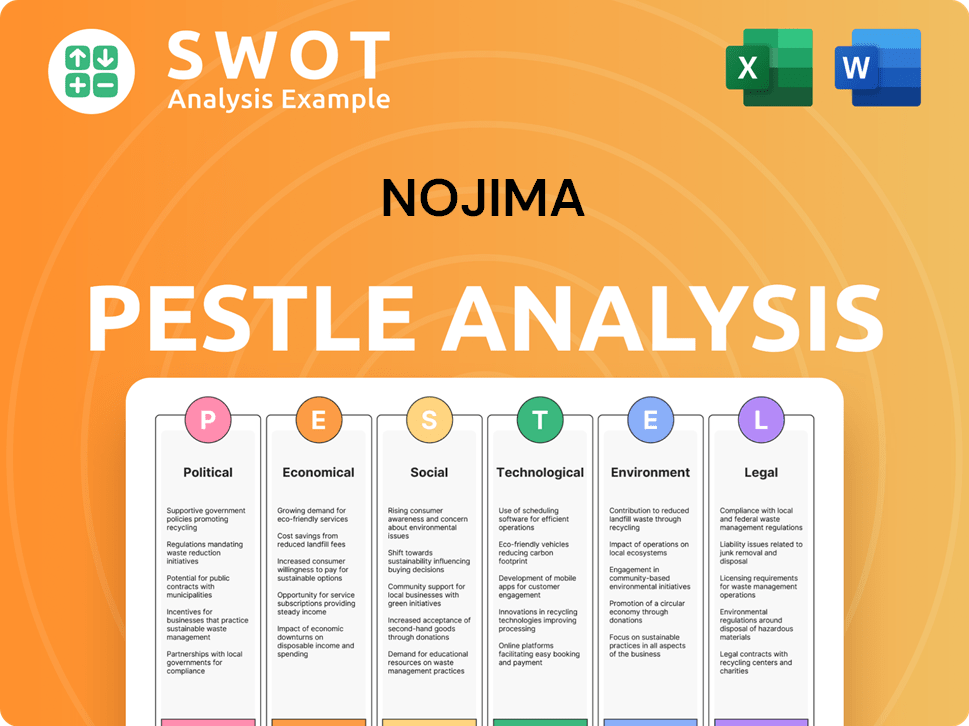

Nojima PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nojima Bundle

What is included in the product

Explores how macro-environmental factors impact Nojima, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Helps teams quickly identify areas of high priority by presenting a summarized version of external factors.

What You See Is What You Get

Nojima PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. This Nojima PESTLE analysis includes all relevant factors affecting their business. Review the structure and details; this is the document you'll download. It's ready for immediate use after your purchase.

PESTLE Analysis Template

Want to decode Nojima's external landscape? Our PESTLE analysis reveals crucial forces impacting the company. We examine political, economic, social, technological, legal, and environmental factors. Get expert insights to understand risks and opportunities. Full analysis ready for immediate download. Make informed decisions today!

Political factors

Government regulations in Japan significantly affect Nojima's retail and electronics operations. Product safety, advertising, and licensing regulations are key. New amendments to product safety laws, effective by December 2025, will impact online sales and child safety measures. These changes require Nojima to adapt its strategies to ensure compliance and maintain consumer trust. For example, the electronics market in Japan is projected to reach $58 billion by the end of 2024.

Nojima, as a consumer electronics retailer, faces risks from trade policy shifts and international relations. For example, Japan's trade with China, a major manufacturing hub, is worth billions. Any trade restrictions could disrupt supply chains and impact product costs. Geopolitical tensions, like those seen in 2024/2025, may affect the availability of key components.

Consumer protection laws are crucial for Nojima's operations. Japan's Consumer Affairs Agency enforces regulations against unfair labeling and misleading advertising. For instance, in 2024, the agency handled over 400,000 consumer complaints. Nojima must ensure transparency in product information to comply. This includes accurately representing product features and pricing across all platforms.

Political Stability and Government Economic Policies

Japan's political stability, underscored by consistent governance, fosters a predictable business environment crucial for consumer electronics. The government's monetary easing and fiscal stimulus, like the 2024 economic package, aim to boost spending and confidence. Despite recovery signs, global uncertainties, including inflation and geopolitical tensions, could impact market sentiment. These factors can influence Nojima's strategic planning.

- Japan's GDP growth forecast for 2024 is around 1.0%.

- Consumer electronics spending saw a 2.3% increase in Q1 2024.

- The government's 2024 stimulus package is valued at $30 billion.

Data Privacy Regulations

Data privacy regulations significantly impact Nojima's operations, particularly its online activities and customer data management. Amendments to the Act on Protection of Personal Information (APPI) are crucial. Stricter rules necessitate adjustments in data handling. Non-compliance risks penalties and reputational damage. The global data privacy market is expected to reach $13.3 billion by 2025.

- APPI amendments require businesses to update data handling practices.

- Compliance is essential to avoid legal and reputational issues.

- The data privacy market is rapidly growing.

Nojima faces impacts from Japanese regulations on product safety, advertising, and licensing, with changes effective by December 2025 impacting online sales and child safety. Trade policy shifts, especially with China, present risks to supply chains and costs amid geopolitical tensions. Consumer protection laws require Nojima to ensure transparency, with Japan's Consumer Affairs Agency handling over 400,000 complaints in 2024.

| Aspect | Details | Impact for Nojima |

|---|---|---|

| Regulations | Product safety, advertising, licensing. Amendments to laws are effective by December 2025 | Compliance costs, adapt strategies, maintain consumer trust. |

| Trade Policy | Japan-China trade relations (billions of dollars). | Supply chain disruption, potential cost increases. |

| Consumer Protection | Consumer Affairs Agency enforces regulations. 400,000+ complaints handled in 2024 | Ensure transparent product information, risk of penalties |

Economic factors

Consumer spending and disposable income heavily impact Nojima's sales. In 2024, Japan's real household income decreased, potentially affecting spending on electronics. The consumer confidence index in Japan has fluctuated, reflecting economic uncertainty. Rising prices and economic concerns may lead to reduced spending on discretionary items.

The Japanese consumer electronics market's growth significantly impacts Nojima. Despite smartphone segment growth, overall consumer electronics retail volume is projected to decrease. In 2024, the consumer electronics market in Japan is valued at approximately ¥7.6 trillion. This decline is expected to continue at a rate of around 1-2% annually through 2025.

Inflation and rising prices directly influence Nojima's operational expenses and consumer spending habits. In 2024, Japan's inflation rate hovered around 2-3%, impacting procurement costs. Consumers are increasingly opting for budget-friendly electronics, a trend amplified by the yen's depreciation against major currencies. This shift affects demand across various price tiers within the electronics market.

Competition within the Retail Sector

Nojima faces fierce competition in the retail sector. It competes with electronics specialists and e-commerce giants, impacting pricing and market share. To stand out, Nojima focuses on services like consulting-based sales. The electronics market is expected to grow, but competition remains high.

- E-commerce sales in Japan reached $180 billion in 2024, increasing competition.

- Nojima's market share in Japan's electronics retail was approximately 6% in 2024.

- Consulting services can increase customer spending by up to 15%.

- Competitive pricing strategies can affect profit margins by up to 10%.

Exchange Rates

Exchange rate volatility significantly influences Nojima's financial performance. Fluctuations in the yen directly affect the pricing of imported electronics and the profitability of international ventures. Yen appreciation, particularly against the US dollar, is predicted to boost market growth in the coming years. This can lead to cost savings on imported components and increased competitiveness in global markets.

- Yen-USD exchange rate in early 2024: approximately 150 JPY per USD.

- Impact of a 10% Yen appreciation on import costs: potential reduction in costs.

- Nojima's overseas revenue: approximately 5% of total revenue.

Economic conditions significantly shape Nojima's operations. In 2024, consumer spending faced pressure due to decreased real household income. Japan's consumer electronics market, valued around ¥7.6T in 2024, faces a projected 1-2% annual decline through 2025, compounded by high inflation and competitive pressures.

| Factor | 2024 Data | 2025 Projection |

|---|---|---|

| Household Income Change | Real income decrease | Dependent on economic recovery |

| Inflation Rate | 2-3% | Projected stable to slight increase |

| Electronics Market Value | ¥7.6T | Continued 1-2% decline |

Sociological factors

Consumer preferences are shifting, impacting electronics demand. Energy-efficient appliances are gaining popularity due to sustainability concerns. For example, in 2024, sales of energy-efficient appliances rose by 15% in Japan. This trend influences product development and marketing strategies. Consumers increasingly prioritize eco-friendly options and sustainable practices.

Japan faces significant demographic challenges. The aging population and declining birthrate shrink the consumer market. For instance, the total population decreased by approximately 800,000 in 2023. This decline affects demand for electronics.

Digital literacy profoundly impacts e-commerce in Japan, influencing online electronics sales. Millennials and Gen Z, fluent in technology, boost social commerce. In 2024, Japan's e-commerce market reached ¥22.7 trillion, showing digital's power. Online reviews and price comparisons also drive consumer choices.

Influence of Social Media and Online Reviews

Social media and online reviews are pivotal in influencing consumer electronics purchases. Platforms host user reviews and tech demos, building trust and easing online buying concerns. In 2024, 70% of consumers check online reviews before buying electronics, impacting sales significantly. Nojima must monitor social sentiment to adapt to consumer preferences.

- 70% of consumers check online reviews before buying electronics (2024 data).

- User reviews and tech demos build consumer trust.

- Social sentiment analysis is essential.

Focus on Customer Experience and Consulting

Japanese consumers prioritize customer service and in-store experiences, especially when buying electronics. Nojima addresses this by offering consulting-based sales to improve customer satisfaction. This strategy aligns with the preference for personalized advice. Nojima's approach aims to build customer loyalty in a competitive market. Data from 2024 shows that 65% of Japanese consumers prefer in-person shopping for electronics due to the opportunity for direct interaction and support.

- 65% of Japanese consumers favor in-person electronics shopping.

- Nojima's consulting-based sales boost customer satisfaction.

Sociological factors influence consumer behavior in Japan’s electronics market. Aging and declining birth rates, reflected in a population drop of 800,000 in 2023, shape market dynamics. Digital literacy impacts e-commerce, with 2024 sales hitting ¥22.7 trillion. Online reviews and preferences for customer service also steer purchasing decisions.

| Factor | Impact | Data |

|---|---|---|

| Consumer Preferences | Demand shifts towards energy-efficient and sustainable products. | Sales of energy-efficient appliances rose 15% in 2024 |

| Demographics | Aging population reduces consumer market size. | Population decreased by ~800,000 in 2023 |

| Digital Influence | Boosts e-commerce and online sales via social commerce. | E-commerce market reached ¥22.7 trillion in 2024 |

Technological factors

Rapid tech advancements fuel new electronics, impacting product cycles and demand. Smartphones' evolution and AI integration are key drivers. In 2024, global consumer electronics revenue reached $1.1 trillion. The market is projected to grow, with AI-powered devices gaining traction. Nojima must adapt to these rapid changes.

The surge in e-commerce and digital shopping platforms significantly impacts electronics retailers like Nojima. In fiscal year 2024, online sales in Japan's consumer electronics market reached ¥2.5 trillion. Nojima's online segment must adapt to compete effectively. Integrating online and offline experiences, as Nojima aims to do, is crucial for capturing market share. This strategy aligns with the growing consumer preference for omnichannel shopping.

Nojima is integrating AI and digital transformation (DX) to improve operations. This includes AI in products and retail, enhancing customer experiences. The company uses digital engineering for productivity gains. In 2024, DX investments increased by 15%, focusing on online and in-store integration. This shift aims to meet evolving consumer demands.

Development of Payment Technologies

The evolution of payment technologies significantly impacts Nojima's business. Japan's embrace of cashless payments, including QR codes and digital wallets, is rising. This shift affects how customers buy electronics, emphasizing the need for versatile payment options. In 2024, cashless transactions in Japan reached approximately 40%, increasing from 36% in 2023.

- Cashless payment adoption offers convenience.

- Diverse payment support is key for customer satisfaction.

- Adaptation to digital payment trends is crucial.

Technological Infrastructure and Internet Penetration

Japan boasts a robust technological infrastructure, crucial for digital commerce. The country's high internet penetration, reaching approximately 93% in 2024, fuels online retail growth. This advanced setup supports consumers' ability to research and buy electronics seamlessly. Such infrastructure is key for companies like Nojima.

- 2024 internet penetration: ~93%

- Supports online retail and connected devices

- Facilitates consumer research and purchasing

- Essential for companies like Nojima

Tech's fast pace shapes Nojima, driving product cycles. Online sales are key; omnichannel strategy boosts market share. AI, digital payments, and Japan’s high internet penetration, ~93% in 2024, are vital.

| Tech Factor | Impact | 2024 Data |

|---|---|---|

| AI Integration | Enhanced Customer Experience | DX investments up 15% |

| E-commerce | Sales and Digital Shift | Online sales in Japan: ¥2.5T |

| Payment Tech | Cashless Growth | Cashless use: ~40% |

Legal factors

Nojima must adhere to stringent consumer product safety regulations, including the Consumer Product Safety Act, to ensure product safety. These laws are crucial for protecting consumers from hazards. Recent updates focus on online sales and specific product categories like toys. In 2024, the Consumer Product Safety Commission (CPSC) handled over 200 product recalls, reflecting ongoing regulatory scrutiny.

The Japanese e-commerce market faces strict regulations. The ASCT and the DPF Act mandate clear information disclosure and consumer protection. For example, in 2024, the e-commerce market in Japan was valued at approximately $200 billion. These laws ensure fair practices in online retail.

Nojima must comply with advertising and labeling laws to avoid penalties. The Consumer Affairs Agency rigorously enforces these regulations. In 2024, the agency handled over 10,000 consumer complaints related to misleading advertising. Violations can result in significant fines and reputational damage. Proper labeling ensures transparency and builds consumer trust, crucial for long-term success.

Telecommunications Business Law

Revisions to the Telecommunications Business Law are crucial for Nojima, directly affecting mobile phone sales and services. These legal changes shape pricing strategies and competition within the mobile market. The Japanese mobile market saw approximately ¥13.8 trillion in revenue in 2024, with growth projected at 1.5% in 2025. These laws can influence the availability of specific phone models and service bundles.

- Mobile phone sales account for a substantial portion of Nojima's revenue.

- Changes in regulations can affect contract terms and consumer choices.

- Compliance costs may rise due to new legal requirements.

- The regulatory environment impacts market competition and pricing.

Data Protection and Privacy Laws

Nojima must strictly adhere to Japan's Act on Protection of Personal Information (APPI) to protect customer data. APPI regulates how data is collected, used, and stored, impacting Nojima's operations across its retail and online channels. Non-compliance can lead to severe penalties, including fines and reputational damage, as seen in past data breaches. This necessitates robust data security measures and transparent privacy policies. The global data privacy market is projected to reach $135.7 billion by 2025.

Nojima must prioritize consumer safety and product labeling. Compliance with e-commerce regulations and advertising laws, enforced by bodies like the Consumer Affairs Agency, is essential to prevent penalties. Data privacy, governed by APPI, demands robust security measures given the global data privacy market is projected to hit $135.7 billion by 2025.

| Legal Aspect | Regulation | Impact on Nojima |

|---|---|---|

| Product Safety | Consumer Product Safety Act | 200+ recalls in 2024, strict safety standards |

| E-commerce | ASCT, DPF Act | $200B market in 2024, mandates fair practices |

| Advertising | Consumer Affairs Agency enforcement | 10,000+ complaints, significant fines |

Environmental factors

Regulations drive Nojima’s product choices. Energy efficiency standards and e-waste rules affect what they sell. Nojima promotes eco-friendly goods, reflecting the trend. For example, in 2024, Japan saw a 15% increase in sales of energy-efficient appliances due to new standards.

Consumer demand for sustainable products is increasing, impacting purchasing decisions. Nojima's focus on energy-efficient appliances aligns with this trend. In 2024, the global market for green products is estimated to reach $3.7 trillion. Nojima can capitalize on this by promoting eco-friendly options. This strategy can boost sales and brand image.

Nojima faces growing pressure to showcase corporate social responsibility and sustainability, influencing its public image and operations. In 2024, consumer surveys indicated that over 70% of consumers prefer brands with strong CSR. Nojima's commitment to environmental initiatives and societal contributions is crucial. For example, Nojima has reported a 15% reduction in carbon emissions from its stores by Q4 2024, reflecting its dedication to these areas.

Supply Chain Environmental Impact

Nojima's supply chain's environmental impact is an indirect factor. It is relevant as the lifecycle of electronics, from production to shipping, affects the environment. Consumers and stakeholders increasingly prioritize sustainable practices, making supplier responsibility crucial. This includes responsible sourcing of materials and eco-friendly manufacturing processes.

- In 2024, the electronics industry faced increased scrutiny regarding e-waste management and carbon emissions from transportation.

- Companies are under pressure to reduce their carbon footprint, with many setting targets for Scope 3 emissions (supply chain).

- Approximately 53.6 million metric tons of e-waste was generated globally in 2019.

Climate Change and Natural Disasters

Climate change and natural disasters pose significant risks to Nojima's operations in Japan. Increased frequency of extreme weather events could damage stores and disrupt supply chains. The economic impact of natural disasters in Japan reached $200 billion in 2024, signaling heightened vulnerability. Businesses must prioritize resilience.

- Increased frequency of typhoons and floods.

- Potential for supply chain disruptions.

- Rising insurance costs for property.

- Need for disaster preparedness plans.

Nojima must adapt to environmental regulations like energy efficiency and e-waste rules. Consumer demand for sustainable products boosts eco-friendly options, supported by the $3.7T green products market in 2024. Growing pressure to showcase CSR affects Nojima's public image.

| Aspect | Impact on Nojima | Data |

|---|---|---|

| Regulations | Drives product choices | Japan's 15% increase in energy-efficient appliances sales in 2024. |

| Consumer Demand | Boosts eco-friendly sales | Global green products market reached $3.7T in 2024. |

| CSR Pressure | Influences public image | 70%+ consumers prefer brands with CSR. |

PESTLE Analysis Data Sources

The Nojima PESTLE leverages sources such as industry reports, financial publications, and government statistics for relevant, reliable data. We also consider market research & news articles.