Netflix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Netflix Bundle

What is included in the product

Tailored analysis for Netflix's streaming content portfolio, examining each quadrant for strategic decisions.

Printable summary optimized for A4 and mobile PDFs, delivering concise insights for effective strategy.

Preview = Final Product

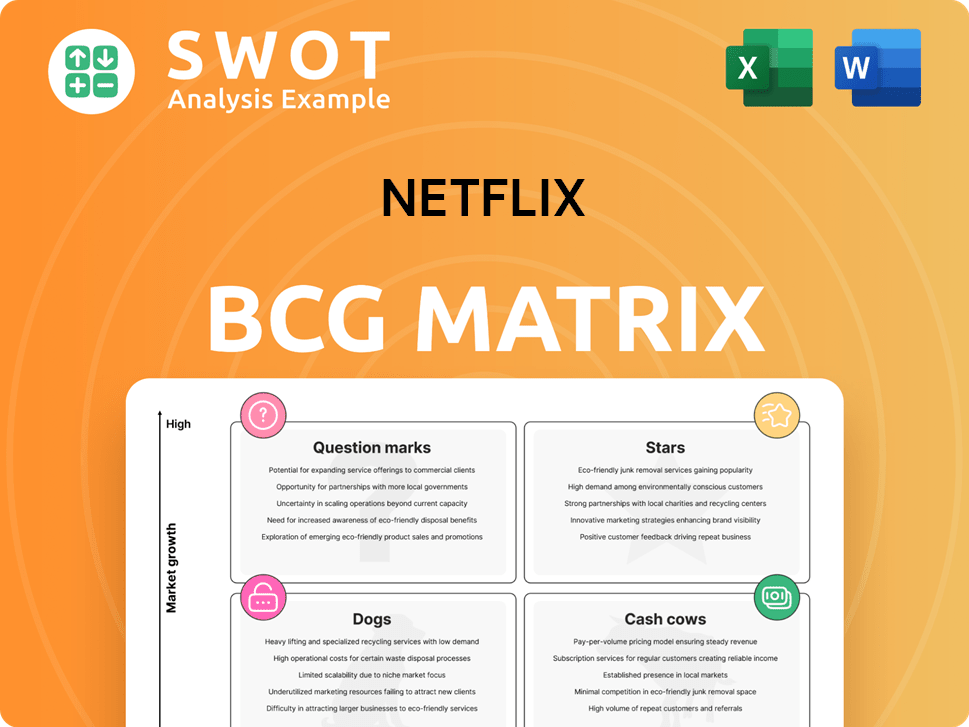

Netflix BCG Matrix

The preview showcases the complete Netflix BCG Matrix report you'll receive. It's the same, fully formatted document ready for your strategic review and decision-making after purchase, free of watermarks.

BCG Matrix Template

Netflix's content strategy is a dynamic mix. This preview hints at its Stars (hit shows), Cash Cows (subscriber revenue), Dogs (less popular content), and Question Marks (new originals). Understand how Netflix allocates resources. The full BCG Matrix reveals precise product placements, strategic implications, and actionable insights. Get instant access for data-backed recommendations and a competitive edge. Purchase now for a comprehensive strategic tool.

Stars

Netflix's original series, like 'Squid Game,' boosted subscriber growth, a key Star. These shows drive viewership, securing their Star status. Netflix invests in new seasons, maintaining its competitive edge. In 2024, originals like 'Wednesday' drew massive views.

Netflix's global expansion, especially in Asia and Latin America, is a major growth driver. In 2024, international streaming revenue reached $18.7 billion, reflecting strong subscriber growth. Localized content, like the Korean drama "Squid Game," boosted appeal, driving subscriber additions. This strategy is key for growth, offsetting market saturation in North America and Europe.

The ad-supported tier is a "Star" in Netflix's BCG Matrix, attracting price-conscious consumers. This tier has seen growth, with about 40% of new sign-ups in Q4 2023 choosing it. Advertisers gain access to Netflix's massive audience, boosting revenue. In Q4 2023, Netflix's ad tier had nearly 23 million monthly active users.

Content Licensing (Select Titles)

Select licensed content, especially popular and long-lasting shows, can be classified as stars in Netflix's BCG matrix. These titles draw in a large audience and contribute significantly to viewing hours. For example, "Friends" was a major driver. Netflix licenses content strategically to offer a wide variety to its subscribers, complementing original shows.

- "Friends" was licensed by Netflix until 2019, costing around $100 million annually.

- Licensed content accounted for a significant portion of Netflix's viewing hours in 2024.

- Netflix's content budget for licensing was substantial, estimated at billions of dollars annually.

Live Events and Sports

Netflix is expanding into live events, a high-growth area. Their live sports streaming, like NFL games, attracts large audiences. This boosts advertising revenue and strengthens their market position. Further investment could solidify Netflix's streaming leadership.

- Netflix's ad-supported plan reached 40% of new sign-ups in Q4 2023.

- Netflix's revenue grew 13% year-over-year in Q4 2023.

- Netflix's operating income rose to $1.5 billion in Q4 2023.

- Netflix had 260.8 million paid memberships globally as of Q4 2023.

Netflix's original content and global expansion are key stars, driving subscriber growth. The ad-supported tier also shines, attracting new users and boosting revenue. Strategic licensing of popular shows, along with live event ventures, reinforces their star status.

| Feature | Details | 2024 Data |

|---|---|---|

| Original Series | Boosts viewership and subscriber growth. | "Wednesday" and other originals drove significant views |

| Global Expansion | Drives growth, especially in Asia and Latin America. | International revenue at $18.7B |

| Ad-Supported Tier | Attracts price-conscious consumers. | 40% of new sign-ups in Q4 2023 |

Cash Cows

Netflix's subscription model is a cash cow in established markets, like North America, providing consistent revenue. In Q3 2023, Netflix's revenue in the US and Canada was $3.79 billion. This stable income funds new content and expansion. The company's operating income in North America reached $2.2 billion in Q3 2023.

Netflix's brand recognition is a cornerstone of its cash cow status. Its brand is synonymous with streaming entertainment. The company boasts strong customer retention rates. In Q4 2023, Netflix added 13.1 million subscribers. Sustaining loyalty is key for this position.

Netflix's content recommendation algorithm is a cash cow, boosting user engagement and retention. In 2024, Netflix's subscriber base grew, partly due to personalized suggestions. This algorithm significantly reduces churn, a key factor in maintaining its financial stability. The enhanced user experience directly supports its strong revenue stream.

Efficient Content Licensing

Netflix's efficient content licensing is a cash cow, driving its profitability. The company's strong relationships with studios enable competitive content acquisition. Efficient distribution ensures timely, cost-effective content delivery to subscribers. In 2024, Netflix invested approximately $17 billion in content, highlighting its commitment. Its licensing prowess supports a subscriber base of over 260 million globally.

- Content licensing is a core strength.

- Strong studio relationships secure content deals.

- Efficient distribution lowers costs.

- Significant content investment boosts value.

Password Sharing Crackdown

Netflix's password-sharing crackdown is a prime example of a cash cow strategy, boosting both subscribers and revenue. This move has successfully converted non-paying users into paying customers, enhancing financial performance. The initiative has solidified Netflix's position in the market.

- In Q3 2023, Netflix added 8.76 million subscribers globally.

- Revenue for Q3 2023 reached $8.54 billion, a 7.8% increase year over year.

- Netflix's operating income grew to $1.9 billion in Q3 2023.

- The company's operating margin reached 22% in Q3 2023.

Netflix's subscription model is a cash cow in established markets like the US and Canada, providing stable revenue. Efficient content licensing and strong brand recognition contribute to its financial stability. In Q4 2023, Netflix's global revenue reached $8.8 billion.

| Aspect | Details | Impact |

|---|---|---|

| Subscription Model | Steady income from existing markets. | Funds new content and expansion. |

| Brand Recognition | Synonymous with streaming. | High customer retention. |

| Content Licensing | Strong studio relationships. | Cost-effective content delivery. |

Dogs

Not all Netflix originals succeed; some, like certain documentaries, struggle to gain viewers, leading to financial losses. These underperforming titles are "dogs" in the BCG matrix. In 2024, less than 50% of Netflix's original content broke into the top 10, highlighting the risk. Regularly assessing content strategy is key to reducing losses from these failures.

Outdated licensed content, or "dogs," are older titles with low viewership. These titles take up space, but don't bring in much money. Netflix removes these regularly to make room for fresh content. In 2024, Netflix removed hundreds of older licensed shows and movies. This helps the platform stay current and competitive.

Netflix faces challenges in some markets, such as India, where growth has been slow, with about 6.7 million subscribers as of late 2024. These markets might have cultural differences or strong local competitors. Reassessing strategies is needed to improve performance. Netflix's investment in these regions is around $400 million in 2024.

Unpopular Features or Services

Netflix's "Dogs" category, representing unpopular features, includes services that don't resonate with a large audience. These underperforming features can drain resources, as evidenced by the $100 million spent on content that did not gain traction in 2024. Discontinuing these can lead to a 5% boost in operational efficiency. Focusing on popular content, like the top 10 shows that generated 70% of viewing hours, is key.

- Inefficient Resource Allocation: Wasted investments in underperforming features.

- Financial Impact: Content that didn't gain traction cost $100 million in 2024.

- Strategic Focus: Prioritizing popular content can improve efficiency.

- Operational Efficiency Boost: Discontinuing unpopular features can boost by 5%.

Regions with High Churn and Low Acquisition

Certain regions, classified as "Dogs" in Netflix's BCG matrix, show high churn and low acquisition. These areas might face tough competition from local streaming services or global giants. Factors like limited internet infrastructure or affordability issues also contribute. Netflix must devise region-specific strategies to overcome these hurdles.

- Example: Latin America, with its competitive landscape and economic challenges.

- Churn rates can be high, as seen in some regions, with fluctuations year-over-year.

- Low acquisition could be linked to piracy or lack of payment methods.

- Tailoring content and pricing is vital for improvement.

Netflix's "Dogs" include underperforming content, outdated licenses, and struggling markets. Underperforming features cost $100 million in 2024. Discontinuing dogs can boost operational efficiency by 5%.

| Category | Examples | Financial Impact (2024) |

|---|---|---|

| Content | Unpopular originals | $100M spent without traction |

| Licensed Titles | Outdated movies, shows | Reduced library costs |

| Regional Markets | Slow growth in India | $400M investment |

Question Marks

Netflix's gaming venture is a question mark, being a relatively new area with uncertain outcomes. They've acquired studios and released mobile games, but their revenue impact is unclear. As of Q3 2024, Netflix reported 8.7 million gaming downloads, but the revenue is still minimal. Strategic content investment is key to turning gaming into a "star".

Netflix's move into live sports is a question mark in its BCG matrix. Securing rights to stream live sports is expensive, with costs often exceeding $100 million annually for major events. The return on investment is uncertain, and the high costs could strain Netflix's profitability. Careful analysis of the potential audience and revenue streams is crucial for success.

Netflix's foray into interactive content, like "Bandersnatch," is a question mark in its BCG matrix. These ventures are still evolving, with their long-term success uncertain. As of Q4 2023, Netflix had 260.8 million subscribers worldwide. Investing in interactive formats is key to assessing their future.

New Technology (VR/AR)

Netflix's exploration of VR/AR represents a "Question Mark" in its BCG matrix. These technologies could redefine content consumption, but face adoption challenges. Their future hinges on consumer uptake and technological advancements. Strategic investment and close monitoring are vital for long-term success.

- VR/AR market is projected to reach $85.1 billion by 2024.

- Netflix has shown interest in interactive content, which aligns with VR/AR potential.

- Adoption rates remain uncertain; therefore, it is a high-risk, high-reward scenario.

- Netflix needs to balance investments in established and emerging technologies.

Expansion into New Content Formats

Expansion into new content formats, like short-form videos or podcasts, puts Netflix in the "Question Mark" quadrant of the BCG matrix. These ventures aim to attract new audiences and increase revenue, but their long-term success is uncertain. A clear strategy and careful evaluation are crucial for these new formats to flourish. Netflix's investment in gaming, for example, is a similar type of expansion.

- Netflix's revenue in 2023 reached $33.72 billion.

- Netflix's Q4 2023 earnings showed a revenue increase of 12.5% year-over-year, reaching $8.8 billion.

- In Q4 2023, Netflix added 13.1 million subscribers globally.

- Netflix's operating income for 2023 was $6.9 billion.

Netflix's VR/AR efforts are in the "Question Mark" category. The VR/AR market is expected to hit $85.1 billion by 2024. This aligns with Netflix's interest in interactive content. Success depends on adoption and strategic investment.

| Aspect | Details |

|---|---|

| Market Size (2024) | $85.1 billion (VR/AR) |

| Netflix Strategy | Focus on Interactive Content |

| Key Consideration | Adoption and Investment |

BCG Matrix Data Sources

Our Netflix BCG Matrix draws from Netflix's financial reports, streaming industry analysis, and market share data.