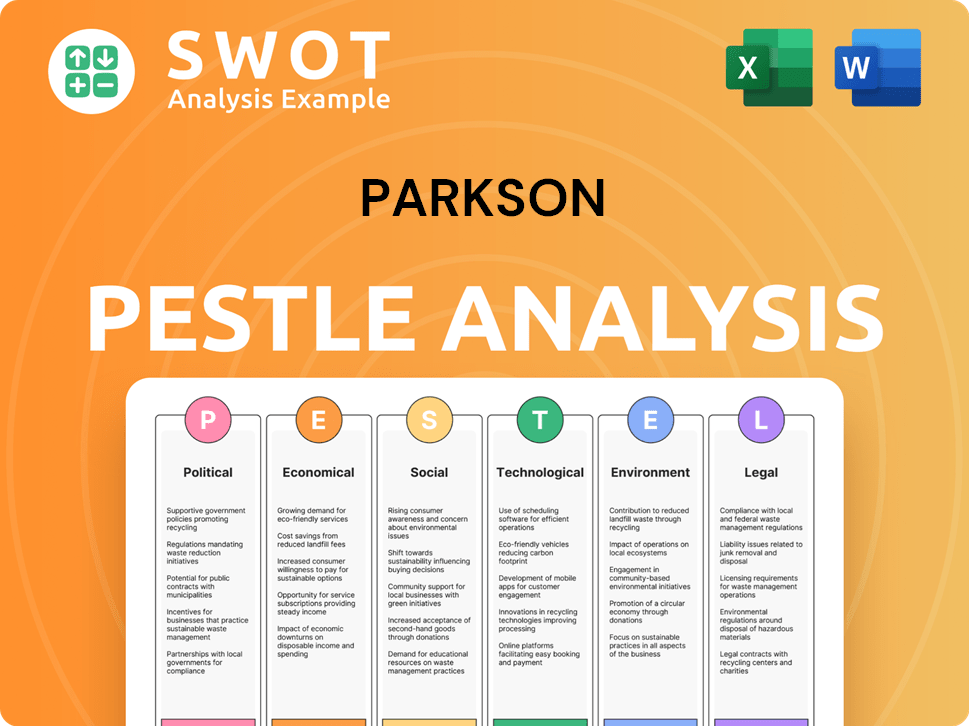

Parkson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Parkson Bundle

What is included in the product

Examines macro factors impacting Parkson across political, economic, social, technological, environmental, and legal aspects.

Helps pinpoint the most impactful external factors for agile decision-making.

What You See Is What You Get

Parkson PESTLE Analysis

This is the complete Parkson PESTLE analysis document. What you're previewing contains the exact content and format of the purchased product.

PESTLE Analysis Template

Explore the complex external factors influencing Parkson's market position with our focused PESTLE analysis. Uncover the political landscape impacting operations, understand economic pressures, and assess technology's role. Our in-depth analysis considers social trends and environmental concerns, revealing potential opportunities and threats. Ready to gain a competitive edge and informed decisions? Get the complete Parkson PESTLE analysis now.

Political factors

Political stability is vital for Parkson's Southeast Asia operations. Government changes or unrest can hurt consumer confidence and spending. For example, political instability in Myanmar saw retail sales drop significantly in 2023. These factors can also shift trade policies impacting retail.

Government trade policies, such as tariffs and quotas, directly affect Parkson's cost structure. The Regional Comprehensive Economic Partnership (RCEP), effective since 2022, reduces tariffs among member nations, potentially lowering costs for Parkson if it sources products from these regions. Conversely, new tariffs could increase expenses. In 2024, trade agreements and policy shifts continue to reshape supply chain economics.

Retail regulations and licensing significantly influence Parkson's strategies. Store hours, product safety, and licensing requirements differ globally. In 2024, complying with China's evolving retail laws cost companies an average of 5% of operational budgets. These factors impact market entry and operational costs. Parkson must navigate these complexities for successful expansion.

Foreign Investment Policies

Foreign investment policies significantly affect Parkson's expansion. Southeast Asian nations like Malaysia and Indonesia have varying rules, influencing market access. For instance, Malaysia's retail sector saw foreign investment of $1.2 billion in 2023. Changes in these policies can hinder or boost Parkson's growth strategies. These regulations dictate partnership opportunities and operational flexibility.

- Investment laws impact market entry.

- Partnerships are shaped by policies.

- Operational flexibility is affected.

- Policy changes create risks.

Consumer Protection Laws

Parkson must meticulously comply with consumer protection laws across all its operational regions, focusing on product quality, accurate pricing, and ethical advertising. These regulations, which differ by country and region, directly influence consumer trust and brand reputation. Non-compliance can lead to significant penalties, including hefty fines and legal battles, impacting profitability. Stricter consumer protection laws are being implemented globally, such as in the EU where the New Deal for Consumers was introduced, and the US where the FTC is actively enforcing advertising standards.

- EU's New Deal for Consumers: Aims to strengthen consumer rights and enforcement.

- FTC Enforcement: Actively monitors and enforces advertising standards in the US.

- Penalties: Non-compliance may lead to fines and legal action.

Political risks significantly impact Parkson, with instability hurting sales; Myanmar's unrest caused a drop in retail in 2023. Trade policies, influenced by agreements like the RCEP, can lower costs if properly utilized. Navigating these complex regulations remains essential.

| Aspect | Impact on Parkson | Data Point |

|---|---|---|

| Political Stability | Affects consumer spending and investment | Myanmar retail sales fell 20% in 2023 during unrest. |

| Trade Policies | Impacts costs through tariffs/agreements | RCEP reduces tariffs among member states. |

| Retail Regulations | Determines market entry costs | China's compliance cost ~5% of OpEx in 2024. |

Economic factors

Consumer spending in Southeast Asia significantly affects Parkson. Factors like economic growth and inflation are crucial. In 2024, Indonesia's consumer spending grew by 5%, impacting retail positively. Rising disposable incomes, as seen in Malaysia, support spending. Employment levels are also key indicators.

Exchange rate volatility significantly impacts Parkson's profitability by altering import costs. For example, a weaker Malaysian Ringgit against the USD raises the price of imported goods. In 2024, the Ringgit's fluctuations against major currencies have been noticeable, affecting retail margins. Currency hedging strategies become essential to mitigate these risks.

High inflation, currently a concern, diminishes consumer buying power, potentially reducing spending on discretionary goods. Parkson must carefully adjust pricing strategies. In 2024, Malaysia's inflation rate was around 1.5%. This necessitates close monitoring of price adjustments to maintain competitiveness.

Economic Growth in Southeast Asia

Southeast Asia's economic growth fuels its retail sector. Robust economies boost consumer confidence and retail sales. The Asian Development Bank forecasts 4.6% growth for Southeast Asia in 2024 and 4.9% in 2025. This expansion supports retail investments.

- 2024 Southeast Asia GDP growth: 4.6%

- 2025 Southeast Asia GDP growth: 4.9%

- Increased consumer spending expected.

Interest Rates

Interest rates significantly shape consumer behavior and business investment. Elevated interest rates often curb consumer spending on major purchases and discretionary items. Conversely, lower rates can stimulate borrowing and boost economic activity. For example, in 2024, the Federal Reserve's interest rate hikes aimed to combat inflation, impacting borrowing costs.

- Federal Reserve raised interest rates several times in 2024.

- Higher rates can slow down consumer spending.

- Lower rates can boost economic growth.

Economic factors significantly affect Parkson. Consumer spending in Southeast Asia grew, impacting retail positively. Rising disposable incomes, along with strong regional GDP growth in 2024, support sales. The ADB forecasts 4.9% growth for Southeast Asia in 2025.

| Economic Indicator | 2024 | 2025 (Forecast) |

|---|---|---|

| Southeast Asia GDP Growth | 4.6% | 4.9% |

| Malaysia Inflation Rate | ~1.5% | - |

| Indonesia Consumer Spending Growth | 5% | - |

Sociological factors

Consumer preferences in Southeast Asia are shifting, impacting retail. There's a rising demand for health, wellness, and sustainable products. Parkson must adjust its offerings to meet these evolving lifestyle trends. For instance, the market for organic food in Southeast Asia is projected to reach $1.2 billion by 2025.

Rapid urbanization and population growth in Southeast Asia are pivotal. This trend fuels larger customer bases. Urban centers, like those in Malaysia and Indonesia, are key. Southeast Asia's population is projected to reach 700 million by 2025, enhancing market opportunities for retailers like Parkson.

Cultural and religious factors in Southeast Asia heavily influence consumer choices. For instance, Halal certification is crucial in Malaysia and Indonesia. In 2024, the Muslim population in Southeast Asia is approximately 240 million. Parkson must tailor marketing and product offerings to respect these diverse cultural nuances to succeed.

Income Distribution and Social Stratification

Income distribution and social stratification significantly influence Parkson's market approach. Understanding income levels helps in product range and pricing strategies. In Malaysia, the top 20% of households earn about 46% of the total income. Parkson must cater to various income segments for optimal sales. This includes offering products appealing to both high- and middle-income consumers.

- High-income consumers drive demand for luxury goods.

- Middle-income consumers seek value and affordability.

- Income inequality impacts purchasing power dynamics.

- Targeted marketing strategies are crucial for each group.

Consumer Confidence and Sentiment

Consumer confidence significantly influences spending habits, directly affecting retail sales. Job security and economic forecasts heavily shape consumer sentiment. For example, if people feel secure in their jobs and optimistic about the economy, they're more likely to spend. This impacts Parkson's sales and profitability.

- In 2024, consumer confidence in Malaysia fluctuated, reflecting global economic uncertainties.

- Positive sentiment often correlates with increased discretionary spending in retail sectors.

- Economic outlook, including inflation and interest rates, plays a vital role.

Shifting consumer behaviors drive retail adjustments in Southeast Asia. Growing health and wellness preferences, alongside sustainable product demands, are notable. The market for organic food is expected to hit $1.2B by 2025. Parkson must adapt product offerings.

Urbanization boosts consumer bases in key hubs such as Malaysia and Indonesia. Southeast Asia's population is estimated at 700M by 2025, presenting market chances. Cultural aspects, including Halal practices, affect offerings. The Muslim population in Southeast Asia totaled around 240 million in 2024.

Income levels dictate Parkson's approach to product range and pricing tactics. The top 20% of Malaysian households earn about 46% of the total income. Catering to varied income tiers—high-end luxury vs. value—is crucial. Consumer confidence tied to job security and economics significantly impacts spending habits.

| Factor | Impact | Data |

|---|---|---|

| Consumer Preferences | Demand shifts | Organic food market: $1.2B (2025) |

| Urbanization | Customer growth | SEA population: 700M (2025) |

| Cultural Influences | Product adaptations | Muslim pop.: ~240M (2024) |

Technological factors

The surge in Southeast Asia's e-commerce market, projected to reach $172 billion in 2024, offers Parkson avenues for expansion. To compete, Parkson must bolster its online platforms, enhance e-commerce infrastructure, and adopt omnichannel models. Failure to adapt could lead to a decline in market share, as digital retail gains prominence. Parkson's investment in these areas is crucial for future growth.

Southeast Asia's high mobile phone penetration, with over 70% smartphone adoption in key markets like Malaysia and Indonesia as of late 2024, directly impacts Parkson. The surge in mobile payments and shopping apps, with transactions expected to exceed $100 billion in 2025, demands a mobile-first approach. Parkson must enhance its mobile platforms to capture this growing segment. Failure to do so risks losing market share to competitors with superior mobile experiences.

Parkson can leverage in-store tech to boost customer experience. Self-checkouts and interactive displays can streamline shopping. Personalized recommendations can drive sales; In 2024, retailers saw a 15% sales lift with such tech. This improves efficiency and engagement.

Data Analytics and Personalization

Data analytics is crucial for Parkson to understand its customers. By analyzing behavior, Parkson personalizes marketing and product suggestions. This boosts customer engagement. In 2024, retailers using personalization saw a 10-15% increase in sales. Parkson can use data to refine its strategies.

- Personalized marketing can lift conversion rates by up to 20%.

- Data-driven decisions improve inventory management.

- Customer lifetime value increases with personalization.

- Retailers adopting AI for personalization grew revenue by 18%.

Supply Chain Technology and Logistics

Supply chain technology and logistics are crucial for Parkson. Technological improvements can streamline operations, cut expenses, and boost delivery speed. Implementing systems like automated inventory management can reduce stockouts. Enhanced logistics can significantly impact customer satisfaction and operational profitability.

- In 2024, the global supply chain management market was valued at approximately $19.2 billion.

- By 2025, it's projected to reach over $21 billion.

- Investing in technologies can lead to a 15-20% reduction in logistics costs.

Parkson should aggressively use tech to boost e-commerce; the SE Asia market will hit $172B in 2024. Mobile payments are soaring, with over $100B in transactions expected in 2025. In-store tech like self-checkouts and personalized displays boosted sales 15% for some retailers in 2024.

| Technology Area | Impact | 2024-2025 Data |

|---|---|---|

| E-commerce | Market Expansion | SE Asia market: $172B (2024), Mobile payments over $100B (2025) |

| Mobile Platforms | Customer Engagement | 70% smartphone adoption in key markets. |

| In-Store Tech | Streamlined Shopping | Retailers sales lift up to 15% |

Legal factors

Parkson faces legal hurdles, adhering to retail laws across its operating countries, covering permits, store rules, and consumer rights. Compliance costs can be substantial. In 2024, retail businesses faced an average of $15,000 in legal fees due to regulatory changes. Non-compliance may lead to hefty penalties, potentially impacting profitability. Parkson must stay updated with evolving retail legislations.

Parkson must adhere to employment and labor laws in Southeast Asia, covering minimum wage, working hours, and benefits. In 2024, Indonesia's minimum wage rose by 3.6% on average. Compliance avoids legal issues and ensures fair treatment. This is critical for maintaining a positive brand image. Failure can lead to penalties and reputational damage.

Parkson must comply with advertising and marketing regulations to avoid legal issues. These include truth in advertising and promotional guidelines. In 2024, advertising spending in the retail sector reached $20 billion. Non-compliance can lead to fines and reputational damage. Furthermore, consumer protection laws are crucial for ethical marketing.

Data Privacy and Protection Laws

Parkson faces stringent data privacy regulations due to digital expansion. Compliance is crucial to avoid penalties and maintain customer trust. The General Data Protection Regulation (GDPR) and similar laws in other regions mandate secure data handling. Failure to comply can result in significant fines, potentially impacting financial performance.

- GDPR fines can reach up to 4% of global annual turnover.

- Data breaches cost companies an average of $4.45 million in 2023.

Intellectual Property Laws

Parkson must navigate intellectual property laws to protect its brands and respect others' rights. This includes trademarks, copyrights, and patents. In 2024, global spending on IP protection is estimated at $600 billion. Infringement can lead to significant financial penalties and reputational damage. Parkson's legal team must stay updated on evolving regulations.

- Trademark registration is crucial for brand protection.

- Copyright laws safeguard creative content, like marketing materials.

- Patent laws are relevant if Parkson develops unique products.

- Compliance minimizes legal risks and fosters trust.

Parkson must follow diverse retail laws, facing costs like $15,000 in 2024 for regulatory compliance. Employment and labor laws, including wage changes (Indonesia: +3.6%), impact operations. Data privacy rules are vital, as breaches cost ~$4.45M in 2023, GDPR fines reaching 4% of global revenue.

| Legal Aspect | Compliance Need | Financial Impact (2024/2025) |

|---|---|---|

| Retail Laws | Permits, consumer rights | Fees ~ $15,000; Penalties vary |

| Employment | Wage, hours, benefits | Indonesia's wage up 3.6%; Penalties |

| Data Privacy | GDPR, secure data | Breach cost ~$4.45M; GDPR fines to 4% |

Environmental factors

Southeast Asia shows rising environmental awareness, impacting consumer choices. Governments are enacting stricter regulations. For example, the ASEAN region's green economy could reach $1 trillion by 2030. Companies must adopt sustainable practices. These include eco-friendly sourcing and waste reduction.

Waste management and recycling regulations are crucial for Parkson. Stricter rules mean more sustainable practices are needed. Investment in eco-friendly packaging and waste disposal is key. For example, the global waste management market is predicted to reach $2.4 trillion by 2028.

Large department stores like Parkson have substantial energy needs. They might encounter stricter rules on energy use and carbon reduction. China's plan targets a 13.5% cut in energy intensity by 2025. Parkson must adapt to stay competitive.

Ethical Sourcing and Supply Chain Transparency

Consumers are pushing for ethical sourcing and supply chain transparency, which affects companies like Parkson. Demand for products made without exploitation is growing. A 2024 study showed 70% of consumers prefer brands with transparent supply chains. Parkson must ensure its suppliers meet ethical standards to maintain consumer trust and avoid reputational damage.

- 70% of consumers prefer brands with transparent supply chains.

- Ethical sourcing is becoming a key factor in consumer purchasing decisions.

Climate Change Impacts

Climate change poses significant risks to Parkson's operations. Supply chain disruptions are possible due to extreme weather, which can increase costs and reduce product availability. Consumer behavior may shift, with demand fluctuating based on weather patterns, impacting sales forecasts. Regulatory changes, such as carbon taxes or stricter environmental standards, could increase operational expenses. The World Bank estimates that climate change could push over 100 million people into poverty by 2030.

- Supply chain disruptions could increase costs by 10-15%.

- Consumer behavior changes could reduce sales by 5-10% during extreme weather events.

- Regulatory changes could increase operational expenses by 2-3%.

- Severe weather events increased insurance claims by 20% in 2024.

Environmental awareness and sustainability are crucial for Parkson. Stricter regulations are emerging, as Southeast Asia's green economy targets $1 trillion by 2030. Consumers prioritize eco-friendly and ethically sourced products, with 70% preferring brands with transparent supply chains.

Parkson faces risks from climate change, including supply chain disruptions and fluctuating consumer behavior, which might increase costs and reduce sales. Regulatory changes, such as carbon taxes, could also elevate operational expenses, adding up to 2-3% more costs. Insurance claims soared by 20% in 2024 because of extreme weather.

To remain competitive, Parkson must prioritize sustainable practices, improve supply chain transparency, and adapt to climate-related challenges to ensure long-term operational success and maintain consumer trust. Ethical sourcing is becoming key.

| Factor | Impact | Data |

|---|---|---|

| Regulations | Stricter rules | Green economy target: $1T by 2030 in ASEAN |

| Consumer Preference | Eco-friendly products | 70% prefer brands w/ transparent supply chains |

| Climate Change | Supply chain disruption | Insurance claims up 20% in 2024, Costs up 2-3% |

PESTLE Analysis Data Sources

The PESTLE analysis incorporates data from market research, governmental bodies, and financial reports, ensuring accurate insights. We use reliable information on the factors affecting the industry.