Nucor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nucor Bundle

What is included in the product

Tailored analysis for Nucor's product portfolio. Strategic recommendations: invest, hold, or divest.

Printable summary optimized for A4 and mobile PDFs, so stakeholders can easily review and share findings.

Full Transparency, Always

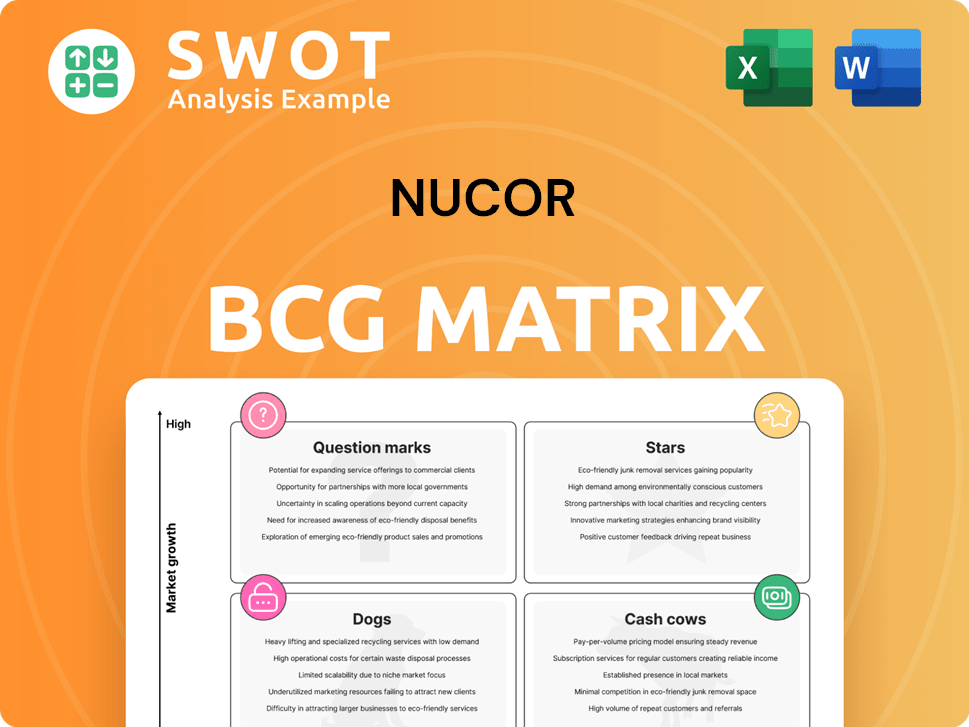

Nucor BCG Matrix

The displayed preview is identical to the Nucor BCG Matrix report you'll receive. The full, ready-to-use document includes detailed analysis and strategic insights.

BCG Matrix Template

Nucor's BCG Matrix offers a snapshot of its diverse steel product portfolio. This helps identify areas of strength & opportunity. Are their products Stars, generating high growth? Or Cash Cows, stable earners? This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Nucor's sustainable steel products, leveraging electric arc furnace (EAF) technology and recycled scrap, are a "Stars" product. This positions Nucor in a high-growth market, driven by demand for eco-friendly materials. In 2024, Nucor's steel mills operated at 80% capacity. Investing in this area can drive further market leadership.

Nucor's data center solutions, including steel components and doors, target the booming data center market. This expansion leverages acquisitions like C.H.I. and Rytec. The strategy offers integrated solutions, boosting customer value. For 2024, the data center market is projected to reach over $150 billion.

Nucor's value-added steel products, including those from Nucor Building Group and Vulcraft, are key. These products target specific needs, often yielding higher margins. In 2024, Nucor's focus increased profitability. Expanding these lines can maintain growth and market share. The value-added products accounted for 55% of sales in Q3 2024.

Strategic Acquisitions

Nucor's strategic acquisitions, including CHI Overhead Doors and Rytec, open doors to new markets and broaden its product range. These moves boost Nucor's growth by diversifying revenue and strengthening its market position. In 2024, Nucor's acquisition strategy continues. It's a key driver for expansion and market leadership.

- CHI Overhead Doors and Rytec are examples of strategic acquisitions.

- These acquisitions expand product offerings and market reach.

- Diversification of revenue streams is a key benefit.

- Acquisitions enhance Nucor's competitive advantage.

Infrastructure Development

Infrastructure development in the U.S. is booming, fueled by government spending, creating a strong need for steel. Nucor, a major North American steel producer, is perfectly placed to benefit from this. Focusing on infrastructure projects can significantly increase Nucor's growth and market share. This strategic move aligns with the company's goals.

- The Infrastructure Investment and Jobs Act allocated $1.2 trillion, boosting steel demand.

- Nucor's revenue in 2024 reached $34.1 billion.

- Nucor's steel production capacity is over 27 million tons annually.

Nucor's sustainable steel products are "Stars" in the BCG matrix due to high growth. These leverage electric arc furnace (EAF) tech and recycled scrap. In 2024, Nucor's mills ran at 80% capacity. Investing in this area enhances market leadership.

| Metric | Value |

|---|---|

| 2024 Steel Production Capacity | 27+ million tons |

| Q3 2024 Sales | $8.79B |

| 2024 Revenue | $34.1B |

Cash Cows

Nucor's bar products, like rebar and angles, are cash cows due to stable demand in construction. These products, made with 96.2% recycled content in 2024, attract eco-minded buyers. Efficient production and strong market share are key to maintaining a reliable cash flow from this segment. In 2024, Nucor's earnings per share (EPS) were $20.03.

Nucor's sheet products, vital for automotive, appliances, and construction, enjoy steady demand. Despite slower growth, high sales volumes create strong cash flow. In 2024, this segment contributed significantly to Nucor's revenue. Focusing on operational efficiency boosts profitability.

Nucor's beam products are crucial for construction, supported by infrastructure and building projects, ensuring steady demand. These products represent a reliable cash source due to their established market position and consistent sales. Focus on cost-effective production maintains profitability. In 2024, Nucor's steel mills produced 17.9 million tons of steel.

Recycling Operations

Nucor's recycling operations, a key part of its business, function as a reliable and economical source of raw materials. This vertical integration strategy boosts cost management and reduces the need for outside suppliers. Ongoing investments in recycling technologies and facilities are crucial for boosting efficiency and generating more cash. In 2024, Nucor's scrap recycling segment, under the brand name of "Nucor Recycling," processed approximately 18 million tons of ferrous and nonferrous scrap, contributing significantly to the company's revenue and profitability.

- Nucor Recycling processes around 18 million tons of scrap annually.

- Vertical integration enhances cost control and supply chain stability.

- Investments in tech improve efficiency and cash flow generation.

- Nucor's recycling segment is a major revenue contributor.

Strong Customer Relationships

Nucor's robust customer relationships are a cornerstone of its cash cow status. These enduring connections with clients across diverse sectors ensure a steady revenue flow, thanks to trust and consistent quality. Nucor's commitment to top-notch service and customized solutions further solidifies these bonds, securing ongoing cash generation. In 2024, Nucor's customer satisfaction scores remained high, reflecting the strength of these relationships.

- Customer retention rates at Nucor are consistently above industry averages, indicating strong loyalty.

- Nucor's sales to repeat customers account for a significant portion of its overall revenue.

- Investments in customer service initiatives have demonstrably improved customer satisfaction.

- Long-term supply agreements with major clients provide revenue predictability.

Nucor's cash cows, like bar, sheet, and beam products, generate steady revenue from stable demand in construction and manufacturing. These segments benefit from strong market positions, efficient production, and high customer retention rates. This ensures consistent cash flow. The Recycling division is another example of a cash cow, with 18 million tons of scrap processed annually.

| Product Segment | Key Features | 2024 Financial Data |

|---|---|---|

| Bar Products | Stable demand, recycled content | EPS: $20.03 |

| Sheet Products | High sales volume, steady demand | Significant revenue contribution |

| Beam Products | Essential for construction | 17.9 million tons of steel produced |

Dogs

Nucor's DRI facilities could struggle with volatile raw material costs and market shifts. If these facilities consistently underperform, they may be classified as dogs. Considering Nucor's strategy, they may need to divest or restructure these assets. In Q3 2024, Nucor's steel mills saw a slight margin decrease due to market fluctuations.

Nucor's "Dogs" could be facilities with low operating rates and profitability, potentially leading to impairment charges, as seen in 2024. These facilities might struggle to compete, requiring substantial investment. Considering their strategic fit and potential divestiture could be wise. For example, in 2024, Nucor recorded impairment charges related to certain facilities.

Commodity-grade steel, like standard steel products, often lands in the dogs category due to low margins and fierce competition. Nucor faces pressure from imports, impacting profitability. In 2024, steel imports were a significant factor, affecting the industry. Focusing on higher-value products boosts performance, according to recent reports.

Outdated Technologies

Outdated steelmaking methods, such as older blast furnaces, fit the "Dogs" category for Nucor. These technologies often incur higher operational expenses and struggle to compete with Nucor's more efficient electric arc furnace (EAF) approach. Upgrading or replacing these technologies is crucial for boosting efficiency and cutting environmental footprints. For instance, in 2024, blast furnaces used significantly more energy per ton of steel than EAFs.

- Outdated technologies increase operational costs.

- Blast furnaces use more energy than EAFs.

- Modernization enhances efficiency and reduces environmental impact.

- Outdated technologies struggle to compete.

Geographically Isolated Operations

Geographically isolated operations, like some Nucor facilities in remote areas, can face tough profitability hurdles. High transport costs and limited market access hinder their ability to compete effectively. Nucor's 2024 financial reports might highlight these challenges, especially in specific product lines. Reassessing these sites' strategic value is crucial, potentially leading to consolidation or closure decisions.

- Nucor's 2023 net sales were approximately $34.1 billion.

- Geographic isolation impacts supply chain efficiency and customer reach.

- High transportation costs cut into profit margins.

- Consolidation could improve operational efficiency.

Nucor's "Dogs" include underperforming facilities and outdated technologies. These face low profitability and require significant investment. In 2024, impairment charges reflected the challenges these face.

| Category | Characteristics | Impact |

|---|---|---|

| Outdated Facilities | High operational costs, low efficiency | Reduced profitability |

| Commodity Steel | Low margins, import competition | Reduced revenue |

| Geographically Isolated | High transport costs | Limited market access |

Question Marks

Nucor's new sheet mill in Mason County, West Virginia, slated for completion by late 2026, targets a growing market, requiring a substantial capital outlay. This project is a strategic move to capitalize on rising steel demand. Success hinges on effective marketing and competitive pricing strategies to capture market share. In 2024, Nucor reported revenues of $33.5 billion.

Nucor's February 2024 plan for a rebar micro mill in the Pacific Northwest aims to meet rising infrastructure demands. This venture requires operational efficiency to compete with established firms. Success depends on effective sales and customer acquisition, vital for capturing market share in the region. Data from 2024 shows a 6% increase in construction spending in the Northwest, highlighting the market opportunity.

Launched in January 2023, ElcyonTM targets the wind energy sector with sustainable steel plate products. The market for sustainable materials is expanding, with a projected global value of $372.8 billion in 2024. Success hinges on meeting industry needs and gaining acceptance. Targeted marketing and collaboration are crucial for ElcyonTM's growth.

Expansion into New Geographic Markets

Nucor's strategic moves into new geographic areas, whether through acquisitions or new projects, create both chances and risks. These expansions need substantial capital and contend with existing competitors. For example, Nucor acquired California Steel Industries in 2023. Successful ventures require detailed market evaluations and strategic alliances. In 2024, Nucor's capital expenditures are expected to be around $2.3 billion.

- Acquisition of California Steel Industries in 2023.

- Projected 2024 capital expenditures of approximately $2.3 billion.

- Need for detailed market analysis.

- Importance of strategic partnerships.

Innovative Steel Solutions

Nucor's innovative steel solutions, targeting sectors like data centers and renewable energy, are currently question marks in its BCG matrix. These ventures, while promising high growth, demand substantial R&D and market validation. Successfully navigating these challenges is crucial for transforming these innovations into high-performing stars. Nucor's strategy involves significant investment in research and development to secure early market adoption.

- Nucor's Q4 2024 earnings were reported on January 30, 2025.

- Nucor's full-year 2024 earnings were also reported on January 30, 2025.

- The company's focus on innovation is a key strategy for future growth.

Nucor's innovative projects, like those in data centers and renewable energy, currently face uncertainties, classifying them as "question marks". These ventures require significant investment in R&D to secure market acceptance. The transition from "question mark" to "star" status hinges on effective R&D and market strategy.

| Metric | 2024 Value | Notes |

|---|---|---|

| R&D Spending | $150M (estimated) | Focused on new steel solutions. |

| Target Market Growth | 15-20% (renewable energy) | Projected growth in target sectors. |

| Market Share Target | 5% within 3 years | Aggressive market penetration goals. |

BCG Matrix Data Sources

The Nucor BCG Matrix leverages financial reports, market analyses, and expert evaluations. These data points underpin strategic decisions, promoting accurate assessments.