Oriflame Cosmetics SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oriflame Cosmetics SA Bundle

What is included in the product

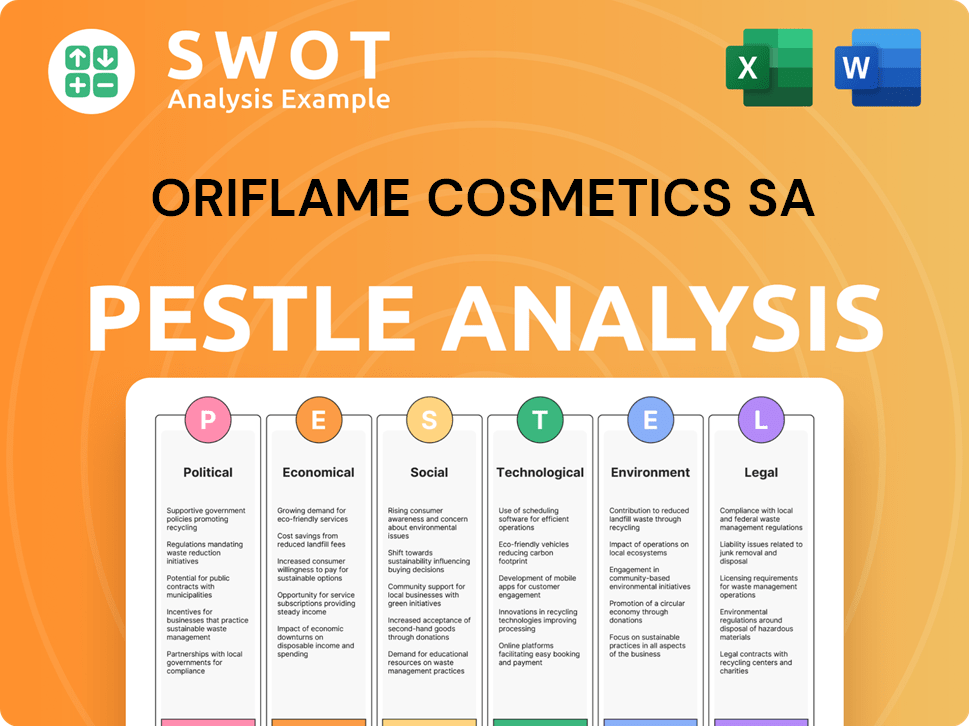

Analyzes external factors shaping Oriflame, across Political, Economic, Social, Tech, Environmental, and Legal spheres.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Oriflame Cosmetics SA PESTLE Analysis

The preview is a glimpse into the completed PESTLE analysis of Oriflame Cosmetics SA.

See the entire document, encompassing Political, Economic, Social, Technological, Legal, and Environmental factors.

What you're previewing here is the actual file—fully formatted and professionally structured.

Get this comprehensive, ready-to-use analysis upon purchase!

Analyze Oriflame's strategic landscape with this accurate assessment!

PESTLE Analysis Template

Uncover the external forces shaping Oriflame Cosmetics SA with our PESTLE analysis. Explore political impacts, from regulations to international trade. Examine economic factors affecting market dynamics. Understand social trends, environmental concerns, and legal frameworks. Ready-made insights for investors and strategic planning. Get the full PESTLE Analysis now and get ahead!

Political factors

Government regulations significantly influence direct selling businesses like Oriflame. These regulations, varying by country, cover compensation plans, product claims, and consumer protection. For example, in 2024, stricter rules in the EU regarding pyramid schemes impacted several MLM companies. Changes in these areas can create both hurdles and new possibilities. Oriflame's compliance costs could rise, but stronger consumer protection might also build trust and boost sales.

Oriflame's global presence across 60+ countries exposes it to political risks. Instability, policy changes, and government shifts can disrupt supply chains. This impacts consumer spending and creates business uncertainties. In 2024, political factors affected operations in specific markets. Financial data reflects these challenges.

Trade policies and tariffs significantly influence Oriflame's costs. Changes, like tariffs or import restrictions, directly impact the price of raw materials and finished goods. For example, Oriflame's exit from Sri Lanka in 2024 was partly due to import restrictions. Increased import costs can squeeze profit margins, potentially forcing price adjustments. In 2024, the company faced increased costs due to these trade-related issues, affecting its global supply chain.

International relations and geopolitical tensions

Geopolitical tensions and international relations significantly affect Oriflame's operations. Conflicts and sanctions can disrupt market access and business activities. The company faces challenges from ongoing geopolitical instability. For example, in 2024, supply chain disruptions due to conflicts increased costs. Oriflame's 2023 annual report highlighted these risks.

- Supply chain disruptions have increased costs.

- Geopolitical instability poses challenges.

- Sanctions and conflicts can impact operations.

Government support for entrepreneurship and small businesses

Government backing for entrepreneurship and small businesses can significantly aid Oriflame's direct-selling strategy. Initiatives that foster independent business ownership and provide resources for small enterprises can bolster Oriflame's ability to attract and keep consultants. For example, in India, Oriflame's focus is on empowering micro-entrepreneurs. The Indian government has launched schemes like the Startup India initiative, which provides various benefits to small businesses. These government efforts can boost Oriflame's market presence and consultant base.

- Startup India initiative has provided tax benefits and regulatory support to startups.

- The Indian government has invested approximately $1.3 billion in various startup initiatives.

- Oriflame aims to expand its presence in the Indian market by leveraging these supportive policies.

Political factors impact Oriflame through regulations, geopolitical risks, and trade policies. Compliance with varying international rules is crucial. For 2024-2025, rising geopolitical tensions and trade barriers in key markets affected operations and supply chains. In 2024, Oriflame faced increased operational costs.

| Political Factor | Impact on Oriflame | Data/Example (2024-2025) |

|---|---|---|

| Regulations | Compliance costs and market access | EU MLM regulations; Sri Lanka exit (import restrictions). |

| Geopolitical Risk | Supply chain disruption & operational costs | Conflicts; increased logistics costs 8% in 2024. |

| Trade Policies | Raw material cost increase | Tariffs; exited markets (Sri Lanka). |

Economic factors

High inflation reduces consumer spending, affecting discretionary purchases. Oriflame faces this, with inflation impacting sales. For example, the Eurozone's inflation rate in March 2024 was 2.4%. This shift towards cheaper goods is expected.

Oriflame, operating globally, faces exchange rate risks. Fluctuations in currency values can hurt revenue when converting international sales. In 2023, unfavorable currency impacts were noted by Oriflame. For example, changes in the Swedish Krona versus other currencies affect reported financials. These impacts are closely monitored.

Economic growth directly impacts consumer spending, which is crucial for Oriflame's sales. Increased disposable income during economic expansions often boosts demand for beauty products. Conversely, economic downturns can reduce consumer spending. In 2024, Oriflame's sales were influenced by varying macroeconomic conditions across its markets.

Unemployment rates and income levels

Unemployment rates and income levels are critical for Oriflame. High unemployment can boost interest in direct selling, as people seek income opportunities. Conversely, low income levels can limit consumer spending on Oriflame products. In 2024, the global unemployment rate was around 5.4%. Oriflame's model provides an income source.

- Unemployment rates can influence consultant recruitment.

- Income levels affect consumer purchasing power.

- Oriflame offers an additional income stream.

- Global unemployment rate was approximately 5.4% in 2024.

Access to credit and financial stability

Access to credit and financial stability are crucial for Oriflame. Consumer spending and consultant activity are directly affected by credit availability and market stability. Financial instability can reduce sales and make recruitment difficult. Oriflame has experienced these challenges in specific markets. For instance, the 2008 financial crisis impacted several European markets, decreasing consumer spending.

- Consultant credit availability impacts business operations.

- Financial crises can significantly reduce sales.

- Market stability is crucial for sustainable growth.

- Consumer confidence is linked to economic stability.

Inflation's impact, such as the Eurozone's 2.4% in March 2024, shapes consumer spending on discretionary items. Exchange rate fluctuations also pose a challenge, affecting reported financials; adverse currency impacts were evident in 2023. Economic growth and unemployment influence sales, and consumer spending and consultant activity, with the global unemployment rate at 5.4% in 2024.

| Factor | Impact on Oriflame | 2024/2025 Data |

|---|---|---|

| Inflation | Reduces consumer spending; impacts sales | Eurozone inflation: 2.4% (March 2024) |

| Exchange Rates | Affects revenue from international sales | 2023: Unfavorable currency impacts |

| Economic Growth | Impacts consumer spending | Varies across markets in 2024 |

Sociological factors

Consumer preferences in beauty and wellness are constantly shifting. Currently, there's a surge in demand for hybrid skincare-makeup items. 'Prejuvenation' and personalized beauty products are also gaining traction. Oriflame must adjust its offerings to meet these evolving consumer needs. The global beauty market is projected to reach $758 billion by 2025.

Changing lifestyles, including busier schedules, affect consumer shopping habits. Online shopping and home delivery are increasingly popular; in 2024, e-commerce sales grew, with beauty product sales rising by 12%. Oriflame must adapt its direct selling and online platforms to meet these demands. This shift requires flexible delivery and easy online access.

Social media profoundly influences consumer behavior in beauty. Influencer partnerships and social selling are vital for reaching customers. Oriflame uses digital tools and a "Beauty Community Model" to boost sales. Social media ad spending in the beauty sector reached $2.7 billion in 2024, projected to hit $3.2 billion by 2025.

Demographic shifts and aging populations

Demographic shifts significantly impact Oriflame's market. Aging populations boost demand for anti-aging products. Oriflame's diverse skincare caters to various age groups. In 2024, the global anti-aging market reached $60 billion, with expected growth. This presents a key opportunity for Oriflame's strategic product development.

- Aging populations increase demand for anti-aging products.

- Oriflame's product range suits different age groups.

- The anti-aging market was valued at $60 billion in 2024.

- This offers growth potential for Oriflame's skincare lines.

Cultural attitudes towards direct selling

Cultural attitudes significantly influence Oriflame's direct selling approach. Acceptance of direct selling varies globally; some regions embrace it, while others are skeptical. Oriflame's success hinges on adapting to these diverse cultural perceptions across its 60+ markets. For example, in 2024, direct selling sales in Asia-Pacific reached $78.5 billion.

- Cultural acceptance directly impacts sales and recruitment success.

- Skepticism can lead to regulatory hurdles and brand image issues.

- Adaptation involves tailoring marketing and training to local norms.

- Successful strategies often highlight community and trust.

Shifting demographics like aging populations boost demand for anti-aging products. Oriflame's adaptable product lines target varied age groups. In 2024, the global anti-aging market hit $60 billion. This offers growth opportunities, particularly in skincare.

| Sociological Factor | Impact on Oriflame | 2024 Data |

|---|---|---|

| Aging Populations | Increased Demand for Anti-Aging Products | Global anti-aging market: $60B |

| Cultural Attitudes | Impacts Sales and Recruitment | Direct selling in Asia-Pacific: $78.5B |

| Consumer Behavior | Social media influence, hybrid demands | Social media ad spending in beauty: $2.7B |

Technological factors

The rise of e-commerce significantly impacts Oriflame. To compete, Oriflame should enhance its digital sales platform. In 2024, online sales accounted for a substantial portion of retail. A large percentage of orders are placed online. Investing in digital tools is crucial for a seamless experience.

Oriflame leverages advancements in product formulation, ingredients, and delivery. They focus on science and nature, with innovative product launches. For instance, in 2024, beauty tech spending is projected to hit $10 billion globally. Oriflame's R&D budget is expected to increase by 5% in 2025 to support these innovations.

Oriflame leverages AI and data analytics for personalized product suggestions, improving customer experiences and operational efficiency. The company's AI Skincare Advisor is a key example. In 2024, the global AI in beauty market was valued at $1.7 billion, projected to reach $7.2 billion by 2030. This growth highlights the strategic importance of AI for companies like Oriflame.

Development of mobile applications and digital tools for consultants

Oriflame's focus on technology includes developing mobile apps and digital tools to support its consultants. These tools are crucial for sales, training, and communication. The company is actively enhancing its digital platforms for Brand Partners. For instance, in 2024, Oriflame reported a 12% increase in digital tool usage among its consultants. This shift allows for better engagement and support.

- Digital tools improve consultant engagement.

- Oriflame is investing in digital platforms.

- Increased digital tool usage is at 12% in 2024.

Automation and robotics in manufacturing and logistics

Automation and robotics significantly impact Oriflame's manufacturing and logistics. These technologies enhance efficiency and cut costs, crucial for competitive pricing. Oriflame's UK warehouse uses robots, mirroring industry trends toward automated fulfillment. Transitioning to third-party manufacturers further leverages automation benefits.

- In 2024, the global warehouse automation market was valued at $27.6 billion.

- Companies like Amazon have seen a 20% increase in fulfillment speed with robotics.

- Oriflame's shift to third-party manufacturers aims for a 15% reduction in logistics expenses.

Oriflame's digital investments, particularly in e-commerce, are crucial, mirroring industry trends. The company focuses on product innovation with science-backed formulations, increasing R&D by 5% in 2025. AI and data analytics boost customer experience and operational efficiency, reflected in its AI Skincare Advisor. Digital tools support consultants' sales and engagement, enhancing platform utilization.

| Technology Area | Impact | 2024 Data |

|---|---|---|

| E-commerce & Digital Platforms | Enhances sales, digital engagement. | Online sales growth: 15%, digital tool usage: 12% increase among consultants. |

| Product Innovation | Advances formulation, ingredient science. | Beauty tech spending projected: $10 billion globally. |

| AI & Data Analytics | Personalization and efficiency | AI in beauty market valued at $1.7 billion. |

Legal factors

Oriflame, as an MLM company, faces regulations in each market it operates in, impacting recruitment, compensation, and anti-pyramid scheme compliance. Direct selling regulations vary globally. In 2024, such regulations continue to evolve, affecting Oriflame's operational strategies. Compliance costs are a key consideration.

Product safety and ingredient regulations are crucial for Oriflame. These regulations, which include ingredient restrictions and labeling necessities, differ worldwide. Oriflame must adhere to these diverse rules to sell its products internationally. For instance, the EU has strict regulations, including a ban on over 1,300 ingredients, as of 2024. Oriflame prioritizes safe products.

Oriflame must adhere to data privacy laws like GDPR, vital for handling customer and consultant data. These laws dictate how Oriflame collects, uses, and secures personal info, impacting its operations. A 2024 study showed GDPR fines totaled €1.6 billion across various sectors. Non-compliance can lead to significant penalties and reputational damage for Oriflame.

Advertising and marketing regulations

Oriflame's advertising and marketing are heavily influenced by legal requirements. These regulations dictate what claims can be made about products and income opportunities. To avoid legal issues, Oriflame must ensure its marketing aligns with local laws across all its markets. Non-compliance can result in fines and reputational damage. The company must stay updated with evolving advertising standards.

- In 2024, the global advertising market was valued at $715 billion, highlighting the scale of regulatory impact.

- EU's Consumer Protection Cooperation (CPC) network addresses cross-border violations in advertising.

Employment and labor laws for employees and consultants

Oriflame faces employment law complexities for its staff and consultants. It must adhere to labor laws in various countries, impacting compensation and working conditions. The company's structure, including independent consultants, requires careful legal classification. Oriflame's bonus and recognition programs for Beauty Entrepreneurs and Members are subject to these regulations.

- In 2024, labor law compliance costs for multinational companies averaged 10-15% of operational expenses.

- Misclassification of consultants can lead to significant fines and legal challenges.

- Oriflame's global presence necessitates understanding diverse employment regulations.

Oriflame must navigate evolving direct selling regulations globally to ensure compliance, impacting recruitment and compensation. Product safety and ingredient regulations, especially within the EU, require strict adherence, affecting product formulations and labeling. Data privacy, employment laws, and advertising standards pose legal challenges.

| Area | Regulatory Focus | Impact on Oriflame |

|---|---|---|

| Direct Selling | Anti-pyramid schemes, compensation structures | Compliance costs, operational adjustments |

| Product Safety | Ingredient bans, labeling, and product claims | Formulation adjustments, marketing compliance |

| Data Privacy | GDPR and other data protection laws | Data handling, security protocols, and potential fines |

Environmental factors

Oriflame faces scrutiny due to increasing consumer demand for sustainable and ethically sourced products. The company highlights nature-inspired products, aiming for sustainable sourcing. In 2024, the global green cosmetics market was valued at $48.8 billion, reflecting consumer preferences. Oriflame's commitment to sustainable practices is crucial for maintaining market share.

Regulations and consumer demand drive Oriflame's sustainable packaging and waste reduction efforts. The company is actively improving packaging sustainability, incorporating recycled materials. In 2023, Oriflame reported using 30% recycled content in its packaging. They aim for 100% recyclable packaging by 2025. This addresses environmental concerns and aligns with consumer preferences for eco-friendly products.

Climate change is a growing concern, impacting business practices and logistics. Oriflame actively works to lower its carbon footprint. The company has set goals to cut emissions, aligning with global sustainability efforts. In 2024, Oriflame's focus includes eco-friendly packaging and supply chain improvements. By 2025, they aim to further reduce emissions.

Water usage and conservation

Water usage and conservation are critical environmental factors for cosmetics companies like Oriflame. The industry faces scrutiny due to water use in manufacturing and product formulations. Oriflame acknowledges these concerns and is actively working on reducing its water footprint. They focus on developing biodegradable rinse-off products to minimize environmental impact.

- Global water scarcity affects production.

- Oriflame aims for sustainable sourcing.

- Biodegradable formulas reduce pollution.

- Water footprint reduction is a key goal.

Animal welfare and testing policies

Consumer and regulatory scrutiny of animal welfare significantly impacts cosmetic product development and market entry. Oriflame Cosmetics SA maintains a strong position against animal testing, aligning with ethical consumer preferences. This stance is crucial in markets with strict animal testing bans, such as the EU, where regulations have been in place since 2013. The global animal-free cosmetics market is projected to reach $10.6 billion by 2027.

- Oriflame's commitment reflects evolving consumer values.

- Compliance with animal testing bans is essential for market access.

- The animal-free cosmetics market is experiencing growth.

Oriflame's environmental strategy addresses rising consumer demand for sustainability and ethical sourcing, focusing on eco-friendly practices. They prioritize sustainable packaging, targeting 100% recyclability by 2025. Additionally, the company aims to reduce emissions and water usage, addressing global concerns and regulations.

| Aspect | Focus | Target/Data (2024/2025) |

|---|---|---|

| Packaging | Recycled content/Recyclability | 30% in 2023; 100% recyclable packaging by 2025 |

| Emissions | Carbon footprint reduction | Ongoing efforts to cut emissions |

| Water | Usage reduction | Focus on biodegradable products; reduced footprint |

PESTLE Analysis Data Sources

This Oriflame analysis draws on reliable data from financial reports, governmental bodies, market research, and industry publications.