Owens Corning Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Owens Corning Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Clean and optimized layout for sharing or printing of the BCG matrix.

Delivered as Shown

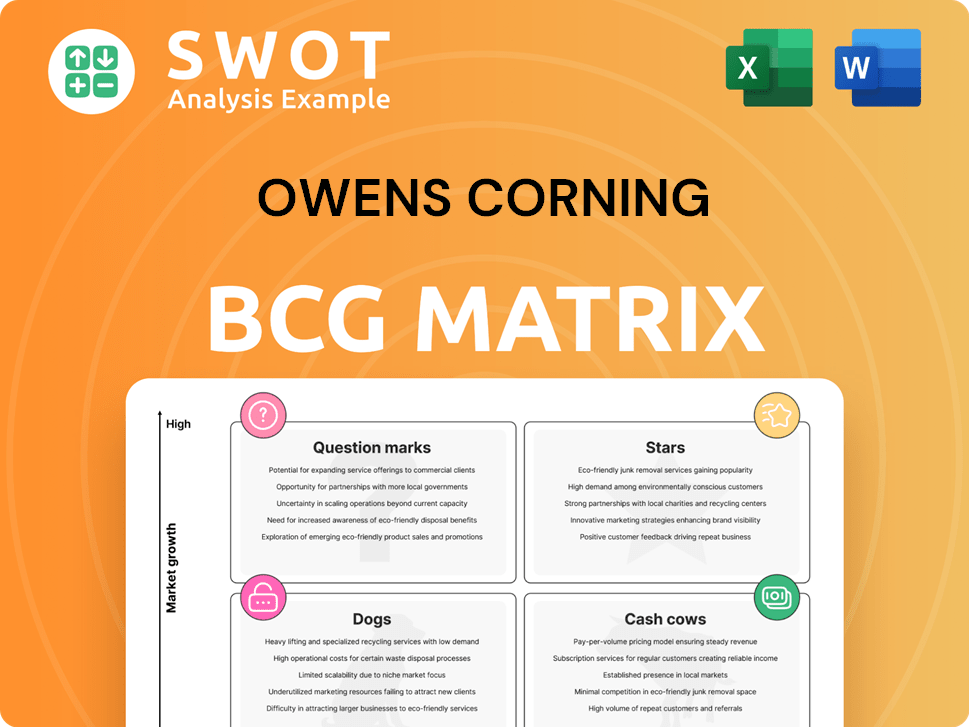

Owens Corning BCG Matrix

This preview shows the complete Owens Corning BCG Matrix you'll receive. Instantly downloadable and watermark-free, it offers actionable insights for your strategic planning—no alterations needed.

BCG Matrix Template

Owens Corning's BCG Matrix paints a picture of its diverse portfolio. Examining products within "Stars," "Cash Cows," "Dogs," and "Question Marks" reveals strengths and vulnerabilities. Understanding the competitive landscape is crucial for strategic decisions. This snapshot barely scratches the surface of Owens Corning's positioning. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Owens Corning's dedication to sustainable building materials is a strong suit. The company's focus on energy-efficient products meets rising demand for green solutions. For example, in 2024, the global green building materials market was valued at $367.4 billion. This positions them well in a high-growth sector.

Owens Corning's roofing shingles, especially the laminate ones, are a star due to high demand and a solid contractor network. The company's commitment is shown by investing in new shingle manufacturing, such as the recent facility in the southeastern U.S. The roofing market is boosted by repair and remodeling. In 2024, the roofing segment saw strong revenue growth.

Fiberglass insulation is a key product for Owens Corning, benefiting from a growing construction market and energy efficiency standards. It holds a significant market share across residential, commercial, and industrial sectors, including HVAC systems. In 2024, the North American insulation market was valued at approximately $7.2 billion, with fiberglass insulation being a major component. This segment is expected to grow due to stricter regulations.

Strategic Acquisitions

Owens Corning's strategic acquisitions, such as Masonite International Corporation, have been pivotal in expanding its market presence. These moves boost revenue, solidifying its leadership in residential building products. Integration drives synergies, fostering growth in the building materials sector. In 2024, Owens Corning's revenue reached $9.8 billion, reflecting the impact of these acquisitions.

- Masonite International acquisition enhances market share.

- Revenue growth reflects successful integration strategies.

- Synergies drive operational efficiencies.

- Strategic acquisitions boost market leadership.

Innovation in Composites

Owens Corning's composites segment shines as a star in its BCG matrix. It focuses on high-value materials for building, renewable energy, and infrastructure. This strategy leverages its tech to meet the demand for lightweight and durable materials. This innovation, coupled with sustainability, fuels growth and leadership.

- In 2024, the global composites market was valued at approximately $100 billion.

- Owens Corning's sales in the Composites segment were $3.1 billion in 2023.

- The company is investing in new technologies to improve product performance.

- Owens Corning is expanding its presence in the renewable energy market.

Owens Corning's Stars include roofing shingles and composites, vital for high growth. The roofing segment's strong 2024 revenue growth boosts its star status. Composites' focus on tech meets rising demand for sustainable materials.

| Segment | 2024 Revenue (Estimate) | Market Growth |

|---|---|---|

| Roofing | $4.5B | 5% |

| Composites | $3.3B | 7% |

| Insulation | $2.8B | 4% |

Cash Cows

Owens Corning's residential roofing is a cash cow. The repair and remodel sectors generate consistent revenue. Owens Corning holds a strong market share. Demand is steady, and profitability is reliable in this mature market. In 2024, roofing sales were a significant part of their revenue.

Commercial roofing mirrors residential, offering Owens Corning stable revenue. Their durable, weather-resistant materials and strong contractor/distributor ties ensure market presence. Ongoing maintenance and replacements boost its cash cow status. In 2024, the commercial roofing market is estimated to be around $13 billion. Owens Corning's roofing segment generated $3.3 billion in net sales in 2023.

Owens Corning's fiberglass composites are cash cows in industrial/infrastructure. They offer durability and cost-effectiveness, ensuring steady revenue. These applications require minimal investment, generating consistent cash flow. In 2024, Owens Corning's net sales were approximately $9.7 billion, with composites contributing significantly. The company's focus is on maintaining profitability in established markets.

Insulation in Existing Buildings

The insulation market in existing buildings is a cash cow for Owens Corning, fueled by energy efficiency upgrades. Fiberglass insulation, a cost-effective solution, is popular among homeowners seeking to lower energy costs. This segment demands minimal marketing and delivers consistent revenue. This strategy is supported by the growing demand for energy-efficient home improvements.

- Owens Corning's net sales for 2023 were $9.7 billion.

- The residential market represented a significant portion of this revenue.

- Energy efficiency retrofits are a key driver in this market.

North American Market

Owens Corning's North American operations, especially in the U.S., are a cash cow. The construction and automotive sectors fuel demand for its goods. The company's brand strength and distribution generate steady cash flow. Owens Corning benefits from the region's emphasis on energy efficiency.

- In 2024, North America accounted for over 70% of Owens Corning's total revenue.

- The company's Roofing segment, a key product in the region, saw a 5% sales increase in Q3 2024.

- Owens Corning's adjusted EBIT from North American Insulation was $135 million in Q3 2024.

Owens Corning's cash cows consistently deliver strong revenue with minimal investment. These include roofing, fiberglass composites, and insulation in existing buildings. The company's North American operations are a significant cash generator. In 2024, they focused on maintaining profitability.

| Segment | 2024 Revenue (Est.) | Key Characteristics |

|---|---|---|

| Roofing | $3.5B+ | Stable demand, strong market share |

| Composites | $3.0B+ | Durability, cost-effectiveness |

| Insulation | $2.0B+ | Energy efficiency, upgrades |

Dogs

Owens Corning's glass reinforcements business, divested in 2024 to Praana Group, fits the "Dog" quadrant of the BCG matrix. Despite generating $1.2 billion in revenue in 2023, it wasn't core to their strategy. This move allows focus on North America/Europe building products. The divestiture helps allocate capital to growth areas.

Owens Corning divested its building materials business in Asia, mirroring the glass reinforcements division's fate. This strategic move, encompassing China and Korea, signals a shift away from low-growth markets. The divestiture aligns with a focus on North America and Europe. This business unit likely fit into the "Dog" quadrant of the BCG Matrix.

Some of Owens Corning's commodity-based products, like certain insulation types, could be classified as dogs in its BCG matrix. These products face fierce price competition, impacting profit margins. For instance, in 2024, the insulation market saw fluctuating prices due to supply chain issues. Such products typically have low growth potential. The company may consider strategic moves like divestiture to boost overall profitability.

Non-Strategic Geographies

In regions where Owens Corning's presence is weak, their products can be classified as dogs in the BCG matrix. These areas often show low growth and demand considerable investment to compete effectively. For example, in 2024, Owens Corning might have seen lower sales growth in certain international markets. Re-evaluating the strategy or exiting these markets might be necessary to improve profitability.

- Low Market Share: Products struggle to gain traction.

- High Investment Needs: Significant funds are needed for growth.

- Limited Growth Potential: Markets may offer slow expansion.

- Strategic Reassessment: Possible exit or revised strategy.

Products Facing Substitution

For Owens Corning, "Dogs" represent products vulnerable to substitution. These products, like certain roofing or ceiling materials, face competition from alternatives. Declining market share and profitability are typical for these offerings. Owens Corning's 2024 financial reports will show how successful they are at keeping these products competitive.

- Substitution risk is a key concern.

- Innovation is crucial for maintaining relevance.

- Profitability can be negatively impacted.

- Owens Corning needs to adapt its strategy.

Owens Corning's "Dogs" include divested units like glass reinforcements and certain building materials, which showed low growth and market share. These segments, facing competition and substitution risks, often underperformed. Strategic actions like divestitures aim to redirect resources to higher-growth areas. For example, in 2024, certain product lines struggled to meet revenue targets.

| Characteristic | Impact | Example (2024) |

|---|---|---|

| Low Market Share | Reduced profitability | Glass Reinforcements divestiture |

| Limited Growth | Strategic reassessment | Building materials in Asia |

| Substitution Risk | Margin pressure | Roofing/ceiling materials |

Question Marks

Owens Corning's acquisition of Masonite, a door manufacturer, places it in the "Question Mark" quadrant of a BCG matrix. This move signifies a new business area with uncertain long-term growth. In 2024, Masonite's revenue was approximately $3 billion. Owens Corning must invest in marketing and distribution. Success depends on effectively integrating Masonite and capturing market share.

Owens Corning's prefabricated building solutions are a question mark in its BCG matrix. This segment aligns with sustainability goals and offers potential for cost savings. However, the market is new, with uncertain demand and regulatory challenges. Significant investment and innovation are needed for success in this segment. In 2024, the prefabricated construction market was valued at $139.5 billion globally.

Owens Corning's international expansion, especially in high-growth developing regions, is a question mark. These markets offer revenue potential but pose risks like instability and competition. In 2024, emerging markets showed varied growth, with some, like India, exceeding expectations. Success requires strategic investment and careful planning, considering factors like currency fluctuations and local regulations.

Advanced Composite Materials

Advanced composite materials represent a question mark for Owens Corning within the BCG matrix. These materials, crucial for electric vehicles and aerospace, demand substantial R&D investments. They promise high performance and premium pricing, but face competition. Strategic partnerships are vital for success in this domain.

- Owens Corning's revenue in 2023 was approximately $9.7 billion.

- The global composites market is projected to reach $140 billion by 2028.

- R&D spending in 2023 was about $180 million.

- Strategic partnerships are essential for success.

Circular Economy Initiatives

Owens Corning's circular economy efforts, like shingle recycling, are question marks in its BCG Matrix. These initiatives target sustainability and potential cost benefits, but demand substantial investment in technology and infrastructure. The economic feasibility of these projects must be proven to warrant further investment.

- Owens Corning has a goal to recycle 1 billion pounds of materials annually by 2030.

- The company's sustainability report from 2023 highlights progress in waste reduction and recycled content usage.

- Investments in recycling technology and partnerships are critical for scaling these initiatives.

- Market acceptance and demand for recycled materials influence the success of these programs.

Owens Corning's initiatives face uncertainty in the BCG matrix, requiring strategic investment and market assessment. Masonite's integration and international expansion involve growth potential but face challenges. The company's revenue was $9.7 billion in 2023.

| Initiative | Challenges | 2024 Data/Projections |

|---|---|---|

| Masonite | Integration, market share | $3B revenue |

| Prefabricated Building | Demand, regulations | $139.5B global market |

| International Expansion | Instability, competition | India's growth exceeded expectations |

BCG Matrix Data Sources

The Owens Corning BCG Matrix is constructed from SEC filings, market analyses, and expert assessments for strategic precision.