Neomobile Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Neomobile Bundle

What is included in the product

Neomobile's BCG analysis spotlights growth opportunities, financial strengths, and strategic divestment areas.

Export-ready design for quick drag-and-drop into PowerPoint, speeding up crucial analyses and reports.

Delivered as Shown

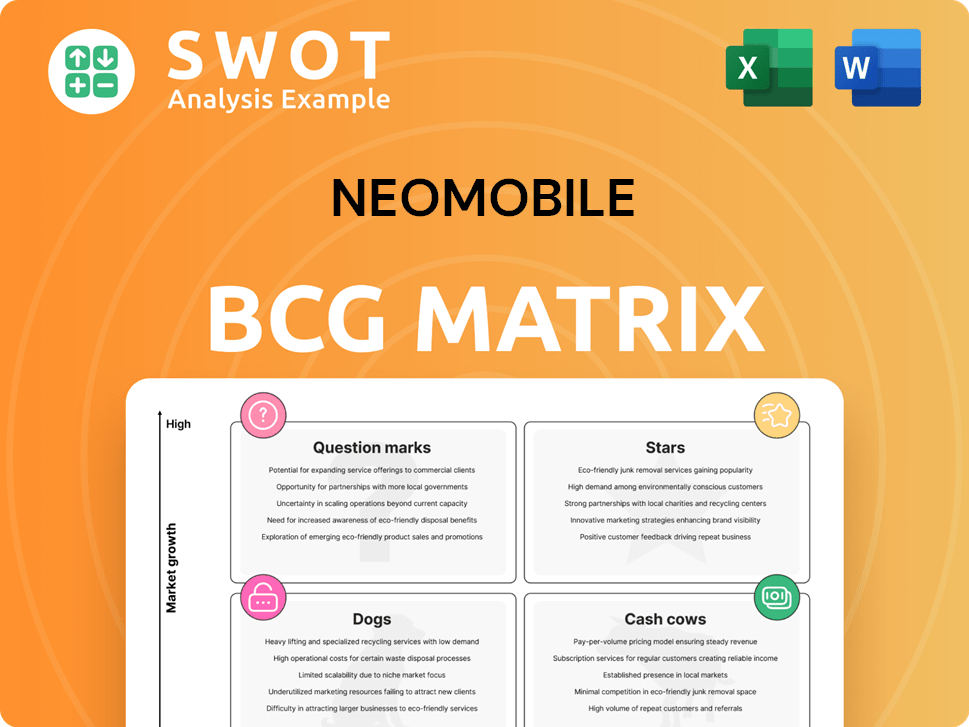

Neomobile BCG Matrix

The preview shows the complete Neomobile BCG Matrix report you'll receive. Upon purchase, you'll get the full, editable document, ready for immediate strategic application and tailored analysis.

BCG Matrix Template

Explore Neomobile's strategic landscape! This preview shows product placements within the BCG Matrix. Discover potential Stars, Cash Cows, Dogs, and Question Marks within their portfolio. Understand how market share and growth rate shape their strategy. Purchase the full report for detailed quadrant analysis and actionable recommendations. Gain competitive clarity and investment insights.

Stars

Neomobile's mobile payment solutions, if dominant in a booming market, would have been stars. This indicates leadership in a quickly growing sector. The global mobile payment market was valued at $3.16 trillion in 2023. It's projected to reach $18.87 trillion by 2030.

If Neomobile offered sought-after digital entertainment, it would be a Star. Such content, popular on rapidly growing mobile channels, would drive revenue. In 2024, the global mobile gaming market hit $97.3 billion, showing strong growth potential. This positions successful digital entertainment as a key driver for Neomobile's success.

If Neomobile's DCB services held a significant market share in a booming area, they'd be Stars. DCB's growth is fueled by rising mobile use and digital content demand. The DCB market was valued at $70.7 billion in 2024, and expected to reach $119.8 billion by 2029. This makes DCB a high-growth prospect.

User Acquisition Solutions

If Neomobile's user acquisition tactics were successful and gaining ground, they would likely be classified as "Stars" in the BCG Matrix. User acquisition is pivotal in a rapidly expanding market like mobile commerce, where competition is fierce. Effective user acquisition solutions are highly valuable because they directly impact revenue and market share.

- In 2024, the global mobile commerce market is projected to reach $3.56 trillion.

- User acquisition costs can vary widely, with some industries seeing costs of $2 to $10 per install.

- Conversion rates from app installs to paying users are often less than 5%.

- Successful user acquisition strategies can lead to a 20-30% increase in customer lifetime value.

Mobile Commerce Platform (Hypothetical)

Imagine Neomobile's mobile commerce platform as a Star. To shine brightly, it needed substantial market share in a booming sector. The platform would have offered a superior user experience and innovative features. For example, in 2024, mobile commerce accounted for roughly 70% of all e-commerce sales worldwide.

- High market share in a growing market.

- Excellent user experience and features.

- Rapid sales growth.

- Strong brand recognition.

Stars in Neomobile's context meant high market share within expanding sectors. This included mobile payments and commerce, with mobile commerce projected at $3.56 trillion in 2024. Successful strategies boosted revenue significantly, reflected in user acquisition's impact.

| Feature | Impact | Example (2024) |

|---|---|---|

| Market Share | High revenue | Mobile commerce at $3.56T |

| User Acquisition | Boosted revenue | Conversion rates under 5% |

| Market Growth | Increased profits | DCB market $70.7B |

Cash Cows

If Neomobile had stable, high-revenue partnerships with mobile network operators (MNOs) requiring little investment, they'd be cash cows. These partnerships would thrive in mature markets, ensuring consistent revenue. For instance, in 2024, the global mobile content market was valued at around $40 billion, showing steady growth. This stability would make them highly profitable.

Legacy content distribution agreements represent a stable income source, requiring minimal upkeep. These agreements are often in mature markets with predictable consumer habits. For instance, in 2024, digital content sales generated approximately $180 billion globally. This segment offers consistent cash flow.

If Neomobile's core mobile payment infrastructure is fully developed and stable, it can be a Cash Cow, generating consistent revenue with minimal upgrades. This infrastructure would be well-established and highly reliable. In 2024, the mobile payments market continues to grow, with transactions expected to reach $7.7 trillion globally.

Mature Market Segments

If Neomobile targeted mature mobile commerce segments offering steady profits with minimal reinvestment, they'd be cash cows. These segments would provide reliable revenue streams. They'd be characterized by established customer bases and predictable demand. Think of them as the financial backbone, funding other ventures.

- Established mobile payment solutions.

- Subscription services with high retention rates.

- Mature e-commerce platforms with repeat customers.

- Partnerships with established telecom providers.

Basic Mobile Payment Services

Basic mobile payment services, like those for everyday transactions, fit the "Cash Cows" category in Neomobile's BCG matrix. These services, widely adopted and requiring little innovation, thrive in markets with high adoption but low growth. For example, in 2024, mobile payment transactions in the US reached $1.15 trillion, with steady but not explosive growth.

- High market share but low growth potential defines these services.

- These services generate substantial cash flow with minimal new investment.

- Mature markets characterize Cash Cows in this context.

- The focus is on maintaining market share and profitability.

Cash Cows in Neomobile's BCG Matrix are stable, high-profit ventures. They need little investment, generating consistent cash flow from established markets. For example, mature mobile commerce segments and subscription services exemplify this, with mobile payments reaching $7.7 trillion in 2024. These generate reliable revenue.

| Feature | Description | 2024 Data |

|---|---|---|

| Market Growth | Low, stable growth | Mobile payments: $7.7T |

| Investment Needs | Minimal, focusing on maintenance | Digital content sales: $180B |

| Revenue Source | Mature services, subscription, partnerships | Mobile content market: $40B |

Dogs

Unsuccessful expansion attempts by Neomobile into new regions or markets with low market share would be classified as Dogs in the BCG Matrix. These ventures would show little promise of growth or profitability. For example, if Neomobile entered a market like Brazil in 2024, and failed to gain significant traction, it would be a Dog. In 2024, the mobile market in Brazil grew only by 5.2%

Obsolete technology platforms at Neomobile, like outdated messaging services, are categorized as Dogs in the BCG Matrix. These platforms generated minimal revenue. For example, legacy SMS services saw a revenue decline of 15% in 2024. The company replaced these with modern solutions.

Content partnerships failing to draw users or boost revenue classify as Dogs. These underperforming ventures necessitate reevaluation. For instance, if a 2024 partnership yielded less than a 5% return on investment, it would be a Dog. Continued investment in such partnerships is typically unwise.

Ineffective User Acquisition Campaigns

Ineffective user acquisition campaigns, characterized by low ROI and failure to attract users, represent a "Dog" in the Neomobile BCG Matrix. These campaigns drain resources without yielding substantial growth. For instance, a 2024 study showed 60% of mobile ad campaigns globally fail to meet ROI targets. This leads to financial losses and missed opportunities.

- High Customer Acquisition Cost (CAC).

- Low conversion rates from ads.

- Poor targeting leading to irrelevant clicks.

- Decreased marketing budget.

Niche Services with Declining Demand

Niche services with waning demand fall into the "Dogs" quadrant of the BCG Matrix. These services, once catering to a small, specialized market, are now facing diminishing relevance. This decline is often due to shifts in consumer preferences or the emergence of more popular alternatives. For example, in 2024, demand for certain pet grooming services decreased by 15% due to the rise of DIY grooming kits.

- Declining demand.

- Highly specialized.

- Losing relevance.

- Small market segment.

Dogs in Neomobile's BCG Matrix include unsuccessful ventures and declining services. These represent low market share and growth potential. In 2024, the mobile market's ROI challenges and shifts led to Dogs.

| Category | Examples | 2024 Impact |

|---|---|---|

| Market Failures | Brazil expansion, obsolete tech | SMS revenue down 15%, mobile growth 5.2% |

| Poor Partnerships | Low ROI ventures | Less than 5% ROI, ad campaign failure 60% |

| Declining Services | Niche services | Demand dropped by 15% due to market changes |

Question Marks

If Neomobile invested in emerging mobile payment technologies with uncertain market potential, these would be Question Marks. These technologies would operate in high-growth markets but with low market share. For instance, the mobile payment market is projected to reach $18.7 trillion in 2024. However, Neomobile's specific market share would be low initially.

Venturing into new, unchartered emerging markets, where Neomobile's presence is minimal, classifies as a Question Mark in the BCG Matrix. These markets, while promising high growth, come with inherent risks. Consider that in 2024, emerging markets like India and Brazil showed substantial mobile market expansion. This expansion offers both potential for significant returns and the challenge of navigating unfamiliar terrains.

Venturing into innovative content formats for mobile entertainment, such as interactive videos or augmented reality games, positions Neomobile as a Question Mark. This strategy aligns with a high-growth market, but the user adoption rates remain unpredictable. For instance, the global mobile gaming market is projected to reach $272 billion by 2024, yet success hinges on content appeal. The financial commitment is substantial, with average development costs for new mobile games ranging from $50,000 to $2 million.

Partnerships with New Platforms

Venturing into partnerships with emerging mobile platforms or app stores, characterized by high growth potential yet uncertain user bases, categorizes Neomobile as a Question Mark. These alliances represent speculative investments, where success is not guaranteed. The strategic rationale includes potential for significant returns. However, the inherent risks demand careful evaluation. In 2024, such ventures could involve allocating around 10-15% of the marketing budget.

- Market Entry: Facilitates entry into new markets or segments.

- Risk Assessment: Requires rigorous risk assessment due to uncertain outcomes.

- Resource Allocation: Demands flexible resource allocation for adaptability.

- Performance Monitoring: Needs continuous monitoring of performance metrics.

Pilot User Acquisition Programs

Pilot user acquisition programs involve new strategies to attract specific demographics. These programs need to demonstrate effectiveness in a high-growth environment, which is crucial for startups. Such initiatives aim to quickly increase the user base, which is vital for market dominance. Success hinges on the ability to scale efficiently and adapt to changing market dynamics. They test innovative approaches to find what resonates.

- Focus on targeted campaigns for specific demographics or niches.

- Test new strategies to prove effectiveness in a high-growth environment.

- Aim to increase user base quickly to gain market share.

- Adapt to change and scale efficiently.

Question Marks in the BCG Matrix represent high-growth markets with low market share, demanding strategic investment decisions. These ventures often involve emerging technologies or unproven business models, carrying significant risks. In 2024, these could involve allocating around 10-15% of the marketing budget.

| Aspect | Description | Data (2024) |

|---|---|---|

| Market Growth | High potential but uncertain returns | Mobile payment market projected to reach $18.7T |

| Market Share | Low or minimal presence | Neomobile's initial market share low |

| Investment | Requires strategic investment | Average game dev costs: $50K-$2M |

BCG Matrix Data Sources

Neomobile's BCG Matrix uses financial statements, market research, industry reports, and performance data for strategic analysis.