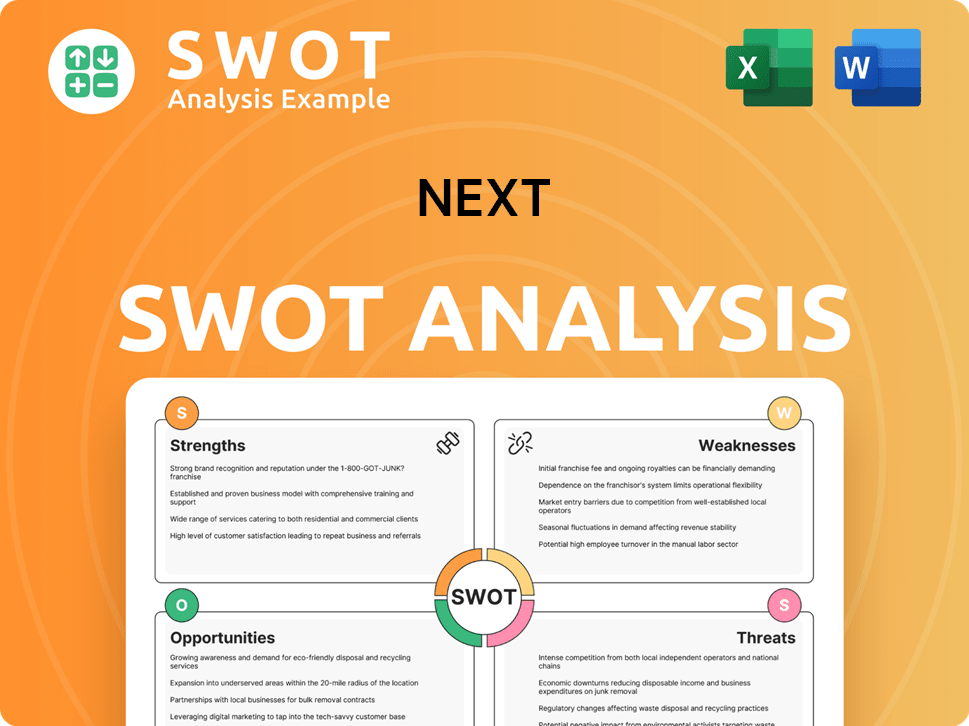

Next SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Next Bundle

What is included in the product

Outlines the strengths, weaknesses, opportunities, and threats of Next.

Focuses strategic efforts for clearer objectives.

Same Document Delivered

Next SWOT Analysis

This is the same SWOT analysis document included in your download. See a complete analysis now. The full report's format is as shown.

SWOT Analysis Template

Curious about what truly drives this company's success? This sneak peek offers a glimpse of its position. However, the full SWOT analysis unveils deeper strategic insights. It offers expert commentary and data-driven analysis.

Strengths

Next benefits from its established brand, a key strength in a competitive market. This recognition fosters customer loyalty, crucial for repeat business. The brand's reputation for quality and style supports a strong market position. In 2024, Next's brand value remained a significant asset, reflected in its sales figures.

Next's multi-channel strategy, combining physical stores, online platforms, and catalogues, significantly broadens its customer base. In 2024, online sales contributed a substantial portion of total revenue, demonstrating the effectiveness of its digital presence. This integrated approach allows for cost efficiencies and improved customer service, such as convenient in-store pick-up options. The company's digital sales have been growing, with a 6.8% increase in online sales in 2024.

Next's diverse product range, spanning clothing, footwear, home goods, and accessories, is a key strength. This diversification protects against downturns in specific areas. In 2024, Next Home sales increased, showcasing the success of this strategy. The broader offering attracts a wider customer base, boosting overall resilience.

Robust Financial Performance

Next showcases robust financial health, even amid retail sector hurdles. The company's profits remain healthy, supported by a solid balance sheet. Recent forecasts point to sustained sales and profit before tax growth, indicating resilience. This strong financial footing enables strategic investments and safeguards against economic downturns.

- 2024/2025: Expecting continued sales growth.

- Profit before tax is projected to increase.

- Strong financial position supports strategic investments.

- Solid balance sheet mitigates economic risks.

Established Infrastructure and Supply Chain

Next benefits from a strong infrastructure, including advanced e-commerce capabilities and the "Total Platform" technology, which enhances operational efficiency. This robust infrastructure supports a seamless customer experience, ensuring timely product delivery and order fulfillment. The company's established supply chain is a key strength, enabling it to adapt to market changes effectively and manage inventory efficiently. In 2024, Next invested £100 million in its online platform.

- E-commerce investments: £100 million in 2024.

- Supply chain efficiency: Supports timely product delivery.

- Technology: Utilizes "Total Platform" for operational enhancements.

- Market Adaptability: Enables quick responses to changing trends.

Next's brand strength boosts customer loyalty, evidenced by solid 2024 sales. Its diverse channels include a robust online presence with 6.8% sales growth. The product range protects against specific area downturns, exemplified by growing Next Home sales. Financial health, with profits and growth in 2024/2025, supports strategic investments.

| Strength | Description | 2024/2025 Data |

|---|---|---|

| Brand Recognition | Established brand; customer loyalty. | Sales figures reflect brand value |

| Multi-Channel Strategy | Physical stores, online platforms. | 6.8% increase in online sales. |

| Diversified Product Range | Clothing, home goods, etc. | Next Home sales increase |

| Financial Health | Healthy profits; robust balance sheet. | Expectations for continued growth |

Weaknesses

Next's substantial UK market dependence poses a key weakness. Approximately 80% of its retail sales come from the UK. This concentration heightens vulnerability to UK economic downturns. For instance, a 2024 UK employer tax hike could curb consumer spending. Slow domestic sales growth remains a concern.

Operating a vast network of physical stores leads to high costs. These costs include rent, utilities, and staffing, impacting profitability. Market shifts, like the growth of online shopping, can hurt physical store sales. In 2024, retail operating expenses averaged 30% of sales. Optimizing the store network is crucial to stay competitive.

The fashion and home retail sector faces fierce competition. Many retailers battle for market share, including established brands and online rivals. This pressure demands constant innovation and differentiation to stay ahead. In 2024, the industry saw a 7% decrease in profit margins due to this.

Potential for Supply Chain Disruptions

Next faces supply chain risks, like other retailers. Geopolitical events and logistical issues can cause shipping delays. These delays impact product availability, affecting sales and operations, as seen in 2023. For example, in 2023, Next reported a 3.1% decrease in full price sales.

- Shipping delays due to external factors.

- Impact on product availability and sales.

- Operational challenges and increased costs.

- Geopolitical events and logistical issues.

Challenges in Adapting to Rapidly Changing Consumer Preferences

Next faces the ongoing challenge of adapting to fast-evolving consumer preferences, especially in fashion. The retail sector's susceptibility to rapidly changing styles demands accurate forecasting. Failing to anticipate these shifts can lead to excess inventory and reduced profitability.

- Fashion industry's volatility requires constant adaptation.

- Misjudging trends can result in significant financial losses.

- Next must balance innovation with market responsiveness.

- Inventory management is crucial to mitigate risks.

Next's dependence on the UK market (80% of sales) poses a significant vulnerability to economic downturns. High operational costs, including rent, limit profitability. Next faces supply chain risks like shipping delays affecting product availability. The need to adapt to rapid fashion changes creates further financial instability.

| Weakness | Description | Impact |

|---|---|---|

| UK Market Concentration | 80% sales from UK. | Economic downturns impact sales; Employer tax hike of 2024 may curb consumer spending. |

| High Operational Costs | Extensive store network. | High rent and staffing expenses; Operating expenses 30% of sales in 2024. |

| Supply Chain Risks | Geopolitical issues and logistical challenges. | Shipping delays and decreased product availability. In 2023, reported a 3.1% decrease in full price sales. |

Opportunities

Next is focusing on significantly expanding its online business, aiming for substantial growth. The 'Total Platform' strategy, offering services to other brands, broadens revenue streams. Enhancing digital capabilities and partnerships are crucial for market expansion. In 2024, online sales accounted for a major portion of total sales, highlighting the importance of this opportunity.

International expansion presents a key opportunity for Next. Growth in Europe and the Middle East could diversify revenue. Improving website functionality and delivery is crucial for success. In 2024, Next's international sales increased, showing this potential. This strategy aims to boost overall performance.

Next has the opportunity to grow by creating new brands and acquiring others. This broadens their product range and attracts new customers. In 2024, Next's brand portfolio generated strong sales. They are exploring new market segments. This strategy is expected to boost revenue.

Growth in Financial Services

Next's financial services arm, which provides customer credit, strengthens its asset base and supports group earnings. With the potential for increased credit use among consumers, there's an opportunity to grow credit sales and interest revenue, bolstering overall financial results. In 2024, Next's financial services reported a profit of £193 million. This division's ability to offer credit is particularly valuable in a changing economic landscape.

- Financial services profit: £193 million (2024)

- Growth potential in credit sales.

- Supports overall performance.

Enhancing Product Portfolio and Offering

Expanding product lines is key to growth. Adding homeware, beauty, and premium brands boosts appeal. Initiatives like Seasons attract customers. Focus on quality and design across price points. In 2024, beauty sales grew 12% for some retailers.

- New product categories broaden the customer base.

- Premium brands increase average transaction value.

- Quality and design drive customer loyalty.

- 2024 data shows strong demand for expanded offerings.

Next's online expansion drives significant growth, leveraging its 'Total Platform' for broader revenue streams. International expansion in Europe and the Middle East boosts diversification, supported by enhanced digital capabilities and delivery. Expanding product lines, including homeware and beauty, alongside financial services (earning £193M in 2024) fortify its financial performance.

| Opportunity | Details | 2024 Data/Impact |

|---|---|---|

| Online Business Growth | Expanding online presence; "Total Platform". | Online sales = major portion of total sales |

| International Expansion | Growth in Europe, Middle East. Improve website/delivery. | Int. sales increased. |

| New Brands & Acquisitions | Broaden product range; new segments. | Brand portfolio generates strong sales |

Threats

Intensifying competition remains a significant threat. Next faces fierce competition from online retailers and fast-fashion brands. The rise of low-cost online disruptors and competitors like Marks & Spencer challenge Next's market share. This demands constant innovation and differentiation to maintain profitability. In 2024, the UK clothing market saw increased price wars.

Economic downturns and a high cost of living pose substantial threats. Consumer spending patterns shift, reducing discretionary spending. For example, in Q1 2024, retail sales dipped by 0.8% due to inflation. This negatively impacts sales and profit margins.

Global supply chain issues, exacerbated by geopolitical events, cause shipping delays and increase costs. These disruptions impact inventory, delay deliveries, and affect profitability. For example, in early 2024, shipping costs from Asia to the US rose by 15%. Businesses must mitigate these risks.

Changing Consumer Preferences and the Need for Continuous Innovation

Next faces significant threats from changing consumer preferences, especially those shaped by social media. To stay relevant, continuous innovation in product offerings is crucial. Failing to adapt quickly can lead to a loss of market share. For example, the fashion industry sees trends shift rapidly; in 2024, some brands experienced sales declines of up to 15% due to outdated styles.

- Rapid shifts in consumer demand necessitate quick product adjustments.

- Social media's influence accelerates trend cycles, demanding agile responses.

- Outdated offerings risk reduced market share and brand value.

Increasing Operating Costs

Retailers, like Next, are constantly battling rising operational expenses. Wage inflation and other costs create pressure, impacting profit margins. Next's commitment to cost control is essential. Maintaining profitability is key in a competitive retail landscape.

- Wage inflation is a significant concern.

- Operating expenses include rent, utilities, and supply chain costs.

- Next reported increased operating costs in recent financial reports.

Next faces threats from competition, economic shifts, and supply chain disruptions.

Changing consumer preferences demand agile responses.

Rising operational costs also pose a threat to profitability, especially due to wage inflation, for example, by mid-2024, these were up 6%.

| Threats | Impact | Mitigation Strategies |

|---|---|---|

| Competition | Reduced market share, profit decline | Product innovation, market differentiation |

| Economic downturns | Decreased consumer spending | Cost control, strategic promotions |

| Supply chain issues | Shipping delays, cost increases | Diversified sourcing, improved inventory mgmt |

SWOT Analysis Data Sources

This SWOT analysis draws on reliable sources: financial data, market reports, expert opinions, and competitor analysis.