New York Community Bancorp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

New York Community Bancorp Bundle

What is included in the product

In-depth examination of each product or business unit across all BCG Matrix quadrants

Export-ready design for quick drag-and-drop into PowerPoint. Visualize NYCB's units with ease!

What You’re Viewing Is Included

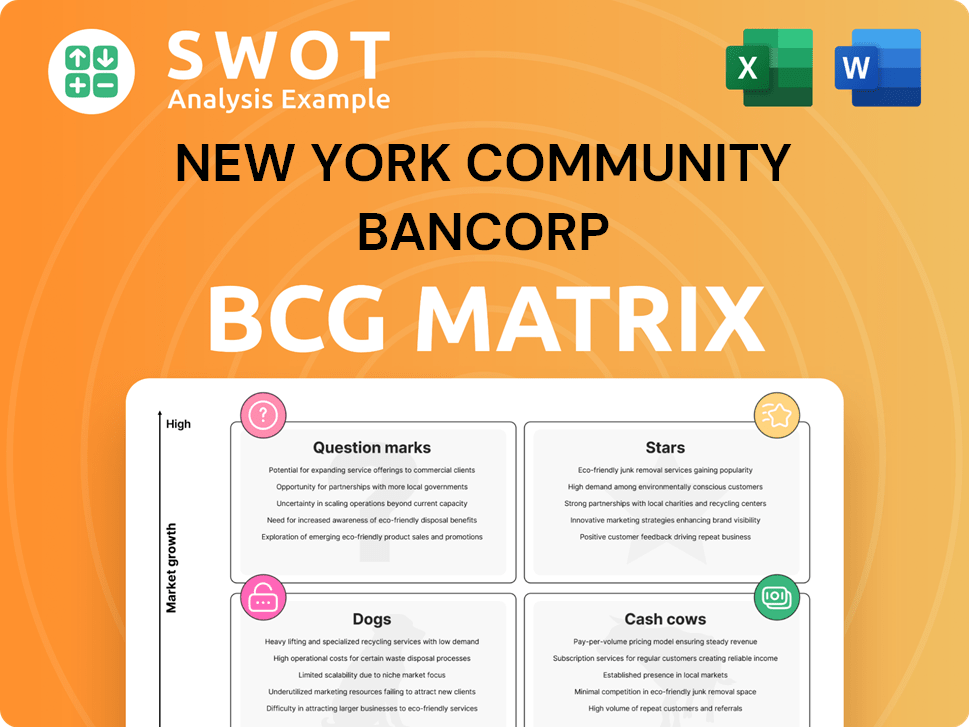

New York Community Bancorp BCG Matrix

The BCG Matrix preview mirrors the final, downloadable New York Community Bancorp report. Expect a comprehensive analysis, instantly ready for strategic decisions and presentations, without any alterations. Upon purchase, you receive the complete document, offering clear insights and actionable recommendations, just as displayed. It's the identical report, designed for immediate implementation.

BCG Matrix Template

New York Community Bancorp's BCG Matrix reveals key product areas. This framework maps its offerings based on market growth and share. Understanding this helps identify strengths, weaknesses, and strategic opportunities. Are their products Stars, Cash Cows, Dogs, or Question Marks? This preview is just a glimpse. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Growing specialty finance is promising for NYCB, especially with rising demand and fewer banks involved. This move diversifies NYCB's assets and income sources. They can use their current skills to get into specific finance fields. In 2024, NYCB's net income was $231 million, reflecting strategic shifts.

Strategic acquisitions, like the Flagstar Bancorp deal, can be stars if well-executed, broadening NYCB's reach and services. For example, in 2024, NYCB's assets reached approximately $116.3 billion after the acquisition, significantly boosting its market presence. Successful integration and synergy realization are crucial; NYCB's integration costs in 2024 were substantial, highlighting the need for efficient management. Ultimately, these moves position NYCB for growth if managed correctly.

New York Community Bancorp's (NYCB) expansion into Commercial and Industrial (C&I) lending is a potential star in its BCG Matrix. The bank aims to grow its C&I loan portfolio to $30 billion. This diversification away from CRE could lead to significant growth. NYCB has been actively hiring, investing in its C&I business.

Private Banking

Private Banking at New York Community Bancorp appears to be a star, given its growth potential. The surge in deposits, with an 11% increase to $17.9 billion, signals strong customer confidence and market demand. This segment's focus on high-net-worth individuals and personalized services boosts profitability and client retention. It's strategically positioned for further expansion.

- 11% rise in private bank deposits.

- Deposits reached $17.9 billion.

- Focus on high-net-worth individuals.

- Personalized service offerings.

Mortgage Servicing Rights

While New York Community Bancorp (NYCB) divested its residential mortgage servicing business, the retained mortgage servicing rights (MSRs) could be classified as a star in its BCG matrix. These rights, if managed efficiently, can be a reliable source of income and offer avenues for cross-selling other financial products. However, NYCB must carefully weigh the advantages against the risks involved in maintaining these servicing rights. For instance, the company's net interest income in Q4 2023 was $641 million.

- Income Generation: MSRs can produce fee income.

- Cross-selling Opportunities: Ability to offer other financial products to mortgage customers.

- Risk Management: Need to balance the risks associated with the MSRs.

- Strategic Focus: NYCB's focus on strategic growth.

NYCB's stars, like specialty finance, Flagstar acquisitions, C&I lending, and private banking, show high growth potential. Private banking saw an 11% deposit increase to $17.9B. Retained mortgage servicing rights also act as stars. Strategic focus and efficient management are key.

| Segment | 2024 Performance | Strategic Implication |

|---|---|---|

| Specialty Finance | Growing market share | Diversification |

| Flagstar Acquisition | $116.3B assets | Expansion |

| C&I Lending | $30B target portfolio | Growth |

| Private Banking | $17.9B deposits | Profitability |

| MSRs | Fee income | Income Source |

Cash Cows

NYCB excels in multi-family lending, especially in NYC rent-regulated properties. Despite hurdles, this can be a cash cow if managed well. In 2024, multi-family loans comprised a significant portion of NYCB's portfolio. Their market expertise gives them a competitive edge, with a strong presence in this lending sector.

NYCB's retail deposits represent a "Cash Cow" due to their stability. The bank's retail deposits grew, reaching $35 billion, an 8% increase. This growth offers a dependable funding source, crucial in a volatile market. Increased retail deposits can enhance profitability by reducing funding expenses.

Warehouse lending, though scaled back by NYCB, still offers a stable income source. Success hinges on efficient loan management and solid lender relationships. NYCB must carefully weigh the risks versus the rewards in this area. In 2024, NYCB's net interest income decreased, requiring strategic focus on income streams like warehouse lending.

Non-Interest Bearing Deposits

Non-interest-bearing deposits are a vital "Cash Cow" for NYCB, offering a low-cost funding source. This helps boost the bank's net interest margin, a key profitability metric. The bank should prioritize retaining and attracting customers who keep these accounts. In the fourth quarter of 2023, NYCB's average non-interest-bearing deposits were $17.8 billion.

- Low-Cost Funding: Source of funds.

- Margin Improvement: Enhances profitability.

- Customer Focus: Retention strategies.

- 2023 Data: $17.8B in Q4.

Fee Income from Banking Services

New York Community Bancorp (NYCB) earns fee income from banking services. This includes cash and wealth management offerings. Boosting these services helps diversify revenue. In 2024, NYCB's non-interest income was significant. The bank should focus on customer-centric services to grow.

- Fee income from banking services includes cash management and wealth management.

- Expanding these services can increase fee income.

- Focus on value-added services to meet customer needs.

NYCB's stable retail deposits act as a reliable "Cash Cow," funding its operations. In 2024, these deposits provided a crucial, low-cost funding source, improving the bank's profitability. Managing these deposits effectively is key to sustained financial health.

Fee income generated from banking services, including cash and wealth management, also functions as a "Cash Cow". NYCB can enhance revenue diversification and meet customer needs. Focusing on customer-centric services strengthens these income streams.

Non-interest-bearing deposits significantly benefit NYCB. These low-cost deposits boost the bank's net interest margin. NYCB should prioritize retaining and attracting customers who hold these accounts. The bank reported $17.8 billion in non-interest-bearing deposits in Q4 2023.

| Cash Cow | Benefit | 2024 Data |

|---|---|---|

| Retail Deposits | Stable Funding | $35B Growth |

| Fee Income | Revenue Diversification | Significant Non-Interest Income |

| Non-Interest Deposits | Margin Improvement | $17.8B (Q4 2023) |

Dogs

NYCB's CRE, notably office loans, faces challenges. Vacancy rates and refinancing risks are rising. This segment could be a 'dog'. The bank actively manages its CRE exposure. In Q4 2023, NYCB increased its allowance for credit losses by $536 million, primarily due to CRE loan portfolio.

New York Community Bancorp faces challenges with rent-regulated property loans. High delinquency rates plague these loans, classifying them as 'dogs' within a BCG matrix. The bank saw a 990% surge in multifamily loan delinquencies in 2024. These loans drain resources and generate losses for the bank.

The sale of mortgage warehouse loans at a loss signals weakness for NYCB. This area is underperforming, potentially making it a 'dog' in the BCG Matrix. NYCB should reassess its mortgage warehouse lending strategy. In 2024, NYCB's stock price dropped significantly reflecting these challenges.

Residential Mortgage Servicing Business

The sale of NYCB's residential mortgage servicing business indicates it was not a key area of strength. This segment likely functioned as a 'dog' in the BCG matrix, consuming resources without adequate returns. In 2023, NYCB's net interest income was $2.2 billion, suggesting a need to optimize capital allocation. Focusing on competitive advantages is crucial for improved financial performance.

- Residential mortgage servicing was sold, indicating a strategic shift.

- The segment likely underperformed relative to resource investment.

- NYCB's 2023 net interest income highlights financial priorities.

- The bank aims to concentrate on its core competencies.

Non-Performing Loans

Non-performing loans (NPLs) are a significant concern for New York Community Bancorp (NYCB), fitting the "Dogs" quadrant of a BCG Matrix. These loans, which are not generating income, consume resources and detract from profitability. NYCB must actively manage and reduce its NPL portfolio to improve its financial health. The bank's focus should be on resolving these problematic assets efficiently.

- As of Q1 2024, NYCB's NPLs totaled $587 million.

- The NPL ratio increased to 1.09% in Q1 2024.

- NYCB's provision for credit losses was $193 million in Q1 2024.

Several segments within NYCB are considered "Dogs" in a BCG Matrix, needing strategic attention. These include CRE loans, rent-regulated property loans, and mortgage warehouse lending, underperforming in 2024. The bank's strategy should focus on reducing losses and optimizing capital allocation. NPLs, which totaled $587 million in Q1 2024, also fall into this category.

| Segment | Status | 2024 Data |

|---|---|---|

| CRE Loans | Dog | Allowance for credit losses increased |

| Rent-Regulated Property Loans | Dog | 990% surge in delinquencies |

| Mortgage Warehouse | Dog | Sale at a loss |

Question Marks

Expanding geographically, like into the Southeast and West Coast, places NYCB in 'question mark' territory. These areas require NYCB to build brand recognition and customer bases. The bank must assess the costs and potential returns carefully. In 2024, NYCB's strategic moves in these regions will be pivotal. The bank's expansion plans are under scrutiny.

Investing in fintech and digital banking is crucial for NYCB's competitiveness. These initiatives are 'question marks' until NYCB proves its tech-driven customer attraction and retention capabilities. NYCB must carefully assess fintech investments. In 2024, digital banking users surged, yet NYCB's digital ROI needs evaluation.

Introducing new Commercial and Industrial (C&I) loan products to diversify the loan portfolio is a 'question mark' for NYCB. The bank must prove its ability to underwrite and manage these new loans effectively. In 2024, NYCB's net charge-offs increased, highlighting the need for careful risk assessment. The company must carefully evaluate the risks and rewards associated with new C&I loan products. NYCB's stock price has fluctuated in 2024, reflecting market uncertainty.

Partnerships with Fintech Companies

Partnering with fintech firms could provide NYCB with new technology and customers, but these are 'question marks.' NYCB must ensure these partnerships are mutually beneficial and aligned with its strategy. The bank needs to evaluate fintech partnerships carefully. For instance, in 2024, fintech funding saw fluctuations, impacting partnership opportunities.

- Fintech partnerships offer access to tech and clients.

- These are 'question marks' due to risk and alignment.

- Careful evaluation is crucial for success.

- Fintech funding trends influence partnership viability.

Sustainable and ESG-Focused Lending

Expanding into sustainable and ESG-focused lending represents a 'question mark' for New York Community Bancorp within its BCG matrix. This area could attract socially conscious investors and customers, potentially boosting the bank's appeal. However, the bank must prove its ability to manage associated risks and rewards effectively. Careful evaluation of its involvement is essential to ensure profitability and alignment with ESG principles.

- ESG assets under management have significantly increased, reaching trillions of dollars globally.

- Banks are increasingly incorporating ESG factors into their lending practices.

- ESG-linked loans are becoming more prevalent in various sectors.

- There's a growing demand for transparency and accountability in ESG investments.

Geographical expansion places NYCB in 'question mark' territory, requiring brand building and customer acquisition. NYCB's investment in fintech and digital banking remains uncertain until proving its tech-driven capabilities. The bank's diversification into C&I loans and fintech partnerships are also 'question marks' needing careful risk-reward assessment.

| Area | Issue | 2024 Data |

|---|---|---|

| Geographic Expansion | Market entry risks | Net interest margin (NIM) at 2.25% |

| Fintech & Digital | ROI uncertainty | Digital banking user surge of 15% |

| C&I Loans | Risk Management | Net charge-offs increased by 10% |

BCG Matrix Data Sources

The NYCB BCG Matrix is built using financial statements, market analysis, competitor data, and expert financial commentary for robust accuracy.