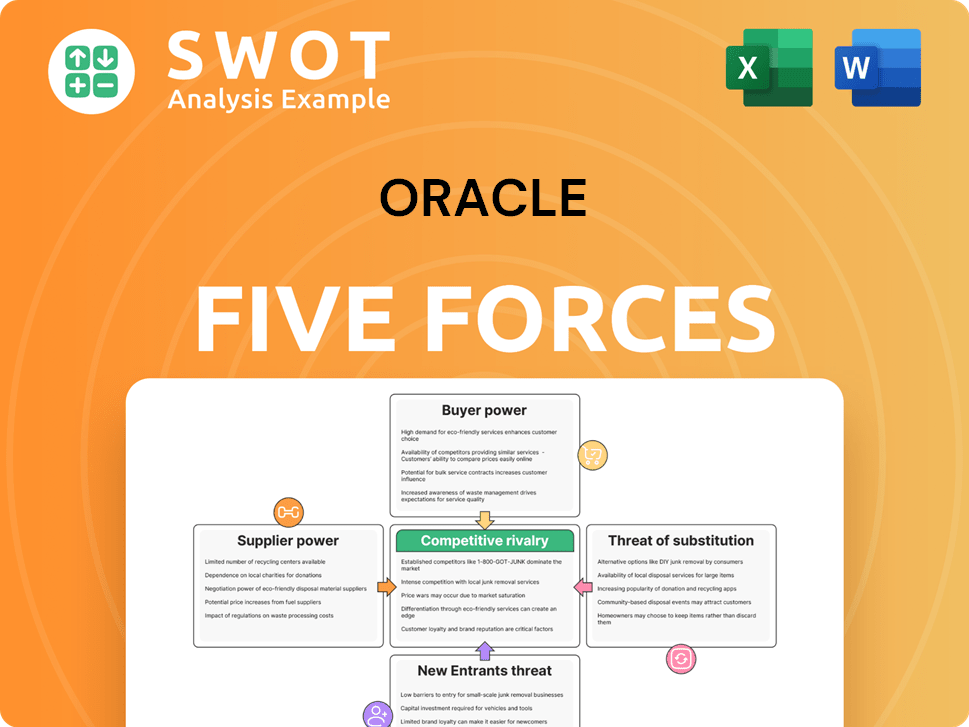

Oracle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oracle Bundle

What is included in the product

Analyzes competitive forces, supplier/buyer power, and potential threats within Oracle's market.

Instantly identify competitive forces with a simple color-coded interface to inform better business decisions.

Same Document Delivered

Oracle Porter's Five Forces Analysis

This Oracle Porter's Five Forces analysis preview is the complete report you'll receive. It provides a comprehensive examination of the competitive landscape. The document breaks down each force impacting Oracle's industry position. Detailed analysis is offered, revealing key insights for strategic decision-making. This is the same professional document accessible immediately after purchase.

Porter's Five Forces Analysis Template

Oracle faces a complex competitive landscape. Supplier power, like dependence on key tech providers, poses a challenge. The threat of new entrants is moderate, given the industry's barriers. Buyer power, from clients, is significant. Competitive rivalry with rivals like Microsoft is intense. Substitutes, such as cloud-based alternatives, are a constant concern.

This preview is just the beginning. Dive into a complete, consultant-grade breakdown of Oracle’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

Oracle's dependence on specific hardware and software suppliers limits its options. This concentration can empower suppliers, particularly those offering unique technologies. Suppliers may then influence pricing and terms, affecting Oracle's costs and innovation. Oracle's negotiation skills are vital; in 2024, Oracle's cost of revenue was $11.6 billion.

The enterprise hardware and cloud infrastructure market is highly concentrated. Companies like Intel and AMD wield considerable power due to their market dominance. This concentration allows suppliers to potentially increase costs for Oracle. In 2024, Intel's revenue was approximately $54 billion, showcasing its scale. To mitigate this, Oracle needs strong supplier relationships.

Oracle's vertical integration minimizes supplier bargaining power by controlling its supply chain. Owning its cloud infrastructure hardware design gives Oracle more control. This strategy can lower costs and reduce dependency on external suppliers. In 2024, Oracle's R&D spending was around $8.5 billion, reflecting this investment. However, it needs substantial R&D.

Strategic partnerships

Oracle strategically partners with tech giants like Intel and Cisco to gain advantages. These partnerships offer access to cutting-edge tech and better pricing terms, improving Oracle's bargaining power. Collaboration with suppliers strengthens Oracle's market position and mitigates supplier control. These alliances also enable co-innovation and early technology access.

- Intel's 2024 revenue reached $54.2 billion, indicating significant market influence.

- Cisco's 2024 revenue was around $57 billion, reflecting its strong position as a supplier.

- Oracle's strategic partnerships help manage costs.

- These collaborations foster innovation.

Customization needs

Oracle's dependence on specialized suppliers for customized software and hardware can elevate supplier power. Suppliers with unique expertise might hold more sway in negotiations with Oracle. Oracle can counteract this by encouraging competition and investing in internal customization capabilities. In 2024, Oracle's R&D spending totaled $7.4 billion, showcasing its commitment to internal innovation and reducing supplier dependence.

- Customization needs can increase supplier power.

- Specialized suppliers may have more leverage.

- Oracle can foster competition to mitigate this.

- Internal R&D and standardization are key.

Oracle faces supplier bargaining power challenges due to reliance on key vendors. Suppliers like Intel and Cisco, with 2024 revenues of $54.2 billion and $57 billion respectively, wield significant influence. Oracle mitigates this through strategic partnerships and internal R&D, spending $7.4 billion in 2024.

| Supplier | 2024 Revenue (approx.) | Impact on Oracle |

|---|---|---|

| Intel | $54.2B | Influences pricing, technology access |

| Cisco | $57B | Affects costs, innovation through partnerships |

| Oracle R&D | $7.4B (2024) | Reduces supplier dependence |

Customers Bargaining Power

Large enterprise clients significantly impact Oracle's revenue, giving them strong bargaining power. These clients can negotiate better pricing and service terms. Oracle must balance profit with customer satisfaction to keep these accounts. Strong relationships and tailored solutions are key; In fiscal year 2024, Oracle's cloud revenue grew 21% to $17.7 billion.

High switching costs can decrease customer bargaining power. Oracle customers, with significant investments in its ecosystem, face costly migrations. This lock-in strengthens Oracle's pricing leverage. However, cloud solutions are gaining traction, aiming to provide flexibility. In 2024, cloud spending increased by 20%, showing a shift away from vendor lock-in.

The enterprise software market, where Oracle operates, is fiercely competitive, featuring giants such as Microsoft, SAP, and Salesforce. This intense competition gives customers significant power, as they have a wide array of choices. Oracle needs to show its unique value to gain and keep customers. In 2024, the global enterprise software market was valued at approximately $672 billion, reflecting the scale of competition.

Long-term contracts

Oracle's enterprise software deals often involve long-term contracts, giving customers significant negotiating leverage. Customers can secure advantageous terms, including price reductions, service level agreements (SLAs), and support benefits. Oracle must skillfully manage these long-term relationships to ensure both customer satisfaction and sustained profitability. Maintaining trust and providing consistent value are crucial for these partnerships. In 2024, Oracle reported a customer retention rate of approximately 80% for its cloud services, reflecting the importance of these long-term contracts.

- Negotiated Discounts: Customers often negotiate discounts, which can range from 5% to 20% off the list price, depending on the contract's size and duration.

- Service Level Agreements (SLAs): SLAs guarantee uptime and performance, with penalties for Oracle if these are not met, such as service credits.

- Support Provisions: Contracts include support, with options like 24/7 access and dedicated support managers, affecting the overall cost.

- Contract Duration: Typical contracts extend from three to five years, influencing how Oracle forecasts revenue.

Cloud subscription model

The cloud subscription model significantly shifts customer power. Customers now find it easier to switch cloud providers due to subscription-based contracts. This flexibility heightens the pressure on Oracle to offer competitive pricing and continuous value. Oracle must focus on delivering a superior cloud experience to maintain customer loyalty.

- Oracle's cloud revenue grew 17% in fiscal year 2024, showing the importance of the cloud.

- The subscription model allows quicker switching, as seen by the industry's 10-15% average churn rate.

- Customer satisfaction scores are critical, with a 2024 industry average NPS of 35 for cloud providers.

- Oracle's investments in innovation are key to maintaining customer loyalty and market share.

Customers have significant bargaining power in the enterprise software market. Large clients can negotiate better deals, and competition provides alternatives. Long-term contracts influence Oracle's revenue predictability. Cloud subscriptions further shift power due to easy switching.

| Factor | Impact | 2024 Data |

|---|---|---|

| Discounts | Influences revenue | Negotiations vary, 5%-20% off. |

| Switching | Increases customer flexibility | Cloud churn rate: 10-15%. |

| Market Growth | Reflects competition | Enterprise software market ~$672B. |

Rivalry Among Competitors

The tech sector is fiercely competitive. Oracle faces rivals like Microsoft and SAP. This competition fuels innovation. Oracle's R&D spending in 2024 was $8.5 billion. Constant investment is crucial for Oracle to maintain its market position.

Oracle faces product overlap with competitors offering similar tech solutions. This intensifies rivalry as companies compete for the same market share. Oracle must differentiate its offerings to gain a competitive edge. In 2024, the global IT market reached $6.7 trillion, highlighting the stakes in this competitive landscape. Focusing on unique features helps.

Oracle confronts intense rivalry in cloud computing, notably from AWS, Microsoft Azure, and Google Cloud. These rivals have a considerable lead; for example, AWS held around 32% of the market in 2024. Oracle's OCI investments and AI focus aim to stand out. Strategic alliances and competitive pricing are crucial for market share growth. In Q3 2024, Oracle's cloud revenue grew by 25% to $5.1 billion.

Innovation imperative

Innovation is vital in tech. Oracle constantly develops new products and services. They invest heavily in R&D to stay ahead. Focusing on AI and machine learning is key for growth. Oracle's R&D spending in 2024 was $8.5 billion.

- Oracle's R&D spending in 2024: $8.5 billion.

- Focus on AI and machine learning for future growth.

- Continuous innovation is a key factor.

- Meet evolving customer needs.

Market share dynamics

Oracle faces stiff competition in the cloud infrastructure market, where its market share is smaller than industry leaders. However, Oracle is experiencing rapid growth in AI-related cloud services, a strategic focus area. Oracle's competitive edge stems from its integrated cloud services and database technology. To boost market share, Oracle must prioritize customer acquisition, product differentiation, and strategic partnerships.

- Oracle's cloud infrastructure market share is around 3% in 2024, significantly behind AWS and Azure.

- Oracle's revenue from cloud services grew by 25% in Q1 2024.

- Oracle has invested heavily in AI, with partnerships and acquisitions in the sector.

- Oracle's key partnerships include collaborations with Nvidia for AI infrastructure.

Oracle faces intense competition, particularly in cloud services from giants like AWS and Microsoft Azure. Oracle's market share in cloud infrastructure is smaller, approximately 3% in 2024, compared to leaders like AWS. However, Oracle's cloud revenue grew 25% in Q1 2024, driven by AI and database technology.

| Metric | Value (2024) | Notes |

|---|---|---|

| Cloud Infrastructure Market Share | ~3% | Significantly behind AWS and Azure |

| Cloud Revenue Growth (Q1) | 25% | Driven by AI and database technology |

| R&D Spending | $8.5 Billion | To stay competitive |

SSubstitutes Threaten

Oracle offers specialized software, including database management and cloud computing solutions. These are designed to meet specific business needs. Direct substitutes with the same functionality are hard to find. Oracle's industry focus, such as in healthcare, reduces the substitute threat. In 2024, Oracle's cloud revenue grew, showing its solutions' stickiness.

Organizations using Oracle face high switching costs, deterring them from substitutes. Migrating platforms is expensive and time-consuming, demanding major system changes. This vendor lock-in reduces the adoption of alternatives. In 2024, Oracle's revenue was $50.08 billion, showing its market hold despite competition.

Vendor lock-in can be a significant barrier against substitute products. Oracle's integrated solutions create interdependence, making it difficult for customers to switch. This strategy strengthens Oracle's market position, reducing the appeal of alternatives. For example, in 2024, Oracle's cloud revenue grew by 25%, indicating continued customer reliance. However, the trend toward open-source solutions challenges this lock-in.

Global customer base

Oracle's global customer base, encompassing large enterprises and government entities, poses a significant barrier to substitutes. Its extensive customer relationships and worldwide reach present a challenge for competitors aiming to replicate Oracle's scale. Oracle’s strong brand and established presence offer a key advantage in a competitive landscape. Focusing on customer satisfaction and market expansion is vital. In 2024, Oracle's revenue reached $50 billion, reflecting its robust market position.

- Global Presence: Oracle operates in over 145 countries, showcasing its extensive reach.

- Customer Retention: Oracle boasts a customer retention rate of approximately 90%, highlighting customer loyalty.

- Market Share: Oracle holds a significant market share in database management systems and enterprise software.

- Revenue Growth: Oracle's cloud services revenue grew by 25% in 2024, indicating strong demand.

Evolving technology landscape

The tech world is always changing, and so do what customers want. Oracle competes with giants like Microsoft, SAP, and Salesforce, offering similar products. New tech and changing tastes can create substitutes. To stay ahead, Oracle needs to keep innovating and keep customers happy. In 2024, Oracle's revenue was about $50 billion, reflecting its market position.

- Oracle's cloud revenue grew by 25% in fiscal year 2024.

- Microsoft's market capitalization exceeded $3 trillion in early 2024.

- SAP's cloud backlog reached €13.8 billion in Q4 2023.

- Salesforce's revenue for fiscal year 2024 was over $34 billion.

The threat of substitutes for Oracle is moderate due to the specialized nature of its software. Despite the presence of competitors, high switching costs and vendor lock-in create barriers. Oracle's focus on cloud services, which grew by 25% in 2024, shows its ability to maintain its market position.

| Aspect | Details | 2024 Data |

|---|---|---|

| Cloud Revenue Growth | Oracle's cloud services revenue | 25% |

| Total Revenue | Oracle's total revenue | $50.08 billion |

| Competitors | Key competitors in the market | Microsoft, SAP, Salesforce |

Entrants Threaten

Entering the enterprise software and cloud computing market demands substantial capital. New entrants face infrastructure, R&D, and marketing costs to rival Oracle. This financial hurdle deters many. Oracle's $16.9 billion in R&D in 2024 boosts its edge, ensuring market dominance.

Oracle benefits from strong brand recognition in the enterprise software market. New entrants face challenges in building brand trust and awareness. Oracle's established reputation supports customer loyalty. In 2024, Oracle's brand value was estimated at $40.9 billion, showcasing its market presence. This recognition is a key competitive advantage.

Oracle, with its vast size, enjoys significant economies of scale, enabling competitive pricing. New entrants struggle against Oracle's cost advantages, hindering their ability to offer comparable value. Oracle's global reach and operational efficiency further solidify its position. In 2024, Oracle's revenue reached $50.1 billion, demonstrating its scale advantage.

Regulatory hurdles

The technology industry faces strict regulations, including data privacy and security. New entrants often struggle with these complex, costly, and time-intensive requirements. Oracle's established compliance expertise gives it a significant advantage. Maintaining robust security and adapting to regulatory changes are vital for sustained success. In 2024, the global cybersecurity market is projected to reach $217.9 billion, highlighting the importance of regulatory compliance.

- Compliance costs can be substantial, impacting new firms.

- Oracle's existing infrastructure aids in regulatory adherence.

- Data privacy regulations are constantly evolving.

- Strong security protocols are essential for trust.

Network effects

Oracle's network effects significantly deter new entrants. As more users adopt Oracle's offerings, the value of these products increases, creating a strong competitive advantage. Oracle fosters this advantage by promoting platform adoption and cultivating a robust ecosystem of partners and developers. This strategy enhances the value proposition for users and makes it harder for new competitors to gain traction.

- Oracle's cloud revenue grew 17% to $5.1 billion in Q3 2024, showcasing strong adoption.

- Oracle has a vast network of partners, exceeding 20,000, which increases its reach and market penetration.

- The company's developer community numbers in the millions, further enhancing its ecosystem.

New entrants face considerable hurdles due to the high capital needs for enterprise software. Oracle’s robust brand and scale offer significant defenses. Strict regulations and network effects further impede market entry.

| Factor | Impact on New Entrants | Oracle's Advantage |

|---|---|---|

| Capital Requirements | High infrastructure, R&D, and marketing costs. | $16.9B in R&D (2024). |

| Brand Recognition | Building trust and awareness is difficult. | $40.9B brand value (2024). |

| Economies of Scale | Struggling with cost advantages. | $50.1B revenue (2024). |

Porter's Five Forces Analysis Data Sources

The Porter's analysis leverages SEC filings, industry reports, and market research data for accurate competitive insights.