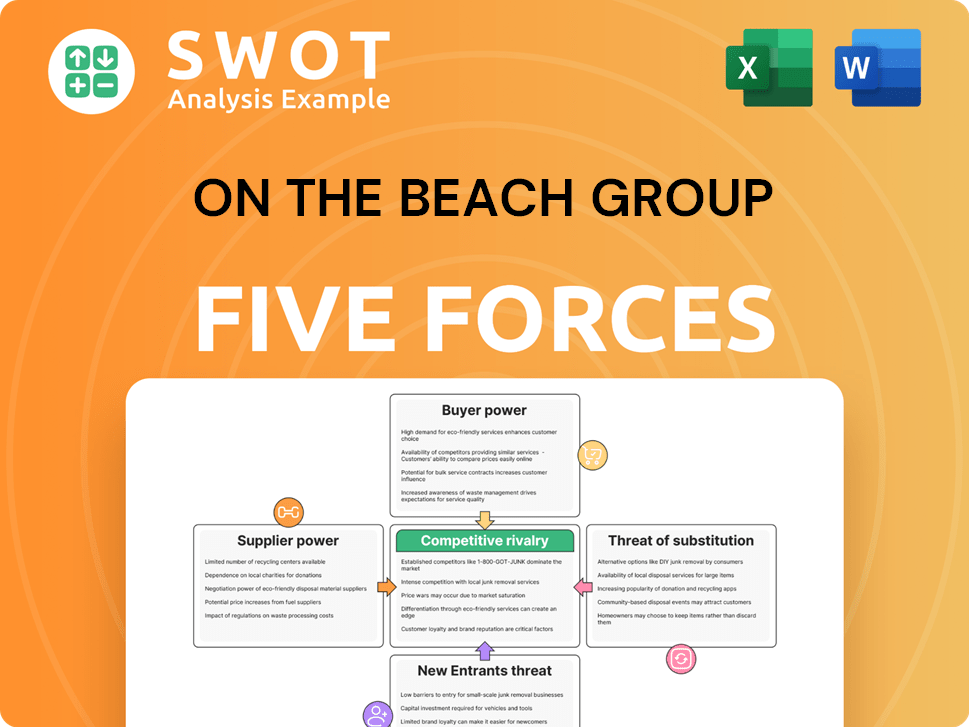

On the Beach Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

On the Beach Group Bundle

What is included in the product

Examines competition, customer power, and market entry threats specific to On the Beach Group.

Quickly assess competitive forces with an interactive, color-coded heat map.

What You See Is What You Get

On the Beach Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This On the Beach Group analysis employs Porter's Five Forces. It evaluates industry rivalry, supplier & buyer power, and threats of new entrants/substitutes. It is a fully formatted, ready-to-use document.

Porter's Five Forces Analysis Template

On the Beach Group faces intense competition, particularly from established online travel agencies (OTAs). Their bargaining power with suppliers, such as airlines and hotels, is moderate but impacted by the volume of bookings. Buyer power is significant due to price comparison tools, enabling customers to easily switch. The threat of new entrants is moderate, offset by brand recognition and the complexity of integrating travel services. Substitute products, like DIY travel planning, pose a growing but manageable threat.

This preview is just the beginning. Dive into a complete, consultant-grade breakdown of On the Beach Group’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Airlines possess moderate supplier power due to their control over flight capacity. On the Beach Group depends on airlines for flight inventory, vital for its package holidays. Airlines can influence prices and availability; in 2024, air travel costs fluctuated significantly. This impacts On the Beach's profitability, as seen with margin shifts in response to fuel costs and demand.

Hotels possess moderate supplier power, primarily due to differentiation. On the Beach relies on hotels for accommodation in package holidays. In 2024, average daily rates (ADR) for hotels in popular European destinations increased by approximately 7%, influencing On the Beach's operational costs. Popular hotels in sought-after locations can negotiate better terms. This affects On the Beach's profit margins.

Ancillary service suppliers like transfer or insurance providers hold minimal power over On the Beach. These services are typically commoditized, with numerous suppliers available. This competitive landscape gives On the Beach leverage. In 2024, the company likely negotiated favorable rates. This is evident in the 2023 report.

Supplier power: Technology platforms

Technology platforms are gaining influence in the travel industry, affecting companies like On the Beach. The company depends on technology for its booking system and customer interaction. Disruptions or price hikes from essential tech providers could significantly impact operations. For instance, in 2024, IT spending in the travel sector is projected to reach $200 billion.

- Reliance on IT: On the Beach's core business depends on its tech platform.

- Provider Impact: Key technology providers can affect operations through disruptions.

- Cost Concerns: Increased prices from tech providers can also hurt profitability.

- Industry Trend: The travel sector's IT spending is substantial, highlighting tech's significance.

Supplier power: Payment processors

Payment processors hold moderate power over On the Beach. The company depends on reliable payment services for its transactions. The industry is dominated by a few key players, giving them leverage. This allows them to impact transaction fees and other terms.

- In 2024, the global payment processing market was valued at approximately $100 billion.

- Companies like Visa and Mastercard control a significant portion of this market.

- Transaction fees can range from 1% to 4% depending on the service.

Payment processors have a moderate influence on On the Beach's operations. They are crucial for handling transactions; the industry is dominated by key players. This can affect On the Beach's profitability through transaction fees.

| Supplier | Influence | Impact on On the Beach |

|---|---|---|

| Payment Processors | Moderate | Affects transaction costs and operational terms. |

| Visa/Mastercard | Significant market share | Fees can range from 1% to 4%. |

| Market Value (2024) | Approx. $100B | The company's reliance means fees matter. |

Customers Bargaining Power

Customers of On the Beach Group exhibit high price sensitivity, crucial in a competitive online travel market. Price comparison is straightforward, intensifying the need for competitive pricing. In 2024, the company's revenue was £196.8 million, reflecting the price-sensitive environment. To attract and retain customers, On the Beach must maintain competitive prices.

Switching costs for customers are notably low. Consumers can effortlessly shift to rival online travel agencies, or even book directly with airlines and hotels. This ease of switching compels On the Beach to continuously enhance its customer experience. In 2024, online travel sales reached approximately $756.5 billion worldwide, highlighting the competitive landscape. On the Beach must offer strong value to retain customers.

Customers wield considerable bargaining power due to easy information access. Online platforms and reviews allow for informed choices, driving price sensitivity. On the Beach needs a strong reputation to counter this, particularly given the competitive travel market. In 2024, the online travel market reached $756.5 billion, highlighting the importance of customer influence. Transparent pricing is crucial for retaining customers.

Buyer power: Customization options

Customers' ability to customize their travel experiences significantly impacts On the Beach Group. Travelers increasingly demand tailored holiday packages. This pressure forces On the Beach to provide diverse options and flexible booking. Offering extensive customization enhances customer power.

- 2024: On the Beach focuses on delivering bespoke travel packages.

- Customization is a key differentiator in the competitive online travel market.

- Flexible booking arrangements are increasingly crucial for customer satisfaction.

- On the Beach must adapt to evolving customer preferences to stay competitive.

Buyer power: Brand loyalty

Brand loyalty for On the Beach is moderate. Customers have options in the online travel market, lessening strong allegiance. To keep customers, On the Beach must provide great value. In 2024, the online travel market saw fierce competition. This environment demands continuous innovation and enticing offers.

- Customer retention strategies.

- Market competition analysis.

- Value proposition enhancement.

- Loyalty program effectiveness.

Customers of On the Beach Group possess significant bargaining power, amplified by easy access to information and price comparison tools. This high power necessitates competitive pricing strategies to attract and retain customers. In 2024, the online travel market hit $756.5 billion, making customer influence critical.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High due to easy comparison | On the Beach revenue: £196.8M |

| Switching Costs | Low, easily switch providers | Online travel market: $756.5B |

| Customization | Demands tailored packages | Focus on bespoke travel |

Rivalry Among Competitors

The online travel market, where On the Beach operates, is fiercely competitive. It battles against other online travel agencies (OTAs), traditional travel agents, and direct bookings. This rivalry, intensified by players like Booking.com and Expedia, leads to pressure on pricing and marketing. For example, in 2024, the advertising spend in the travel sector reached approximately $10 billion, reflecting the intensity of the competition.

The competitive landscape features large, established players. TUI, Expedia, and Booking Holdings possess substantial market share and resources. In 2024, TUI's revenue was over €20 billion. On the Beach needs strong differentiation to succeed against these giants.

On the Beach Group operates in a market where marketing spend is a major factor. Online travel agencies must invest heavily in online advertising to attract customers. This increases the pressure on profitability for all players.

: Consolidation

The travel industry sees constant consolidation. Larger players emerge through mergers and acquisitions, increasing competitive pressure. On the Beach Group must adjust to these shifts to stay competitive. This means being agile and ready to respond to new market dynamics. For instance, in 2024, TUI Group's market cap was approximately €6.4 billion.

- Mergers can create stronger rivals.

- On the Beach needs to be flexible.

- Adaptation is key to survival.

- The competitive landscape evolves.

: Differentiation challenges

Differentiation poses a significant hurdle for On the Beach. It's tough for online travel agencies to stand out based on just price or what they offer. To truly compete, On the Beach must focus on providing top-notch customer service and unique travel packages. This strategy helps them carve out a special place in the market.

- Customer satisfaction scores are crucial; for example, a 2024 study shows agencies with higher scores see repeat bookings.

- Unique package deals, like those combining flights and hotels, can set On the Beach apart.

- Investing in technology to personalize travel experiences is another key area.

- Consider partnerships with niche travel providers for exclusive offers.

Intense competition marks On the Beach's market, with rivals like Booking.com. High marketing costs, such as the $10 billion sector spend in 2024, impact profitability. Adaptability to mergers and differentiation through customer service are crucial for On the Beach to stay competitive.

| Aspect | Details | Impact |

|---|---|---|

| Key Competitors | TUI, Expedia, Booking Holdings | High market share, pricing pressure |

| Marketing Spend (2024) | Approx. $10B | Reduces profit margins |

| Differentiation | Customer service, unique packages | Helps gain market share |

SSubstitutes Threaten

Direct bookings with airlines and hotels pose a considerable threat to On the Beach Group. Customers can choose to book directly, circumventing the need for an OTA like On the Beach. To remain competitive, On the Beach must provide unique value. In 2024, direct bookings accounted for a substantial portion of travel sales, highlighting this ongoing challenge.

Alternative holiday types, like cruises or adventure travel, pose a threat as substitutes. Customers might opt for these experiences instead of standard beach holidays. In 2024, cruise bookings surged, reflecting this shift. On the Beach needs to expand offerings or focus on specific customer segments. For example, in 2023, the adventure travel market was valued at $263 billion, signaling potential competition.

Package holiday alternatives, like independent travel where you book flights and hotels separately, pose a threat to On the Beach. Consumers can easily compare prices and customize their trips. On the Beach must emphasize the value and ease of its package deals to compete effectively. In 2024, independent travel bookings saw a 10% increase, highlighting the need for On the Beach to innovate.

: Staycations

Staycations and domestic travel pose a threat to On the Beach. Customers might opt for holidays closer to home, reducing demand for international travel. On the Beach needs to adapt its services to meet this shift. The UK staycation market is significant; for example, in 2023, domestic tourism spending in the UK reached £77.4 billion. This trend demands strategic adjustments.

- Increased Popularity: Domestic travel is becoming more popular.

- Customer Choice: Customers may choose staycations over international trips.

- Adaptation Needed: On the Beach must adjust offerings.

- Market Size: The UK staycation market is substantial.

: All-inclusive resorts

All-inclusive resorts pose a threat to On the Beach as substitutes, appealing to customers seeking convenience. These resorts bundle accommodation, meals, and activities into a single price, simplifying travel planning. On the Beach must compete by offering greater flexibility and competitive pricing on customized packages. In 2024, the all-inclusive market is valued at billions, growing annually. This growth indicates the ongoing appeal of all-inclusive options.

- Market size of all-inclusive resorts is billions.

- On the Beach needs to focus on flexibility and price.

- All-inclusive resorts offer bundled packages.

- Customers choose all-inclusive for convenience.

The threat of substitutes for On the Beach includes direct bookings, alternative holidays, and package holiday options. Staycations and all-inclusive resorts also present competition.

These substitutes offer customers different ways to travel, requiring On the Beach to adapt. Direct bookings and staycations are experiencing growth. The all-inclusive market is booming.

On the Beach needs to differentiate itself through flexibility, value, and specialized offerings to compete effectively.

| Substitute | Impact | 2024 Data |

|---|---|---|

| Direct Bookings | High | Significant portion of travel sales |

| Alternative Holidays | Medium | Cruise bookings surged |

| Package Alternatives | Medium | 10% increase in independent travel |

Entrants Threaten

Low capital requirements for online platforms significantly lower barriers to entry. Establishing an online travel agency doesn't demand heavy capital investment. This ease of entry attracts new competitors. For example, in 2024, the average startup cost for an online travel agency was around $50,000-$100,000, a relatively low sum. This makes it easier for new players to enter the market.

Established brand loyalty creates a high barrier for new entrants. On the Beach Group, with its established reputation, benefits from this. New competitors face the challenge of building trust. They'll need substantial marketing investments to compete effectively. In 2024, On the Beach Group's marketing spend was significant, reflecting its strong brand presence.

On the Beach Group faces a threat from new entrants due to technology dependence. Dependence on tech providers lowers barriers to entry. New competitors can use established platforms. This reduces the need for in-house tech development. This lowers costs; for example, in 2024, cloud services reduced IT infrastructure costs by up to 30% for some travel startups.

: Regulatory hurdles

Regulatory hurdles for new entrants are moderate, affecting online travel agencies like On the Beach Group. These companies must adhere to consumer protection and data privacy regulations. This compliance adds to the costs and complexities, acting as a barrier. The UK's Competition and Markets Authority (CMA) has been active in regulating the travel sector. In 2024, the CMA investigated several travel firms for unfair practices.

- Compliance costs: Costs associated with meeting regulatory requirements.

- Data protection: GDPR and other data privacy laws impact operations.

- Market investigations: CMA investigations can impact new entrants.

- Legal expertise: New entrants need legal expertise to navigate regulations.

: Economies of scale

Economies of scale present a significant barrier for new entrants in the online travel agency (OTA) market. Established players like TUI Group and Booking.com benefit from their size. They can secure better deals with airlines and hotels. This allows them to offer more competitive pricing.

- TUI Group's revenue in 2023 was approximately €20.7 billion.

- Booking Holdings (Booking.com's parent company) had a market capitalization of over $100 billion in 2024.

- Smaller OTAs often struggle with higher operating costs.

- New entrants find it difficult to match the pricing of established companies.

The threat from new entrants to On the Beach Group is moderate. Low startup costs for online platforms ease market entry. However, established brand loyalty and economies of scale pose significant challenges. Regulatory compliance adds costs, influencing the competitive landscape.

| Factor | Impact | Example (2024 Data) |

|---|---|---|

| Startup Costs | Lowers Entry Barriers | $50,000-$100,000 for an OTA |

| Brand Loyalty | High Entry Barrier | Significant marketing spend needed |

| Economies of Scale | High Entry Barrier | TUI Group's €20.7B revenue (2023) |

Porter's Five Forces Analysis Data Sources

The analysis leverages financial reports, market share data, industry publications, and competitor analysis.