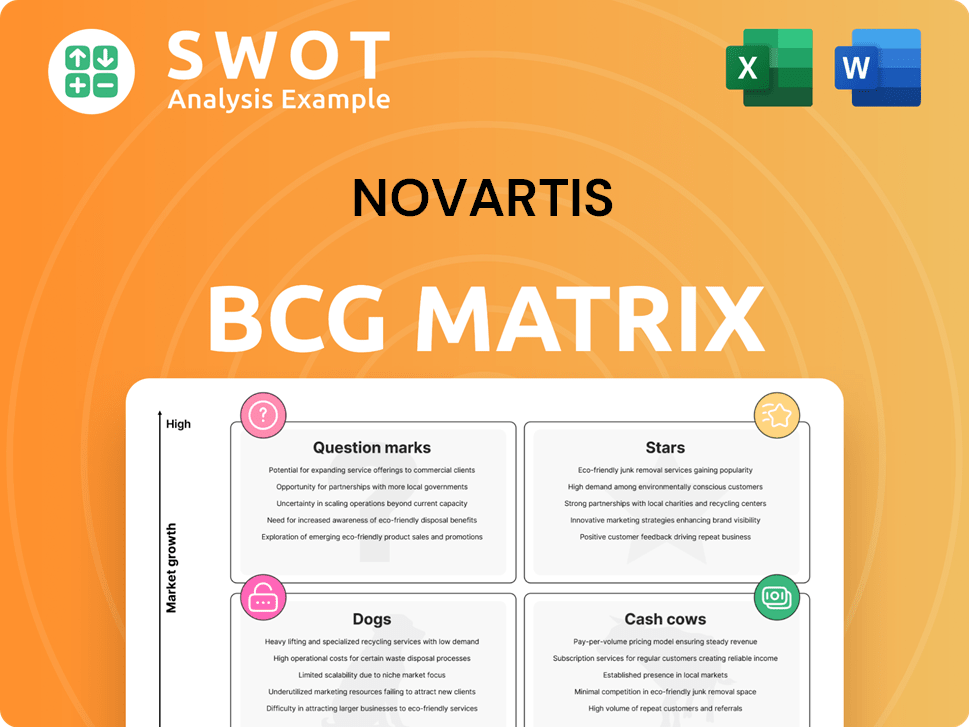

Novartis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Novartis Bundle

What is included in the product

Novartis BCG Matrix analysis: tailored insights for their diverse product portfolio, highlighting investment, hold, and divest decisions.

Clean, distraction-free view optimized for C-level presentation, offering key insights.

Delivered as Shown

Novartis BCG Matrix

The displayed Novartis BCG Matrix preview is identical to the purchased document. You'll receive the complete, ready-to-use report, professionally designed for strategic assessment.

BCG Matrix Template

Novartis’s BCG Matrix offers a snapshot of its diverse pharmaceutical portfolio. We see products categorized into Stars, Cash Cows, Question Marks, and Dogs. This helps identify growth potential & resource allocation needs. Understanding these placements is key to strategic decision-making. Analyzing each quadrant is critical for long-term success. Purchase the full BCG Matrix for detailed insights & data-driven recommendations.

Stars

Novartis' oncology products are a standout in its portfolio, with Kisqali and Pluvicto leading the charge. These drugs are market leaders, contributing significantly to revenue. Pluvicto's recent FDA approval for earlier use is a game-changer. In 2023, Novartis' oncology sales reached $16.6 billion, showing strong growth.

Cosentyx is a leading immunology product for Novartis, showing robust growth with expanded uses. Its impressive clinical results and easy dosing have solidified its market position. In 2024, Cosentyx sales reached $4.8 billion, a 9% increase. Further investment in new forms and applications will help it remain a star.

Kesimpta, a key drug in Novartis's neuroscience portfolio, is a star performer. It's a leading multiple sclerosis treatment. In 2024, Kesimpta sales continued to surge. This growth highlights its strong market position and effectiveness. As the neuroscience market expands, Kesimpta is poised to stay a top asset.

Radioligand Therapy (RLT) Platform

Novartis' Radioligand Therapy (RLT) platform is a cornerstone of its growth strategy, holding a unique position in the pharmaceutical industry. Novartis is the only entity with a dedicated commercial RLT portfolio, showcasing its global expertise. This platform, featuring Pluvicto and Lutathera, is a key driver for Novartis.

- In 2024, Pluvicto generated $1.19 billion in sales.

- Novartis is investing in expanding RLT manufacturing.

- Lutathera sales were $633 million in 2024.

Geographic Expansion

Novartis's geographic expansion is crucial for its star performance. China and Japan are key growth drivers. This expansion leverages local market dynamics and regulatory changes. Emerging markets are vital to sustain star status.

- In 2024, Novartis saw significant revenue growth in China, with sales increasing by over 10%.

- Japan's market also contributed strongly, with a 7% revenue increase in the same period.

- Emerging markets collectively account for over 20% of Novartis's total revenue.

Novartis' stars include oncology (Kisqali, Pluvicto), immunology (Cosentyx), and neuroscience (Kesimpta). These are market leaders driving significant revenue growth, with sales in 2024 showing robust performance.

| Star Product | 2024 Sales (USD billions) | Key Features |

|---|---|---|

| Kisqali | $2.2 | Oncology, strong revenue |

| Cosentyx | $4.8 | Immunology, 9% growth |

| Kesimpta | $2.9 | Neuroscience, Multiple Sclerosis |

Cash Cows

Novartis' established pharmaceutical brands, like certain immunology and neuroscience drugs, are cash cows, consistently generating significant revenue. These products, already approved and marketed, require less investment, offering a stable income stream. In 2024, these brands contributed significantly to Novartis' overall revenue, demonstrating their sustained profitability. Efficient brand management is key to maintaining this cash flow.

Cosentyx, a key asset for Novartis, remains a strong cash cow in the immunology market. In 2024, Cosentyx sales are projected to reach approximately $6 billion. Novartis is investing in new formulations and exploring additional indications to ensure its continued growth. This strategic focus aims to solidify Cosentyx's position as a reliable revenue generator. These efforts are crucial for maintaining its cash cow status.

Entresto, a top cardiovascular drug, remains a cash cow for Novartis. In 2024, it brought in billions in revenue, solidifying its position. Despite generic competition looming, its brand strength supports continued cash flow. Novartis must actively manage its lifecycle to counter generic impacts. Entresto's 2024 sales were over $6 billion.

Operational Efficiency

Novartis's operational efficiency is key to its cash cow status. The company focuses on streamlining operations and managing costs. This approach boosts profitability and cash flow. Maintaining this efficiency is crucial for a strong financial position. In 2023, Novartis reported core operating income of $17.1 billion.

- Cost-cutting initiatives enhance profitability.

- Streamlined processes improve cash flow.

- Operational excellence drives financial strength.

- Focus on efficiency is a strategic priority.

Strategic Partnerships

Novartis strategically partners to boost its portfolio and market presence. These collaborations open doors to new tech and markets, boosting revenue. For example, in 2024, Novartis partnered with Alnylam for cardiovascular disease treatments. Key partnerships are vital for long-term success and cash flow.

- 2024 partnership with Alnylam.

- Enhances product offerings.

- Drives revenue growth.

- Expands market reach.

Cash cows, like Cosentyx and Entresto, fueled Novartis's 2024 financials. These established drugs generate substantial revenue with lower investment needs, ensuring profitability. Novartis focused on brand management and operational efficiency to maximize cash flow. Strategic partnerships further bolstered its market presence in 2024.

| Drug | 2024 Projected Sales | Status |

|---|---|---|

| Cosentyx | ~$6B | Cash Cow |

| Entresto | >$6B | Cash Cow |

| Operational Income (2023) | $17.1B | Overall |

Dogs

Gilenya, once a key neuroscience product for Novartis, now faces challenges. Sales have decreased due to generic competition, impacting its market share. In 2024, Gilenya's sales were approximately $300 million, a significant drop. This decline positions Gilenya as a 'dog' in the BCG matrix. Strategic options might include divestiture or focusing on niche markets.

Lucentis, a Novartis product, faces declining sales, signaling a shrinking market share. This mature product experiences stiff competition, classifying it as a 'dog' in the BCG matrix. In 2023, Lucentis's sales were significantly impacted. Novartis might re-evaluate its investment, considering strategic shifts. The product's growth potential appears limited amid market dynamics.

The Exforge Group, part of Novartis's portfolio, has experienced minimal growth in the competitive cardiovascular market. Its potential for future expansion is limited. As a 'dog' in the BCG Matrix, strategic adjustments like divestiture may be considered. In 2024, Novartis faced challenges in this segment, with sales figures reflecting the tough competition.

Galvus Group

The Galvus Group, under Novartis, faces declining sales, signaling shrinking market share and limited growth. This product's maturity and rising competition categorize it as a 'dog' in the BCG Matrix. Novartis might reassess its investment, exploring other strategic moves. In 2024, Galvus sales saw a decrease.

- Sales Decline

- Market Share Loss

- Mature Product

- Limited Growth

Diovan Group

The Diovan Group, part of Novartis's BCG Matrix, is categorized as a 'dog' due to minimal growth and heightened competition in the cardiovascular market. The group's future expansion potential is limited. Strategic actions like divestiture or repositioning might be necessary to optimize resource allocation. For instance, the global cardiovascular drugs market was valued at approximately $100 billion in 2024, with limited growth for older drugs like Diovan.

- Market competition is intense.

- Growth prospects are constrained.

- Resource reallocation is a potential strategy.

- Divestiture might be considered.

Several Novartis products are classified as "dogs" in the BCG Matrix due to declining sales, shrinking market share, and limited growth potential. Gilenya, with sales around $300 million in 2024, faces generic competition. Other "dogs" include Lucentis, the Exforge Group, Galvus Group, and Diovan Group.

| Product | 2024 Sales (Approx.) | Status |

|---|---|---|

| Gilenya | $300M | Dog |

| Lucentis | Declining | Dog |

| Exforge Group | Minimal Growth | Dog |

| Galvus Group | Decreasing | Dog |

| Diovan Group | Limited Growth | Dog |

Question Marks

Remibrutinib, an oral BTK inhibitor, is a question mark in Novartis' BCG Matrix. Currently in Phase III trials for multiple sclerosis and chronic urticaria, its market share is uncertain. Successful trials could boost it significantly. As of 2024, Novartis' R&D spending is around $10 billion, indicating investment in drugs like remibrutinib.

Pelacarsen, a drug targeting Lp(a), is a question mark in Novartis's BCG matrix. Partnered with Akcea, its success hinges on cardiovascular outcomes trials. Peak sales could reach multi-billion dollars, but positive trial results are vital. Regulatory approval is crucial for pelacarsen to move from a question mark to a star. In 2024, the cardiovascular drugs market was valued at approximately $120 billion.

OAV101 IT, a follow-up to Zolgensma, targets spinal muscular atrophy (SMA) with easier administration. As a gene therapy, it faces market uncertainty, classifying it as a question mark in Novartis' BCG matrix. The drug's high potential is contrasted by the need for market penetration. Pivotal trial results for OAV101 IT are anticipated in the near future, influencing its strategic placement within the portfolio.

Ianalumab

Ianalumab, an anti-BAFF-R antibody, is a question mark in Novartis's BCG matrix, primarily due to its early-stage status. It's currently undergoing trials for Sjogren's syndrome and immune thrombocytopenia (ITP). The market potential is considerable, but success hinges on upcoming trial results. Data expected in 2025 and 2026 will be crucial for determining its future.

- Phase 3 trials are ongoing, with data readouts expected in the next two years.

- The market for Sjogren's and ITP treatments is substantial, potentially leading to blockbuster sales.

- Competition includes other treatments for these conditions.

- The success of clinical trials will dictate whether ianalumab becomes a star or a dog.

Fabhalta

Fabhalta, a Novartis drug, is positioned as a "Question Mark" in the BCG Matrix, indicating high market growth potential but uncertain market share. It demonstrates promising results in treating paroxysmal nocturnal hemoglobinuria (PNH), a rare blood disorder. Projected peak annual sales figures are anticipated, but the actual market capture remains a key unknown. Successful commercialization and sustained investment are crucial for Fabhalta to transition into a "Star."

- Fabhalta treats paroxysmal nocturnal hemoglobinuria (PNH).

- High growth potential but uncertain market share.

- Projected peak annual sales are anticipated.

- Commercial success is key for "Star" status.

Ianalumab's future hinges on trial results for Sjogren's and ITP.

The market for these treatments is significant, and competition is present. Data due in 2025-2026 will determine its success.

If successful, ianalumab could become a star drug.

| Aspect | Details |

|---|---|

| Target Diseases | Sjogren's syndrome, ITP |

| Status | Early-stage trials |

| Market Potential | Substantial |

| Data Timeline | 2025-2026 |

BCG Matrix Data Sources

The Novartis BCG Matrix uses financial statements, market reports, competitive analysis, and expert evaluations for strategic accuracy.