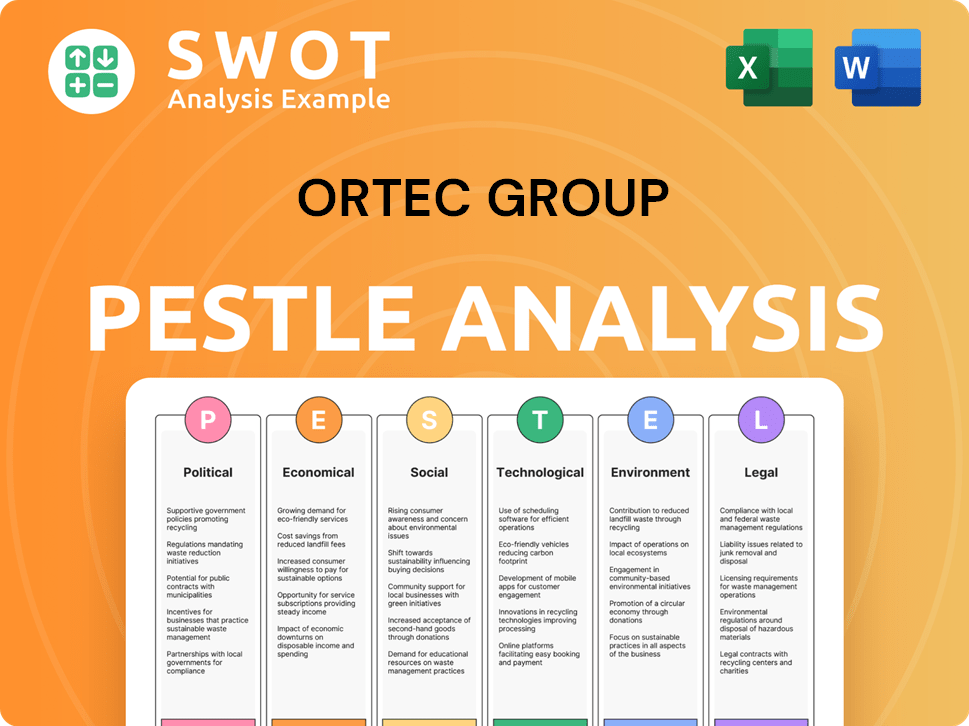

Ortec Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ortec Group Bundle

What is included in the product

A PESTLE analysis detailing how external macro-environmental factors impact the Ortec Group across six dimensions.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Ortec Group PESTLE Analysis

This preview showcases the complete Ortec Group PESTLE Analysis document. The structure, content, and formatting you see now is the exact file you'll download. No hidden sections or different versions – what you see is what you get! Prepare for a thorough strategic tool. After buying, it is yours!

PESTLE Analysis Template

Stay ahead of the curve with our PESTLE Analysis tailored for Ortec Group. We delve into the political, economic, social, technological, legal, and environmental factors affecting its operations. Identify opportunities, mitigate risks, and strengthen your market strategies using our expert insights. Purchase the full report now for a comprehensive analysis at your fingertips!

Political factors

Ortec Group faces stringent government regulations in nuclear, defense, and environmental sectors. Changes in safety, environmental, and operational policies directly influence projects. Compliance is key; for example, the global nuclear decommissioning market is projected to reach $18.6 billion by 2025. Such shifts can impact project timelines and costs.

Ortec Group's operations, spanning Africa and Europe, are significantly affected by political stability. Political instability in regions like certain African nations can disrupt project timelines and increase operational costs. For instance, political turmoil in 2024 led to a 15% delay in infrastructure projects in some African countries, impacting Ortec's contracts.

Government infrastructure spending, a key driver for Ortec Group, is projected to increase. For example, the U.S. government plans to invest $1.2 trillion in infrastructure over several years. This includes roads, bridges, and energy projects. Such investments can boost Ortec's project pipeline. Conversely, reduced spending could pose challenges.

International relations and trade policies

For Ortec Group, which engages in international contracting and engineering, international relations and trade policies are crucial. Changes in trade agreements, tariffs, or sanctions directly impact their project execution capabilities across various regions. For instance, in 2024, the World Trade Organization (WTO) reported that global trade growth slowed to 2.6%, underscoring the sensitivity of international projects.

The imposition of new tariffs, like those between the US and China, can increase project costs and delay timelines. Political instability in regions where Ortec operates can also halt projects. The EU's trade policies, with their focus on sustainability, also influence project requirements.

- Global trade growth slowed to 2.6% in 2024.

- Tariffs between the US and China impact project costs.

- Political instability can disrupt projects.

- EU sustainability policies influence project requirements.

Defense and security policies

Ortec Group's defense sector involvement makes it sensitive to government policies. Defense spending shifts and project changes directly affect demand for their services. For example, the U.S. defense budget for 2024 is approximately $886 billion. This highlights the significance of security policy on business.

- Changes in defense spending directly impact Ortec's revenue.

- Policy shifts can alter project timelines and requirements.

- Priorities in national security influence service demand.

Ortec faces political risks like instability in African nations and defense policy shifts. Compliance with regulations, influenced by global markets and tariffs, is crucial. Infrastructure spending, such as the $1.2T US plan, and global trade affect operations.

| Aspect | Impact | Example (2024-2025 Data) |

|---|---|---|

| Regulations | Project delays/costs | Nuclear decommissioning: $18.6B market by 2025 |

| Political Instability | Disruptions, cost increases | 15% project delay in Africa (2024) |

| Infrastructure Spending | Project pipeline boosts | US $1.2T infrastructure plan |

Economic factors

Ortec Group's fortunes hinge on industrial activity. Strong economic growth boosts demand for its services in sectors like energy and environment. In 2024, industrial production in the Eurozone showed moderate growth, impacting project timelines. Economic downturns could slow investments in maintenance and engineering.

As a player in the oil and gas sector, Ortec Group faces commodity price swings. Changes affect client investments, impacting demand for Ortec's services. For example, in 2024, Brent crude oil prices varied, influencing project viability. The EIA forecasts oil prices averaging $85/barrel in 2025.

Inflation, impacted by factors such as supply chain disruptions and global events, affects Ortec Group by increasing project costs. For example, in early 2024, material prices saw fluctuations, impacting project budgets. Interest rate changes influence borrowing costs for Ortec and its clients, potentially affecting project feasibility. The Federal Reserve held rates steady in early 2024, but future decisions will be crucial for project financing. The current environment necessitates careful financial planning.

Availability of financing for projects

Access to financing is vital for Ortec Group's clients, especially for big industrial and infrastructure projects. The ease with which clients can obtain funding directly impacts the number of potential projects. High interest rates or limited financing options could slow down project pipelines, as seen in late 2023 and early 2024. For example, the European Central Bank's interest rate hikes in 2023 influenced project financing.

- Interest rate hikes in 2023 and early 2024, influenced project financing.

- Availability and cost of financing can influence project pipelines.

Currency exchange rates

Ortec Group, as a global entity, must navigate currency exchange rate volatility. These fluctuations directly affect operational costs, impacting profitability across different geographic locations. For instance, a strong euro could make Ortec's services more expensive in countries with weaker currencies. This can reduce competitiveness and potentially influence investment decisions.

- Eurozone inflation reached 2.4% in March 2024.

- The EUR/USD exchange rate has varied between 1.07 and 1.10 in Q1 2024.

- A 10% adverse currency movement could reduce net profit by 5%.

Ortec Group's performance correlates with industrial output and commodity prices, directly influencing project demand and financial planning. Inflation and interest rates affect project costs and financing, requiring careful budgetary controls. Currency exchange rate fluctuations add complexity, impacting profitability across different operational locations.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Industrial Activity | Affects demand | Eurozone industrial output growth: ~1% (2024), Forecast: ~1.5% (2025) |

| Oil Prices | Influence project viability | Brent Crude avg. $82/barrel (Q1 2024), EIA forecast: $85/barrel (2025) |

| Inflation/Rates | Impact costs/financing | Eurozone inflation: 2.4% (March 2024), ECB interest rates stable. |

Sociological factors

Ortec Group heavily relies on a skilled workforce, encompassing engineering, technical trades, and project management. The availability of qualified personnel directly impacts operational efficiency and project timelines. Attracting and retaining talent is crucial, with competition for skilled workers intensifying. In 2024-2025, the demand for these skills remains high, and companies are investing in training programs.

Ortec Group's operations heavily rely on a robust health and safety culture, especially in industrial and environmental contexts. A positive safety culture minimizes workplace accidents, which is crucial for project timelines and cost management. Consider that in 2024, the industrial sector saw a 7% decrease in workplace injuries due to enhanced safety protocols. Moreover, a strong safety culture enhances employee morale and productivity. It also protects the company's reputation and maintains compliance with stringent industry regulations.

Ortec Group's environmental and industrial work affects communities. Positive public perception and good relations are vital. A strong reputation helps secure the "social license" to operate. In 2024, companies with strong community ties saw a 15% increase in project approvals.

Aging infrastructure and societal needs

Aging infrastructure presents significant opportunities for Ortec Group. The need for infrastructure upgrades, maintenance, and decommissioning services is rising. Societal demands for improved waste management and environmental solutions further boost their market. For example, the global infrastructure market is projected to reach $15.3 trillion by 2025, with substantial growth in renovation and repair.

- Global spending on infrastructure is expected to increase by 40% by 2030.

- The waste management market is growing at an average rate of 5.5% annually.

- Government regulations are tightening, increasing the need for environmental remediation.

Changing societal attitudes towards environment and sustainability

Societal attitudes are shifting, with a growing emphasis on environmental sustainability. This impacts client expectations and regulatory frameworks. Ortec Group's environmental services are directly affected. The global green technology and sustainability market is projected to reach $74.5 billion by 2025.

- Increased demand for eco-friendly solutions.

- Stricter environmental regulations.

- Opportunities for innovation in waste management.

Ortec Group must navigate social shifts towards sustainability, which directly influence its environmental service offerings. Public perception and community relations are crucial for obtaining the "social license" to operate; companies with strong community ties saw project approval increases. The growing focus on eco-friendly solutions and waste management opens innovation opportunities.

| Aspect | Impact | Data |

|---|---|---|

| Sustainability | Increased demand for green tech & compliance | $74.5B by 2025 in the green tech market. |

| Community Relations | Impacts project approvals and public perception | 15% project approval increase for community-tied firms (2024) |

| Waste Management | Innovation, regulation drive growth | Waste market growing at 5.5% annually. |

Technological factors

Advancements in engineering and industrial technologies present both chances and hurdles for Ortec Group. Integrating innovations is key to staying competitive and providing cutting-edge solutions. For example, the global industrial automation market, estimated at $196.4 billion in 2024, is projected to reach $326.3 billion by 2032, highlighting the need for Ortec to adapt. Staying current with these technologies is crucial.

Ortec Group benefits from advancements in environmental remediation. The development of more effective technologies, like thermal desorption, enhances their service offerings. In 2024, the global environmental remediation market was valued at $62.3 billion. This growth is fueled by stricter environmental regulations, creating opportunities for companies like Ortec. New techniques improve efficiency and reduce costs, increasing profitability.

Digitalization, data analytics, and AI are transforming industries. Companies leverage these for efficiency and better client services. The global AI market is projected to reach $200 billion by 2025. This offers Ortec Group avenues for process optimization.

Automation and robotics

Automation and robotics are transforming industrial maintenance and inspection, enhancing safety and efficiency for companies like Ortec Group. The global industrial robotics market is projected to reach $75.3 billion by 2029, growing at a CAGR of 10.1% from 2022. This technology allows for remote operations in hazardous environments, expanding service offerings. Ortec Group can leverage these advancements to optimize operations.

- The industrial robotics market is experiencing significant growth.

- Automation improves safety and efficiency in industrial settings.

- Robotics expands the scope of services offered.

Development of renewable energy technologies

The rise of renewable energy technologies significantly impacts companies like Ortec Group. Growth in this sector increases demand for engineering, construction, and maintenance services. Ortec's support for energy transition aligns with this technological advancement. The global renewable energy market is projected to reach $1.977 trillion by 2030. This presents opportunities for Ortec.

- Global renewable energy market expected to reach $1.977 trillion by 2030.

- Ortec Group's services are well-positioned to benefit from this growth.

Ortec Group faces tech opportunities. The industrial automation market is set to hit $326.3B by 2032. Automation enhances services, as the AI market could reach $200B by 2025.

| Technology | Market Size (2024-2030) | Growth Driver |

|---|---|---|

| Industrial Automation | $196.4B - $326.3B (2032) | Efficiency, Innovation |

| AI | $200B (by 2025) | Process Optimization |

| Renewable Energy | $1.977T (by 2030) | Sustainability Trends |

Legal factors

Ortec Group's environmental services are significantly impacted by environmental laws globally. These laws govern pollution, waste, and remediation. The global environmental services market was valued at $43.8 billion in 2024 and is projected to reach $58.9 billion by 2029. Compliance is essential, and changing regulations open new service prospects for Ortec.

Ortec Group's industrial operations are subject to stringent safety regulations. These include rules on equipment, hazardous materials, and worker protection. Compliance necessitates continuous investment in safety measures, training, and audits. Failure to comply results in penalties and potential operational disruptions. In 2024, OSHA reported over 3,000 workplace fatalities, highlighting the importance of safety protocols.

Ortec Group faces labor law complexities across its global operations. Compliance includes adhering to hiring standards, ensuring safe working conditions, and managing employee relations. In 2024, labor law changes in the Netherlands, where Ortec has a significant presence, focused on flexible work arrangements and minimum wage adjustments. These regulations impact Ortec's operational costs and workforce management strategies.

Contract law and project specific regulations

Ortec Group's projects, especially in engineering, are heavily influenced by contract law and industry-specific regulations. Navigating these legal complexities is essential for project execution and to avoid costly disputes. Compliance failures can lead to significant financial penalties and reputational damage. For example, in 2024, construction firms faced an average of $1.2 million in legal costs due to contract disputes.

- Contract disputes can delay projects by an average of 6 months.

- Regulatory non-compliance penalties have increased by 15% in the last year.

- Ortec Group must maintain up-to-date legal expertise.

- Detailed contract reviews and risk assessments are crucial.

Data protection and privacy laws (e.g., GDPR)

Ortec Group must adhere to data protection laws, such as GDPR, when handling sensitive project and client information. Effective data security measures are crucial to safeguard information. The global data privacy market is projected to reach $13.3 billion in 2024. GDPR non-compliance can lead to significant financial penalties; for example, in 2023, the largest GDPR fine was €345 million.

- Data breaches can cost companies millions.

- GDPR compliance is a legal requirement.

- Data security is paramount.

Legal factors significantly influence Ortec Group’s operations worldwide. Environmental, safety, and labor laws necessitate meticulous compliance, impacting costs and strategies. Data protection, like GDPR, is crucial; in 2024, the global data privacy market reached $13.3 billion. Contract law compliance is key; disputes delay projects and lead to high costs.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Environmental | Compliance & new service opportunities | Global market at $43.8B (2024), forecast $58.9B (2029) |

| Safety | Operational risks & costs | OSHA reported >3,000 workplace fatalities in 2024 |

| Labor | Operational costs & strategy | Netherlands labor law changes: Flexible work/min wage |

Environmental factors

Climate change intensifies extreme weather, impacting regulations and client needs for sustainability. Ortec Group's environmental remediation and energy transition services are crucial. In 2024, global spending on climate change adaptation reached $63.5 billion, reflecting growing urgency. The company's focus aligns with rising demand and regulatory shifts.

The waste management sector is significantly influenced by the rising emphasis on waste reduction, recycling, and circular economy models. Ortec Group, as a waste management service provider, must align with these trends. In 2024, the global waste management market was valued at $2.08 trillion, with projections to reach $2.8 trillion by 2029, indicating substantial growth.

Historical industrial activities and accidental spills create ongoing needs for environmental remediation services, a key driver for Ortec Group. Regulatory demands and public pressure further fuel the demand for these environmental solutions. The global environmental remediation market was valued at $68.7 billion in 2023. It is projected to reach $98.6 billion by 2028, growing at a CAGR of 7.5% from 2023 to 2028.

Availability and management of natural resources

Ortec Group's work in sectors like infrastructure and energy is directly tied to natural resources. Scarcity of materials or issues with resource accessibility can affect project timelines and budgets. Sustainable practices, such as those highlighted in 2024 reports, are vital for long-term viability.

- 2024 saw a 15% increase in demand for sustainable materials in construction, impacting project planning.

- Water scarcity in certain regions has led to a 10% rise in operational costs for related projects.

- Ortec Group is increasingly investing in projects that utilize recycled materials.

Biodiversity loss and ecosystem protection

Growing concerns about biodiversity loss and the need for ecosystem protection are driving stricter environmental regulations globally. This shift compels companies, including Ortec Group, to reduce their ecological impact. For example, the EU's Biodiversity Strategy for 2030 aims to protect at least 30% of the EU's land and sea area. These regulations may increase operational costs and necessitate investments in sustainable practices.

- EU's Biodiversity Strategy for 2030: Protects at least 30% of the EU's land and sea area.

- The global market for biodiversity credits is projected to reach $1.3 billion by 2030.

Environmental factors are pivotal, driving changes in regulations and market demands. The global waste management market, valued at $2.08T in 2024, highlights this. Ortec Group benefits from remediation and waste services amid these shifts.

Resource scarcity and biodiversity concerns further shape the landscape. Construction sees a 15% rise in demand for sustainable materials in 2024. This influences costs and strategies, with the EU's biodiversity strategy setting new benchmarks.

| Factor | Impact on Ortec | 2024/2025 Data |

|---|---|---|

| Climate Change | Increased demand for services | Adaptation spending: $63.5B |

| Waste Management | Growth opportunities | Market value: $2.08T, to $2.8T by 2029 |

| Remediation | Market Expansion | Market value: $68.7B (2023), $98.6B (2028) |

PESTLE Analysis Data Sources

The Ortec Group PESTLE analysis incorporates insights from financial reports, technology studies, and governmental regulatory updates.