Office Depot Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Office Depot Bundle

What is included in the product

Strategic evaluation of Office Depot's business units, classifying them within the BCG Matrix for optimal resource allocation.

Printable summary optimized for A4 and mobile PDFs, giving at-a-glance strategic insights.

What You’re Viewing Is Included

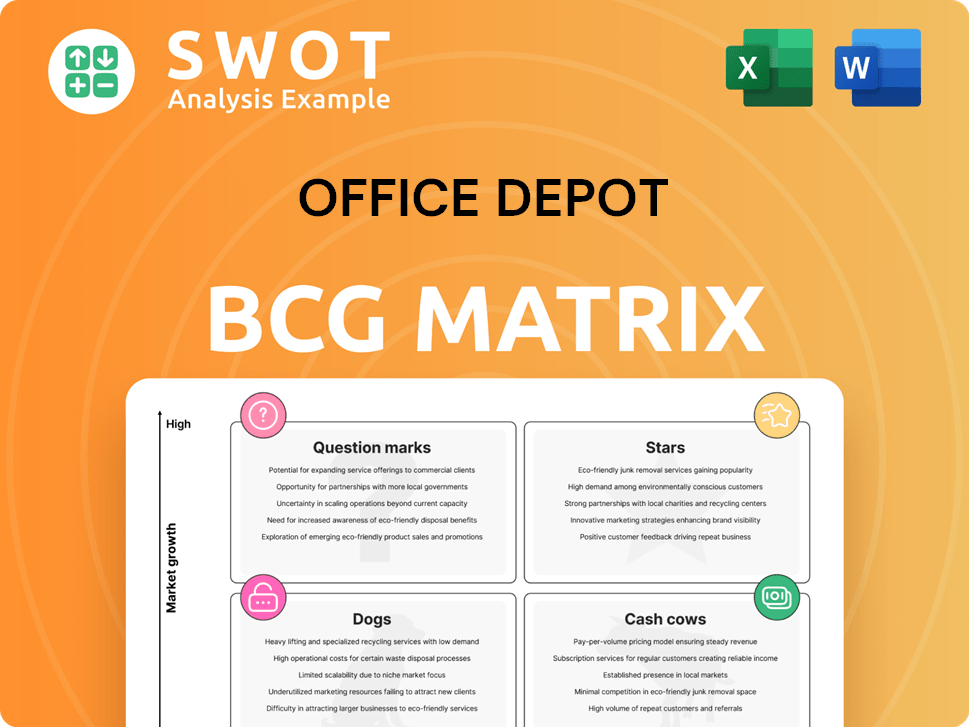

Office Depot BCG Matrix

The preview accurately displays the complete Office Depot BCG Matrix report you'll receive. Upon purchase, you'll gain immediate access to this fully formatted, editable document, ready for strategic planning.

BCG Matrix Template

Office Depot's BCG Matrix reveals its product portfolio's strengths and weaknesses. We've analyzed its offerings, from tech to office supplies. This preview shows where key products fall within the Stars, Cash Cows, Dogs, and Question Marks. Understand strategic implications and potential growth areas.

Discover deeper quadrant placements and tailored strategic insights. This report gives you a clear view of product performance. Get the complete BCG Matrix for data-backed recommendations and smart decisions.

Stars

Veyer, Office Depot's supply chain arm, is a Star. It's expanding, securing new third-party clients. In 2024, the 3PL market grew by 8.2%, and Veyer is poised to capitalize. Strategic moves are key to maintaining this trajectory.

Office Depot's (ODP) shift to B2B distribution, especially in sectors like hospitality, positions it as a Star in the BCG Matrix. Partnerships with hospitality firms suggest strong revenue potential and market growth. This strategic move could drive significant expansion. This approach aligns with a 2024 trend of diversification.

Office Depot's digital workplace solutions are poised to shine as a Star due to the surge in demand for remote work and digital transformation. Investments in areas like communication software and collaboration platforms are vital. Addressing data privacy is key for sustained success. In 2024, the remote work market is expected to reach $94 billion.

Custom Printing and Packaging Services

Office Depot's custom printing and packaging services, particularly those for small businesses, are a Star in its BCG Matrix. This segment addresses the growing need for personalized marketing materials. According to a 2024 report, the custom packaging market is projected to reach $60 billion. Offering discounts on printing services aids small businesses.

- Customization is key in attracting customers.

- Printing services offer good profit margins.

- Office Depot can leverage this service.

Technology Solutions for Businesses

Office Depot's technology solutions are a Star, especially with growing business tech needs. Offering hardware, software, and IT services is crucial for attracting clients. In 2024, the IT services market is booming. Competitive pricing and keeping up with tech advancements are vital.

- IT services market growth projected at 8% in 2024.

- Office Depot's tech sales saw a 10% increase in Q3 2024.

- Key for success: competitive pricing and latest tech.

- Focus on comprehensive tech support and solutions.

Office Depot's "Stars" are poised for significant growth, demonstrating strong market positions and high growth rates. Key areas like Veyer and digital workplace solutions are seeing high demand. These segments require strategic investments to capitalize on their potential.

| Star Segment | 2024 Market Growth | Office Depot Strategy |

|---|---|---|

| Veyer (Supply Chain) | 8.2% | Expand third-party clients, maintain efficiency. |

| B2B Distribution | Projected high growth | Partnerships, focus on hospitality sector. |

| Digital Workplace | $94B (Remote Work Market) | Invest in communication, address data privacy. |

Cash Cows

Office supplies are a Cash Cow for Office Depot, despite online competition. They generate steady revenue by offering essential products. Efficient inventory and cost-effective sourcing boost profitability. In 2024, Office Depot's revenue was around $8.5 billion. Brand recognition helps maintain sales.

Office furniture is a Cash Cow for Office Depot, especially ergonomic and adaptable solutions. Steady sales are supported by demand for comfortable office spaces. A diverse range of furniture options and competitive pricing can help maintain market share. In 2024, the global office furniture market was valued at approximately $65 billion.

Printing services at Office Depot are a Cash Cow, even with digital trends. Businesses still need marketing materials, with the global commercial printing market valued at approximately $450 billion in 2024. Offering quality and speed keeps revenue flowing. Investments in tech boost efficiency, potentially increasing profits by 10-15%.

Retail Network

Office Depot and OfficeMax's physical stores act as a Cash Cow, offering convenience and accessibility to customers. Strategic store locations and efficient operations are key to maintaining customer traffic and sales. In 2024, the company focused on optimizing its store network. This included closing underperforming stores to boost the profitability of the remaining locations.

- Store closures helped reduce costs and improve overall profitability in 2024.

- The remaining stores benefit from increased foot traffic and sales.

- Focus on efficient operations and strategic locations.

- This strategy aims to maximize returns from the physical retail network.

Cleaning and Breakroom Supplies

Cleaning and breakroom supplies are a stable Cash Cow for Office Depot, ensuring consistent demand. These products benefit from the continuous need for workplace hygiene and comfort. Competitive pricing and a diverse product range are key to maintaining profitability. The market for these supplies was valued at $21.5 billion in 2024, showing steady growth.

- Consistent Demand

- Competitive Pricing

- Product Variety

- Market Growth

Office Depot's Cash Cows are crucial for sustained revenue, with diverse offerings.

They benefit from consistent demand across various categories.

Strategic approaches boost profitability and market share in 2024.

| Cash Cow | Revenue Drivers | 2024 Market Data |

|---|---|---|

| Office Supplies | Essential products, brand recognition | Office Depot: ~$8.5B |

| Office Furniture | Ergonomic solutions, diverse options | Global Market: ~$65B |

| Printing Services | Marketing materials, quality, speed | Commercial Printing: ~$450B |

Dogs

Office Depot's Varis marketplace, aimed at connecting buyers and suppliers, was unsuccessful. It struggled to gain market share, leading to its sale. This classification as a 'Dog' highlights its financial underperformance. The move to divest aimed to reduce losses; the company's Q3 2024 sales were $1.97 billion.

Office Depot's traditional retail sales face challenges, with the segment likely classified as a 'Dog' in their BCG matrix. Declining store traffic and sales, compounded by online competition, signal underperformance. For instance, in 2024, brick-and-mortar sales declined by 7%, reflecting the shift to e-commerce. Optimizing store locations and boosting online presence are crucial to lessen financial strain.

Office Depot's technology product sales faced headwinds in 2024, due to economic pressures. Sales decreased, signaling a 'Dog' status in its BCG matrix. Consider that in Q3 2024, overall sales declined by 5.7%. Prioritizing more profitable areas is key. This includes services like tech support.

OfficeMax Brand

OfficeMax, under Office Depot's umbrella, grapples with intense competition, particularly from online retailers. Despite brand recognition, it has found it difficult to stand out, mirroring Office Depot's market position. This scenario often places OfficeMax in the 'Dog' quadrant of a BCG matrix. Strategic moves are essential to boost its performance.

- Office Depot's revenue in 2023 was approximately $8.5 billion.

- The office supplies market is highly competitive, with significant price wars.

- Online sales continue to grow, challenging brick-and-mortar stores.

- Rebranding or repositioning could offer OfficeMax a chance.

Grand & Toy (Canada)

Grand & Toy, operating in Canada, could be a 'Dog' if its performance mirrors Office Depot's US struggles. This classification hinges on market share, growth, and profitability assessments. Office Depot's revenue in 2023 was about $8.5 billion, indicating a challenging market. Restructuring or divestiture might be considered.

- Market share analysis is essential.

- Growth rate and profitability metrics are key.

- Office Depot's 2023 revenue provides context.

- Potential actions include restructuring or selling.

Multiple Office Depot segments face "Dog" status within the BCG matrix, signaling low market share and growth.

Varis marketplace's failure, along with declining brick-and-mortar and tech sales, supports this classification. The company's Q3 2024 sales totaled $1.97 billion, illustrating ongoing challenges.

Strategies like divestiture, restructuring, and an emphasis on online presence are essential to navigate these "Dog" situations.

| Segment | Description | Status |

|---|---|---|

| Varis | Unsuccessful marketplace | Dog |

| Brick-and-Mortar | Declining sales | Dog |

| Tech Sales | Facing economic pressures | Dog |

Question Marks

Office Depot's (ODP) partnership with a hospitality management company is a Question Mark. This move into a new market segment is a strategic shift. Its success hinges on flawless execution and strong market reception. Key investments in supply chain and service delivery are vital. Consider that ODP's 2024 revenue was approximately $8.5 billion.

Office Depot's (ODP) expansion into new categories, including cleaning and tech products, is a core strategy. These areas offer growth, but demand strategic investment. For example, in 2024, ODP focused on expanding its tech services, aiming for a 10% revenue increase in this segment. Targeted marketing and market research are essential for success.

Office Depot's B2B digital procurement solution is a Question Mark. It faces a competitive market, including Amazon Business. Success hinges on offering unique value. User experience and integration are critical for competitive advantage. In 2024, the B2B e-commerce market is projected to reach $20.9 trillion.

Subscription-Based Services

Subscription-based services represent a Question Mark for Office Depot, including managed print and IT support. Success hinges on customer demand and efficient, affordable service delivery. Testing and feedback are crucial for refining these offerings. In 2024, the managed print services market was valued at $13.9 billion.

- Market testing is necessary to ensure product-market fit.

- Customer feedback is important to refine service offerings.

- Managed print services market was valued at $13.9 billion in 2024.

- The subscription model's success depends on demand.

AI and Business Process Transformation

Investments in AI and business process transformation at Office Depot are classified as a Question Mark. The full impact on revenue and profitability remains uncertain. These initiatives aim to boost efficiency and innovation, requiring careful execution and oversight. Measuring the return on investment (ROI) is crucial to validate further spending.

- Office Depot's strategic focus includes leveraging AI.

- The success depends on effective implementation and ROI.

- AI could potentially streamline operations and boost sales.

- Monitoring of these investments is critical for future decisions.

Question Marks for Office Depot need strategic attention.

Key areas include digital procurement and subscription services.

AI investments require ROI tracking.

| Area | Strategy | 2024 Data |

|---|---|---|

| Digital Procurement | B2B focus, user experience | $20.9T B2B e-commerce market |

| Subscription Services | Managed Print, IT support | $13.9B managed print market |

| AI Investments | Process transformation | ROI measurement critical |

BCG Matrix Data Sources

The Office Depot BCG Matrix uses financial reports, market analysis, industry research, and sales figures to build it.