NWS Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NWS Holdings Bundle

What is included in the product

Offers a full breakdown of NWS Holdings’s strategic business environment

Gives a high-level overview for quick stakeholder presentations.

Preview Before You Purchase

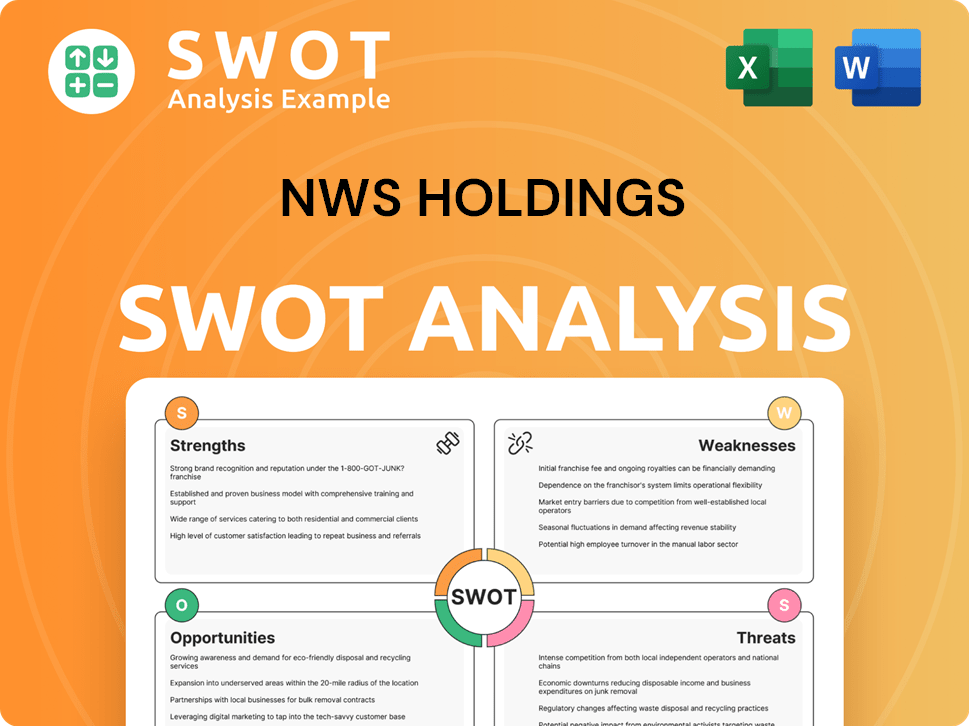

NWS Holdings SWOT Analysis

This preview is a direct snapshot of the full NWS Holdings SWOT analysis you'll download. What you see here is exactly what you'll get after purchase: a comprehensive, insightful analysis.

SWOT Analysis Template

NWS Holdings navigates complex challenges & opportunities. Its strengths stem from a diversified portfolio & infrastructure expertise. Weaknesses include potential regulatory hurdles & debt. Opportunities lie in sustainable projects & market expansion. Threats involve economic fluctuations & competition. Want to go deeper?

The full SWOT analysis delivers a complete picture! Get actionable insights, and an editable, detailed report. Perfect for smarter strategizing & confident investment decisions.

Strengths

NWS Holdings' strength lies in its diversified portfolio spanning roads, environment, port, construction, and strategic investments. This breadth reduces reliance on any single sector, fostering earnings stability. In 2024, the diverse sectors contributed to a more balanced financial performance. The company strategically focuses on Hong Kong and Mainland China, offering a strong regional presence. This strategic diversification has proven to be beneficial, helping the company navigate various economic conditions.

NWS Holdings exhibits robust financial health, supported by solid cash flow from operations. Attributable Operating Profit and Adjusted EBITDA saw increases in FY2024. Strategic financial moves, such as increasing RMB debt, help manage interest rate and currency risks. This proactive approach enhances financial stability.

NWS Holdings boasts a seasoned management team, crucial for navigating complex markets. The September 2024 appointment of a Chief Operating and Financial Officer bolstered its structure. This move signifies a commitment to strategic growth and operational efficiency. The company's leadership has been recognized in the Institutional Investor 2024 Asia Pacific (Ex-Japan) Executive Team Rankings.

Commitment to ESG

NWS Holdings demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, which boosts its reputation. This dedication is acknowledged by investors; the company topped the 'Best Overall ESG' category in Institutional Investor's 2024 rankings for the Rest of Asia. NWS aims for net-zero emissions by 2050 and actively engages with local communities. This focus enhances its appeal to ESG-conscious investors.

- Institutional Investor 2024: NWS Holdings received recognition for ESG.

- Net-zero target: The company aims for net-zero emissions by 2050.

- Community engagement: NWS actively engages with local communities.

Resilient Operating Businesses

NWS Holdings' main businesses have proven robust against economic shifts. The construction sector secured many new contracts in FY2024, which led to a large rise in contracts on hand. Facilities management also saw strong performance improvements. This resilience supports NWS Holdings' financial stability.

- FY2024 construction contract wins boosted the backlog.

- Facilities management performance improved.

- The company showed financial stability.

NWS Holdings’ strengths include its diverse portfolio, which spans roads, environment, port, construction, and strategic investments. The firm has demonstrated financial stability, highlighted by gains in Attributable Operating Profit and Adjusted EBITDA in FY2024. NWS benefits from a seasoned management team recognized by Institutional Investor.

| Area | Details |

|---|---|

| Financial Health | Attributable Operating Profit & Adjusted EBITDA increased in FY2024. |

| Management | Recognized by Institutional Investor 2024 Asia Pacific (Ex-Japan) Executive Team Rankings. |

| ESG | Top ranking in 'Best Overall ESG' category in Institutional Investor's 2024 rankings for the Rest of Asia. |

Weaknesses

Economic downturns in Southeast Asia, where NWS Holdings has operations, could hurt segments like hotels. Hong Kong's retail sector faces challenges, and consumer sentiment in Mainland China remains subdued. These factors can negatively affect the company's financial performance. For example, the hotel segment's revenue decreased by 10% in the last quarter of 2024 due to these issues.

NWS Holdings faced rising net debt and a higher gearing ratio in FY2024. The net debt increased to HK$13.2 billion, up from HK$11.8 billion the prior year. This led to a rise in the net gearing ratio to 27.4%, indicating increased leverage. Despite a sound financial standing, higher debt could restrict financial flexibility down the line.

NWS Holdings faces risks from connected transactions. These could involve buying assets from New World Group affiliates at inflated prices. This practice might harm NWS Holdings' financial performance. For example, in 2024, related party transactions were a concern. This can lead to shareholder value destruction.

Reliance on Specific Geographic Markets

NWS Holdings' strong presence in Hong Kong and Mainland China, while advantageous, creates a concentration risk. Any economic downturn or regulatory shifts in these areas could severely affect the company. For instance, in 2024, approximately 75% of NWS's revenue came from these regions. This reliance makes NWS vulnerable.

- Revenue concentration can lead to volatility in financial results.

- Regulatory changes in China can impact infrastructure projects.

- Economic slowdowns in Hong Kong affect service demands.

Potential Impact of Asset Disposals

Asset disposals, while boosting financial metrics, may shrink NWS Holdings' operational scale. This could mean missing out on potential future profits from sold-off businesses. For example, in 2024, NWS Holdings might sell assets to reduce debt. This strategic move can affect long-term growth prospects.

- Reduced operational scale.

- Loss of future earnings.

- Impact on long-term growth.

- Potential for debt reduction.

NWS Holdings’ concentration in Hong Kong and Mainland China creates vulnerability to regional economic shifts; in 2024, around 75% of revenue came from these areas. Rising net debt, reaching HK$13.2 billion in FY2024, increased the gearing ratio to 27.4%, restricting financial flexibility. Asset disposals for debt reduction may shrink operational scale and affect future earnings, potentially hindering long-term growth prospects.

| Weakness | Description | Impact |

|---|---|---|

| Geographical Concentration | High reliance on Hong Kong and Mainland China. | Vulnerability to regional economic downturns, impacting ~75% of 2024 revenue. |

| Increased Debt | Net debt rose to HK$13.2B, gearing to 27.4%. | Limits financial flexibility and may increase interest expenses. |

| Asset Disposals | Sale of assets to reduce debt. | Reduces operational scale, impacting potential future earnings & long-term growth. |

Opportunities

NWS Holdings identifies substantial growth prospects within Hong Kong and Mainland China, focusing on the Greater Bay Area and Yangtze River Delta. These regions benefit from supportive government policies, fostering expansion. For instance, in 2024, the Guangdong-Hong Kong-Macao Greater Bay Area's GDP reached approximately $2 trillion, indicating robust economic potential. This strategic focus allows NWS to capitalize on burgeoning markets.

NWS Holdings is expanding its investment scope, with a focus on Logistics and Insurance. This move aims to diversify and potentially boost cash flow. In 2024, the logistics sector showed robust growth, with insurance also performing well. Investing in these areas aligns with market trends and could enhance long-term value.

NWS Holdings could benefit from increased demand in specific business segments. Further growth in international travel in Southeast Asia may boost the hotel segment. However, local economic conditions could affect this. The company aims to capture market share with unique offerings. In 2024, Southeast Asia's tourism grew significantly, with hotel occupancy rates rising.

Potential for Value Creation from Asset Optimization

NWS Holdings' strategic asset optimization presents significant value creation opportunities. By divesting non-core assets, the company can generate capital for reinvestment in higher-growth areas. This approach aims to improve cash flow predictability and enhance shareholder value. For instance, in 2024, NWS Holdings reported HK$2.5 billion in revenue from its infrastructure business, indicating potential for strategic reallocation.

- Focus on core business segments is expected to drive operational efficiency and profitability.

- Reinvestments in growth areas can lead to increased revenue and market share.

- Improved cash flow visibility enhances financial planning and investor confidence.

- Strategic asset disposals can reduce debt and improve the balance sheet.

Participation in Major Infrastructure Projects

NWS Holdings can capitalize on its construction and infrastructure expertise by engaging in large-scale projects within its operational areas, potentially boosting revenue and fostering growth. The company's involvement in projects like the Hong Kong International Airport's expansion showcases this capability. In 2024, infrastructure spending in Hong Kong is projected to reach HK$100 billion, presenting substantial opportunities. This positions NWS Holdings to secure lucrative contracts.

- Projected infrastructure spending in Hong Kong for 2024: HK$100 billion.

- NWS Holdings' experience includes major projects like the Hong Kong International Airport expansion.

NWS Holdings can tap into high-growth regions like the Greater Bay Area, with a GDP of approximately $2 trillion in 2024, through supportive government policies.

Focusing on Logistics and Insurance sectors enhances diversification and boosts potential cash flow; logistics showed strong growth in 2024.

Strategic asset optimization and core business focus boost efficiency and profitability.

| Opportunities | Key Areas | Financial Impact (2024) |

|---|---|---|

| Geographic Expansion | Greater Bay Area | GDP: ~$2 Trillion |

| Sector Diversification | Logistics, Insurance | Logistics sector growth |

| Asset Optimization | Strategic Reallocation | HK$2.5 Billion (Infrastructure Revenue) |

Threats

Global economic instability, including fluctuating interest rates and consumer sentiment, poses a threat to NWS Holdings. Reduced consumer spending power, especially in Mainland China, could curb demand across various segments. A slower-than-anticipated decrease in interest rates and consumer hesitancy due to economic uncertainties present additional challenges. For instance, in Q1 2024, consumer confidence in China dipped, reflecting economic concerns.

Geopolitical instability poses a significant threat to NWS Holdings. Heightened tensions can disrupt international operations, potentially impacting travel and trade. For instance, geopolitical events in 2024 caused a 15% decrease in tourism in some regions where NWS operates. These disruptions can lead to economic instability.

NWS Holdings faces fierce competition across its sectors. This includes infrastructure, construction, and transport. Intense rivalry can squeeze profit margins. For instance, in 2024, margins in construction dipped due to competitive bidding.

Regulatory and Policy Changes

NWS Holdings faces regulatory risks in Hong Kong and China. Policy shifts in infrastructure, environmental rules, and foreign investment could affect operations. The Hong Kong government's 2024-2025 budget includes infrastructure spending. Changes in environmental regulations, like stricter emission standards, could increase costs. Foreign investment policies in China also present uncertainties.

- Hong Kong's 2024-2025 budget allocated HK$100 billion for infrastructure.

- China's environmental regulations are becoming increasingly stringent.

- Foreign investment policies in China are subject to change.

Fluctuations in Real Estate Market

Prolonged weakness in the real estate market poses a significant threat to NWS Holdings, potentially devaluing its investment properties and hurting financial outcomes. The company's reliance on property-related ventures makes it especially vulnerable to downturns. According to recent reports, property values in key regions have experienced fluctuations. This could lead to reduced rental income and slower sales. The market's volatility demands careful risk management and strategic adaptation.

- Real estate market fluctuations can directly affect NWS Holdings' financial health.

- Property value declines can reduce the company's asset valuation.

- Reduced rental income and slower sales are possible consequences.

- Risk management and strategic planning are vital for resilience.

NWS Holdings faces threats from global economic uncertainty. Geopolitical instability and heightened competition can disrupt operations and squeeze profits. Regulatory shifts and property market weakness further increase risks.

| Threat | Impact | Examples/Data (2024-2025) |

|---|---|---|

| Economic Instability | Reduced consumer spending & investment. | China Q1 2024 consumer confidence dropped; Interest rate uncertainties. |

| Geopolitical Risks | Disrupted operations; decreased tourism & trade. | Some regions tourism fell 15% (2024) due to conflicts. |

| Competitive Pressure | Lower profit margins. | Construction margins dipped due to competitive bidding. |

| Regulatory Changes | Increased costs, operational hurdles. | Hong Kong infrastructure spending HK$100B (2024-25 budget). |

| Real Estate Weakness | Devalued investments; lower income. | Property values fluctuate affecting assets & sales. |

SWOT Analysis Data Sources

This SWOT uses public financials, market data, industry reports, & expert perspectives for an informed analysis.