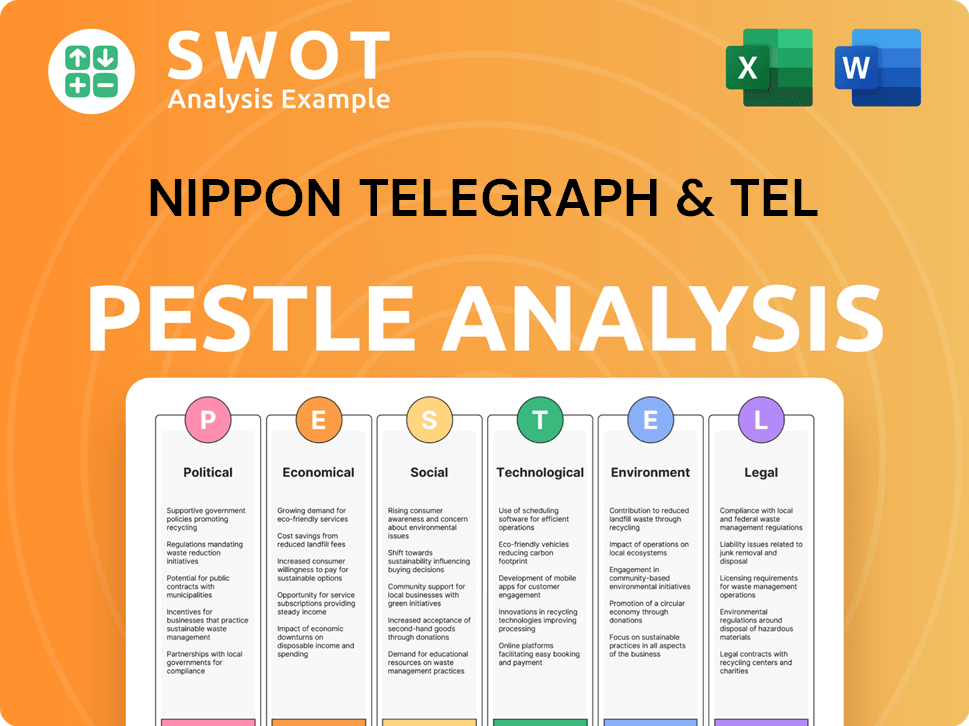

Nippon Telegraph & Tel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nippon Telegraph & Tel Bundle

What is included in the product

This PESTLE analysis examines how macro factors impact Nippon Telegraph & Tel's strategy and performance across various domains.

Helps support discussions on external risk during planning sessions.

Full Version Awaits

Nippon Telegraph & Tel PESTLE Analysis

This NTT PESTLE analysis preview shows the complete report. The document structure and content are exactly as shown.

See the final version before purchase—it's fully formatted.

What you preview is the exact downloadable file.

No tricks! After purchase, this is what you get immediately.

PESTLE Analysis Template

Navigate Nippon Telegraph & Tel's future with our PESTLE Analysis. We break down the political climate, economic factors, social trends, technological advancements, legal landscape, and environmental concerns impacting their business. Uncover key opportunities and threats shaping their strategies and gain insights for your market analysis. Download the full analysis and equip yourself with actionable intelligence for strategic decision-making.

Political factors

NTT navigates stringent government rules. Licensing, spectrum allocation, and data privacy laws directly affect its business. Policy shifts significantly influence NTT's strategies. The April 2024 revisions to the NTT Law aimed to boost global competitiveness. These changes can alter NTT's market position.

NTT, as a global entity, faces political instability risks across its operational regions. Geopolitical events and government shifts directly impact market dynamics and infrastructure projects.

For instance, political instability can disrupt supply chains and alter regulatory frameworks, impacting NTT's investments. A 2024 report indicated a 15% increase in geopolitical risk premiums in emerging markets.

Changes in government policies can lead to modifications in telecom regulations, potentially affecting NTT's market share and profitability. The company's Q1 2025 financial reports will likely reflect these adjustments.

Furthermore, stable political environments are crucial for long-term infrastructure investments, which are core to NTT's business model. The company's 2024 capital expenditure plans are closely tied to political stability.

Business relationships with local governments and partners are also vulnerable to political changes, requiring NTT to adapt its strategies to maintain operational continuity.

The Japanese government's substantial ownership in Nippon Telegraph & Tel (NTT) is a key political factor. As of early 2024, the government maintained a significant stake, influencing NTT's strategic choices. This ownership gives NTT access to government support, but also subjects it to potential regulatory constraints. For example, government policies impacted NTT's restructuring efforts in 2024, according to recent financial reports.

International Trade and Investment Policies

NTT's extensive global operations make it highly sensitive to international trade and investment policies. Alterations in tariffs, trade barriers, and foreign investment regulations directly affect its international growth prospects. For example, the US-China trade tensions in 2024-2025 could indirectly influence NTT's supply chains and market access in both regions. These shifts can impact NTT's profitability and strategic partnerships worldwide.

- US-China trade tensions could disrupt supply chains.

- Tariffs and trade barriers can increase operational costs.

- Foreign investment restrictions might limit market access.

- International collaborations could be affected.

Cybersecurity as a National Security Concern

Cybersecurity is a major national security concern, leading governments to strengthen regulations. NTT, as a key telecom provider, faces increased requirements for cybersecurity. This impacts NTT's investments and daily operations, as they must comply with evolving standards. The global cybersecurity market is projected to reach $345.4 billion by 2025.

- Cybersecurity spending is expected to grow annually.

- NTT must adapt to stricter compliance measures.

- Increased investment in security infrastructure is necessary.

- Regulations directly affect NTT's operational strategies.

Nippon Telegraph & Tel (NTT) operates under significant government influence due to government ownership and stringent regulations. Political instability and geopolitical events present risks to NTT's global operations and investments, with emerging markets showing a 15% rise in geopolitical risk premiums as of early 2024. Cybersecurity regulations are a crucial factor.

| Political Factor | Impact on NTT | Data Point (2024/2025) |

|---|---|---|

| Government Ownership | Influences strategic choices, regulatory constraints. | Govt. held a significant stake. |

| Political Instability | Disrupts supply chains, impacts infrastructure projects. | Geopolitical risk premiums in emerging markets up 15%. |

| Cybersecurity Regulations | Increases compliance costs and operational adjustments. | Global cybersecurity market projected to reach $345.4B by 2025. |

Economic factors

NTT's financial health is intricately tied to global economic conditions. Economic expansions in key markets, like the Asia-Pacific region, where NTT has a strong presence, boost demand for its services. Conversely, economic downturns can reduce investment in infrastructure and negatively affect NTT's profitability. For instance, in fiscal year 2024, NTT's consolidated revenue reached ¥14.9 trillion, demonstrating its sensitivity to global financial trends.

Inflation poses challenges for NTT, potentially increasing operational expenses like energy and equipment costs. In 2024, Japan's inflation rate hovered around 2-3%, impacting NTT's cost structure. Interest rate fluctuations also influence NTT, affecting borrowing costs for network expansion and tech investments. Japan's interest rates have been historically low, but any increases could impact NTT's financial planning. As of late 2024, the Bank of Japan maintained its monetary policy, but future shifts could affect NTT's investment strategies.

NTT faces currency exchange rate risks due to its global operations. Fluctuations impact the Yen value of international revenues and costs. For instance, a stronger Yen reduces the value of foreign earnings. In 2024, the USD/JPY rate varied significantly, affecting NTT's financial results.

Competition in the Telecommunications Market

The telecommunications market is fiercely competitive, with numerous providers vying for customer attention. This intense competition forces NTT to carefully manage its pricing strategies. In 2024, the average revenue per user (ARPU) in Japan's mobile market was around ¥4,300, reflecting pricing pressures. NTT's ability to maintain its market share depends on its ability to offer competitive services.

- Market share is a key metric, and it's crucial for NTT to maintain its leading position.

- Profitability can be affected by pricing competition and the need for continuous investment.

- NTT needs to focus on innovation to differentiate itself from competitors.

Investment in New Technologies

NTT's business model heavily relies on investing in cutting-edge technologies such as 5G, 6G, and IOWN. Economic conditions directly impact the scale and speed of these investments. For instance, a strong economy can facilitate larger investments, while a downturn might necessitate budget adjustments. NTT's capital expenditures in fiscal year 2024 amounted to approximately ¥2.5 trillion. This includes investments in network infrastructure and research & development.

- NTT's 5G investments are crucial for network expansion and service upgrades.

- 6G research is ongoing, with potential impacts on future infrastructure spending.

- IOWN's development requires significant financial commitment over several years.

Economic expansions boost demand, while downturns reduce investment. In 2024, NTT's revenue reached ¥14.9 trillion, sensitive to global trends. Inflation (2-3% in Japan, 2024) and interest rates impact costs, investments. Currency fluctuations, like USD/JPY rate variations in 2024, also affect financial results.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| GDP Growth | Influences service demand & investments | Japan: est. 1.0% (2024), Asia-Pac: varied |

| Inflation | Affects operational costs, pricing | Japan: 2-3% (2024) |

| Interest Rates | Impacts borrowing & investment costs | BOJ policy: ongoing, potential shifts |

Sociological factors

Shifting consumer habits, such as the rising need for mobile data and high-speed internet, directly shape NTT's services and strategies. Digital and real-world lifestyles are increasingly intertwined, impacting service design. In 2024, mobile data consumption surged, reflecting this trend, with average monthly usage per user growing by 15% in Japan. NTT's focus has subsequently shifted to meet these evolving demands, ensuring relevance.

Japan's rapidly aging population presents both challenges and opportunities for NTT. The shrinking and aging domestic customer base could lead to decreased demand for traditional telecom services. To address this, NTT might need to focus on services tailored to the elderly, such as remote healthcare solutions or simplified communication tools. This demographic shift necessitates workforce adaptations and strategic initiatives. For instance, in 2024, nearly 30% of Japan's population was aged 65 or older, highlighting the urgency for NTT to adapt its business models.

The digital divide affects NTT through policy and public expectations. In Japan, 93.7% of households had internet access in 2024. NTT's goal is a prosperous future for all. They must address the digital divide to ensure inclusive access. This involves providing affordable, reliable internet services across Japan.

Workforce Diversity and Inclusion

Societal focus on diversity, equity, and inclusion (DEI) significantly shapes NTT's human resources and corporate culture. NTT DATA Business Solutions has established sustainability goals that incorporate DEI principles. In 2024, NTT aimed to increase the representation of women in management roles. This commitment aligns with broader industry trends, as companies increasingly prioritize diverse workforces.

- NTT aims for 30% female representation in management by 2030.

- NTT DATA Business Solutions has a DEI strategy focused on employee development and inclusive leadership.

- In 2023, NTT invested $100 million in DEI initiatives.

Social Acceptance of New Technologies

Societal acceptance is crucial for the success of new technologies such as AI and human enhancements. Addressing public concerns about job displacement, the need for new skills, and privacy is essential. A 2024 study showed that 60% of people worry about AI impacting their jobs. Furthermore, 70% of Japanese adults believe data privacy is very important.

- Job displacement concerns need proactive solutions like retraining programs.

- Addressing privacy issues will build trust and encourage technology adoption.

- Public education is vital to understanding and accepting new technologies.

Societal trends profoundly impact NTT. DEI initiatives are vital, with NTT targeting 30% female management representation by 2030. Public trust in AI and data privacy are critical; 60% fear AI job impacts. Affordable internet access remains essential to bridge the digital divide.

| Initiative | Impact | 2024 Data |

|---|---|---|

| DEI Goals | Enhance Workplace Diversity | $100M investment in DEI |

| AI Acceptance | Manage Public Concerns | 60% worry about AI job impacts |

| Digital Divide | Ensure Inclusive Access | 93.7% households with internet |

Technological factors

Nippon Telegraph & Telephone (NTT) heavily relies on advancements in network technology. 5G and the development of 6G are critical for faster and more efficient services. The All-Photonics Network (APN), part of NTT's IOWN concept, aims for significant improvements. These innovations drive NTT's goal of enhanced connectivity and reduced energy use. NTT invested ¥1.4 trillion in R&D in FY2024.

The telecommunications sector is undergoing a transformation driven by AI. NTT's focus on AI is evident through the development of its lightweight AI model, 'tsuzumi', which enhances service delivery and network management. The global AI market is projected to reach $1.81 trillion by 2030. This includes using AI for cybersecurity, a critical area for NTT.

Cybersecurity threats are evolving rapidly, demanding constant innovation in protection. NTT's proficiency is vital for safeguarding its infrastructure and client services. In 2024, global cybersecurity spending is projected to reach $214 billion, a 14% increase. NTT invests heavily in advanced security measures to stay ahead of these threats.

Cloud Computing and Data Centers

Cloud computing's rise boosts data center needs, a market NTT excels in. NTT's data center revenue reached ¥898.8 billion in FY2023. The global data center market is projected to hit $517.1 billion by 2030. NTT continues expanding its data center footprint worldwide to meet escalating digital demands.

- NTT's data center revenue grew, showcasing market strength.

- Global data center market's significant growth implies opportunities.

- NTT's expansion aligns with growing cloud computing trends.

Photonics-Electronics Convergence Technology

Nippon Telegraph & Telephone (NTT) is deeply involved in photonics-electronics convergence, central to its "IOWN" vision. This technology aims to drastically cut power use and boost computing capabilities. NTT's commitment includes substantial investments in research and development. For example, NTT's R&D spending in fiscal year 2024 was approximately ¥400 billion, with a significant portion allocated to advanced technologies like photonics.

- NTT aims for a 100x improvement in power efficiency with IOWN.

- Photonics-electronics convergence is key to achieving this goal.

- NTT plans to deploy IOWN infrastructure by 2030.

Technological advancements like 5G and 6G are crucial for NTT's service upgrades. AI integration, highlighted by models like 'tsuzumi', boosts service efficiency and cybersecurity efforts. NTT's R&D spending was ¥1.4 trillion in FY2024, supporting its technological leadership.

| Technology Area | Key Focus | Impact |

|---|---|---|

| 5G/6G Networks | Faster data speeds | Enhanced connectivity |

| Artificial Intelligence | Service Delivery | Improved efficiency |

| R&D Investment FY2024 | ¥1.4 trillion | Innovation & security |

Legal factors

NTT’s global operations face regulations like the Telecommunications Business Act. These laws affect market access and service provisions. Regulatory shifts can alter interconnection agreements and operational costs. For example, in 2024, Japan saw updates to telecom regulations impacting NTT's domestic strategies. Recent legal changes necessitate careful adaptation by NTT to maintain compliance and competitiveness.

Data privacy laws like GDPR are crucial. NTT must follow strict data rules globally. Compliance costs impact operational budgets significantly. Failure leads to hefty fines; consider penalties from 2024-2025. Staying compliant is essential for business continuity and reputation.

NTT faces antitrust scrutiny due to its strong presence in Japan and global ambitions. The company's market share in Japan's fixed-line services was approximately 47% in 2024. Overseas, NTT's acquisitions, like Dimension Data, have drawn regulatory attention.

Supply Chain Due Diligence Laws

Nippon Telegraph & Telephone (NTT) must navigate supply chain due diligence laws. These laws, like the German Supply Chain Due Diligence Act, mandate risk assessments for human rights and environmental issues within their supply chains. This affects NTT's vendor selection and ongoing relationships. For example, in 2024, over 1,000 German companies were assessed under this law.

- Compliance requires significant investment in monitoring and reporting.

- Non-compliance can lead to hefty fines and reputational damage.

- NTT must ensure its suppliers meet these stringent standards.

Intellectual Property Laws

Intellectual property (IP) laws are vital for Nippon Telegraph & Telephone (NTT). They safeguard NTT's research and development (R&D) and technological advancements. NTT heavily relies on patents, copyrights, and trademarks to protect its innovations. Effective IP protection is essential for NTT's competitive edge in the telecom industry. In 2024, NTT's R&D spending reached ¥490 billion, highlighting the importance of IP.

- Patent filings: NTT files hundreds of patents annually.

- Copyrights: Protects software and content.

- Trademarks: Brands and services protection.

- Legal frameworks: Crucial for business operations.

Legal factors greatly shape Nippon Telegraph & Telephone's (NTT) global strategy. Data privacy rules, such as GDPR, and intellectual property (IP) laws like patents, are essential for protecting NTT’s tech and customer info. Antitrust scrutiny, particularly in Japan, affects NTT's market dominance. In 2024, global data protection fines exceeded $10 billion, underscoring compliance urgency.

| Legal Aspect | Impact on NTT | Recent Data/Example (2024-2025) |

|---|---|---|

| Telecommunications Regulations | Affects market access, operations, costs | Japan's telecom regulation updates. |

| Data Privacy Laws | Compliance, costs, fines, reputation | Global data protection fines > $10B. |

| Antitrust Scrutiny | Market share & acquisitions challenges | NTT's ~47% market share in Japan. |

Environmental factors

Climate change is a key environmental challenge. NTT aims for carbon neutrality. The company is pushing for net-zero emissions across all its activities and supply chain. In 2023, NTT invested ¥300 billion in green initiatives. They aim to reduce emissions by 80% by 2030.

The telecommunications sector, including NTT's data centers, is a major energy user. NTT actively works on energy efficiency through programs like the TPR Campaign. In 2024, NTT aimed to reduce its carbon footprint. NTT's IOWN concept also focuses on energy-efficient technologies, supporting sustainability goals.

NTT is actively increasing its renewable energy use, crucial for cutting its carbon footprint. The company is investing heavily in renewable energy projects. In 2024, NTT aimed for 30% renewable energy use. This aligns with its goal to power facilities with renewables, aiming for 50% by 2030.

Waste Management and Circular Economy

NTT is focusing on waste management and circular economy to reduce its environmental impact. This involves designing equipment for recyclability and extending product lifecycles. In 2024, NTT increased its efforts to reuse and recycle materials from retired equipment. For example, in 2024, the company recycled 95% of its e-waste. This commitment aligns with global sustainability goals.

- 95% of e-waste recycled in 2024.

- Focus on equipment recyclability.

- Adoption of circular economy principles.

- Efforts to extend product lifecycles.

Environmental Regulations and Reporting

Nippon Telegraph & Tel (NTT) must adhere to environmental regulations and reporting standards in all its operational countries. This includes managing waste, reducing emissions, and ensuring sustainable resource use. NTT's commitment to environmental responsibility is crucial for maintaining its reputation and operational licenses. The company's environmental performance data is often disclosed in its annual reports.

- NTT has set goals to reduce its greenhouse gas emissions by 80% by fiscal year 2030 compared to fiscal year 2013 levels.

- NTT's environmental investments reached approximately ¥100 billion in fiscal year 2024.

NTT tackles climate change via net-zero emission targets. The company invested ¥100 billion in environmental initiatives in fiscal year 2024. They target 80% emission reduction by 2030.

Data centers' energy use spurs focus on efficiency. NTT leverages renewable energy, targeting 50% usage by 2030. Efforts in waste reduction are marked by 95% e-waste recycling in 2024.

| Initiative | Target/Goal | Fiscal Year |

|---|---|---|

| Emissions Reduction | 80% decrease | 2030 |

| Renewable Energy Use | 50% of energy | 2030 |

| Environmental Investment | ¥100 billion | 2024 |

PESTLE Analysis Data Sources

Our Nippon Telegraph & Tel PESTLE uses official gov. reports, industry publications, and financial databases.