Norwegian Cruise Line Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Norwegian Cruise Line Holdings Bundle

What is included in the product

Analysis of NCL's cruise brands using the BCG matrix, highlighting investment strategies.

Printable summary optimized for A4 and mobile PDFs, offering concise insights for swift executive briefings.

Preview = Final Product

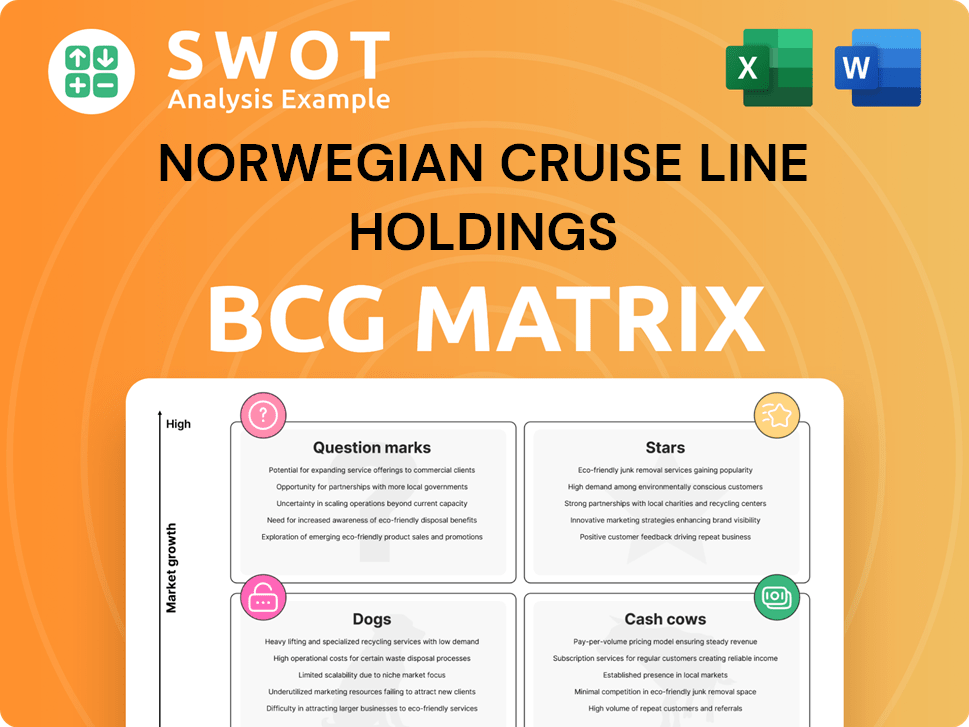

Norwegian Cruise Line Holdings BCG Matrix

The BCG Matrix previewed is identical to the purchased report. After buying, you'll receive a fully formatted analysis of Norwegian Cruise Line Holdings. This instantly downloadable document is ready for immediate application.

BCG Matrix Template

Norwegian Cruise Line Holdings navigates a dynamic market, its portfolio spanning diverse cruise experiences. Identifying its "Stars" is crucial for growth, highlighting offerings with high market share & potential. "Cash Cows" provide steady revenue, funding for innovation & expansion. "Dogs" may need repositioning or divestment, impacting resource allocation. Question Marks require careful evaluation, promising growth or potential pitfalls.

The sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Norwegian Cruise Line Holdings (NCLH) saw a remarkable financial rebound in 2024. The company reported record revenues and EBITDA, illustrating its successful post-pandemic recovery. Strategic moves led to strong onboard and ticket yields, boosting its industry standing. For example, in Q3 2024, NCLH's total revenue was $2.5 billion.

Norwegian Cruise Line Holdings (NCLH) boasts a diverse brand portfolio. This includes Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. These brands target various demographics, widening market reach. In 2024, NCLH's diverse approach helped it achieve a revenue of approximately $8.5 billion.

Norwegian Cruise Line Holdings (NCLH) is strategically growing its fleet. It has 13 new ships due between 2025 and 2036. This could increase capacity by over 37,000 berths. The expansion signals confidence in the cruise industry's future. NCLH aims to meet rising demand.

Global Footprint

Norwegian Cruise Line Holdings (NCLH) boasts a significant global footprint, crucial for its position in the BCG matrix. In 2024, NCLH's fleet includes 32 ships, reaching about 700 destinations worldwide. This widespread presence enables NCLH to cater to diverse traveler preferences and navigate various market conditions effectively.

- Fleet Size: 32 ships.

- Destinations: Approximately 700 worldwide.

- Market Coverage: Strong in established and emerging markets.

- Passenger Capacity: Millions of passengers annually.

Commitment to Sustainability

Norwegian Cruise Line Holdings (NCLH) shines as a "Star" in its BCG matrix due to its strong commitment to sustainability. This commitment, driven by the Sail & Sustain program, addresses climate action, waste reduction, and responsible sourcing, appealing to eco-conscious travelers. NCLH aims for net-zero greenhouse gas emissions by 2050, showcasing its dedication to environmental stewardship. In 2024, NCLH invested significantly in eco-friendly technologies and practices to reduce its carbon footprint.

- Sail & Sustain program focuses on climate action, waste reduction, and responsible sourcing.

- NCLH is actively pursuing net-zero greenhouse gas emissions by 2050.

- In 2024, NCLH invested in eco-friendly technologies.

NCLH's "Stars" status highlights its robust growth and market leadership. The company's strategic investments in sustainability, such as its Sail & Sustain program, boost its appeal. These moves attract eco-conscious travelers, contributing to NCLH's positive financial outlook.

| Metric | Details |

|---|---|

| Sustainability Initiatives | Sail & Sustain Program; Net-zero goal by 2050 |

| 2024 Investments | Focus on eco-friendly technologies |

| Market Position | Strong growth, market leadership |

Cash Cows

Norwegian Cruise Line, the flagship brand, targets a broad audience with its Freestyle Cruising. This approach ensures steady revenue streams for NCLH. In 2024, the brand's consistent performance supported the company's financial stability. Its diverse offerings and flexibility make it a reliable cash generator.

NCLH benefits from a strong presence in North America, a key cruise market. In 2024, North America accounted for a significant percentage of cruise departures. The Caribbean, a top destination for Americans, boosts NCLH's revenue. NCLH's strategic itineraries and private islands enhance its appeal to this market.

Norwegian Cruise Line Holdings (NCLH) leverages private island destinations like Great Stirrup Cay and Harvest Caye to boost revenue. These exclusive locations attract guests, increasing shore excursion and onboard spending. NCLH is investing in infrastructure, with plans for Great Stirrup Cay including a multi-ship pier and enhanced amenities. In 2024, NCLH's revenue was approximately $8.4 billion.

Strategic Cost Management

Norwegian Cruise Line Holdings (NCLH) strategically manages costs, boosting profitability. This focus, along with operational efficiency, solidifies its cash cow status. NCLH actively reduces net leverage to optimize its financial position. This approach supports sustained financial health and shareholder value.

- NCLH's Q3 2023 adjusted EBITDA was $868.7 million, showing strong profitability.

- The company aims to reduce net leverage to below 4.0x by the end of 2024.

- Cost savings initiatives include fuel efficiency and supply chain optimization.

Loyalty Programs

Norwegian Cruise Line Holdings (NCLH) relies heavily on its loyalty programs, which act as cash cows by fostering repeat bookings and strong customer retention. These programs offer rewards and perks to loyal cruisers, encouraging them to choose NCLH brands repeatedly. For example, NCLH's "Latitudes Rewards" program provides benefits based on the number of cruise days, driving customer loyalty and predictable revenue streams.

- Latitudes Rewards are a key part of NCLH's strategy.

- Loyalty programs boost revenue stability.

- Repeat bookings are a key source of income.

- Customer retention is a core focus.

Norwegian Cruise Line Holdings (NCLH) leverages its robust market position and efficient operations, solidifying its status as a cash cow. The company focuses on profitability with cost-saving initiatives. NCLH's strategic financial management aims to reduce net leverage to below 4.0x by the end of 2024.

| Metric | Value | Year |

|---|---|---|

| Q3 2023 Adj. EBITDA | $868.7M | 2023 |

| 2024 Revenue (approx.) | $8.4B | 2024 |

| Target Net Leverage | <4.0x | End of 2024 |

Dogs

Older Norwegian Cruise Line Holdings (NCLH) ships, like those built before 2010, face challenges. They often have lower fuel efficiency than newer models. This can lead to higher operating costs. Older vessels might also lack the latest features, potentially affecting customer appeal. In 2024, NCLH's older ships may see lower occupancy rates compared to newer ones.

Some Norwegian Cruise Line Holdings (NCLH) routes face lower demand. These routes, potentially affected by seasonality or political issues, see reduced occupancy. For instance, specific Alaska cruises in the off-season might show lower bookings. In Q3 2024, NCLH reported an overall occupancy of 107.8%, but some itineraries likely lagged. These routes need strategic marketing to boost interest.

Norwegian Cruise Line Holdings (NCLH) carries substantial debt, a key "Dog" characteristic. The company's debt load remains significant, potentially hindering its ability to invest. As of Q3 2024, NCLH's total debt was around $12.7 billion. High debt restricts flexibility during downturns. This impacts its financial performance.

Over-Reliance on U.S. Market

Norwegian Cruise Line Holdings (NCLH) heavily relies on the U.S. market. This concentration exposes NCLH to U.S. economic fluctuations and policy changes. Diversification could stabilize revenues, as in 2024, over 60% of NCLH's guests originated from the U.S.

- U.S. Market Dependence: Over 60% of guests from the U.S. in 2024.

- Economic Vulnerability: Susceptible to U.S. economic downturns.

- Regulatory Risk: Exposed to changes in U.S. travel regulations.

- Diversification Strategy: Expansion into other markets to mitigate risk.

Operational Inefficiencies

Operational inefficiencies within Norwegian Cruise Line Holdings, categorized as "Dogs" in the BCG matrix, can manifest as increased expenses or reduced customer contentment. Enhancing operational effectiveness through process improvements and technological upgrades is vital for boosting profitability. For instance, in 2024, the company faced challenges, with operational expenses impacting margins. Addressing these issues is crucial for survival.

- Increased operational costs due to inefficiencies.

- Potential for decreased customer satisfaction.

- Need for process and technology improvements.

- Impact on overall profitability and financial performance.

NCLH's "Dogs" include older ships with high costs. Routes with low demand also fit this category, as do those with heavy debt. A key element is NCLH's reliance on the U.S. market. Operational inefficiencies also lead to "Dog" status.

| Category | Issue | Impact |

|---|---|---|

| Older Ships | High fuel costs, outdated features | Lower occupancy, higher expenses |

| Low-Demand Routes | Seasonal, political issues | Reduced bookings, underperformance |

| High Debt | $12.7B in Q3 2024 | Limits investment, financial flexibility |

| U.S. Market Dependence | Over 60% of guests from U.S. in 2024 | Vulnerability to U.S. economic changes |

| Operational Inefficiencies | Increased costs, lower satisfaction | Reduced profitability, financial issues |

Question Marks

Emerging markets represent a "Question Mark" for Norwegian Cruise Line Holdings (NCLH) in its BCG matrix. NCLH eyes expansion, particularly in Asia and South America, for growth. This strategy faces risks: political instability, economic uncertainty, and cultural differences. NCLH aims to tap into growing middle-class populations. In 2024, emerging market growth in the cruise sector is projected at 10-15%.

New ship classes, like the Prima-Plus for Norwegian, are a major NCLH investment. These new vessels, including those for Oceania and Regent, aim to draw in more customers. They boast innovations in design, technology, and amenities. In 2024, NCLH's capital expenditures were significant, reflecting this expansion.

Norwegian Cruise Line Holdings (NCLH) is investing heavily in sustainability. This includes alternative fuels and waste reduction. A key goal is net-zero emissions by 2050. In 2024, NCLH spent $175 million on environmental initiatives. This helps brand image and attracts eco-minded travelers.

Technology Integration

Norwegian Cruise Line Holdings (NCLH) is investing in technology, which is a "Question Mark" in its BCG Matrix. This involves adopting AI for personalized experiences and digital platforms. These investments can boost revenue but also require spending on infrastructure and training. For example, in 2024, NCLH's tech investments totaled $150 million.

- AI-driven personalization aims to tailor activities and dining.

- Digital booking platforms streamline the customer journey.

- Infrastructure upgrades are crucial for technology integration.

- Training programs help staff utilize new tech effectively.

Partnerships and Collaborations

Partnerships and collaborations are vital for Norwegian Cruise Line Holdings (NCLH), especially for market expansion. Strategic alliances, like the one with Alibaba in China, offer access to new customer segments and regions. However, these partnerships require meticulous management to ensure aligned interests and successful outcomes. NCLH's focus on the Asian-Pacific market through such collaborations is notable.

- Alibaba partnership targets the rapidly growing Chinese and Asian-Pacific markets.

- These collaborations are crucial for expanding customer reach.

- Careful management is required for successful partnerships.

- NCLH aims to tap into new market segments through alliances.

Technology investments are "Question Marks" for NCLH. AI and digital platforms drive personalization and efficiency. Investments totaled $150M in 2024, but require infrastructure and training. These investments can boost revenue.

| Aspect | Details | 2024 Data |

|---|---|---|

| Investment Focus | AI, Digital Platforms | $150M |

| Objective | Personalization, Efficiency | |

| Challenges | Infrastructure, Training |

BCG Matrix Data Sources

This BCG Matrix utilizes comprehensive data from NCLH financial reports, market analysis, and industry publications, creating reliable positioning.