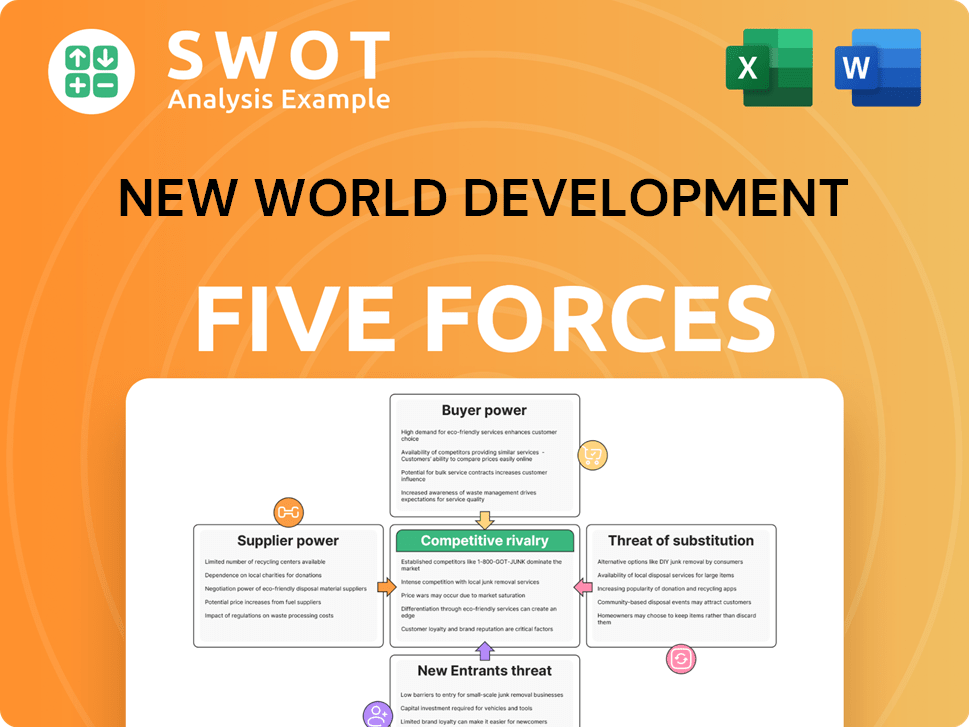

New World Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New World Development Bundle

What is included in the product

Tailored exclusively for New World Development, analyzing its position within its competitive landscape.

Customize pressure levels to reflect changing market conditions and emerging risks.

Preview Before You Purchase

New World Development Porter's Five Forces Analysis

This preview presents the complete Porter's Five Forces analysis of New World Development. You are viewing the identical document that you will download immediately after your purchase, fully accessible and ready to use.

Porter's Five Forces Analysis Template

New World Development faces moderate rivalry, intensified by market saturation. Buyer power is substantial, influenced by property price sensitivity. The threat of new entrants is relatively low due to high capital requirements and established market presence. Substitute threats are moderate, with alternative investments available. Supplier power is generally manageable.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore New World Development’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers can significantly influence New World Development (NWD). In 2024, the concentration of suppliers for essential materials like cement and steel remains a key factor in the property development sector. Limited supplier options give them leverage to set prices and terms.

If switching suppliers is costly for New World Development, suppliers gain leverage. This is especially true with long-term contracts, specialized products, or required certifications. For example, in 2024, construction materials prices fluctuated, impacting project costs and supplier relationships. This makes switching more difficult.

Fluctuations in raw material prices, like steel and cement, directly affect New World Development's project costs. Suppliers of these materials can wield substantial power, particularly if the company uses fixed-price contracts. For example, in 2024, steel prices saw a 10-15% increase due to supply chain disruptions.

Labor Market Dynamics

Labor market dynamics significantly impact New World Development. The availability and cost of skilled labor, such as construction workers and specialized engineers, influence project costs. Shortages increase the bargaining power of labor suppliers, like recruitment agencies and unions. Rising labor costs can squeeze profit margins and affect project feasibility. These factors are crucial in assessing NWD's financial outlook.

- In 2024, construction labor costs rose by 5-7% in key markets.

- Shortages in skilled engineering staff increased recruitment costs by up to 10%.

- Labor unions' influence on wage negotiations grew, impacting project budgets.

- NWD's project timelines were affected by labor availability issues.

Supplier Forward Integration

Supplier forward integration poses a significant threat to New World Development's bargaining power. If suppliers possess the resources to undertake property development or infrastructure projects, they can become direct competitors. This potential shift in the market dynamic forces New World Development to concede on pricing and terms to ensure a stable supply chain. This strategic move by suppliers can erode New World Development's profitability.

- Forward integration by suppliers could lead to a decrease in New World Development's gross profit margins.

- The threat is higher when suppliers are large and possess significant capital.

- This issue is especially critical in specialized construction materials or skilled labor.

Supplier power heavily impacts New World Development (NWD). In 2024, construction materials' price fluctuations, like a 10-15% steel increase, affected project costs. Skilled labor shortages also amplified supplier leverage, increasing recruitment expenses.

| Factor | Impact | 2024 Data |

|---|---|---|

| Material Prices | Cost Increase | Steel +10-15% |

| Labor Shortages | Increased Costs | Recruitment +10% |

| Supplier Integration | Profit Erosion | Margin Decrease |

Customers Bargaining Power

In the residential market, price sensitivity varies. Luxury buyers are often less price-sensitive than those seeking mass units. New World Development must assess demand elasticity within its segments. In 2024, Hong Kong's luxury home prices saw a 5% increase, indicating some resilience. Understanding this helps gauge buyer power.

Buyer concentration significantly impacts New World Development's bargaining power. If a few major clients, like government entities or large commercial tenants, account for a large revenue share, their influence rises. This allows these key buyers to negotiate favorable prices and terms. For instance, major infrastructure projects, which could represent a substantial portion of the HK$50 billion revenue in 2024, could be subject to intense price negotiations.

The availability of substitute properties significantly affects customer bargaining power. If numerous comparable housing, commercial, or infrastructure options exist, buyers gain leverage. In 2024, Hong Kong's property market saw fluctuations; the abundance of choices influenced deal-making. For instance, in Q3 2024, the average transaction price for residential properties saw a 3% drop, reflecting customer negotiation strength.

Access to Information

Buyers' access to information significantly influences their bargaining power. Property values, construction expenses, and market trends are readily available, enhancing their negotiation leverage. Online platforms and real estate agencies provide comparative data, enabling informed choices. This data-driven approach strengthens buyers' positions in transactions.

- The Real Estate Market in Hong Kong: The total value of domestic property transactions in 2024 reached approximately HK$340 billion.

- Online Data Availability: Over 90% of Hong Kong's population uses the internet, with widespread access to property listings and market analysis tools.

- Market Trends: In 2024, property prices experienced a decrease of about 5-10% in certain areas of Hong Kong, influenced by economic uncertainty and interest rate hikes.

- Construction Costs: The average construction cost per square foot for residential buildings in Hong Kong was around HK$4,000-HK$5,000 in 2024.

Switching Costs for Buyers

Switching costs for property buyers are typically high because of the substantial financial commitment. Commercial tenants, however, may face lower relocation costs, thereby increasing their bargaining power. Lower switching costs enable buyers to switch to rival properties if the terms are not advantageous. This dynamic underscores the importance of offering competitive terms to retain customers. In 2024, New World Development's revenue reached HK$46.2 billion, showing the impact of customer power.

- High investment levels create high switching costs for residential buyers.

- Commercial tenants have more flexibility with lower switching costs.

- Low switching costs increase buyer power.

- Competitive terms are crucial to retain customers.

Customer bargaining power varies with market segments; luxury buyers show less price sensitivity than those seeking mass units.

Concentration of buyers, like government or large commercial tenants, boosts their influence, affecting pricing.

Substitutes, readily available market data, and lower switching costs enhance customer negotiation strength, as seen in 2024 property trends.

| Factor | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | Luxury vs. Mass | Luxury home price increase: 5% |

| Buyer Concentration | Negotiating Power | HK$50B infrastructure projects |

| Substitutes | Negotiating Power | Q3 avg. price drop: 3% |

Rivalry Among Competitors

The property development and infrastructure sectors in Hong Kong and mainland China are highly competitive. Established firms and new entrants fiercely compete. Market concentration, though present, fuels aggressive pricing and marketing. In 2024, New World Development faced rivals like Sun Hung Kai Properties and Henderson Land Development.

A slower industry growth rate intensifies competition. If the Hong Kong property market slows, New World Development faces pressure to secure projects and maintain profitability, intensifying rivalry. In 2024, Hong Kong's property market saw a decline in sales volume, increasing competition. This environment forces companies to compete more aggressively.

Product differentiation, like New World Development's focus on unique designs and high-quality construction, can reduce competitive rivalry. The 'Artisanal Movement' and cultural-retail landmarks set them apart. In 2024, New World Development's revenue reached HK$47.5 billion, showing the impact of their differentiation strategy. This strategy helps them compete effectively in the market.

Exit Barriers

High exit barriers, common in New World Development's sectors like property and infrastructure, intensify competition. Long-term land leases and significant sunk costs make it difficult for underperforming firms to leave, sustaining market presence. This leads to increased rivalry, especially in infrastructure projects with lengthy concession periods. For example, in 2024, the real estate market faced challenges, but companies with large asset bases like New World Development were less likely to exit.

- Land leases often span decades, tying companies to projects.

- Sunk costs, such as initial investments in infrastructure, cannot be recovered.

- Extended concession periods in infrastructure lock firms into the market.

- These factors increase competitive pressure among existing players.

Competitive Pricing

Competitive rivalry significantly impacts New World Development, particularly through pricing strategies in the mass residential market. Price wars can occur, pressuring profit margins. For example, in 2024, Hong Kong's property prices saw varied adjustments, with some developers offering discounts to attract buyers. This necessitates efficient cost management and the provision of value-added services to justify premium pricing.

- Discounts and promotions are common tactics to stay competitive.

- Efficient cost management is critical for maintaining profitability.

- Value-added services can differentiate properties.

- Market dynamics continuously influence pricing decisions.

Competitive rivalry is intense for New World Development. The market is characterized by aggressive pricing. In 2024, New World Development's revenue reached HK$47.5 billion, amidst a challenging market.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Wars | Pressure on margins | Discounts on property were common |

| Differentiation | Competitive Advantage | 'Artisanal Movement' |

| Exit Barriers | Sustained Competition | Long-term land leases |

SSubstitutes Threaten

In the residential market, renting is a substitute for homeownership, and its attractiveness is influenced by economic conditions. High interest rates in 2024, around 5-7% in Hong Kong, make buying less appealing, potentially boosting rental demand. Government policies, like those affecting property taxes, also sway the choice between renting and buying, impacting New World Development's sales. This dynamic highlights the importance of understanding these factors for forecasting demand for their properties.

For investors, real estate competes with stocks, bonds, and funds. The appeal of these alternatives shifts with market trends and investor feelings, impacting property investment demand. In 2024, the S&P 500 saw a 24% rise, potentially drawing funds away from real estate. Bond yields also influence investor choices.

The shift to telecommuting presents a notable threat to New World Development. As of Q4 2024, approximately 30% of the workforce in developed economies work remotely at least part-time. This trend directly impacts demand for commercial office spaces. If remote work continues to rise, it could diminish the need for traditional office rentals, posing a risk to New World Development's commercial property investments.

Government Policies

Government policies pose a threat by fostering substitutes for New World Development's projects. Policies encouraging affordable housing or new construction methods, like modular construction, could shift demand. This shift could come from policies supporting co-living or prefabricated housing, potentially reducing demand for conventional developments. In 2024, government spending on affordable housing projects in Hong Kong reached HK$20 billion. These initiatives directly compete with traditional developments.

- Government subsidies for alternative housing.

- Regulations favoring sustainable construction.

- Tax incentives for co-living spaces.

- Land use policies promoting high-density housing.

Infrastructure Alternatives

For New World Development, infrastructure alternatives pose a notable threat. These alternatives include enhanced public transportation systems and decentralized utilities. If the government prioritizes public transit, the demand for new road projects could decline. This shift could impact New World Development's investments in infrastructure. For example, Hong Kong's government plans to spend HK$100 billion on public transport improvements by 2025.

- Public transportation investments directly compete with road infrastructure.

- Decentralized utilities offer an alternative to traditional infrastructure projects.

- Government policies significantly influence the viability of infrastructure projects.

- New World Development must adapt to shifting government priorities and alternative solutions.

Substitutes like renting and stocks influence demand. High interest rates (5-7% in HK in 2024) boosted rental demand. Remote work, with 30% of developed economy workforce, lowers office space demand. Gov't policies & infrastructure investments create alternatives too.

| Substitute Type | Impact | 2024 Data |

|---|---|---|

| Rental vs. Homeownership | Affects property sales | HK interest rates 5-7% |

| Real Estate vs. Stocks | Influences investment | S&P 500 up 24% |

| Telecommuting | Reduces office demand | 30% remote work |

Entrants Threaten

The property and infrastructure sectors demand substantial capital, setting a high entry barrier. New entrants face hefty costs for land acquisition, construction, and permits. In 2024, New World Development reported significant capital expenditures, underscoring the financial commitment required. This can deter smaller firms. High capital needs limit the number of potential competitors.

New World Development faces threats from new entrants due to regulatory hurdles. Stringent requirements and lengthy approval processes in Hong Kong and mainland China deter new players. Zoning laws and environmental regulations add complexity. Building codes also make market entry difficult. In 2024, the construction industry in Hong Kong saw a 5% decrease in new projects, reflecting these challenges.

New World Development (NWD) has a solid brand reputation, fostering customer trust and loyalty. This established presence gives NWD a significant advantage over newcomers. Constructing such a brand takes substantial time and resources, acting as a barrier. In 2024, NWD's brand value remained a key asset in a competitive market.

Access to Land

Securing prime land is vital for real estate success. New entrants face challenges competing with established developers like New World Development, which often have strong ties with landowners and government entities. These relationships can lead to preferential treatment in land acquisition. For example, in 2024, New World Development secured several key land parcels through government tenders. This makes it harder for new players to enter the market.

- Established developers often have advantages.

- Relationships influence land acquisition.

- New entrants face significant hurdles.

- Competitive disadvantage.

Economies of Scale

Economies of scale pose a significant barrier for new entrants in New World Development's market. Established companies like New World Development benefit from economies of scale in construction, procurement, and marketing, lowering their overall costs. Their large-scale projects enable them to negotiate advantageous deals with suppliers and spread fixed costs, giving them a cost advantage. This advantage makes it difficult for new companies to compete on price and profitability.

- New World Development's revenue in 2023 was approximately HK$53.1 billion.

- The company's cost of sales was about HK$27.2 billion in 2023, reflecting economies of scale in construction.

- In 2023, New World Development spent approximately HK$1.5 billion on advertising and promotion.

- New entrants often struggle to match the established cost structures of large players like New World Development.

The property market requires significant capital, with high entry barriers. Regulatory hurdles and lengthy approvals in Hong Kong and mainland China also deter new players. NWD's strong brand and economies of scale further protect against new entrants.

| Aspect | Details | 2024 Data Points |

|---|---|---|

| Capital Costs | Land acquisition, construction | HK$5 billion in capital expenditure |

| Regulatory Hurdles | Approvals, permits | Construction project decrease by 5% |

| Brand Reputation | Customer trust | NWD's brand value sustained |

Porter's Five Forces Analysis Data Sources

The analysis uses data from company filings, market research reports, and competitor analyses to inform its Porter's Five Forces framework.