National Grid Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Grid Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio.

Printable summary optimized for A4 and mobile PDFs, so stakeholders can quickly reference the business performance.

Preview = Final Product

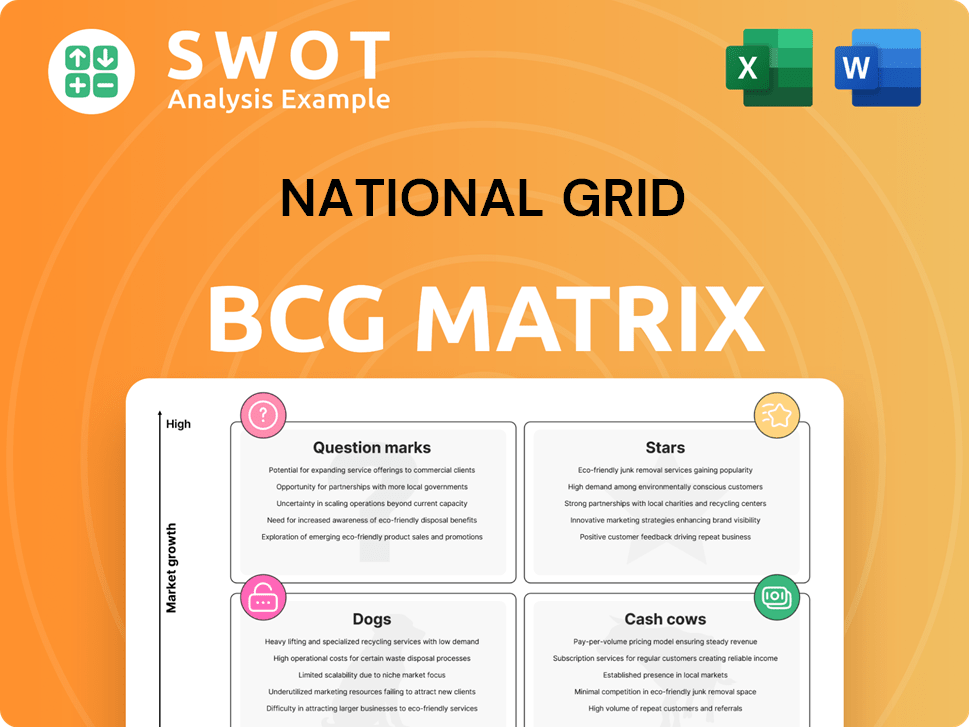

National Grid BCG Matrix

The National Grid BCG Matrix preview is the complete file you'll receive. This ensures the document's quality and readability for strategic planning. The purchased report is designed to provide immediate insights and ready-to-use analysis. You'll gain a comprehensive, professional-grade matrix, ideal for presentation. Get the same version you see now, instantly, upon purchase.

BCG Matrix Template

Ever wonder how National Grid juggles its vast portfolio? This sneak peek explores their products using the BCG Matrix: Stars, Cash Cows, Dogs, and Question Marks. It offers a glimpse into strategic decisions, but the full report provides much more.

Uncover detailed quadrant placements and data-driven recommendations. The complete BCG Matrix reveals market positioning and provides actionable insights.

Get instant access to the full report to pinpoint leaders and resource drains, and make the right capital allocation decisions. Ready-to-use strategic tool awaits!

Stars

Strategic infrastructure projects, like National Grid's 'Great Grid Upgrade,' are key. These projects aim to connect 50GW of offshore wind by 2030. The UK government supports this, making them stars. National Grid invested £7.5 billion in 2024, showing commitment.

National Grid's $100 million investment in AI startups highlights a high-growth opportunity within the energy sector. AI solutions, such as those from Amperon, boost grid efficiency. In 2024, the global smart grid market was valued at $30.5 billion, showing strong growth. These technologies will optimize energy distribution and cut costs.

Renewable energy interconnection technologies are a high-growth area, crucial for grid modernization. Smart Wires and LineVision offer innovative power flow control and dynamic line rating solutions, respectively. These technologies boost existing infrastructure capacity to accommodate more renewables. In 2024, the global smart grid market was valued at $35.8 billion, reflecting this growth.

Battery Storage Systems

National Grid's strategic investments in battery storage, exemplified by projects like those on Long Island, aim to optimize peak demand management and lower carbon emissions. This forward-thinking approach, alongside initiatives by National Grid Renewables, underscores their leadership in a rapidly expanding market. The company has allocated significant capital towards these technologies. These investments are pivotal for grid modernization and sustainability. These efforts are aligned with the growing need for energy storage solutions.

- National Grid has invested roughly $100 million in battery storage projects by 2024.

- The Long Island battery storage project, operational in 2024, has a capacity of 40 MW.

- Renewable energy capacity additions in 2024 are projected to increase by 20% compared to 2023.

- The battery storage market is projected to grow by 25% annually through 2030.

Subsurface Mapping with AI

AI-driven subsurface mapping, like Exodigo, boosts project accuracy and efficiency, marking it as a Star for National Grid. This technology significantly cuts risks, costs, and project delays, especially in the expanding infrastructure sector. The global subsurface utility engineering market, valued at $6.3 billion in 2024, is projected to reach $10.5 billion by 2029. This growth underscores the technology's high potential and strategic importance.

- Market size: $6.3B in 2024.

- Expected growth: $10.5B by 2029.

- Reduces project risks and costs.

- Enhances project efficiency.

Stars represent high-growth, high-market-share investments for National Grid. Strategic projects like the 'Great Grid Upgrade' and AI investments are prime examples. National Grid's £7.5 billion investment in 2024 highlights this commitment.

| Investment Area | Market Share | Growth Rate |

|---|---|---|

| AI in Energy | High | 20% (2024) |

| Renewable Interconnections | High | 25% (2024) |

| Battery Storage | Growing | 25% annually (by 2030) |

Cash Cows

National Grid's UK electricity transmission is a cash cow. It's a stable, regulated business providing essential services. This generates consistent revenue with slow growth. In 2024, National Grid's UK regulated asset base was valued at approximately £40 billion.

Regulated gas transmission in Great Britain mirrors electricity transmission, offering a stable income. Despite decarbonization trends, it's a strong cash generator. Minimal investment supports ongoing operations. National Grid's gas transmission revenue was £2.4 billion in 2023/24.

National Grid's electricity and gas delivery in Massachusetts is a Cash Cow due to its consistent revenue stream. The Massachusetts market is mature, ensuring stable demand. In 2024, National Grid invested heavily in infrastructure, with $870 million allocated for Massachusetts. Efficiency enhancements and maintenance boost cash flow in these established operations.

Electricity and Gas Delivery in Rhode Island

National Grid's electricity and gas delivery in Rhode Island mirrors its Massachusetts operations, providing a stable, regulated income. This segment boasts consistent demand, thanks to essential services and infrastructure. Limited new investments are needed, making it a reliable cash generator. Rhode Island's energy sector is vital for the state's economy, ensuring steady operations. For 2023, National Grid's Rhode Island operations likely mirrored Massachusetts's stable performance.

- 2023: Steady revenue due to regulated rates.

- Infrastructure: Established, reducing capital needs.

- Demand: Consistent, driven by essential services.

- Regulation: Ensures stable financial performance.

Electricity and Gas Delivery in New York

National Grid's electricity and gas delivery in New York is a cash cow. It benefits from a large customer base and a regulated market. This ensures a stable income stream. Despite the need for upgrades, the established infrastructure supports consistent demand. In 2024, National Grid invested heavily in NY infrastructure.

- National Grid serves millions of customers in New York.

- The regulated market provides stable revenue.

- Ongoing investments are crucial for infrastructure.

- Consistent demand fuels a steady income.

Cash cows for National Grid include UK electricity and gas transmission, and operations in Massachusetts, Rhode Island, and New York. These segments offer steady, regulated income. Minimal new investment requirements make them reliable cash generators.

| Segment | Key Feature | 2024 Status |

|---|---|---|

| UK Electricity Transmission | Regulated, essential service | £40B asset base |

| Massachusetts | Mature market | $870M infrastructure investment |

| New York | Large customer base | Ongoing infrastructure upgrades |

Dogs

National Grid's assets dependent on fossil fuels, like older power plants, fall into the "Dogs" category. These assets struggle with low growth due to the energy transition. For example, in 2024, National Grid faced increasing pressure to retire or repurpose fossil fuel infrastructure. This is due to stricter environmental rules. This could lead to financial liabilities.

SF6-reliant equipment, like circuit breakers, faces challenges. National Grid and others are under pressure to reduce SF6 use. Costs for upkeep and upgrades of this equipment are rising. The long-term value is diminishing due to environmental concerns and regulations. In 2024, the EU proposed stricter SF6 limits, increasing pressure.

Outdated grid technology, like older infrastructure in National Grid's portfolio, often falls into the "Dogs" quadrant of the BCG Matrix. These assets are less efficient, requiring costly upgrades without substantial performance gains. For example, in 2024, National Grid spent billions on grid modernization. Such investments may yield minimal returns compared to modern alternatives.

Projects Facing Connection Queue Delays

Renewable projects, often stuck in lengthy grid connection queues, can resemble 'dogs' in a BCG Matrix. These projects face delays, with wait times potentially stretching to 15 years. The delayed returns and uncertainty associated with these projects significantly decrease their value and profitability. This inefficiency in grid connections hinders the realization of their full potential.

- National Grid reported that the average connection time for new projects is around 5 years, with some projects experiencing delays of up to 10 years.

- The UK government's estimates suggest that grid connection delays could cost the renewable energy sector billions of pounds in lost investment and revenue.

- Approximately 90% of the new projects are waiting for grid connections as of late 2024.

Assets Vulnerable to Extreme Weather

Infrastructure vulnerable to extreme weather, needing constant, expensive repairs, fits the "Dogs" category in National Grid's BCG Matrix. Climate change intensifies these challenges, decreasing reliability and profitability. For instance, in 2024, extreme weather caused $10 billion in infrastructure damage. This results in lower returns.

- Increased repair costs due to storms.

- Reduced asset lifespan.

- Lower profitability.

- Decreased reliability of services.

Assets in the "Dogs" category, like those dependent on fossil fuels or outdated technology, face significant challenges. These face low growth prospects and increasing pressure from regulatory and environmental factors. The financial burden of maintaining and upgrading these assets, coupled with decreasing reliability, further diminishes their value within National Grid's portfolio.

| Category | Examples | Challenges |

|---|---|---|

| Dogs | Fossil fuel plants, SF6 equipment, outdated grid tech, projects with grid delays, weather-vulnerable infrastructure | Low growth, environmental regulations, high maintenance costs, long connection times, extreme weather damage |

| Financial Impact (2024) | Billions in grid modernization with low returns, $10B infrastructure damage from weather | Decreased profitability, reduced asset lifespan, lower service reliability |

| Regulatory Impact (2024) | Stricter SF6 limits proposed by the EU | Increased compliance costs, accelerated asset retirement |

Question Marks

National Grid's green hydrogen venture is a question mark in its BCG matrix. The technology is nascent, facing uncertain demand and high upfront costs. In 2024, the global green hydrogen market was valued at approximately $2.5 billion. Significant investments are needed, with costs potentially reaching $10 per kilogram.

Strategic infrastructure projects in early development, like those awaiting regulatory approval, are "question marks" in National Grid's BCG matrix. These projects demand significant investment with uncertain returns, such as the $1.2 billion Viking Link project. The success of these projects could transform them into "stars." In 2024, National Grid's capital expenditure was approximately £8.4 billion.

Community and residential solar investments are question marks for National Grid, holding a small market share currently. These projects face adoption hurdles, but distributed generation's rise offers potential. Supportive policies are crucial; for example, in 2024, the U.S. residential solar market grew 17% year-over-year. Effective marketing is key to transforming these into stars.

VEIR's Superconducting Transmission Lines

National Grid's partnership with VEIR on high-temperature superconducting lines falls under the "Question Mark" quadrant of the BCG Matrix. This collaboration aims to develop groundbreaking power transmission technology. Despite its potential to transform energy delivery, it's still in early phases, facing hurdles in technical and commercial viability.

- The project is in the research and development phase, with no immediate revenue generation.

- High initial investment costs are a significant risk.

- Success hinges on overcoming technical and market entry challenges.

Integration of Smart Grid Technologies

The integration of smart grid technologies presents a "Question Mark" in National Grid's BCG matrix. This stems from the substantial upfront investments required and the uncertain adoption pace. These technologies, including advanced sensors and AI-driven systems, aim to boost efficiency and reliability. If successful, they could become valuable assets.

- National Grid invested $3.8 billion in smart grid technologies by the end of 2023.

- The U.S. smart grid market is projected to reach $66.1 billion by 2028.

- Smart meters have been installed in over 60% of U.S. households.

- AI-powered grid management can reduce outage durations by up to 40%.

Question marks for National Grid include green hydrogen, strategic infrastructure, community solar, and superconducting lines. These ventures require substantial investments, facing demand and regulatory uncertainties. Smart grid integration adds further complexities.

| Venture | Investment (Approx.) | Market Status (2024) |

|---|---|---|

| Green Hydrogen | $10/kg cost | $2.5B global market |

| Viking Link | $1.2B | Awaiting approval |

| Smart Grid | $3.8B invested (by 2023) | $66.1B market by 2028 (projected) |

BCG Matrix Data Sources

National Grid's BCG Matrix is informed by financial reports, market analysis, industry research, and expert opinions for insightful strategic decisions.