N-able SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

N-able Bundle

What is included in the product

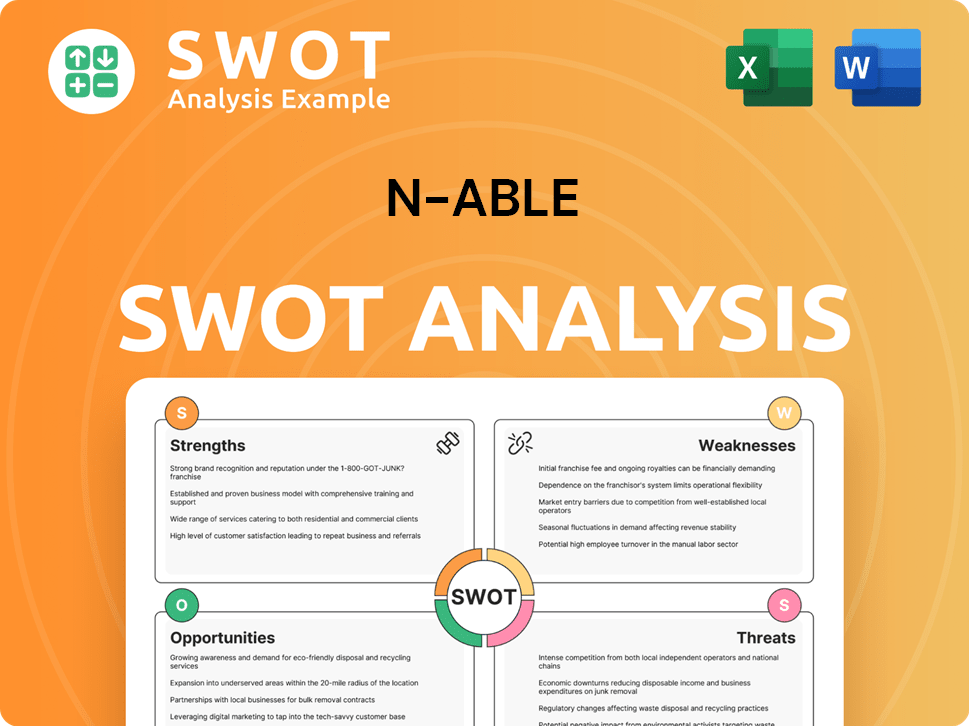

Offers a full breakdown of N-able’s strategic business environment.

Simplifies complex assessments with a clean and comprehensive visual.

Preview the Actual Deliverable

N-able SWOT Analysis

You're looking at the real N-able SWOT analysis you'll get. This preview is from the complete, post-purchase document. Purchase unlocks the full version with all the detailed insights. It's a professional analysis, ready for your use.

SWOT Analysis Template

N-able's strengths in cloud-based services are undeniable. But are you aware of its vulnerabilities and emerging threats? Our SWOT analysis highlights opportunities for growth and the internal factors driving N-able's performance. We've only scratched the surface.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

N-able's strength lies in its comprehensive software suite tailored for Managed Service Providers (MSPs). Their platform integrates RMM, security, and data protection, streamlining operations. This unified approach allows MSPs to offer diverse services. The platform boasts over 20 integrated tools, enhancing service delivery and efficiency. In Q1 2024, N-able reported a 14% year-over-year growth in its software revenue, showcasing its market appeal.

N-able's strength lies in its strong focus on Managed Service Providers (MSPs). The company's model revolves around serving MSPs, offering specialized solutions and support. This specialization allows N-able to gain deep expertise in the MSP market and build strong partner relationships. N-able currently serves over 12,000 MSPs worldwide. This focus strengthens its position in a growing market.

N-able's dedication to innovation is a core strength. They continuously invest in R&D, integrating AI and machine learning. Over the past year, N-able released more than 50 product updates, enhancing their platform. This commitment ensures MSPs can offer advanced solutions. This helps them address evolving IT needs effectively.

Robust Security and Data Protection Offerings

N-able's strong focus on security is a key advantage, especially with rising cyber threats. Their solutions help MSPs protect client networks, infrastructure, and data. The Adlumin acquisition boosts their XDR and MDR capabilities. According to a 2024 report, cybersecurity spending is projected to reach $212 billion. This focus offers a competitive edge.

- Multi-layered cybersecurity solutions.

- Data protection offerings for MSPs.

- Enhanced XDR and MDR capabilities.

- Acquisition of Adlumin.

Positive Financial Performance

N-able showcases robust financial health, marked by consistent revenue increases and healthy gross profit margins. This financial strength allows N-able to confidently pursue strategic investments and business growth. In 2024, N-able's revenue saw a rise of more than 10% compared to the previous year, accompanied by strong gross profit margins, indicating efficient operations.

- Revenue Growth: Over 10% increase in 2024.

- Gross Profit Margins: Maintained strong margins.

- Financial Stability: Provides a solid base for investments.

N-able's integrated suite and focus on MSPs are core strengths, streamlining operations. The company's dedication to innovation, with continuous R&D, and focus on security further solidifies its market position. Robust financial health, marked by revenue growth, supports strategic investments.

| Strength | Details | Data Point (2024-2025) |

|---|---|---|

| Comprehensive Platform | Integrated RMM, security, data protection. | 14% software revenue growth (Q1 2024). |

| MSP Focus | Specialized solutions, strong partner relationships. | Over 12,000 MSPs served worldwide. |

| Innovation | Continuous R&D, AI and machine learning integration. | 50+ product updates released. |

Weaknesses

N-able's strong reliance on the MSP market, while a strength, creates a significant weakness. This concentration limits diversification, potentially hindering growth if the MSP market faces challenges. The company is vulnerable to downturns or increased competition within the MSP segment. For example, in Q4 2023, revenue from MSPs was 95% of total revenue.

N-able's growth brings the risk of platform complexity. Smaller MSPs might find the extensive feature set overwhelming. User feedback indicates navigation challenges. This could hinder feature adoption. Underutilization might impact ROI. In 2024, 15% of users cited complexity as a key issue.

Customer support concerns are a weakness for N-able. Some users report delayed responses and unhelpful guidance. Inconsistent support can hurt satisfaction and retention. Recent surveys show customer satisfaction scores for tech support are often below industry averages, with about 20% of users reporting negative experiences in 2024. This can lead to churn.

Integration Challenges with Specific Systems

N-able's integration capabilities, though generally strong, can face hurdles with older systems or unique IT setups. This can translate into extra work and potential costs for MSPs. For example, a 2024 survey indicated that 35% of MSPs spend significant time on integrations. These challenges might involve custom coding or workarounds.

- Compatibility issues with legacy software.

- Need for custom scripting or API development.

- Potential for increased implementation time.

- Risk of integration errors or conflicts.

Lower Return on Equity Compared to Industry Average

N-able's ROE lags behind its industry peers, a key weakness. This indicates that the company might not be maximizing the returns from shareholder investments. While net income has seen growth, the efficiency in utilizing equity appears comparatively lower. For 2024, the median ROE for the software industry was around 15%. N-able's ROE needs improvement.

- Inefficient Equity Use.

- Lower Profitability.

- Growth vs. Efficiency.

- Industry Comparison.

N-able's high MSP market concentration creates vulnerability and limits diversification opportunities. Growth brings the risk of platform complexity that might be challenging for some MSPs. In Q4 2024, customer satisfaction scores are below the industry average. These aspects combined can lead to lower user engagement.

| Weakness | Description | Impact |

|---|---|---|

| Market Concentration | Reliance on MSPs (95% in Q4 2023) | Limits growth; vulnerability to MSP issues. |

| Platform Complexity | Extensive feature set may be overwhelming. | Hindered adoption (15% cited as an issue in 2024). |

| Customer Support | Delayed, unhelpful guidance. | Low satisfaction (20% negative experience in 2024); churn risk. |

Opportunities

N-able can seize the chance to grow by offering enhanced cybersecurity services. The rise in cyber threats, especially to SMEs, fuels demand for strong security. Endpoint detection and response (EDR) and security awareness training are key areas. The global cybersecurity market is projected to reach $345.4 billion in 2024.

N-able can capitalize on the growing digital adoption in emerging markets, expanding its reach globally. In 2023, over half (51%) of N-able's revenue originated outside the U.S. This presents a huge opportunity to grow sales. The company can tailor solutions for these markets.

N-able can leverage strategic partnerships to boost its offerings. Collaborations with tech firms expand its reach. The Technology Alliance Program is key. In Q4 2023, N-able's revenue was $265.5 million, showing growth. This approach enhances the MSP ecosystem.

Increasing Demand for IT Services in the SME Market

The SME market's increasing reliance on IT services fuels demand for MSPs, benefiting N-able. This trend is supported by substantial market growth forecasts. The IT services market for SMEs is projected to reach $600 billion by 2025, up from $450 billion in 2023, indicating significant expansion. This growth signifies a major opportunity for N-able to offer its tools and infrastructure.

- Projected IT spending by SMEs in 2025: $600 billion.

- Market growth from 2023 to 2025: 33.3%.

Potential for Upselling and Cross-selling to Existing Partners

N-able can boost revenue by upselling and cross-selling to existing partners. Encouraging Managed Service Providers (MSPs) to adopt more solutions is key. Management sees significant unrealized revenue per device. For example, in Q4 2024, N-able reported a 13% increase in revenue, showing growth potential. This strategy leverages existing relationships for expansion.

- Upselling and cross-selling can increase revenue.

- Encouraging MSPs to adopt more solutions is key.

- Management sees unrealized revenue per device.

- Q4 2024 showed a 13% revenue increase.

N-able should strengthen cybersecurity services due to rising threats, targeting a $345.4B market by 2024. Global expansion is key; 51% of 2023 revenue was outside the U.S. Partnerships, like the Technology Alliance Program, and upselling boost growth, aiming for the $600B SME IT market by 2025.

| Opportunity | Description | Data Point |

|---|---|---|

| Cybersecurity Growth | Meet demand for stronger security services, focusing on EDR & training. | Cybersecurity market expected to reach $345.4B in 2024. |

| Global Market Expansion | Leverage international adoption by adapting solutions for emerging markets. | 51% of 2023 revenue outside U.S.; significant expansion. |

| Strategic Partnerships | Boost offerings through tech collaborations. | Q4 2023 revenue: $265.5M, indicating growth through the approach. |

| SME Market Growth | Capitalize on IT service demand from SMEs. | $600B IT services market by 2025. |

| Upselling/Cross-selling | Boost revenue by encouraging more adoption within existing partners. | Q4 2024: 13% revenue increase demonstrating impact. |

Threats

The IT management market is fiercely competitive, with major players like ConnectWise, Kaseya, and SolarWinds aggressively seeking market share. N-able must constantly innovate to stand out and retain its market position. In 2024, the IT management software market was valued at approximately $30 billion globally. The pressure to offer superior solutions and competitive pricing is intense. This requires significant investment in R&D.

Rapid technological changes pose a significant threat to N-able. The company must constantly invest in R&D to stay relevant. Otherwise, its solutions could become outdated. The IT services market is projected to reach $420 billion in 2024. Failing to adapt can lead to a loss in market share.

The cybersecurity landscape is constantly changing, demanding that N-able continuously enhance its security measures. New and advanced threats pose a persistent risk, requiring ongoing investment in protective technologies. A breach could severely disrupt services, potentially harming N-able's reputation and financial performance. In 2024, the average cost of a data breach was $4.45 million, underscoring the financial stakes involved.

Potential Negative Impact of a Business Sale

A potential sale of N-able introduces several threats. Uncertainty during the acquisition process could disrupt operations and impact employee morale. New ownership might shift the company's strategic focus, potentially affecting its long-term goals. Integration challenges, such as merging IT systems, often lead to inefficiencies. News about a possible sale surfaced in 2024, increasing these concerns.

- Acquisition process uncertainty.

- Strategic focus changes.

- Integration challenges.

- Employee morale impact.

Economic Downturns Affecting SME Spending

Economic downturns pose a threat to N-able as SMEs may cut IT spending. Reduced budgets directly impact demand for MSP services, affecting N-able's revenue streams. During the 2008 recession, IT spending decreased by up to 10% for some businesses. This trend could resurface. The latest forecasts from the IMF predict a global economic slowdown in 2024/2025.

- Decreased IT budgets.

- Reduced demand for services.

- Impact on revenue.

N-able faces strong competition, with $30B IT market value in 2024. Constant tech advancements necessitate continuous R&D; $420B IT service market by 2024. Cybersecurity threats, costing $4.45M per breach in 2024, demand constant vigilance.

Potential acquisitions bring uncertainty, affecting operations. Economic downturns risk SME budget cuts and revenue impacts; IMF forecasts a 2024/2025 slowdown.

| Threat | Description | Impact |

|---|---|---|

| Market Competition | Aggressive competition in IT management software. | Requires continuous innovation, R&D investment. |

| Technological Change | Rapid advancements, potential obsolescence of solutions. | Risk of losing market share if not adapted; market size $420B. |

| Cybersecurity Threats | Constantly evolving risks; data breaches. | Financial damage, reputational harm; average breach cost $4.45M. |

SWOT Analysis Data Sources

The N-able SWOT analysis is constructed with financial reports, market analysis, and expert perspectives for an informed strategic evaluation.