OneStream PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

OneStream Bundle

What is included in the product

Evaluates OneStream's external macro-environment across Political, Economic, etc. dimensions. Highlights threats/opportunities with data.

Helps identify relevant factors for better strategy formulation and streamlined decision-making.

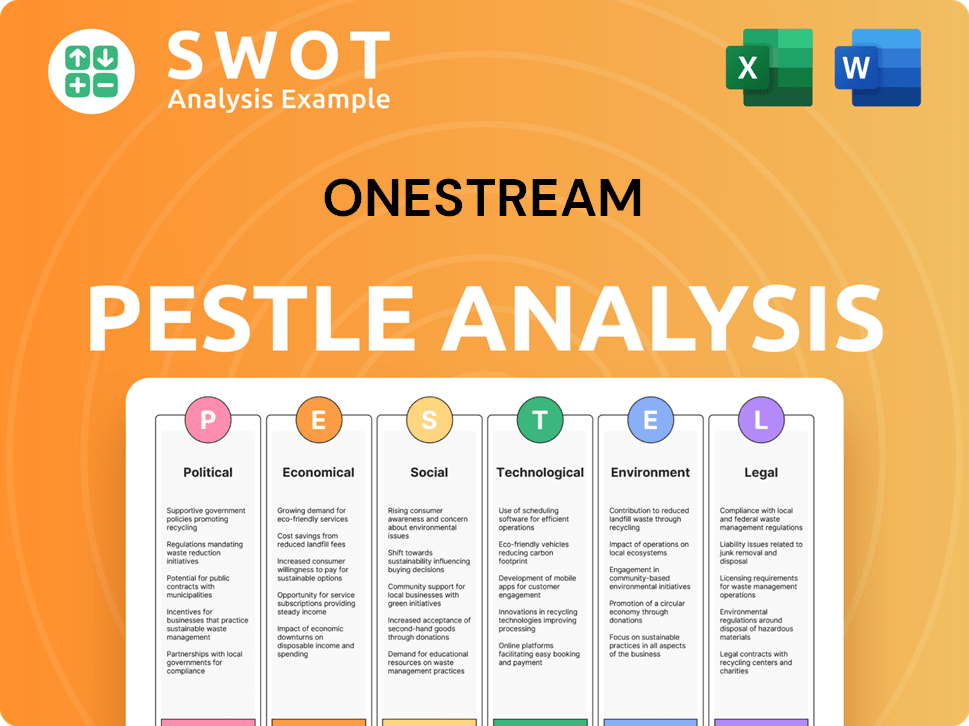

Preview the Actual Deliverable

OneStream PESTLE Analysis

The preview showcases the complete OneStream PESTLE analysis. This comprehensive document is formatted professionally.

All sections and details you see are included. Get the same ready-to-use file immediately after purchase.

There are no hidden sections or differences; the displayed version is final.

PESTLE Analysis Template

Navigate the complexities surrounding OneStream with our dedicated PESTLE analysis. Uncover crucial insights into the political, economic, social, technological, legal, and environmental factors impacting their operations. Our expertly researched report provides a clear picture of external influences, helping you understand risks and identify opportunities. This isn’t just a surface-level overview; it's a strategic deep dive designed for decision-makers. Gain a competitive edge: Download the full OneStream PESTLE analysis now!

Political factors

Government policies significantly shape the tech landscape. Supportive policies for foreign investments can boost tech adoption, benefiting companies like OneStream. Tax policy shifts, as financial leaders watch closely, can alter financial forecasts. A 2024 study showed that 60% of firms adjusted their financial strategies due to tax changes. This impacts demand for financial planning platforms.

Political instability and geopolitical events significantly affect businesses. Wars and tensions can disrupt international operations. For instance, the Russia-Ukraine war has dramatically increased energy prices. This uncertainty underscores the importance of financial planning tools like OneStream. Robust forecasting becomes crucial for navigating these risks, as demonstrated by recent market volatility.

Trade policies and tariffs create economic uncertainty, potentially impacting business operations. This can affect market stability and the need for financial software. For instance, the U.S. imposed tariffs on $360 billion of Chinese goods in 2018-2019. Such actions can directly influence financial software demand.

Regulatory Environment

Regulatory shifts significantly affect financial software like OneStream. Changes in financial regulations, such as those from the SEC or FASB, directly influence how companies handle financial reporting and compliance. OneStream's platform is designed to adapt to these changes, offering solutions for complex reporting requirements. For instance, in 2024, the SEC enhanced cybersecurity disclosure rules impacting financial reporting.

- SEC's cybersecurity disclosure rules have increased the need for robust reporting.

- OneStream helps companies meet these evolving standards.

- Compliance costs can vary significantly with regulatory changes.

Government Spending and Budget Priorities

Government spending and budget priorities directly impact OneStream's market, especially in sectors like government and education, key customer bases. Increased spending in these areas can boost demand for financial management platforms. For example, the U.S. federal government's budget for fiscal year 2024 allocated $776 billion for education and training. These investments highlight the importance of efficient financial tools.

- U.S. federal government's budget for fiscal year 2024 allocated $776 billion for education and training.

- Government spending on IT is projected to increase by 6.5% in 2024.

Political factors heavily influence OneStream’s market dynamics. Supportive government policies foster market growth, benefiting tech firms. Tax regulations impact financial strategies, as seen in the 60% of firms adjusting strategies due to tax changes.

Geopolitical events, such as conflicts, and trade policies, like tariffs, create economic uncertainty. Such shifts increase the demand for forecasting tools. The Russia-Ukraine war significantly drove up energy prices.

Regulatory changes by bodies such as the SEC drive the need for advanced financial reporting solutions. Government spending priorities, notably in education and IT, boost the demand for financial management platforms.

| Aspect | Impact on OneStream | 2024-2025 Data Point |

|---|---|---|

| Government Policies | Tech adoption & Investment | Govt. IT spending increase projected by 6.5% |

| Political Instability | Market Uncertainty & demand for forecasting | Energy prices surged due to war |

| Regulatory Shifts | Demand for compliance tools | SEC enhanced cybersecurity disclosure rules. |

Economic factors

Global economic uncertainty, fueled by potential recessions and inflation, presents significant challenges for businesses. Supply chain constraints continue to impact operations, adding to the complexity. A growing economy can unlock financial investment opportunities, but navigating uncertainties is key. OneStream's platform aids companies in managing financial risk and building resilience.

Inflation affects OneStream's costs, potentially leading to price adjustments. In March 2024, the U.S. inflation rate was 3.5%. Interest rates influence investment strategies and the economic environment. The Federal Reserve held rates steady in May 2024. These factors are crucial for OneStream's financial planning.

Market volatility poses significant financial risks. OneStream's financial risk management tools, such as scenario analysis, are crucial. These tools help assess and mitigate the impacts of market fluctuations. For example, in 2024, the VIX index, a measure of market volatility, has shown notable swings, reflecting economic uncertainty.

Investment Trends

Investment trends are significantly shaped by the growing demand for sustainable investments, especially those focused on Environmental, Social, and Governance (ESG) factors. This shift is influencing how businesses manage their operations and disclose their performance. The rising prominence of ESG considerations amplifies the need for platforms like OneStream, which provides ESG reporting functionalities integrated with financial data. In 2024, ESG assets are projected to reach $50 trillion globally.

- ESG investments are expected to grow by 15% annually through 2025.

- Companies with strong ESG ratings often experience lower cost of capital.

- OneStream's ESG capabilities are seeing a 20% increase in adoption among its clients.

Customer Spending and Investment in Technology

OneStream's revenue growth heavily relies on attracting new customers and expanding the use of its platform among existing clients. Companies' investment in financial management systems, such as OneStream, is closely linked to their economic confidence and strategic goals. For 2024, the global market for financial planning software is projected to reach $13.5 billion, reflecting ongoing investment. This trend underscores the importance of economic factors.

- Global financial planning software market projected to be $13.5 billion in 2024.

- Customer acquisition and expansion are key revenue drivers for OneStream.

- Economic outlook directly impacts investment in financial management systems.

Economic factors, like inflation at 3.5% in March 2024, affect OneStream's costs. Market volatility, shown by VIX swings, poses risks, managed with tools like scenario analysis. The projected $13.5 billion 2024 market for financial planning software highlights the sector's growth.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Inflation | Raises costs, affects pricing | 3.5% (March 2024, US) |

| Market Volatility | Financial risk | VIX index fluctuating |

| Software Market | Revenue potential | $13.5B (Global, 2024) |

Sociological factors

Growing awareness and acceptance of advanced financial systems among finance professionals and decision-makers can boost platforms like OneStream. In 2024, a study showed a 20% increase in businesses adopting cloud-based financial solutions. This trend indicates a shift towards more sophisticated tools. These tools aim to streamline financial processes and improve decision-making. The shift is driven by the need for real-time data and enhanced analytics.

The "war on talent" continues, with skilled workforces crucial for business success. Businesses are increasing training investments to bridge skill gaps. OneStream's user-friendliness and required expertise impact adoption rates and training needs. In 2024, Deloitte's report showed 77% of businesses struggled to find skilled staff.

Resistance to change is a common hurdle when introducing new software like OneStream. Overcoming this requires understanding and addressing employee concerns. A user-centric approach, focusing on ease of use and training, is key. In 2024, studies show that 60% of ERP implementations face resistance due to change management issues.

Emphasis on Diversity, Equity, and Inclusion (DEI)

Emphasis on Diversity, Equity, and Inclusion (DEI) is a key sociological factor. Investments in DEI initiatives continue. Companies' commitment to DEI can influence business strategy, potentially affecting technology investments. OneStream, like other firms, may face expectations to demonstrate DEI progress. This impacts its brand image and stakeholder relations.

- DEI spending increased, with companies allocating more resources to these initiatives in 2024 and 2025.

- Investors increasingly scrutinize companies' DEI performance, influencing investment decisions.

- OneStream could be expected to integrate DEI considerations into its corporate social responsibility (CSR) reports.

Stakeholder Expectations and Transparency

Stakeholders, including investors, regulators, and customers, are increasingly focused on a company's environmental, social, and governance (ESG) impact. This growing demand for transparency is reshaping business practices. Companies must provide clear and detailed information about their ESG performance to maintain trust and attract investment. This societal shift underscores the need for comprehensive reporting solutions, like OneStream's ESG capabilities.

- 2024: ESG assets hit $42 trillion globally.

- 2025: Projected ESG market growth to $50 trillion.

- Increasing investor scrutiny demands detailed ESG data.

- OneStream helps meet these evolving reporting needs.

OneStream faces heightened DEI scrutiny, affecting brand image and stakeholder relations. Growing ESG demands necessitate detailed reporting, which OneStream supports. Increased societal focus drives investment toward companies with strong ESG performance.

| Sociological Factor | Impact on OneStream | 2024/2025 Data |

|---|---|---|

| DEI Initiatives | Influence on brand image, stakeholder relations. | DEI spending rose, investors assess DEI performance. |

| ESG Demand | Highlights need for comprehensive reporting. | ESG assets grew to $42T in 2024, with growth projected to $50T in 2025. |

| Societal Focus | Shifts investment toward strong ESG performers. | Investors increasingly demand detailed ESG info. |

Technological factors

Technological advancements, especially in AI and machine learning, are transforming financial planning and analysis. OneStream is integrating AI into its platform for forecasting, anomaly detection, and scenario modeling. This is a major driver of its product innovation. For instance, the AI in financial planning software market is projected to reach $5.2 billion by 2025.

Cloud computing is a major tech trend. OneStream uses a cloud platform for scalability. This helps manage large datasets efficiently. In 2024, cloud spending is forecast to reach $678.8 billion, a 20.7% increase from 2023. Effective data management is key for OneStream's operations.

OneStream's integration with various systems like ERP and CRM is crucial. Its technology facilitates unified financial data management. However, setup complexity varies. In 2024, seamless integration capabilities are key to platform adoption. OneStream's revenue grew 30% in 2023, showing its strong market position.

Data Security and Reliability

Data security and reliability are paramount for OneStream. The platform must provide accurate, consistent, and reliable data to support informed decision-making and regulatory compliance. Ensuring data integrity is crucial, especially given the increasing frequency of cyberattacks targeting financial systems. For example, in 2024, financial institutions reported a 38% rise in cyberattacks. Robust security protocols and regular audits are essential.

- Cybersecurity spending in the financial sector is projected to reach $200 billion by 2025.

- Data breaches cost financial institutions an average of $5.9 million in 2024.

- 95% of financial institutions use cloud-based security solutions.

Pace of Technological Change

The swift advancement of technology poses both challenges and opportunities for OneStream. Rapid changes can disrupt project timelines and necessitate ongoing innovation to remain competitive. OneStream's emphasis on continuous product development directly addresses this factor. The company invested approximately $70 million in R&D in 2024. This focus is crucial, as 60% of companies report technology as a primary driver of market disruption.

- R&D investment of $70 million in 2024.

- 60% of companies view technology as a key disruption factor.

Technological factors significantly impact OneStream. AI integration boosts forecasting; the AI in financial planning software market will hit $5.2B by 2025. Cloud computing and system integration, with cloud spending at $678.8B in 2024, are crucial. Data security is paramount, reflected by the $200B cybersecurity spending projected for the financial sector by 2025. OneStream's $70M R&D investment in 2024 is essential due to technology’s disruptive role.

| Technology Aspect | Impact on OneStream | Data |

|---|---|---|

| AI in FP&A | Enhanced Forecasting | $5.2B market by 2025 |

| Cloud Computing | Scalability and Efficiency | $678.8B spending in 2024 |

| Data Security | Data Integrity & Trust | $200B cybersecurity spend by 2025 |

| R&D Investment | Innovation & Competitiveness | $70M invested in 2024 |

Legal factors

Compliance with financial regulations and having a clear legal framework for data management and security are crucial for any company's operational integrity. OneStream's platform supports adherence to reporting standards like GAAP and IFRS. In 2024, companies faced significant penalties for non-compliance; for example, the SEC imposed over $4.6 billion in penalties. OneStream assists in navigating these complex requirements. It is a critical factor for financial health.

Legal factors significantly influence OneStream's operations. Mandatory ESG disclosures are expanding globally; the UK and EU have already implemented them. OneStream's ESG reporting solution helps businesses comply with these regulations. The market for ESG software is projected to reach $36.4 billion by 2028. OneStream aligns with frameworks like SASB, GRI, and CSRD.

Data privacy and security laws, like GDPR, are crucial. OneStream must comply to protect financial and operational data. Breaches can lead to hefty fines. For example, in 2024, the average cost of a data breach was $4.45 million globally. Compliance is essential.

Software Licensing and Service Terms

Software licensing and service terms are crucial for understanding how OneStream's platform can be used. These terms dictate user rights, data privacy, and limitations of liability. They also cover aspects like intellectual property rights and acceptable use policies. In 2024, OneStream updated its licensing agreements to reflect evolving data security standards.

- Updates in 2024: OneStream's terms now explicitly address AI-related usage.

- Data Privacy: Compliance with GDPR and CCPA is a key focus.

- Liability: The terms limit OneStream's liability for data breaches.

- User Rights: Clarifies the scope of use and restrictions on modifications.

Corporate Governance Regulations

Corporate governance regulations, encompassing board structure and ethical guidelines, shape how OneStream operates legally. These regulations ensure accountability and transparency in financial reporting and decision-making processes. Companies must adhere to these rules to maintain investor confidence and avoid legal penalties. The Sarbanes-Oxley Act of 2002 in the U.S. significantly impacts corporate governance, setting standards for financial reporting and internal controls.

- SOX compliance costs for large companies average $1.8 million annually.

- Globally, the trend is towards stricter governance.

- Failure to comply can result in lawsuits.

- In 2024, governance failures led to significant losses.

Legal compliance requires OneStream's robust framework to adhere to reporting standards and manage data securely. Mandatory ESG disclosures are expanding, with ESG software projected to reach $36.4 billion by 2028. Compliance with data privacy laws like GDPR is essential, given the average cost of a 2024 data breach globally was $4.45 million.

| Legal Factor | Impact | Data/Example (2024/2025) |

|---|---|---|

| Financial Regulations | Compliance & penalties | SEC penalties > $4.6B in 2024 |

| ESG Disclosures | Compliance for transparency | Market projected to reach $36.4B by 2028. |

| Data Privacy | Protection & penalties | Average data breach cost: $4.45M globally in 2024 |

Environmental factors

Environmental, Social, and Governance (ESG) factors are becoming increasingly important, requiring companies to report their environmental impact, including carbon emissions and climate change vulnerability. OneStream provides solutions to help companies collect, calculate, and report environmental data. In 2024, ESG assets reached $40.5 trillion globally, highlighting the growing significance of environmental reporting.

Climate change presents significant risks and opportunities, requiring companies to assess potential financial impacts. Transparency regarding ESG risk factors, including climate change, is crucial. OneStream's platform aids in evaluating these impacts. According to the IPCC, global temperatures are projected to rise by 1.0°C to 1.8°C by 2050.

Organizations are increasingly focused on sustainability, setting ambitious goals like NetZero emissions. OneStream's platform aids in planning and forecasting for these initiatives. It helps track performance against set targets. For instance, in 2024, the global ESG investment market reached $40.5 trillion, reflecting this shift.

Resource Use and Supply Chain Impact

Environmental reporting assesses how a company uses resources and affects its supply chain. OneStream can integrate data to capture this, aiding in tracking environmental impact. In 2024, 68% of businesses increased their focus on supply chain sustainability. This integration is crucial for compliance and strategic planning.

- 68% of firms boosted supply chain sustainability focus in 2024.

- OneStream helps track resource use and supply chain effects.

Environmental Regulations and Standards

Environmental factors are crucial for businesses. Compliance with evolving sustainability disclosure standards, such as those from the ISSB, is vital. OneStream's platform assists in aligning reporting with these standards. In 2024, the global ESG reporting software market was valued at $1.2 billion, projected to reach $2.5 billion by 2029, growing at a CAGR of 15.9%. This underscores the importance of environmental considerations.

- The ISSB standards aim to create a global baseline for sustainability disclosures.

- OneStream helps streamline ESG reporting processes.

- Growing market for ESG reporting software.

- Environmental regulations impact business operations and strategy.

Environmental factors increasingly influence business strategy and compliance. Firms must meet sustainability reporting standards, supported by tools like OneStream. The ESG software market grew in 2024, reflecting this shift.

| Key Aspect | Data/Insight | Year |

|---|---|---|

| ESG Assets | $40.5 Trillion Globally | 2024 |

| Supply Chain Sustainability Focus | 68% of Businesses Increased Focus | 2024 |

| ESG Software Market | $1.2 Billion Value | 2024 |

PESTLE Analysis Data Sources

OneStream's PESTLE uses data from government agencies, market reports, economic indicators, and regulatory databases. Data ensures analysis is accurate and reflects current market dynamics.