NFI Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NFI Industries Bundle

What is included in the product

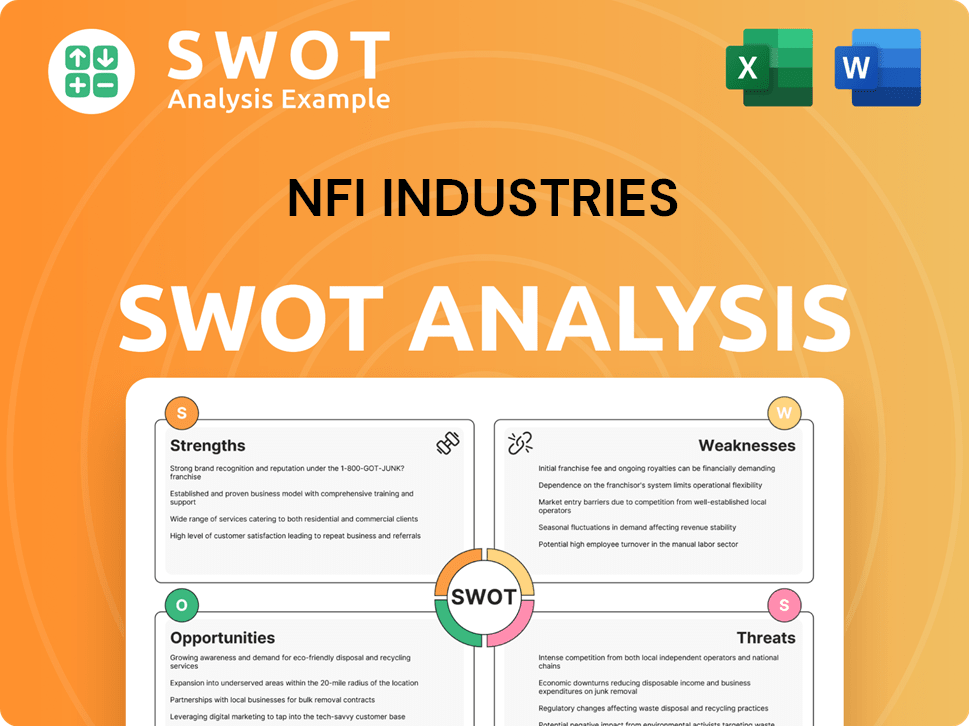

Analyzes NFI Industries’s competitive position through key internal and external factors

Simplifies complex SWOT insights into an actionable, at-a-glance view.

What You See Is What You Get

NFI Industries SWOT Analysis

What you see is what you get: this preview displays the actual NFI Industries SWOT analysis.

It’s not a simplified version or excerpt; the complete document mirrors the preview exactly.

Purchase the analysis and instantly download the same in-depth report shown below.

Receive comprehensive insights, fully accessible and ready for your use post-purchase.

No hidden sections—just the full, detailed SWOT assessment is provided.

SWOT Analysis Template

This glimpse reveals key areas for NFI Industries, including its logistics strengths. We've touched on risks like market competition, and growth drivers like e-commerce. We have also highlighted financial insights and a look at future strategies.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

NFI Industries stands out with its comprehensive service offerings. They provide a broad spectrum of supply chain solutions, covering transportation, warehousing, and global logistics. This all-encompassing approach positions them as a one-stop shop. Their diverse services boost customer retention and market penetration. In 2024, NFI's revenue reached $3.6 billion, reflecting the strength of their integrated model.

NFI Industries dominates the North American market. They lead in heavy-duty transit buses, motorcoaches, and aftermarket services. This strong position gives them a competitive edge. In 2024, NFI reported a significant market share in key segments, solidifying its dominance.

NFI Industries' strength lies in its focus on Zero-Emission Vehicles (ZEBs). They are actively expanding their ZEB fleet, responding to environmental regulations and customer demand. This leadership in green logistics is further cemented by ambitious net-zero emission targets. For example, in 2024, NFI increased its ZEB fleet by 30% and plans to invest $500 million by 2025.

Record Backlog and Strong Order Book

NFI Industries benefits from a substantial record backlog, ensuring solid revenue. This backlog fuels growth expectations, especially in 2025. A strong order book reflects high customer demand and trust in NFI's products. The company's backlog stood at $3.1 billion as of Q1 2024, up from $2.7 billion in Q1 2023.

- Revenue visibility for 2024 and 2025.

- Demonstrates customer confidence.

- Provides a buffer against economic downturns.

- Supports production planning.

Strategic Acquisitions and Partnerships

NFI's strategic moves, like acquiring Transfix's freight brokerage, showcase its proactive approach to growth. This expansion has broadened NFI's service offerings and market reach. These acquisitions and partnerships indicate a strong ability to adapt to industry changes. They are also evidence of NFI's commitment to leveraging technology.

- Acquisition of Transfix's freight brokerage operation.

- Expanded service capabilities.

- Increased geographic footprint.

- Enhanced technological adoption.

NFI boasts comprehensive, integrated supply chain solutions, enhancing market reach. In 2024, revenue reached $3.6B, reflecting its strength. Their focus on Zero-Emission Vehicles and strategic acquisitions also provide key strengths, like adding Transfix. These strengthen customer retention.

| Strength | Details | 2024 Data |

|---|---|---|

| Integrated Services | Comprehensive supply chain solutions | $3.6B revenue |

| Market Leadership | North American dominance in key segments. | Significant market share |

| Zero-Emission Focus | Expansion of ZEB fleet and investments. | 30% ZEB fleet increase. |

Weaknesses

NFI Industries faces supply chain vulnerabilities. Disruptions, especially for components like bus seating and EV parts, can delay production. Reliance on suppliers poses risks, impacting delivery timelines. In Q1 2024, supply chain issues slightly affected production. Specifically, delays in EV component deliveries were noted.

NFI Industries confronts labor market weaknesses within the logistics and transportation industry. The sector needs skilled drivers and technicians. Despite improvements, labor availability remains regionally challenging. This can affect operational efficiency and raise costs. The driver shortage is expected to persist through 2025, according to the American Trucking Associations.

As NFI scales up production, especially for advanced zero-emission buses, production efficiency may fluctuate. Maintaining quality and controlling costs during this expansion is a persistent hurdle. For instance, in Q4 2023, NFI reported a slight dip in gross profit margin, reflecting these challenges. They are investing in automation to mitigate these effects.

Exposure to Economic Sensitivity

NFI Industries faces economic sensitivity, where demand for its services fluctuates with economic cycles. Downturns can reduce freight volumes, affecting revenue and profitability. For example, during the 2023-2024 period, the logistics sector saw a 10-15% decrease in demand due to economic slowdowns. This vulnerability requires careful financial planning.

- Freight volume drops can directly impact NFI's revenue streams.

- Economic uncertainty leads to cautious spending by clients.

- Recessions may force NFI to lower prices to stay competitive.

- Diversification into less cyclical areas can help mitigate risks.

Integration Risks from Acquisitions

NFI Industries faces integration risks when acquiring new businesses, potentially disrupting operations and creating inefficiencies. Successfully merging different technologies, systems, and company cultures is critical. Failure to integrate smoothly can lead to decreased productivity and financial setbacks. The company's past acquisitions, such as the 2023 purchase of a warehousing solutions provider, highlight these challenges.

- Integration challenges can lead to operational disruptions.

- Cultural clashes can slow down synergy realization.

- System incompatibilities can cause data management issues.

NFI Industries' weaknesses include supply chain issues, with EV components causing delays. Labor shortages in the logistics sector can increase costs and hinder operations. Fluctuating production efficiency during expansion, coupled with economic sensitivities, impacts revenue.

| Weakness | Impact | 2024 Data |

|---|---|---|

| Supply Chain | Production delays and cost increases | EV component delays in Q1 2024 affected production |

| Labor | Increased costs and operational inefficiencies | Driver shortages projected through 2025 (American Trucking Associations) |

| Production Inefficiency | Reduced margins | Slight dip in gross profit margin in Q4 2023 |

Opportunities

The rising global emphasis on cutting emissions and government backing for eco-friendly transport offers NFI a chance to boost its zero-emission bus and coach market share. U.S. tax credits for electric vehicles, like those offered in the Inflation Reduction Act, boost this opportunity. In 2024, the global electric bus market was valued at $26.8 billion, with projections to reach $62.8 billion by 2032. NFI's proactive stance positions it well.

NFI's aftermarket services are performing well, signaling growth potential. They can expand parts and services for their vehicle base and possibly others. This segment provides a reliable revenue source. In Q1 2024, aftermarket sales grew 12%, indicating strong demand. This area is crucial for sustained profitability.

NFI Industries can leverage AI and automation to boost efficiency. In 2024, the global supply chain AI market was valued at $2.8 billion, with projections to reach $15.6 billion by 2029. This growth signals a significant opportunity for NFI to adopt these technologies. Data analytics enables route optimization. Predictive maintenance can reduce downtime, and innovative customer solutions are possible.

Growth in E-commerce and Last-Mile Delivery

The booming e-commerce sector creates substantial opportunities for NFI Industries. Increased online shopping necessitates efficient warehousing, distribution, and last-mile delivery solutions. NFI's established capabilities in these areas allow for service expansion. The e-commerce market is projected to reach $7.4 trillion globally by 2025. In 2024, e-commerce sales in the U.S. hit $1.1 trillion, showing significant growth potential for logistics providers like NFI.

- Growing e-commerce market.

- Demand for warehousing.

- Expansion of services.

- Last-mile delivery.

Infrastructure Development and Investment

NFI Industries can capitalize on infrastructure growth. Government and private investments in areas like EV charging stations and port expansions offer avenues for NFI's services. This includes providing transportation and logistics support for these projects. The Infrastructure Investment and Jobs Act, passed in 2021, allocates substantial funds.

- Investments in infrastructure are projected to reach $3.5 trillion by 2025.

- The global electric vehicle charging infrastructure market is expected to reach $25.6 billion by 2027.

NFI Industries sees major growth in electric buses and aftermarket services, responding to global climate goals and growing demand for parts and services. The rise of e-commerce, coupled with infrastructure spending, creates further prospects for warehousing, last-mile delivery, and specialized transport solutions. Adoption of AI and automation further enhances efficiency.

| Opportunity | Details | 2024/2025 Data |

|---|---|---|

| Electric Vehicles | Expanding zero-emission bus market, taking advantage of US tax credits | $62.8B global market by 2032. U.S. EV market grew 47% YOY in Q1 2024. |

| Aftermarket Services | Growth in parts, maintenance, and services. | Q1 2024 aftermarket sales grew 12%. |

| AI and Automation | Use AI for route optimization and predictive maintenance | Supply chain AI market estimated at $15.6B by 2029. |

| E-commerce | Expansion of warehousing and logistics in the booming e-commerce sector. | US e-commerce sales reached $1.1T in 2024. |

| Infrastructure Growth | Provide transport and logistics for projects like EV charging. | Infrastructure spending estimated at $3.5T by 2025. EV charging market $25.6B by 2027. |

Threats

The logistics market faces fierce competition, impacting pricing and profitability. NFI Industries competes with major players like UPS and FedEx. In 2024, the global logistics market was valued at over $10 trillion. Intense competition can force companies to lower prices to attract customers.

Global economic volatility, trade policy shifts, and geopolitical events present significant challenges. These factors can disrupt NFI's supply chains, affecting freight volumes. For instance, a 2024 report indicated a 7% drop in global trade. This uncertainty directly impacts NFI's financial stability.

Rising operating costs pose a threat to NFI Industries. Fluctuating fuel prices and labor costs can squeeze profit margins. Continued investment in technology and infrastructure further increases expenses. In Q1 2024, NFI's operating expenses rose by 7%, impacting overall profitability. These pressures demand strategic cost management.

Regulatory Changes and Compliance

NFI Industries faces threats from evolving regulations. Evolving transportation regulations, environmental standards, and trade policies create compliance challenges. Adapting operations and vehicle offerings requires significant investments. For example, the trucking industry spent an estimated $12.5 billion on compliance in 2023.

- Compliance costs are rising industry-wide.

- New emission standards necessitate fleet upgrades.

- Trade policy shifts can disrupt supply chains.

- Regulatory changes demand continuous adaptation.

Cybersecurity Risks

Cybersecurity risks are a significant threat as NFI Industries' supply chains become more digital. Protecting sensitive customer and operational data is essential. Data breaches can lead to financial losses and reputational damage. The cost of cybercrime is projected to reach $10.5 trillion annually by 2025.

- Increased digitalization of supply chains expands attack surfaces.

- Data breaches can cause significant financial and operational disruptions.

- Maintaining customer trust requires robust cybersecurity measures.

- Cybersecurity incidents are on the rise globally.

NFI Industries faces profitability threats from logistics market competition and price pressures. Global economic and political instability disrupt supply chains, as demonstrated by the 7% trade drop in 2024. Rising operating costs and evolving regulations create compliance challenges, exemplified by $12.5 billion industry spend in 2023. Cybersecurity risks from increasing digitalization further threaten data and operational integrity, with cybercrime costs projected to reach $10.5 trillion by 2025.

| Threat | Impact | Mitigation |

|---|---|---|

| Competition | Pricing pressure, margin erosion | Operational efficiency, service differentiation |

| Economic Volatility | Supply chain disruptions, reduced volumes | Diversified routes, risk management strategies |

| Rising Costs | Increased expenses, reduced profitability | Cost controls, technology adoption |

| Regulations | Compliance costs, operational changes | Proactive adaptation, investment |

| Cybersecurity | Data breaches, financial and reputational damage | Robust security, employee training |

SWOT Analysis Data Sources

NFI's SWOT leverages financial reports, market analysis, and expert perspectives, providing a data-driven view of the company.