Northern Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Northern Trust Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Quickly understand business unit performance with a simple graphic.

What You’re Viewing Is Included

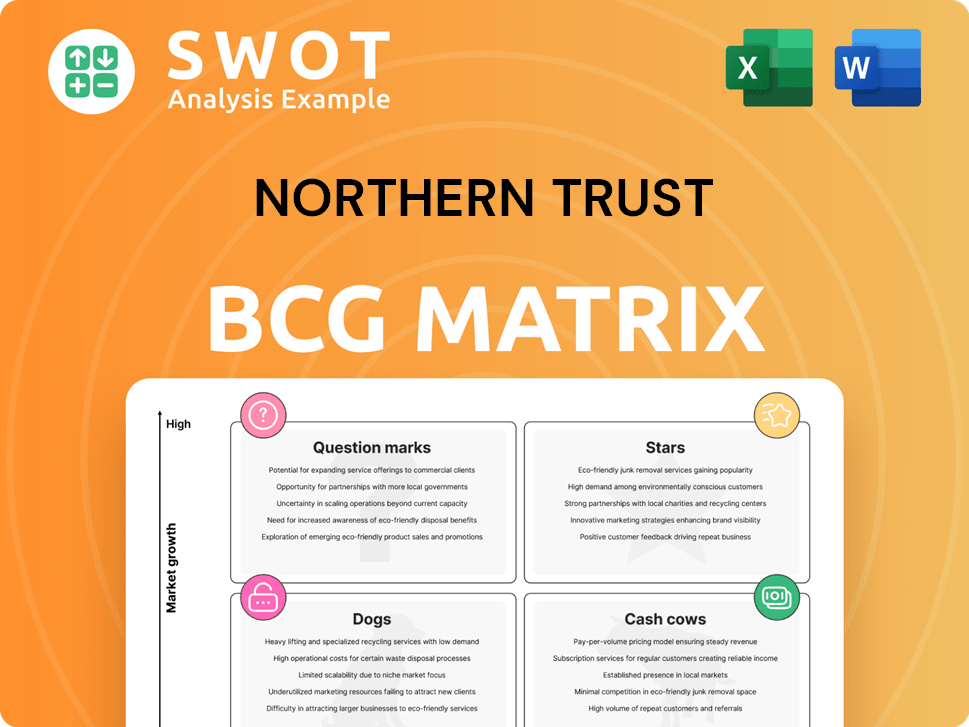

Northern Trust BCG Matrix

The displayed BCG Matrix preview is the exact document you'll receive. Download the comprehensive analysis, ready for strategic insights.

BCG Matrix Template

Northern Trust's BCG Matrix offers a snapshot of its diverse product portfolio. This framework categorizes offerings based on market share and growth rate, revealing strategic implications. Question Marks, Stars, Cash Cows, and Dogs—each quadrant demands a unique approach. This preview is just a glimpse.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Northern Trust's Asset Servicing segment shines, showcasing robust growth. Custody and fund administration fees surged, reflecting client loyalty and new wins. Assets under custody/administration are up, underlining its market leadership. In Q3 2024, asset servicing revenue rose, driven by higher fees.

Northern Trust's Wealth Management is growing, especially with 'Family Office Solutions'. They target ultra-rich clients and focus on expanding globally. The division saw client assets rise, showing the appeal of its investment strategies. In 2024, assets under management grew significantly.

Northern Trust is seeing increasing momentum in alternative investments. The Asset Management division is on track to almost double its capital-raising pace. Securing significant mandates from infrastructure firms signals strong demand for their expertise. This positions them well to handle economic challenges and grow in private markets. In Q3 2023, Northern Trust's AUM reached $1.43 trillion.

Technological Innovation

Northern Trust's focus on technological innovation, especially in cloud infrastructure and AI, is a key strength. The company's partnership with TCS highlights its dedication to modernizing its platforms. These initiatives boost client service and cement Northern Trust's tech leadership. For example, Northern Trust's tech spending in 2024 reached $500 million.

- Tech spending of $500 million in 2024.

- Partnership with TCS for platform modernization.

- Focus on cloud and AI for efficiency.

- Enhanced client service delivery.

Strategic Capital Returns

Northern Trust prioritizes returning capital to shareholders, showing confidence in its financial health and liquidity. A solid CET1 ratio supports these returns while keeping a strong balance sheet. This shareholder focus, along with operational efficiency, positions Northern Trust well for investors. In 2024, Northern Trust's dividend yield was approximately 2.6%.

- Dividend Yield: Approximately 2.6% (2024)

- CET1 Ratio: Strong, supporting capital returns

- Share Repurchases: Ongoing, enhancing shareholder value

- Capital Allocation: Focused on shareholder returns and growth

Northern Trust's "Stars" include Asset Servicing and Wealth Management, showing high growth and market share. Asset Servicing is boosted by rising custody fees and new client wins. Wealth Management's expansion, particularly with Family Office Solutions, is impressive.

| Aspect | Details | 2024 Data |

|---|---|---|

| Asset Servicing Revenue | Driven by increased fees | Up in Q3 |

| Wealth Management Growth | Focus on ultra-rich clients | Assets Under Management rose significantly |

| Tech Spending | Investment in cloud and AI | $500 million |

Cash Cows

Northern Trust's custody and fund administration services are a cash cow, generating consistent revenue. These services leverage Northern Trust's substantial asset base, providing stability. Recurring fees from institutional clients are common in this area. In Q4 2023, Northern Trust's assets under custody were $15.5 trillion.

Northern Trust's trust and estate services are a cash cow, offering steady fee income from high-net-worth clients. Their expertise and personalized service foster strong client loyalty, ensuring recurring revenue. In 2023, Northern Trust's Wealth Management segment, which includes these services, reported $1.9 billion in revenue. This focus on long-term relationships guarantees a stable, profitable business, crucial for financial stability.

Northern Trust's corporate banking services, such as lending and treasury management, are cash cows, generating reliable net interest income. They skillfully manage deposits, enhancing their financial stability. A diverse client base and risk management are crucial. In 2024, their net interest income was about $2.2 billion.

Investment Management for Institutions

Northern Trust's institutional investment management generates steady fees, leveraging its investment expertise. Maintaining and attracting institutional clients is key to sustaining this revenue. Strong investment performance and tailored solutions ensure a reliable income stream. In 2024, Northern Trust's assets under management (AUM) for institutional clients were substantial, contributing significantly to its overall revenue. The company's focus on client retention and performance is reflected in its financial results.

- Institutional AUM growth is a critical metric for Northern Trust.

- Client retention rates directly impact fee income.

- Investment performance drives client satisfaction and referrals.

- Tailored solutions differentiate Northern Trust in the market.

Securities Lending

Northern Trust's securities lending is a cash cow, generating income from lending client securities. This stable revenue stream relies on effective risk management. Optimizing lending practices and strong controls are key to profitability. In 2024, securities lending contributed significantly to their revenue.

- Securities lending provides a steady income source.

- Risk management is crucial for this business.

- Optimization and strong controls enhance profitability.

- This business line is a strong contributor to revenue.

Northern Trust's diverse services, like custody and trust, consistently generate revenue. They capitalize on a large asset base, fostering financial stability. Corporate banking and securities lending further bolster this position. In 2024, these services collectively contributed significantly to their financial performance.

| Service | Revenue Source | Key Feature |

|---|---|---|

| Custody | Recurring fees | $15.5T assets (2023) |

| Trust | Fee income | $1.9B segment revenue (2023) |

| Corporate Banking | Net interest income | $2.2B net interest income (2024) |

Dogs

Given commodity market volatility, services like trading or investment face uncertainty. These services might see fluctuating demand and profitability. For example, in 2024, oil price swings impacted related financial services. Diversifying or reducing exposure to volatile commodities can help. Data from 2024 shows some firms shifting strategies.

Regions with declining AUM, like those in Europe, might be categorized as Dogs in Northern Trust's BCG matrix. These areas face economic headwinds, impacting asset growth. Northern Trust's 2023 AUM decreased slightly in EMEA. Strategies could involve focused investments or resource reallocation.

Services with high operational costs at Northern Trust, like certain specialized asset servicing, could be categorized as Dogs. These services may need substantial tech and staff investments, yet struggle with profitability. For instance, in 2024, operational expenses rose by 5%, impacting margins. Streamlining or outsourcing could boost returns.

Products with Low Client Adoption

Products with low client adoption are considered "Dogs" in Northern Trust's BCG Matrix. These are new offerings that haven't resonated with clients, possibly due to unmet needs or strong competition. For example, in 2024, Northern Trust might have seen lower adoption of its new digital asset custody services compared to traditional asset management products. Improving product development is key.

- Market research can identify unmet needs.

- Competitive analysis helps refine offerings.

- Product adjustments can boost adoption.

- Focus on client-centric solutions.

Businesses Heavily Reliant on Interest Rates

Businesses heavily reliant on net interest income (NII) can be "Dogs" in the Northern Trust BCG Matrix, especially with fluctuating rates. These firms, like some regional banks, may struggle in low-rate environments. For example, the net interest margin (NIM) for U.S. banks saw fluctuations in 2024. Diversifying revenue streams is key to survival.

- NII dependence can lead to decreased profitability.

- Changing market conditions can squeeze margins.

- Diversification and risk management are vital.

- 2024 saw NIM volatility for many institutions.

Certain high-cost services or regions with shrinking assets can be categorized as "Dogs." These areas or services experience low growth. For example, underperforming European regions and services with rising operational costs might fall into this category. Northern Trust can reallocate resources to more profitable areas.

| Category | Example | Data |

|---|---|---|

| Underperforming Regions | Europe | AUM decline in EMEA in 2023 |

| High-Cost Services | Specialized asset servicing | Operational costs up 5% in 2024 |

| Low-Adoption Products | Digital asset custody | Lower adoption than traditional products in 2024 |

Question Marks

Northern Trust's digital asset services are positioned as a question mark in its BCG Matrix. They currently hold a low market share relative to Northern Trust's established financial services. The future depends on innovation and market capture. Investment in technology and partnerships is vital for growth. In 2024, the digital asset market saw significant volatility but continued growth, with Bitcoin's price fluctuating but overall increasing by 30%.

Northern Trust's AI and machine learning efforts are emerging, with their market share currently uncertain. Their long-term competitiveness hinges on successful AI implementation. In 2024, they are investing in AI talent and infrastructure, allocating $150 million for tech advancements. This investment reflects a strategic move towards future growth.

Northern Trust's sustainable investing products could be question marks. Although interest in ESG is growing, market share may be low compared to traditional investments. Success hinges on attracting ESG-focused clients. Innovative strategies are key. In 2024, ESG assets hit $30 trillion globally.

Global Family Office Solutions

Northern Trust's Family Office Solutions, aimed at ultra-high-net-worth clients, is a rising star in its BCG matrix. Its market share is still developing, making its success uncertain. Attracting and keeping these wealthy clients is key for growth. Specialized services are crucial for family offices.

- In 2024, the family office market saw a 10% rise in assets managed.

- Northern Trust's family office division aims for a 15% client acquisition rate.

- Tailored services include investment management, estate planning, and philanthropy.

- The company competes with other major wealth managers in this space.

Expansion in Emerging Markets

Northern Trust's push into emerging markets presents both opportunities and hurdles, fitting the "Question Marks" quadrant of the BCG Matrix. This strategy involves facing regulatory complexities and increased competition within these dynamic economies. Success hinges on Northern Trust's ability to adapt and establish a solid market presence. Investing in local talent and forming strategic alliances are crucial for navigating these challenges.

- Emerging markets offer high growth potential but come with higher risks.

- Regulatory hurdles and competition can hinder expansion efforts.

- Local partnerships and expertise are key to success in these markets.

- The long-term success depends on strategic adaptability and market presence.

Northern Trust views its digital asset services as question marks, due to low market share against established services. Success depends on innovation, technology investment, and partnerships. Bitcoin increased by 30% in 2024 despite volatility.

AI and machine learning efforts are also in the question mark phase. Their competitiveness relies on successful AI implementation. They invested $150 million in tech in 2024.

Sustainable investing products are likewise considered question marks. Attracting ESG-focused clients is key. In 2024, ESG assets reached $30 trillion worldwide.

The push into emerging markets presents both chances and difficulties, fitting the "Question Marks" quadrant. Regulatory complexities and increased competition are involved. Strategic adaptability and local alliances are essential.

| Category | Details |

|---|---|

| Digital Assets | Bitcoin grew by 30% in 2024 |

| AI Investment | $150 million allocated in 2024 |

| ESG Assets | $30 trillion globally in 2024 |

| Family Office Market | 10% asset rise in 2024 |

BCG Matrix Data Sources

The Northern Trust BCG Matrix utilizes comprehensive data: financial reports, market analysis, and expert evaluations, ensuring strategic insights.