Outbrain Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Outbrain Bundle

What is included in the product

Identifies disruptive forces, emerging threats, and substitutes that challenge market share.

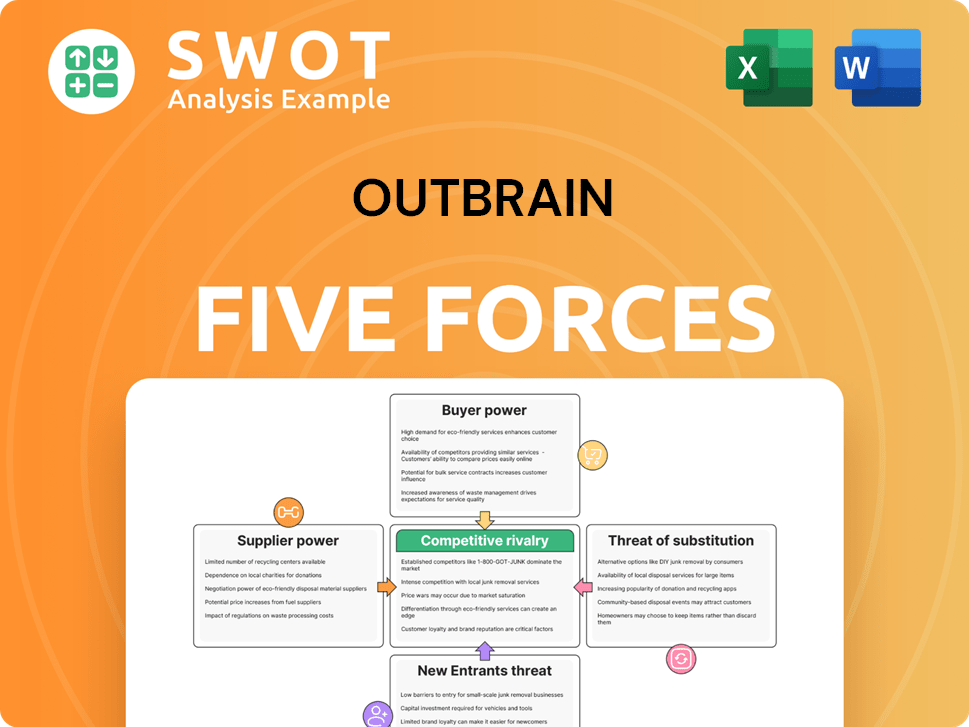

Quickly identify threats with a visual summary of Porter's Five Forces.

Preview Before You Purchase

Outbrain Porter's Five Forces Analysis

The document shown here is the complete Porter's Five Forces analysis for Outbrain. This preview offers you an exact look at the professionally written analysis you'll receive. Immediately after purchase, you’ll download this very file, fully formatted. It's ready for your use without any further adjustments. No surprises—what you see is what you get.

Porter's Five Forces Analysis Template

Outbrain faces a dynamic competitive landscape. Its industry is shaped by factors like buyer power, as publishers negotiate ad rates. The threat of new entrants, especially from tech giants, also looms. Substitute products, like organic content, pose another challenge. Intense rivalry among advertising platforms further complicates the picture.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Outbrain’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Outbrain benefits from limited supplier concentration due to its reliance on many content creators and websites. This dispersed supplier base prevents any single entity from controlling pricing or terms. In 2024, Outbrain's vast network of suppliers, numbering in the thousands, supports this balanced dynamic. This ensures operational stability and competitive pricing for Outbrain. Outbrain's approach mitigates supplier power effectively.

Outbrain operates where the core input, advertising space, is fairly standardized. This setup curbs supplier power because Outbrain can readily shift among various content and ad space sources. This easy switching is key for keeping costs down and adjusting to market changes. Outbrain's ability to quickly adapt gives it an edge. In 2024, digital ad spending reached $286 billion, showing the market's size and Outbrain's flexibility.

Outbrain faces low supplier power, mainly because switching costs are minimal. Integrating publishers is easy, reducing supplier leverage. This flexibility enables Outbrain to adapt quickly based on performance and cost. In 2024, Outbrain's revenue was around $1 billion, showing its ability to manage diverse publisher relationships effectively.

Supplier dependence on Outbrain

Many publishers depend on Outbrain for revenue, making them reliant on the platform. This dependence boosts Outbrain's bargaining power. Outbrain's capacity to generate income for publishers improves its negotiation strength. This dynamic allows Outbrain to set terms. Outbrain generated $282.7 million in revenue in Q4 2023.

- Publisher Dependence: Publishers often depend on Outbrain for a portion of their revenue.

- Power Shift: This dependence gives Outbrain more power in negotiations.

- Revenue Generation: Outbrain's ability to create income for publishers strengthens its position.

- Negotiating Strength: Outbrain can set terms due to its value to publishers.

Availability of alternative suppliers

In the digital advertising realm, Outbrain faces a diverse supplier landscape, including various websites and content platforms. This broad availability of options limits the bargaining power of individual suppliers. Outbrain can negotiate advantageous deals due to this competitive environment, facilitating cost-effective ad placements and expanding its network. This strategic position is crucial for Outbrain's operational success.

- Digital ad spending in the U.S. is projected to reach $329.6 billion in 2024.

- Outbrain's revenue for Q3 2023 was $265.7 million.

- The company's adjusted EBITDA for Q3 2023 was $21.7 million.

Outbrain's supplier power is low due to many content creators and websites. This wide network stops any single entity from controlling prices or terms. Digital ad spending in the U.S. is estimated at $329.6 billion in 2024. Outbrain’s flexibility and vast network support balanced dynamics.

| Aspect | Details | Data (2024) |

|---|---|---|

| Supplier Base | Content creators and websites | Thousands |

| Market Size | Digital Ad Spend | $329.6 Billion (projected) |

| Q3 2023 Revenue | Outbrain's Revenue | $265.7 million |

Customers Bargaining Power

Outbrain's massive advertiser network diminishes individual customer influence. In 2024, Outbrain's reach included over 1.3 billion users monthly. This wide base ensures stability, not depending on single clients. Losing an advertiser has a limited impact due to this diversity.

Advertisers can easily move their ad spending to different platforms, resulting in low switching costs. This makes Outbrain offer competitive pricing and quality service. The ease of switching forces continuous innovation and customer satisfaction. In 2024, Outbrain's revenue was around $1 billion, showing its market presence.

Advertisers wield substantial power due to the availability of alternative platforms. In 2024, digital ad spending is projected to reach $279.8 billion in the U.S., highlighting the competitive landscape. Advertisers can easily shift budgets to platforms offering better ROI. Outbrain faces pressure to provide superior value to retain advertisers.

Customer price sensitivity

Advertisers' price sensitivity significantly impacts Outbrain, as they meticulously assess the return on investment (ROI) of their ad spending. This vigilance compels Outbrain to offer competitive pricing, ensuring it remains attractive in the crowded digital advertising landscape. Outbrain must consistently prove its value to retain existing and gain new advertisers. In 2024, the digital advertising market saw a shift, with advertisers demanding higher ROI.

- Advertisers focus on ROI, impacting pricing.

- Competitive pricing is essential for Outbrain.

- Demonstrating value retains and attracts advertisers.

- Digital ad market trends influence strategies.

Information transparency

Advertisers on Outbrain benefit from significant information transparency. They can access detailed performance metrics and analytics to evaluate campaign effectiveness. This transparency bolsters their bargaining power, allowing them to quickly identify and adjust underperforming ads. To retain advertiser trust and loyalty, Outbrain must provide clear and actionable insights.

- In 2024, Outbrain's revenue was approximately $1 billion, reflecting the importance of advertiser spending.

- Advertisers use metrics like click-through rates (CTR) and conversion rates to assess ad performance; a 1% CTR or higher is generally considered good.

- Outbrain's platform offers real-time data, helping advertisers make immediate adjustments to campaigns.

- Transparency leads to better ROI, with data showing that well-optimized campaigns can achieve a 3x return.

Advertisers hold significant bargaining power due to readily available alternatives. Outbrain must offer competitive pricing and demonstrate superior ROI to retain advertisers. Transparency through performance metrics enhances advertiser control.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Market Competition | High, due to many ad platforms | U.S. digital ad spending: $279.8B |

| Advertiser Control | High, based on ROI and data | Avg. CTR for good ads: 1%+ |

| Outbrain's Revenue | Influenced by advertiser spending | Approx. $1B in 2024 |

Rivalry Among Competitors

The content recommendation and native advertising sector is fiercely contested. Competition among firms like Taboola and others drives down prices. Outbrain must innovate constantly to maintain its market position. In 2024, the digital ad market exceeded $700 billion, highlighting the stakes.

Outbrain faces tough competition from Taboola, Google Ads, and social media platforms. These rivals offer similar content recommendation services, increasing the pressure to attract advertisers and publishers. In 2024, Google Ads generated over $237 billion in ad revenue, highlighting the scale of the competition. Outbrain must differentiate its offerings to compete effectively.

Outbrain's differentiation strategy centers on premium content recommendations and publisher partnerships. This approach attracts advertisers prioritizing brand safety and audience engagement. For example, in 2023, Outbrain's revenue was $1.02 billion, reflecting its focus on quality. A strong brand reputation is vital for competitive advantage in this landscape.

Market consolidation

Market consolidation has been observed in the digital advertising space, with larger entities acquiring smaller competitors. This trend could heighten competitive pressures as the remaining companies gain market power. For instance, in 2024, Google's ad revenue reached approximately $237 billion, reflecting its strong market position. Outbrain needs to navigate this landscape, possibly through strategic alliances or acquisitions to stay competitive.

- Google's ad revenue in 2024 was around $237 billion.

- Consolidation intensifies competition.

- Strategic moves are crucial for Outbrain.

- Partnerships or acquisitions may be necessary.

Innovation imperative

Outbrain operates in a dynamic market where innovation is key to survival. Constant advancements in ad formats, like native advertising, and enhanced targeting capabilities are crucial. Outbrain needs to invest heavily in research and development to maintain its competitive edge. Continuous improvement in its platform attracts and keeps advertisers and publishers satisfied.

- Outbrain's R&D spending in 2023 was approximately $60 million.

- Native advertising is projected to reach $85.8 billion in the US by 2024.

- Outbrain's revenue in Q3 2024 was $300 million.

- They have over 500 employees in R&D and product development.

Competitive rivalry in content recommendation is intense, with major players like Google and Taboola vying for market share. The digital ad market's vast size, exceeding $700 billion in 2024, fuels this competition. Outbrain's ability to differentiate and innovate, demonstrated by its $1.02 billion revenue in 2023, is crucial for survival.

| Aspect | Details | Impact |

|---|---|---|

| Key Competitors | Taboola, Google Ads, social media platforms | Increased pressure on pricing and innovation. |

| Market Size (2024) | Digital ad market over $700 billion | High stakes, attracting significant investment. |

| Outbrain Revenue (2023) | $1.02 billion | Demonstrates market position but requires ongoing competitiveness. |

SSubstitutes Threaten

Direct advertising allows advertisers to place ads independently, avoiding platforms like Outbrain. This offers greater control over ad placement and potentially reduces costs. In 2024, direct ad spending is projected to reach $360 billion globally. Outbrain faces a substitute threat by needing to prove its value proposition. Outbrain must offer superior targeting or performance to compete effectively.

Social media platforms like Facebook and Instagram offer potent advertising alternatives to content recommendation engines like Outbrain. These platforms boast massive user bases and sophisticated targeting capabilities, drawing advertisers. For example, Meta's advertising revenue in Q3 2023 reached $33.64 billion. Outbrain must emphasize its unique value, such as its focus on high-quality content discovery, to compete effectively.

Search engine marketing (SEM) offers a direct alternative to Outbrain's content discovery platform. Advertisers use SEM to target users via keywords, reaching those with immediate needs. In 2024, Google's advertising revenue hit $237.5 billion, highlighting SEM's power. Outbrain combats this by emphasizing its ability to drive discovery and engagement beyond explicit search queries.

Email marketing

Email marketing serves as a direct substitute, especially for businesses with existing customer relationships. This channel provides a cost-effective way to communicate directly with audiences, potentially reducing the need for Outbrain's services. Outbrain must highlight its capacity to access new and wider audiences to stay competitive. In 2024, email marketing spending is projected to reach $89.3 billion globally.

- Cost-Effectiveness: Email marketing is generally cheaper than content recommendation platforms.

- Direct Communication: Allows businesses to communicate directly with their audience.

- Targeting: Businesses can target specific segments of their customer base.

- Audience Reach: Outbrain needs to stress its broader audience reach.

Content marketing

Content marketing poses a threat to Outbrain. Businesses are increasingly creating their own content to attract audiences, lessening their need for paid ads. This strategy fosters brand loyalty and boosts organic traffic. Outbrain must show how it enhances and supports these content marketing initiatives. In 2024, content marketing spending is projected to reach $93.5 billion globally, highlighting its growing importance.

- Content marketing spending reached $93.5 billion globally in 2024.

- Inbound marketing builds brand loyalty.

- Organic traffic is a key benefit of content marketing.

- Outbrain needs to complement content marketing.

Advertisers can choose direct ads, social media, SEM, email, and content marketing over Outbrain. These alternatives pose significant threats because of their cost-effectiveness and direct audience reach. For instance, in 2024, SEM spending reached $237.5 billion. Outbrain must prove its value with superior targeting and reach.

| Substitute | Description | 2024 Spending (approx.) |

|---|---|---|

| Direct Advertising | Ads placed directly by advertisers | $360 billion |

| Social Media | Platforms like Facebook and Instagram | $33.64 billion (Meta Q3 2023 ad revenue) |

| Search Engine Marketing (SEM) | Targeting users via keywords | $237.5 billion (Google) |

| Email Marketing | Direct communication with audiences | $89.3 billion |

| Content Marketing | Creating own content to attract audiences | $93.5 billion |

Entrants Threaten

Establishing a content recommendation platform like Outbrain demands substantial upfront investment. These high capital requirements, including technology, infrastructure, and sales, create a significant barrier. For example, in 2024, the cost to develop a similar platform could easily exceed $50 million. This deters many potential entrants.

Content recommendation platforms like Outbrain thrive on network effects; the more publishers and advertisers, the more valuable the platform becomes. This dynamic creates a significant barrier for new entrants. In 2024, Outbrain's revenue was approximately $1 billion, reflecting its established network.

Outbrain and its main competitors, like Taboola, have built robust brand reputations, which is a significant hurdle for new entrants. In the advertising industry, trust and reliability are paramount. Newcomers face an uphill battle to establish credibility and compete with established names. For example, Outbrain's revenue in 2023 was around $1 billion, showcasing its established market presence. New entrants need to overcome this brand recognition gap to succeed.

Proprietary technology

Outbrain's proprietary technology, including recommendation algorithms and data analytics, presents a significant barrier to new entrants. These technologies are difficult to replicate, offering a distinct competitive advantage. Continuous innovation is crucial for sustaining this technological edge in the dynamic digital advertising landscape. For example, Outbrain's revenue in Q3 2023 was $266 million.

- Recommendation algorithms provide superior content matching.

- Data analytics tools offer in-depth performance insights.

- Proprietary tech increases platform efficiency.

- Ongoing innovation ensures a competitive edge.

Regulatory hurdles

The digital advertising sector faces growing regulatory pressures, especially concerning data privacy and user consent. New entrants must navigate complex and evolving rules, which can be a significant barrier. Compliance costs and the need for specialized expertise add to the challenges. These hurdles can substantially increase the time and resources needed to enter the market.

- Regulations like GDPR and CCPA have significantly impacted the industry.

- Compliance often requires substantial investment in technology and legal expertise.

- Failure to comply can lead to hefty fines and reputational damage.

- The regulatory landscape is constantly changing, requiring ongoing adaptation.

Outbrain faces a moderate threat from new entrants due to several barriers. High initial capital investments, potentially exceeding $50 million in 2024, create a substantial hurdle. Established network effects and brand recognition further protect Outbrain's market position.

| Barrier | Impact | Data |

|---|---|---|

| High Capital Costs | Significant | Platform development costs > $50M (2024) |

| Network Effects | Moderate | Outbrain Revenue ~$1B (2024) |

| Brand Recognition | Moderate | Outbrain Revenue ~$1B (2023) |

Porter's Five Forces Analysis Data Sources

The Outbrain analysis relies on industry reports, financial statements, and competitive landscape assessments to determine competitive dynamics. SEC filings and market research data also shape our strategic understanding.