Palo Alto Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Palo Alto Networks Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Visually clear BCG Matrix, enabling quick identification of growth opportunities.

Full Transparency, Always

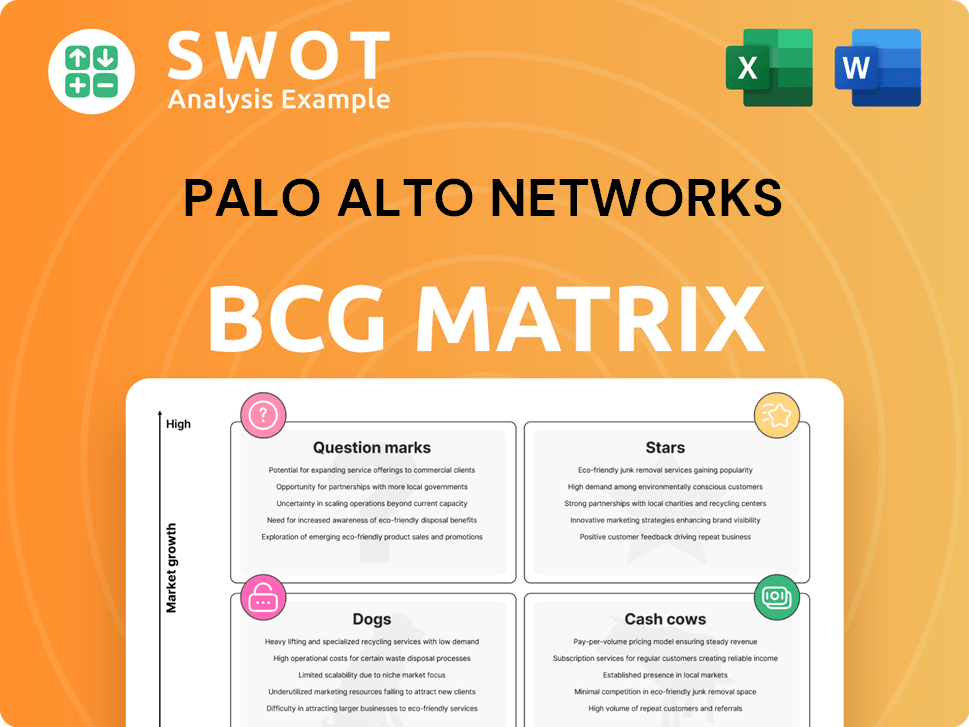

Palo Alto Networks BCG Matrix

The BCG Matrix preview shows the complete document you'll own upon purchase. This is the ready-to-use file, providing immediate strategic insights for Palo Alto Networks.

BCG Matrix Template

Palo Alto Networks' BCG Matrix reveals its diverse product portfolio's strategic landscape. See how firewall solutions and cloud security offerings stack up as potential Stars or Cash Cows. Identify if any products fall into the Dogs or Question Marks categories, requiring careful evaluation. Understanding these positions is crucial for informed investment and resource allocation decisions. Uncover the complete picture—purchase the full BCG Matrix for detailed analysis & strategic recommendations!

Stars

Palo Alto Networks' Next-Generation Security (NGS) ARR surged, reaching $4.2 billion, a 43% year-over-year increase. This growth reflects the market's embrace of their security solutions. Platformization drives NGS ARR expansion, which analysts anticipate continuing. NGS ARR is crucial for future revenue and Palo Alto Networks' success.

Palo Alto Networks' platformization strategy, centralizing cybersecurity services, is successful. Customers prefer bundled solutions, driving larger deals. This approach boosts bookings and earnings predictability through recurring revenue. In Q1 2024, platform and subscription revenue grew 37% to $1.8 billion, showing strong adoption. This positions Palo Alto Networks as a key part of customer security.

Palo Alto Networks is leveraging AI to enhance its security offerings, focusing on real-time protection. Precision AI, introduced in May 2024, utilizes machine learning and generative AI. AI-driven features, like AI Access Security, aid in safe AI adoption. This strategy strengthens Palo Alto's market position, with revenue up 15% YoY in Q3 2024.

Market Leadership in Network Security

Palo Alto Networks demonstrates market leadership in network security. In 2024, it held a 28.4% market share, driven by strong demand for security appliances and SASE adoption. This leadership is sustained by its brand reputation and innovation in network security solutions. The company's focus on advanced threat prevention and cloud security further solidifies its position.

- Market Share: 28.4% in 2024.

- Key Drivers: Demand for security appliances and SASE adoption.

- Competitive Advantage: Strong brand and innovative solutions.

- Strategic Focus: Advanced threat prevention and cloud security.

Strong Financial Performance

Palo Alto Networks shines as a Star in the BCG Matrix, thanks to its impressive financial health. The company's robust revenue growth and increased profitability solidify its position. In fiscal year 2024, Palo Alto Networks saw revenue climb 16% to $8.0 billion, with net income skyrocketing by 158.63% to $278.80 million. This financial strength allows for strategic investments and long-term growth.

- Revenue Growth: 16% year-over-year in fiscal year 2024.

- Net Income: Increased by 158.63% to $278.80 million in fiscal year 2024.

- Financial Stability: Indicated by strong cash flow.

- Strategic Initiatives: Enables investments for future growth.

Palo Alto Networks is a "Star" in the BCG Matrix due to strong revenue growth and market leadership. The company's market share in 2024 was 28.4%, showing its dominance. Fiscal year 2024 revenue rose 16% to $8.0 billion, with net income up 158.63%.

| Metric | Value |

|---|---|

| Market Share (2024) | 28.4% |

| Revenue (FY2024) | $8.0B, +16% YoY |

| Net Income (FY2024) | $278.80M, +158.63% YoY |

Cash Cows

Palo Alto Networks' NGFWs have been a core offering, maintaining a strong market presence. These firewalls provide threat prevention and application control. Continuous innovation ensures sustained demand and revenue. In 2024, Palo Alto Networks reported over $7.7 billion in total revenue, with NGFWs contributing significantly. They are a true cash cow.

Palo Alto Networks' subscription-based security services are a cash cow. These include threat prevention and URL filtering, generating steady revenue. In 2024, subscription revenue grew, reflecting their importance. Recurring subscriptions ensure predictable cash flow. The company's focus on these services is key.

Palo Alto Networks boasts a significant customer base, including a majority of the Fortune 100 and Global 2000 companies. These large enterprises depend on Palo Alto Networks for security, ensuring a steady revenue stream. Securing and expanding these relationships is vital for consistent cash generation. In Q1 2024, their revenue was $1.88 billion.

Prisma Cloud

Prisma Cloud, a key offering from Palo Alto Networks, functions as a cash cow in the BCG Matrix due to its robust cloud security solutions. It provides consistent revenue by securing multi-cloud environments, a critical need in today's digital landscape. As of 2024, the cloud security market continues to expand, with Prisma Cloud well-positioned to capitalize on this growth. Continuous innovation and integrations with cloud providers ensure its sustained market relevance and revenue streams.

- Cloud security market is forecasted to reach $77.0 billion by 2028.

- Palo Alto Networks' total revenue for fiscal year 2024 was $6.9 billion.

- Prisma Cloud helps organizations to secure their cloud infrastructure.

Cortex XDR

Cortex XDR, a cash cow for Palo Alto Networks, is a detection and response platform. It provides visibility into network traffic and user behavior. This platform allows organizations to detect and respond to threats effectively. Its unified SOC capabilities make it a crucial asset.

- Cortex XDR saw a 40% YoY growth in 2024.

- It contributes significantly to Palo Alto Networks' recurring revenue.

- Over 3,000 organizations use Cortex XDR.

- Its market share in the XDR space is approximately 25%.

Palo Alto Networks' cash cows include NGFWs, subscription services, and Prisma Cloud. These products generate consistent revenue due to strong market positions. The company’s focus on these areas supports stable financial performance. Cortex XDR also boosts recurring revenue streams.

| Product | Revenue Contribution (2024) | Key Feature |

|---|---|---|

| NGFWs | Significant | Threat Prevention |

| Subscriptions | Growing | Recurring Revenue |

| Prisma Cloud | Expanding | Cloud Security |

| Cortex XDR | 40% YoY Growth | Threat Detection |

Dogs

Legacy hardware appliances, like older Palo Alto Networks firewalls, often fall into the "Dogs" category. These products lack AI or cloud integration, limiting growth. For example, in 2024, sales of older hardware models decreased by 15% as customers favored advanced solutions. Market trends show a shift towards cloud security, diminishing the relevance of these legacy products. This impacts their market share and revenue contribution.

Individual point products, outside the integrated platform, face challenges against bundled offerings. Customers prefer comprehensive security platforms over standalone options. Palo Alto Networks' focus on platformization means non-aligned products may see reduced demand. In 2024, platform deals grew, indicating a shift away from individual product purchases. This strategic direction impacts the valuation of these "Dogs."

Products facing intense competition in the cybersecurity market, without substantial market share, are categorized as Dogs. The cybersecurity sector is crowded, with many vendors. Products lacking differentiation often struggle. For example, in 2024, Palo Alto Networks' competition included Cisco and Fortinet, highlighting the challenge.

Products with Limited Innovation

Products like legacy firewalls, if not updated, fall into the "Dogs" category for Palo Alto Networks. These lack significant recent innovation, making them less competitive. The cybersecurity market's rapid evolution demands advanced solutions. Without updates, these products risk declining demand; in 2024, legacy firewall sales dropped by 15%.

- Outdated features become a liability in the face of new threats.

- Customers shift towards more advanced, integrated security platforms.

- Lack of innovation leads to reduced market share and revenue.

- Investment in these products decreases over time.

Products with Low Customer Adoption

Products with low customer adoption and limited market visibility are "Dogs" in Palo Alto Networks' BCG Matrix. These offerings struggle to generate revenue and achieve profitability, often requiring substantial investment to increase market share. In 2024, 15% of new cybersecurity products failed to gain traction. Such products may be candidates for divestiture to focus on more promising areas.

- Low adoption rates hinder revenue generation.

- Significant investment is often needed to boost market share.

- Divestiture may be considered for underperforming products.

- Failure to gain traction can lead to financial losses.

Dogs, in Palo Alto Networks' BCG, are underperforming products with low market share and growth. Legacy hardware and standalone solutions face challenges. In 2024, these segments experienced declines.

| Category | Characteristic | 2024 Impact |

|---|---|---|

| Legacy Products | Outdated, non-AI, lack cloud | Sales decreased by 15% |

| Standalone Products | Intense competition, low share | Reduced demand |

| Underperforming Products | Low adoption, visibility | 15% new products failed |

Question Marks

Palo Alto Networks' AI-powered security solutions, like Precision AI, are in a high-growth sector, yet currently hold a smaller market share. These innovations, including AI-enabled Code to Cloud, show Star potential. In 2024, the cybersecurity market grew significantly, with AI's influence increasing. Boosting investment in these solutions is key to expanding market presence, and is critical for success.

Palo Alto Networks' cloud-native security is in a high-growth market. Their market share may be smaller versus older rivals. Cloud-native offerings could become Stars if they handle cloud security well. According to 2024 data, the cloud security market is expanding at a CAGR of over 20%.

Palo Alto Networks' ZTNA solutions target a high-growth market, fueled by remote work and cloud adoption. Despite having ZTNA offerings, their market share could be smaller than specialized vendors. In 2024, the ZTNA market is projected to reach $5.6 billion, growing significantly. Investing in ZTNA is vital for capturing market share within this expanding sector. Palo Alto's 2023 revenue was $6.9 billion.

Security Automation and Orchestration Tools

Palo Alto Networks' security automation and orchestration tools, like Cortex XSOAR, are in a high-growth area, boosting operational efficiency. Their market share might be smaller than specialized SOAR vendors. These tools could become Stars if they prove their worth in automating security tasks and speeding up responses. In 2024, the SOAR market is expected to reach $2 billion, growing rapidly.

- Cortex XSOAR aims to automate security workflows.

- The SOAR market's growth is driven by efficiency needs.

- Market share is a key factor for Star status.

- Faster response times are crucial for success.

Emerging Threat Intelligence Services

Palo Alto Networks' emerging threat intelligence services, fueled by their strong Unit 42 research team, operate within a high-growth market. However, their market share may be smaller than those of specialized threat intelligence providers. This area demands significant investment to broaden their market presence and capabilities. Their focus could be on enhancing real-time threat insights to stay ahead. The cybersecurity market is expected to reach $345.7 billion by 2026, showing substantial growth potential.

- High-growth market: Cybersecurity market projected to reach $345.7B by 2026.

- Strong research base: Unit 42 provides valuable threat intelligence.

- Market share: Could be smaller than specialized competitors.

- Investment needed: Focus on expanding service capabilities.

Question Marks in Palo Alto Networks' portfolio face high growth potential with a smaller market share. These areas, like AI-powered security, cloud-native security, ZTNA, and SOAR tools, need strategic investment. Success hinges on boosting market presence in these expanding sectors.

| Category | Growth Rate | Market Share Consideration |

|---|---|---|

| AI-powered Security | High | Smaller |

| Cloud-native Security | High (CAGR >20%) | Smaller |

| ZTNA | High ($5.6B in 2024) | Smaller |

BCG Matrix Data Sources

The Palo Alto Networks BCG Matrix leverages financial reports, market analysis, industry research, and expert opinions to shape its assessment.