS, mobile wallets, and bill payments, generate stable revenue. These segments benefit from strong brand recognition and a vast network. Bill payments are essential for consistent income. In 2024, ADP brought in $150 million, showing strong market positioning.

| Cash Cow | 2024 Revenue/Transactions | Key Benefit |

|---|---|---|

| ADP (Alternative Digital Payments) | $150M | Consistent Revenue Growth |

| POS & Merchant Networks | 1.5B+ Transactions | Extensive Reach |

| Mobile Wallets | Significant Growth | Facilitates Digital Payments |

| Bill Payments | Significant Volume | Essential Service |

Dogs

Fawry's legacy systems, some dating back to the early 2010s, might be less efficient. These systems could impede innovation and responsiveness to market changes. Upgrading these systems could require substantial investment. Fawry's 2023 financial reports showed a 15% allocation to tech upgrades.

Some of Fawry's services have smaller profit margins. These services might not boost overall profitability much. For 2024, consider services with less than 10% profit margin. Fawry should review and improve these to perform better financially.

Some of Fawry's services are in a highly competitive market, facing rivals in electronic payments. These services risk losing market share and profitability. In 2024, Fawry's revenue grew, but competition could affect future gains. To compete, Fawry must offer better service, new solutions, and strategic alliances.

Underperforming Regional Ventures

If Fawry's regional ventures are underperforming, they might be categorized as dogs in the BCG matrix. These ventures could be absorbing considerable investment without yielding significant returns. For instance, if a 2024 expansion into a specific region saw a 5% revenue increase compared to a 15% industry average, it signals underperformance. Fawry must reconsider its regional strategy and focus on more promising avenues.

- Limited Revenue Growth: A 2024 regional venture might show only a 5% revenue increase.

- High Investment Costs: Significant capital is needed to sustain these ventures.

- Strategic Reassessment: Fawry should evaluate or pivot its regional strategy.

- Market Focus: Prioritize regions with stronger growth potential.

Cash-Intensive Operations

Fawry's cash-intensive operations, including its extensive retail network, could be classified as "Dogs" within the BCG Matrix. These operations may require substantial capital investment without delivering high returns. Optimizing cash flow and minimizing capital needs are crucial for Fawry to improve its financial performance. The company's focus should be on strategies to enhance efficiency and reduce costs in these areas.

- Fawry reported a net profit of EGP 161.6 million in Q1 2024.

- Operating expenses increased to EGP 682.8 million in Q1 2024.

- The company's cash balance was EGP 2.2 billion as of March 31, 2024.

Fawry's "Dogs" include ventures with slow growth and high costs. A 2024 regional venture might show only a 5% revenue increase. Cash-intensive operations like the retail network also fall in this category. Fawry must re-evaluate, cut costs, and focus on better-performing areas.

| Characteristic | Impact | Example (2024 Data) |

|---|---|---|

| Low Growth | Limited Returns | 5% Revenue Increase |

| High Costs | Cash Drain | Q1 2024 Operating Expenses: EGP 682.8M |

| Strategic Need | Re-evaluation/Pivot | Cash Balance as of March 31, 2024: EGP 2.2B |

Question Marks

Fawry's 'Fawry Business' platform, a question mark in its BCG Matrix, targets corporate financial services. It faces competition, highlighting uncertainty. Success hinges on innovative solutions. In 2024, the B2B payments market grew, suggesting potential.

Fawry's Saudi Arabian expansion is a question mark in its BCG matrix. The Saudi market presents opportunities, yet regulatory hurdles and competition exist. Success hinges on adapting services and forming strong partnerships. In 2024, Saudi Arabia's fintech market is projected to reach $18.4 billion, showing high potential.

Fawry's 'Sehetak Fawry' is a question mark in its BCG matrix. The medical insurance market is intensely competitive, with established players. Success hinges on building customer trust and standing out. Fawry needs to leverage its network. In 2024, Egypt's insurance sector saw 15% growth.

SME Lending Services

Fawry's foray into SME lending is a question mark in its BCG matrix. The demand for SME financing is high, but Fawry must manage credit risk and compete. Success hinges on risk assessment and tailored financing. In 2024, SMEs in Egypt contributed over 75% of the workforce.

- Market Demand: High demand for SME financing in Egypt.

- Risk Management: Fawry must effectively assess and manage credit risk.

- Competition: Fawry competes with established financial institutions.

- Tailored Solutions: Success depends on offering customized financing.

Partnerships with Tech Startups

Fawry's alliances with tech startups, including Dirac Systems, Virtual CFO, and Code Zone, represent a question mark in its BCG matrix. These partnerships could boost Fawry's service offerings, but their success hinges on how well they integrate and collaborate. The potential value is significant, but so are the risks, making this a key area to watch. The company's ability to use these startups' expertise is essential for creating effective solutions.

- Dirac Systems: Potential for innovative payment solutions.

- Virtual CFO: Could enhance financial management services.

- Code Zone: Focus on technology to improve Fawry’s offerings.

Fawry's startup alliances are question marks in its BCG matrix. Success depends on integrating these tech partnerships effectively. These alliances aim to improve Fawry’s services. In 2024, tech partnerships are vital for financial innovation.

| Partnership | Focus | Potential Impact |

|---|---|---|

| Dirac Systems | Payment Solutions | Innovative payments |

| Virtual CFO | Financial Management | Enhanced services |

| Code Zone | Technology Solutions | Improved offerings |

BCG Matrix Data Sources

Fawry's BCG Matrix leverages transaction data, market share figures, industry reports, and growth rate predictions for robust strategic analysis.