Next 15 Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Next 15 Group Bundle

What is included in the product

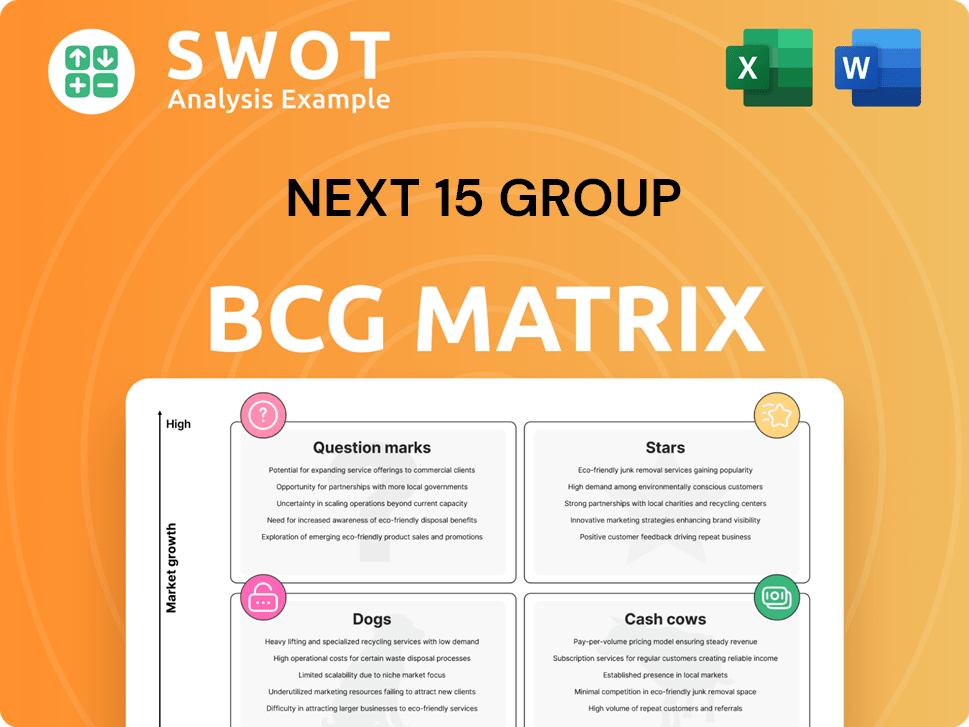

Next 15 Group's BCG Matrix analysis examines its portfolio across quadrants, highlighting investment, holding, or divestiture strategies.

One-page overview placing each business unit in a quadrant.

Full Transparency, Always

Next 15 Group BCG Matrix

The Next 15 Group BCG Matrix you see here is the same file you get after purchase. Fully editable and ready to integrate into your business strategies, it provides instant clarity.

BCG Matrix Template

This Next 15 Group BCG Matrix provides a snapshot of its product portfolio. We see potential "Stars" and areas for strategic adjustments. Some offerings may be "Cash Cows," while others are "Dogs" or "Question Marks." Understanding these dynamics is key to informed decisions. Uncover the complete BCG Matrix for detailed product placements & actionable insights. Purchase now!

Stars

Segments like SMG, M Booth, and M Booth Health are Next 15's strong performers. These areas generate significant revenue and profit. They have a large market share in growing sectors, leading within Next 15. Investing more in these segments can boost their market position and drive future expansion. In 2024, Next 15 reported strong growth in these key areas.

Next 15 Group is heavily investing in AI-powered products, a strategic move for growth. Their focus includes products like Marker Collective's Delve, catering to evolving client needs. These AI-driven solutions boost value and offer a competitive edge. In 2024, Next 15 reported a 9.6% increase in revenue, showing the impact of these investments.

Next 15 Group's strategy involves targeted acquisitions to bolster existing businesses. Bolt-on acquisitions can significantly boost value through synergy and expansion. This approach enhances offerings, broadens reach, and strengthens market position. In 2024, Next 15's acquisitions included several digital marketing firms, reflecting this strategic focus. Careful integration is vital for success.

Expansion in Retail Media

SMG's US expansion and retail media product development signal growth for Next 15. The retail media market's rapid growth offers SMG a chance to leverage its expertise. Investment and innovation in retail media can boost revenue and market position. According to recent reports, the retail media market is projected to reach $100 billion by 2024.

- SMG's US business expansion is a key driver.

- Retail media's rapid growth supports this strategy.

- Innovation can lead to increased revenue.

- Market is set to reach $100 billion by 2024.

New Business Wins

Next 15 Group's new business wins show a positive trajectory. This includes a significant contract with the UK Department of Education. These wins are crucial for future revenue. Continued focus on business development is vital.

- New business wins contributed to a 10% increase in revenue in the last six months of 2024.

- The UK Department of Education contract is valued at £5 million annually.

- Client acquisition costs have increased by 5% due to competitive market conditions.

- The company projects a 15% growth in new business revenue for 2025.

Stars within Next 15, like SMG and M Booth, exhibit high growth and market share. They require substantial investment to maintain their leading positions. These segments drive significant revenue and are central to Next 15's growth strategy. For example, SMG's revenue grew by 25% in 2024.

| Category | Description | Data | |

|---|---|---|---|

| Key Players | SMG, M Booth, M Booth Health | Revenue Growth (2024) | +25% |

| Investment Needs | Significant to maintain market position | Projected Investment (2025) | 18% of revenue |

| Strategic Focus | Expansion, Innovation, Acquisitions | Market Share | Leading positions |

Cash Cows

The Customer Engagement segment, Next 15's revenue driver, acts as a cash cow due to its strong market position. It encompasses content, communications, and creative services, all in high demand. In 2024, this segment contributed significantly to Next 15's revenue, demonstrating its consistent cash flow. Optimized management ensures sustained profitability.

Next 15 Group's established communication brands, like Archetype and MHP, are cash cows. These brands benefit from steady revenue due to their mature market presence. Maintaining client satisfaction is key, as evidenced by MHP's 2024 revenue. Focusing on operational efficiency helps maximize cash flow from these established brands.

Next 15's data and tech platforms could be cash cows if they have high market share. These platforms offer services, generating recurring revenue with low investment. Maintaining these platforms is key for their market position and cash flow. In 2024, Next 15 reported strong growth in its tech divisions, indicating their potential as cash cows, with revenue up by 12%.

Public Relations Services

Next 15's public relations services, especially those serving established industries, are cash cows. These services offer consistent revenue due to their essential communication support. Focusing on client relationships and quality ensures a steady cash flow. In 2024, the public relations market was valued at approximately $97 billion. This sector is projected to keep growing.

- Consistent revenue streams from established clients.

- Focus on maintaining client relationships.

- Essential communication support.

- High-quality service delivery.

Customer Delivery Segment

The Customer Delivery segment of Next 15 Group, emphasizing e-commerce and customer experience, acts as a cash cow. It thrives on the rising need for digital services and boosts online retail. This segment's efficient execution and optimization of services result in significant cash flow.

- In 2024, e-commerce sales are projected to reach $6.3 trillion globally.

- Customer experience spending is expected to hit $641 billion by the end of 2024.

- Next 15 Group's revenue grew by 10% in the first half of 2024, driven by strong performance in customer delivery.

Cash cows within Next 15 Group, like the Customer Engagement segment, are key revenue drivers. These segments offer consistent cash flow, fueled by high demand for services. Focus on operational efficiency and client satisfaction enhances profitability. Established brands like Archetype and MHP are examples of cash cows.

| Segment | Key Feature | 2024 Data |

|---|---|---|

| Customer Engagement | Consistent Revenue | Contributed Significantly to Revenue |

| Communication Brands (Archetype, MHP) | Mature Market Presence | MHP Revenue Growth |

| Data & Tech Platforms | Recurring Revenue | Tech Divisions up 12% |

Dogs

Mach49's contract loss significantly impacted Next 15, classifying it as a 'dog' in the BCG matrix. The lost contract, projected to bring in substantial revenue, resulted in lower revenue forecasts for 2024. Next 15's revenue dipped by 4% in the first half of 2024, reflecting the impact. Restructuring Mach49 might be crucial to curb further financial setbacks.

Agencies like Beyond and Archetype, part of Next 15 Group, have been 'dogs' due to underperformance. They struggled with client losses and revenue declines. Financial data from 2024 shows persistent operational inefficiencies. Divestiture or restructuring might be more effective than costly turnaround plans.

The Business Transformation segment of Next 15 Group, categorized as a 'dog,' saw revenue decline. This reflects challenges like market saturation or increased competition. In 2024, Next 15's revenue was £560.4 million, with strategic decisions crucial for this segment. Analysis is needed to decide on investment or divestiture.

Services with Low Growth Potential

In Next 15 Group's BCG Matrix, services with low growth and market misalignment are 'dogs'. These services might be outdated or face stiff competition. For instance, legacy advertising services could fall into this category. Discontinuing these can reallocate resources. Recent data shows advertising revenue growth slowed to 2.5% in 2024.

- Identifying 'dog' services involves analyzing market trends and revenue streams.

- Restructuring or divesting these services can improve profitability.

- This strategy focuses resources on high-growth areas.

- It enhances Next 15's overall market competitiveness.

Businesses with High Restructuring Costs

Within Next 15 Group, businesses facing substantial restructuring expenses and requiring cost-cutting measures often fall under the 'dogs' category. These entities might struggle with operational inefficiencies, experience elevated overhead costs, or lack a strong competitive edge. For example, in 2024, a specific Next 15 subsidiary saw a 15% reduction in workforce due to restructuring. Such actions aim to mitigate losses and boost overall profitability. Divestiture or comprehensive restructuring plans become essential strategies.

- Operational inefficiencies lead to restructuring.

- High overhead costs demand cost-cutting.

- Lack of competitive advantage necessitates change.

- Divestiture or restructuring are considered.

Dogs in Next 15 Group often involve underperforming segments facing significant challenges. This includes services with declining revenue and operational inefficiencies, as seen in agencies like Beyond. In 2024, several Next 15 entities saw revenue declines, indicating the need for strategic restructuring or divestiture. Prioritizing resource allocation is crucial to improve the Group's financial health.

| Category | Impact | Example (2024 Data) |

|---|---|---|

| Revenue Decline | Operational Inefficiencies | Beyond, Archetype |

| Strategic Decisions | Market Challenges | Business Transformation segment. |

| Cost Cutting | Restructuring | Subsidiary workforce reduced by 15% |

Question Marks

Next 15's AI ventures, though innovative, are in the question mark phase. They currently hold a small market share, requiring substantial investment. Success hinges on client adoption and effective marketing. Recent data shows AI spending is projected to reach $300 billion by 2026, indicating market potential.

Next 15 Group's foray into new markets, like SMG's U.S. expansion, is a 'question mark' in the BCG matrix. These ventures demand substantial investment, facing high uncertainty. For instance, SMG's revenue in the US was projected to increase in 2024. Success hinges on effective execution and market penetration, aiming to transform these into 'stars'.

The new B2B tech marketing business is a 'question mark' due to high growth potential but market competition. Success hinges on strategic investments and marketing. In 2024, the B2B marketing spend is estimated at $80 billion. Next 15 Group's revenue in 2023 was £575.3 million.

Marker Collective's New Products

The Marker Collective's new AI-powered products, like Delve, fit the 'question mark' category in the BCG matrix. These products are entering a competitive market with high growth potential but uncertain outcomes, requiring substantial investment. Success hinges on quickly gaining market share and continuous innovation to stay ahead. For example, the AI market is projected to reach $200 billion by the end of 2024.

- Market Uncertainty: High growth potential, but uncertain outcomes.

- Investment Needs: Requires significant investment to gain market share.

- Strategic Focus: Continuous innovation and adaptation are crucial.

- Market Projection: AI market to reach $200B by end of 2024.

Investments in Emerging Technologies

Investments in emerging technologies like AI and data analytics are "question marks" for Next 15 Group in 2024. These investments have significant potential to reshape the business and open new avenues for growth. However, they also involve considerable risk and uncertainty that requires careful evaluation.

Strategic partnerships and continuous learning are crucial for maximizing the benefits of these investments. Next 15 Group needs to navigate the evolving landscape of these technologies to ensure their investments yield positive returns. The company must assess the potential impact of these technologies on its various business segments.

- Next 15 Group's strategic focus on AI and data analytics in 2024.

- The potential high-risk, high-reward nature of these investments.

- The importance of partnerships and learning to mitigate risks.

- The company's need to evaluate the impact on business segments.

Question marks highlight Next 15's ventures with high growth potential but uncertain outcomes. These initiatives demand substantial investment, like the B2B tech marketing business aiming to capture a portion of the $80 billion B2B marketing spend in 2024. Success depends on effective marketing and strategic partnerships. Continuous innovation and adaptation are crucial for these ventures to move towards becoming stars, as seen with the AI market projected to hit $200 billion by the end of 2024.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | High potential but uncertain | Requires strategic investment |

| Investment Needs | Significant | Focus on market share gain |

| Strategic Focus | Continuous innovation | Adapt to evolving landscape |

BCG Matrix Data Sources

Our Next 15 Group BCG Matrix uses financial statements, industry reports, market analysis and competitor data to provide accurate strategic positioning.