Nanogate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nanogate Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs for easy stakeholder review.

Preview = Final Product

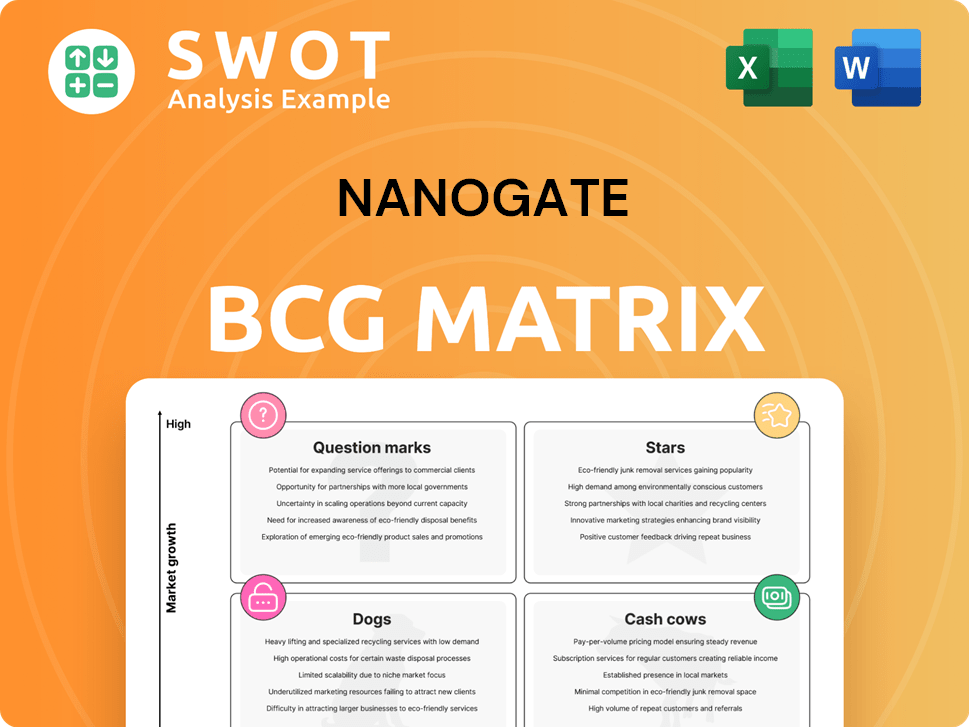

Nanogate BCG Matrix

The Nanogate BCG Matrix preview is identical to the purchased document. This means you'll get the full, ready-to-use version immediately after buying. It's designed to support your strategic decision-making.

BCG Matrix Template

Nanogate's BCG Matrix reveals its product portfolio's strategic positions. Understanding its "Stars" and "Cash Cows" is crucial for growth. This preview offers a glimpse into its market dynamics. Uncover how Nanogate allocates resources and manages risks. Identifying "Dogs" and "Question Marks" unlocks key strategic decisions. Gain in-depth analysis and actionable insights—purchase the full BCG Matrix today!

Stars

Nanogate excels in intelligent automotive surfaces, blending design with function. These surfaces boost aesthetics and durability with features like scratch resistance. Strong market demand and ongoing innovation make this a high-growth area. In 2024, the automotive coatings market was valued at approximately $20 billion, showing strong growth.

Nanogate's "New Mobility Solutions," including lightweight components for EVs, are a star. The EV market is booming; in 2024, global EV sales exceeded 14 million units. Nanogate's tech, blending electronics and design, offers a competitive edge. Investment is key to sustaining this growth.

Nanogate's artificial metals are a promising area, offering cost-effective and sustainable alternatives. These materials provide lightweighting and design flexibility, crucial for automotive and aerospace. In 2024, the global market for advanced materials, including these, was estimated at over $90 billion, with strong growth expected. Further innovation and market penetration will solidify this area as a star.

IMSE (Injection Molded Structural Electronics)

Nanogate's IMSE is a shining star, leading in electronics integration with 3D injection molded plastics. It excels in creating smart surfaces and HMIs for automotive, smart homes, and appliances. Strategic partnerships and tech transfer drive its success. In 2024, the smart surfaces market is projected to reach $10.5 billion.

- IMSE allows for functional integration in plastic parts.

- It enables smart surfaces and HMIs.

- Nanogate benefits from strategic partnerships.

- The market for smart surfaces is expanding.

Nanotechnology-Based Heat Exchangers

Nanogate's heat exchanger technology, focusing on high-performance surfaces for light metals, is a star. These coatings boost efficiency and lifespan, crucial for heating systems. International market expansion further cements its stellar status. Nanogate's revenue in 2024 reached €100 million, with a 15% growth in the heat exchanger segment.

- 2024 Revenue: €100 million.

- Heat Exchanger Segment Growth: 15% in 2024.

- Focus: High-performance surfaces for light metals.

- Benefit: Increased efficiency and lifespan.

Nanogate's "Stars" show high growth potential and strong market share. They drive revenue and attract significant investment. These areas include automotive surfaces, EV solutions, and advanced materials, all with solid 2024 market values.

| Star Product | 2024 Market Value | Key Benefit |

|---|---|---|

| Automotive Surfaces | $20B | Aesthetics & Durability |

| EV Solutions | $14M EV Sales | Lightweight Components |

| Artificial Metals | $90B | Cost-Effective & Sustainable |

Cash Cows

Nanogate's home appliance components are a reliable cash source, benefiting from steady demand and customer loyalty. This segment's stability is key. In 2024, the home appliance market saw consistent growth, providing a solid foundation. Efficiency improvements further boost cash flow.

Nanogate's medical device coatings are a cash cow, generating consistent revenue. The medical device market was valued at $612.7 billion in 2023, with steady growth. These coatings, offering biocompatibility and sterilization, meet industry needs. Strong manufacturer relationships ensure revenue stability.

Nanogate's surface finishing, like scratch-resistant coatings for consumer electronics, is a cash cow. This sector benefits from the consistent demand for attractive, durable devices. In 2024, the global market for consumer electronics is projected to reach $1.08 trillion. Investing in efficient processes ensures revenue generation.

Plastic Metallization Services

Nanogate's plastic metallization services are a steady source of revenue, acting as a cash cow. These services offer alternatives to traditional metal components, appealing to sectors wanting lighter, cheaper options. Innovation in metallization is key. The global market for plastic metallization was valued at USD 5.2 billion in 2024.

- Market size reached USD 5.2 billion in 2024.

- Offers lightweight and cost-effective solutions.

- Focus on innovation in metallization techniques.

- Serves various industries.

Automotive Interior Trim

As part of Techniplas, Nanogate's automotive interior trim production is a stable cash cow. It leverages established OEM and Tier 1 supplier relationships. The focus on quality and cost efficiency ensures consistent revenue. The automotive interior trim market was valued at $78.5 billion in 2024. This segment's growth is projected at a CAGR of 4.2% from 2024 to 2032.

- Stable revenue stream from OEM contracts.

- Focus on cost-effective manufacturing processes.

- High customer retention rates.

- Market growth supported by vehicle production.

Nanogate’s cash cows consistently generate revenue, essential for financial stability. Their home appliance segment, benefiting from steady demand, thrived in 2024. The medical device coatings, projected to reach $786.2 billion by 2032, provide steady income. Surface finishing and plastic metallization, with markets valued at $1.08 trillion and $5.2 billion, respectively, remain strong.

| Cash Cow | Market Size (2024) | Key Features |

|---|---|---|

| Home Appliance Components | Consistent Growth | Steady demand, customer loyalty |

| Medical Device Coatings | $612.7B (2023) | Biocompatibility, sterilization |

| Surface Finishing | $1.08T | Attractive, durable devices |

| Plastic Metallization | $5.2B | Lightweight, cost-effective |

Dogs

Following the sale of its core business, Nanogate's textile and care systems likely face challenges. This segment might show low growth and market share. The restructuring may lead to divestiture or discontinuation. In 2024, this area may show a decrease in revenue. It reflects a strategic shift.

The insolvent subsidiaries of Nanogate, now part of Techniplas, are potential dogs in the BCG matrix. These assets, including Nanogate Management Services GmbH and others, may have low growth and need substantial investment. In 2024, assessing their strategic value within Techniplas is critical, especially given Nanogate's past financial struggles. The goal is to determine if these assets can be revitalized or if they will continue to be a drain on resources.

Outdated nanocomposites, with low market share in slow-growth markets, often become dogs. These products might be obsolete, facing tough competition. For instance, a 2024 report indicated a 5% decline in demand for certain older nanocomposites. Phasing out such products could be crucial for financial health.

Non-Strategic Joint Ventures

Non-strategic joint ventures with low market share and growth are "dogs" in Nanogate's BCG Matrix. These ventures, outside core areas like Intelligent Surfaces, New Mobility, and Artificial Metals, can be resource drains. In 2024, consider re-evaluating or terminating such ventures to improve overall financial performance.

- Focus on core competencies.

- Assess joint venture alignment.

- Monitor market share and growth.

- Reallocate resources effectively.

Low-Margin Coating Applications

Low-margin coating applications with limited growth are "dogs" in Nanogate's portfolio. These face intense price competition, reducing profitability. Strategies may involve improving efficiency or exiting these markets. For example, in 2024, the automotive coatings segment saw a 2% profit margin, prompting strategic reviews.

- Low-margin coating applications face intense price competition.

- Limited growth prospects characterize these segments.

- Improving efficiency or exiting markets is crucial.

- Profit margins in specific segments, such as automotive coatings, were low in 2024.

Dogs within Nanogate's BCG Matrix represent underperforming segments. These include insolvent subsidiaries, outdated nanocomposites, and non-strategic joint ventures. In 2024, re-evaluation and strategic decisions are vital for these areas. The aim is to cut losses and free up resources.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Insolvent Subsidiaries | Low growth, high investment need | Continued drain on resources |

| Outdated Nanocomposites | Low market share, declining demand | Revenue decline, potential phase-out |

| Non-Strategic Ventures | Low growth, outside core areas | Financial strain, potential termination |

Question Marks

Nanogate's printed electronics, with low market share, targets high growth. This tech integrates functional materials into plastics. Strategic partnerships and investments are vital. In 2024, the printed electronics market was valued at $13.5 billion. This could boost Nanogate's position, transforming it into a star.

Nanogate's functional foils for FIM present opportunities in automotive and beyond, yet demand considerable investment for market penetration. FIM enables high-quality, decorative, and functional plastic part production. Focused marketing and product advancement are crucial for positioning this as a leading solution. The global FIM market was valued at $2.3 billion in 2023, projected to reach $3.5 billion by 2028.

Nanogate's high-temperature materials and thermoplastics offer significant growth potential, though their current market share is limited. These materials excel in harsh conditions, vital for industries like aerospace. In 2024, the market for advanced materials grew by approximately 7%, indicating strong demand. R&D investment can drive market penetration.

Strategic Cooperation in Air Filtration Systems

Nanogate's strategic cooperation in air filtration systems targets a market with strong growth potential, although it presently has a limited market share. The demand for improved air quality and health solutions drives this sector. Successful product development and strategic alliances are vital for capturing the expanding market. The global air purifier market was valued at USD 12.65 billion in 2023 and is expected to reach USD 22.82 billion by 2030.

- Market Growth: The air purifier market is growing at a CAGR of 8.75% from 2023 to 2030.

- Strategic Alliances: Partnerships are crucial for market penetration and expansion.

- Product Development: Innovation in air filtration is key to success.

- Market Share: Nanogate needs to focus on gaining a larger market share.

Applications of Radar-Transparent Surfaces

Nanogate's radar-transparent surfaces have significant applications in the automotive and aerospace sectors, representing a high-growth market. These surfaces are crucial for integrating radar sensors seamlessly into vehicles and aircraft. The current market share is relatively low, indicating substantial growth potential. Strategic partnerships and continuous innovation are key to increasing market penetration.

- Automotive radar market expected to reach $14.1 billion by 2028.

- Aerospace radar market projected to grow, driven by advancements in autonomous systems.

- Nanogate's focus on R&D is vital for staying competitive.

- Partnerships with major automotive and aerospace manufacturers are essential.

Nanogate's Question Marks, like radar-transparent surfaces and air filtration, show high growth potential but low market share. Success demands significant investment in R&D and strategic partnerships to boost market penetration. Focusing on innovation in these areas can transform them into Stars.

| Product | Market Growth Rate (2024) | Nanogate's Market Share |

|---|---|---|

| Radar-Transparent Surfaces | High (Aerospace & Automotive) | Low |

| Air Filtration Systems | 8.75% CAGR (2023-2030) | Low |

| High-Temp Materials | Approx. 7% | Low |

BCG Matrix Data Sources

Nanogate's BCG Matrix uses company reports, market analyses, and expert opinions to ensure actionable insights.