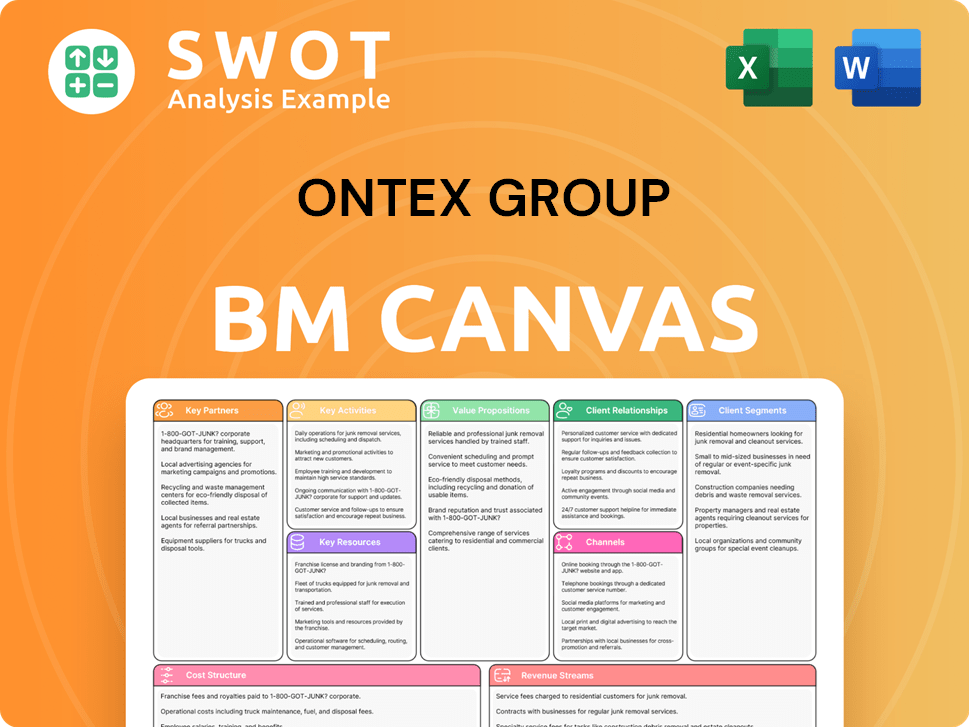

Ontex Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ontex Group Bundle

What is included in the product

Ontex Group's BMC reflects its global operations, detailing customer segments, channels, and value propositions.

High-level view of the company’s business model with editable cells.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas previewed here for the Ontex Group is the actual document you'll receive. There's no difference between the preview and the downloadable file upon purchase. You'll gain full access to the complete, ready-to-use Canvas.

Business Model Canvas Template

Explore Ontex Group's core business model! Their focus is on personal hygiene products, targeting diverse customer segments. Key partnerships with retailers and suppliers drive their operational efficiency. Revenue streams come from product sales across various brands. Dive deeper into their value proposition and cost structure.

Partnerships

Ontex Group depends on its suppliers for materials like non-wovens. Reliable sources are key for production. Strong supplier relations ensure quality and supply. Standardizing materials allows big-scale procurement. This improves service and efficiency. In 2024, Ontex's cost of sales was approximately €2.1 billion, highlighting the importance of efficient material sourcing.

Retailers and healthcare providers are crucial for Ontex. They serve as key channels, ensuring product accessibility. Collaborations on private labels and partnerships for adult care are vital. Ontex aims to fully focus on these brands by 2025. In 2024, Ontex's retail sales were about 70% of revenue.

Efficient logistics are vital for Ontex's global reach. It partners with logistics providers for timely, cost-effective deliveries. Ontex's products reach about 100 countries. In 2023, Ontex reported €2.3 billion in sales, highlighting the importance of its distribution.

Technology and Innovation Partners

Ontex Group's partnerships with technology and innovation partners are crucial for driving advancements in product development and manufacturing. This collaboration focuses on creating sustainable and cost-effective products, a core strategic pillar. The strategy includes faster innovation cycles and a unified product platform. These partnerships enable Ontex to stay competitive and meet evolving consumer needs.

- Cost reduction: Ontex aims for €100 million in cost savings by 2026, partly through tech partnerships.

- Sustainability: Emphasis on eco-friendly materials and processes.

- Innovation: Development of new product features, like improved absorption technology.

- Efficiency: Streamlining manufacturing processes through automation and data analytics.

Sustainability Organizations

Ontex Group actively forges key partnerships with sustainability organizations to bolster its eco-friendly initiatives. Collaborations with entities like The Shift and the Belgian Alliance for Climate Action are pivotal. These alliances help Ontex achieve its sustainability targets and enhance its brand image. In 2024, Ontex earned a gold medal from EcoVadis, ranking in the top 5% for transparency in sustainable practices.

- Partnerships with sustainability organizations support environmental goals.

- Collaborations boost Ontex's reputation.

- EcoVadis awarded Ontex a gold medal in 2024.

- Ontex is in the top 5% of assessed companies.

Ontex Group strategically forms tech and innovation partnerships for product development. These collaborations aim for cost savings, targeting €100 million by 2026. Partnerships also focus on sustainability, innovation, and enhancing manufacturing efficiency. EcoVadis recognized Ontex's commitment, awarding a gold medal in 2024.

| Partnership Type | Focus Area | 2024 Highlight |

|---|---|---|

| Technology | Product Development | €100M Cost Savings Target by 2026 |

| Sustainability | Eco-Friendly Initiatives | EcoVadis Gold Medal |

| Retailers | Sales Channels | 70% Revenue from Retail |

Activities

Ontex's core is product development, constantly adapting to consumer needs. They focus on creating new and enhancing current offerings. A key example is the launch of Dreamshield 360° and Stop&Lock. In 2024, Ontex invested significantly in R&D, aiming to improve product performance and user experience. This strategy helps maintain their market position.

Manufacturing and production are core activities for Ontex. Efficient processes are vital for producing high-quality hygiene products affordably. Optimizing production and assets is key for competitiveness. Ontex focuses on harmonizing and upgrading assets, optimizing networks, and achieving manufacturing excellence. In 2023, Ontex's net sales were approximately €2.3 billion.

Sales and marketing are key for Ontex. They promote products to retailers and consumers. Strong relationships and service are vital. In 2024, Ontex focused on brand building, especially in Europe. This strategy aims to boost market share and revenue.

Supply Chain Management

Supply chain management is crucial for Ontex Group, ensuring a steady stream of raw materials and finished products. This encompasses procurement, logistics, and inventory control. Optimizing the product portfolio has led to contract reviews with suppliers of non-woven materials. This focus improves product quality, customer service, and operational efficiency.

- In 2024, Ontex reported €2.3 billion in net sales.

- The company's supply chain initiatives aim to reduce costs by 5%.

- Ontex operates globally, with manufacturing in 10 countries.

- The company sources materials from over 500 suppliers.

Strategic Divestments and Acquisitions

Ontex Group's strategic activities involve carefully managing its portfolio through divestments and acquisitions. The company has recently sold businesses in Turkey and Brazil. These moves aim to streamline operations and concentrate on key markets. By the end of 2025, Ontex plans to focus entirely on its retailer and healthcare brands.

- In 2023, Ontex completed the sale of its business in Turkey.

- The company's net sales for Q1 2024 were €568.1 million.

- Ontex aims to achieve a net leverage ratio of below 3.0x by the end of 2024.

Ontex excels in product innovation, illustrated by Dreamshield. Efficient manufacturing, vital for competitiveness, is another key area. Sales and marketing, particularly brand building in Europe, are essential. Supply chain management is also crucial. Ontex's strategic activities include portfolio management.

| Activity | Description | 2024 Focus |

|---|---|---|

| Product Development | Innovation and improvement of products | R&D Investment |

| Manufacturing | Efficient production of hygiene products | Optimizing networks |

| Sales & Marketing | Promoting products to consumers and retailers | Brand building in Europe |

| Supply Chain | Procurement, logistics, and inventory control | Cost reduction by 5% |

| Strategic Activities | Portfolio management via divestments/acquisitions | Focus on core brands |

Resources

Ontex operates across 14 countries, with strategically placed manufacturing facilities vital for production. These facilities produce personal hygiene products, critical to its operations. The company's sites hold certifications like ISO 9001 and ISO 13485. These sites also hold MDSAP, BRC, IFS, and GMP certifications. In 2024, Ontex's revenue was approximately EUR 2.4 billion.

Ontex leverages a portfolio of established brands such as Canbebe, Helen Harper, and iD. These brands are key for market presence. Patents are crucial for securing a competitive edge. In 2024, Ontex filed 28 new patent families. This drives innovation in premium segments.

Ontex's supply chain network is key for raw material sourcing and product distribution. This is vital for meeting consumer needs. Ontex uses data to stay competitive. In 2024, Ontex reported a revenue of €2.3 billion, showing the network's importance.

Human Capital

Human capital is crucial for Ontex Group, driving innovation, ensuring high-quality manufacturing, and maintaining strong customer relationships. The company's workforce of around 5,500 employees is a core asset. Ontex reinforced its PRIDE values in 2023, focusing on employee engagement. These values help create a positive work environment.

- Ontex's workforce plays a key role in its operations.

- PRIDE values support employee engagement.

- High-quality manufacturing relies on skilled employees.

- Innovation and customer relations are driven by people.

Financial Resources

Financial resources are crucial for Ontex Group's strategic execution. These resources support investments in R&D, manufacturing expansion, and strategic projects. As of December 31, 2024, Ontex reported a strong liquidity position. This includes €124.2 million in cash and €246 million available under a €270 million revolving credit facility, ensuring financial flexibility.

- Cash position: €124.2 million (Dec. 31, 2024)

- Available credit facility: €246 million (out of €270 million)

- Supports R&D and expansion

- Enables strategic initiatives

Ontex relies on its facilities, brands, supply chain, workforce, and finances.

The company uses established brands and patents for market advantage and innovation.

Ontex's solid financial position supports strategic growth.

| Key Resource | Description | 2024 Data |

|---|---|---|

| Manufacturing Facilities | Production sites vital for product output and distribution across 14 countries. | Revenue of approx. €2.4B. Certifications: ISO 9001, etc. |

| Brands & Patents | Established brands (Canbebe, Helen Harper, etc.), patents for competitive edge. | 28 new patent families filed |

| Supply Chain | Network for sourcing raw materials and distributing products to meet demand. | Revenue of €2.3 billion |

| Human Capital | Workforce driving innovation, manufacturing quality, and customer relations. | Approx. 5,500 employees. PRIDE values reinforced. |

| Financial Resources | Funding investments in R&D, expansion, and strategic projects. | €124.2M cash, €246M credit facility available (Dec. 31, 2024). |

Value Propositions

Ontex's value lies in its provision of quality personal hygiene products across various categories. These include baby care items, feminine hygiene solutions, and adult incontinence products. The company focuses on delivering comfort and reliability through its product design and manufacturing processes. In 2024, Ontex reported a revenue of €2.2 billion, demonstrating the market's trust in its offerings.

Ontex's affordable pricing strategy centers on delivering accessible personal hygiene products. This is especially crucial for private label brands, ensuring essential items are within reach for many. A key focus is offering innovations at competitive prices to maximize customer value. In 2024, the personal hygiene market saw increased demand for cost-effective solutions.

Ontex emphasizes sustainability, minimizing environmental impact through sustainable materials and waste reduction. They integrate sustainability into products, invest in people, and uphold ethical standards with full transparency. In 2023, Ontex reported €2.2 billion in net sales, demonstrating a focus on sustainable practices within their business model.

Customized Products for Retailers

Ontex Group's value proposition includes customized products for retailers. They collaborate with retailers to create private label brands, catering to specific customer demands. This approach enables retailers to offer distinct and varied product lines. Partnering with retailers and healthcare providers broadens Ontex's customer reach.

- Ontex's private label sales in 2023 were a significant portion of its revenue.

- This strategy allows retailers to compete effectively with established brands.

- Customization also helps in building customer loyalty.

- This model supports market segmentation and targeted product development.

Innovative Features

Ontex Group's value proposition centers on innovation, constantly improving its product offerings. This dedication ensures better performance and user convenience. Features like advanced leak protection and enhanced comfort are key. The launch of technologies such as Dreamshield 360° and Stop&Lock Anti-Leak highlights this commitment.

- Dreamshield 360° technology aims to improve leakage protection and fit.

- Stop&Lock Anti-Leak is designed for enhanced absorbency.

- Ontex's R&D spending in 2024 amounted to approximately €40 million.

- Ontex aims to be a leader in product innovation.

Ontex offers quality personal hygiene products, including baby care, feminine hygiene, and adult incontinence items, focusing on comfort and reliability. It provides affordable, accessible personal hygiene solutions, essential for private label brands, with cost-effective innovations. The company emphasizes sustainability, using sustainable materials and minimizing environmental impact.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Quality Products | Offers reliable baby care, feminine hygiene, and adult incontinence products. | Revenue: €2.2 billion |

| Affordable Pricing | Provides accessible products, especially for private labels. | Market demand for cost-effective solutions increased. |

| Sustainability | Focuses on sustainable materials and waste reduction. | Net sales in 2023: €2.2 billion |

Customer Relationships

Ontex Group utilizes direct sales teams, focusing on relationships with major retailers and healthcare providers. These teams offer tailored service and support, fostering customer-centricity. In 2024, Ontex saw 6.2% organic sales growth, driven by strong relationships. This approach streamlines portfolios and enhances business outcomes. Customer satisfaction scores are key metrics.

Ontex Group's customer service focuses on building loyalty and satisfaction. They handle inquiries, resolve issues, and offer product information. In 2024, Ontex aimed to improve customer service response times by 15%. This includes agile and effective request handling, essential for maintaining a strong market position.

Ontex Group cultivates collaborative partnerships with retailers and healthcare providers, tailoring products to their demands. These collaborations solidify enduring relationships, vital for market stability. Commercial teams, alongside R&D, streamline the product range, maintaining customer loyalty. In 2024, Ontex reported a revenue of EUR 2.3 billion, emphasizing the importance of strong partnerships. This strategy ensures continued market presence.

Data-Driven Insights

Ontex Group leverages data analytics to deeply understand customer behaviors and market dynamics, allowing for the customization of products and services. This data-driven strategy boosts customer satisfaction and boosts sales figures. For example, in 2023, Ontex reported a revenue of approximately €2.2 billion, indicating the effectiveness of its customer-centric approach. Ontex strategically invests in data analytics to maintain a competitive edge in the consumer goods market.

- Data analysis allows Ontex to predict consumer needs.

- Customization is a key element of the Ontex customer strategy.

- The focus is on enhancing customer satisfaction.

- Ontex's investment in data is ongoing.

Sustainability Initiatives

Engaging customers in sustainability strengthens brand loyalty and showcases Ontex's environmental dedication. They promote eco-friendly product options and minimize environmental effects. Ontex's transparency earned a gold medal from EcoVadis, ranking them among the top 5% globally. This commitment resonates with consumers. In 2024, Ontex increased its use of sustainable materials.

- EcoVadis Gold Medal: Top 5% for transparency.

- Focus: Promoting sustainable product choices.

- Impact: Strengthens brand loyalty.

- 2024 Action: Increased sustainable materials usage.

Ontex Group focuses on direct sales and tailored service, fostering strong relationships with retailers. In 2024, the company achieved 6.2% organic sales growth, highlighting effective customer-centric strategies. Customer satisfaction and loyalty are driven by responsive service and collaborative partnerships. Data analytics also support customer understanding.

| Aspect | Description | 2024 Data |

|---|---|---|

| Sales Growth | Organic growth reflects successful relationship management. | 6.2% |

| Revenue | Strong partnerships support revenue. | EUR 2.3 billion |

| Sustainability Ranking | Commitment to sustainability improves brand loyalty. | EcoVadis Gold Medal |

Channels

Retailers, including supermarkets and hypermarkets, serve as Ontex's main distribution channels. They are essential for delivering baby care, feminine care, and adult care products to consumers. Strong retailer relationships are vital for success. Ontex's products are available through retailers in approximately 100 countries, showcasing its extensive reach. In 2024, Ontex reported sales of €2.4 billion.

Pharmacies and drugstores are key channels for Ontex's adult and feminine care products, offering specialized product access. These channels, alongside retail and medical institutions, are primary sales avenues. In 2024, the pharmacy channel saw a 3% growth in sales for similar products. This channel's importance is underscored by its direct customer reach.

Healthcare providers, including hospitals and nursing homes, serve as crucial channels for distributing adult care products, particularly for institutional needs. These channels necessitate tailored sales and distribution approaches to effectively reach the end-users. Ontex collaborates with healthcare providers, and its products are trusted by over 35 million individuals globally. Ontex's 2024 revenue was approximately €2.5 billion.

Online Retail

Online retail is a crucial channel for Ontex, facilitating direct consumer engagement. The company leverages its own online stores and third-party platforms to broaden its market reach. This strategy is particularly relevant given the growing demand from an aging demographic. In 2024, e-commerce sales in the personal care segment are projected to reach $70 billion globally.

- E-commerce platforms provide direct consumer access.

- Ontex utilizes both owned and third-party online stores.

- The strategy aligns with the needs of an aging population.

- Online sales in personal care are expected to increase.

Direct Sales

Ontex Group's direct sales channel focuses on building relationships with key retailers and healthcare providers, offering personalized service, crucial for private label brands. Customer-centricity is at the core, fostering strong relationships and providing excellent service to simplify portfolios for success. In 2023, Ontex's revenue was approximately EUR 2.4 billion. Direct sales contribute significantly to maintaining and expanding market share. This approach ensures tailored support and drives customer loyalty.

- Direct sales teams manage key retailer relationships.

- Personalized service is offered, especially for private labels.

- Customer-centricity builds strong relationships.

- Ontex's 2023 revenue was around EUR 2.4 billion.

Ontex leverages diverse channels: retailers for broad distribution, pharmacies for specialized products, and healthcare providers for institutional needs. E-commerce platforms enable direct consumer engagement, with personal care sales projected to soar. Direct sales teams build strong relationships with retailers. In 2024, e-commerce accounted for 20% of total retail sales.

| Channel | Focus | 2024 Performance Indicators |

|---|---|---|

| Retailers | Mass Market | Sales of €2.4B |

| Pharmacies | Specialized Products | 3% sales growth |

| Healthcare | Institutional | Trusted by 35M+ |

Customer Segments

The Baby Care segment targets parents needing diapers, training pants, and wipes. Ontex offers brands like Canbebe, Helen Harper Baby, and Bio Baby. A significant driver is double-digit volume growth in North American baby care. In 2024, North American sales showed a positive trend. This segment remains crucial for Ontex's revenue.

The feminine care segment targets women of menstruating age. Ontex provides pads, liners, and tampons under Helen Harper and Fiore. In 2024, the global feminine hygiene market was valued at approximately $40 billion. Ontex's focus ensures it captures a share of this significant market.

The Adult Care segment focuses on adults dealing with incontinence, offering products like adult diapers and protective underwear. Ontex targets this segment, catering to the growing needs of an aging demographic. In 2024, the global adult incontinence market was valued at approximately $13.5 billion. Ontex reported that its adult incontinence sales grew by 4.2% in the first half of 2024.

Retailers (Private Label Customers)

Ontex's retailer segment focuses on private label customers. It manufactures personal hygiene products under retailers' brands. By the end of 2025, Ontex plans to concentrate on retailer and healthcare brands. This strategic shift aims to streamline operations. In 2024, private label sales represented a significant portion of Ontex's revenue.

- Focus on private label products for retailers.

- Manufacturing products under retailers' brands.

- Strategic shift towards retailer and healthcare brands by 2025.

- Private label sales contributed a major part of revenue in 2024.

Healthcare Institutions (Hospitals, Nursing Homes)

Ontex Group's healthcare institutions segment includes hospitals and nursing homes. These entities buy adult care products for patient needs. Sales occur through retail, medical institutions, and pharmacies. In 2024, the global market for incontinence products was valued at approximately $11 billion, reflecting the demand in this segment. This segment offers specialized products and services tailored to the healthcare environment.

- Focus on institutional needs.

- Utilize diverse sales channels.

- Address specific patient requirements.

- Capitalize on market growth.

The Baby Care segment targets parents, offering diapers and wipes; North American sales trends were positive in 2024. Feminine Care focuses on women, with pads and tampons; the global market was about $40 billion in 2024. Adult Care serves those with incontinence; the market was around $13.5 billion, with Ontex's sales up 4.2% in H1 2024.

| Customer Segment | Product Examples | Market Size/Growth (2024) |

|---|---|---|

| Baby Care | Diapers, Wipes | Positive Sales Trend in North America |

| Feminine Care | Pads, Liners, Tampons | $40 billion (Global) |

| Adult Care | Adult Diapers | $13.5 billion (Global), Ontex +4.2% (H1) |

Cost Structure

Raw material costs, including non-wovens and superabsorbents, are a substantial expense for Ontex Group. Maintaining profitability demands effective cost management. Streamlining the portfolio boosted non-woven material standardization. This enabled larger-scale procurement from fewer suppliers.

Manufacturing and production costs at Ontex Group encompass labor, energy, and facility upkeep. Optimizing production is key to lowering these expenses. In 2024, Ontex focused on efficiency to improve margins. They aimed for operational excellence through asset upgrades and network optimization.

Distribution and logistics costs cover transport, warehousing, and delivery. Efficient management is crucial for cost reduction. Ontex distributes products in about 100 countries. In 2023, Ontex's logistics expenses were a significant part of its operational costs. They continuously optimize their supply chain for efficiency.

Sales and Marketing Expenses

Sales and marketing expenses cover advertising, promotions, and sales team salaries. These costs are crucial for driving sales and building brand awareness. Ontex invests in strong relationships and excellent service to boost business success. Effective strategies include simplifying portfolios and understanding customer needs. In 2023, Ontex reported significant marketing investments to enhance market presence.

- Advertising and promotions are key to reaching consumers.

- Sales team salaries support direct customer engagement.

- Focus on service improves customer retention rates.

- Simplifying portfolios streamlines market focus.

Research and Development Costs

Ontex Group's research and development (R&D) investments are key for innovation. They focus on new products and process improvements. In 2024, Ontex launched 13 major innovations and filed 28 new patent families. This strategy aims to enhance their premium market position.

- R&D spending is vital for staying competitive.

- Focus on both product and process innovation.

- Ontex's patent filings show a commitment to innovation.

- Innovation efforts aim to capture higher-value market segments.

Ontex Group's cost structure includes raw materials, manufacturing, distribution, sales, and R&D. In 2023, marketing investments boosted market presence. They aim for operational excellence via asset upgrades.

| Cost Area | Focus | 2023 Data |

|---|---|---|

| Raw Materials | Non-wovens, superabsorbents | Substantial expense |

| Manufacturing | Labor, energy, facilities | Efficiency focus |

| Distribution | Transport, warehousing | Significant part of costs |

Revenue Streams

Ontex Group generates revenue through sales of baby care products. This includes diapers, training pants, and wipes, catering to parents and caregivers. Brands like Canbebe, Helen Harper Baby, Bio Baby, and Kiddies target various global markets. In 2024, baby care sales contributed significantly to the company's revenue, reflecting the demand for these products.

Ontex generates revenue through the sales of feminine care products. This includes pads, liners, and tampons, primarily under the Helen Harper and Fiore brands. In 2024, the global feminine hygiene market was valued at approximately $38 billion. Ontex's feminine care segment contributes a portion to this revenue, targeting women of menstruating age.

Ontex generates revenue through sales of adult care products, including diapers, protective underwear, and underpads. These are sold to individuals and healthcare institutions. The company capitalizes on the growing aging population. In 2024, the global adult incontinence market was valued at over $15 billion. Ontex's focus on this market segment is strategic.

Private Label Manufacturing

Private label manufacturing is a significant revenue stream for Ontex Group. It involves producing personal hygiene products like diapers and adult incontinence items for retailers who sell them under their brands. This business model allows Ontex to leverage its manufacturing capabilities and expertise to generate revenue. In 2023, Ontex's revenue was approximately EUR 2.4 billion, with a portion coming from private label contracts.

- Provides a stable revenue source through long-term contracts.

- Utilizes Ontex's existing production capacity efficiently.

- Offers diversification by serving various retail partners.

- Requires strong operational and supply chain management.

Licensing and Patents

Ontex Group leverages its product innovation through licensing and patents to generate revenue. This involves granting other companies the right to use their proprietary technologies. Ontex's long history of innovation provides it with valuable in-house expertise. Licensing agreements contribute to the company's diverse revenue streams. This strategy allows Ontex to capitalize on its intellectual property beyond direct product sales.

- Revenue from licensing proprietary technologies and patents is a key aspect of Ontex's business model.

- Ontex has a strong track record of product innovation.

- Licensing agreements enable Ontex to extend the reach of its technologies.

- This strategy enhances Ontex's revenue diversification.

Ontex Group diversifies its revenue streams through various channels. They sell baby care products like diapers, with brands such as Canbebe and Helen Harper Baby. Feminine care products including pads and liners also contribute to revenue. Adult care items, targeting the aging population, are another key source.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Baby Care | Diapers, wipes, and training pants. | Significant sales across global markets. |

| Feminine Care | Pads, liners, and tampons. | Contributes to a $38B market. |

| Adult Care | Diapers and protective underwear. | Focuses on a $15B+ market. |

Business Model Canvas Data Sources

This Ontex BMC uses financial statements, market analysis, and competitor reports. The information provided offers an overview based on multiple strategic resources.