Pegasystems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pegasystems Bundle

What is included in the product

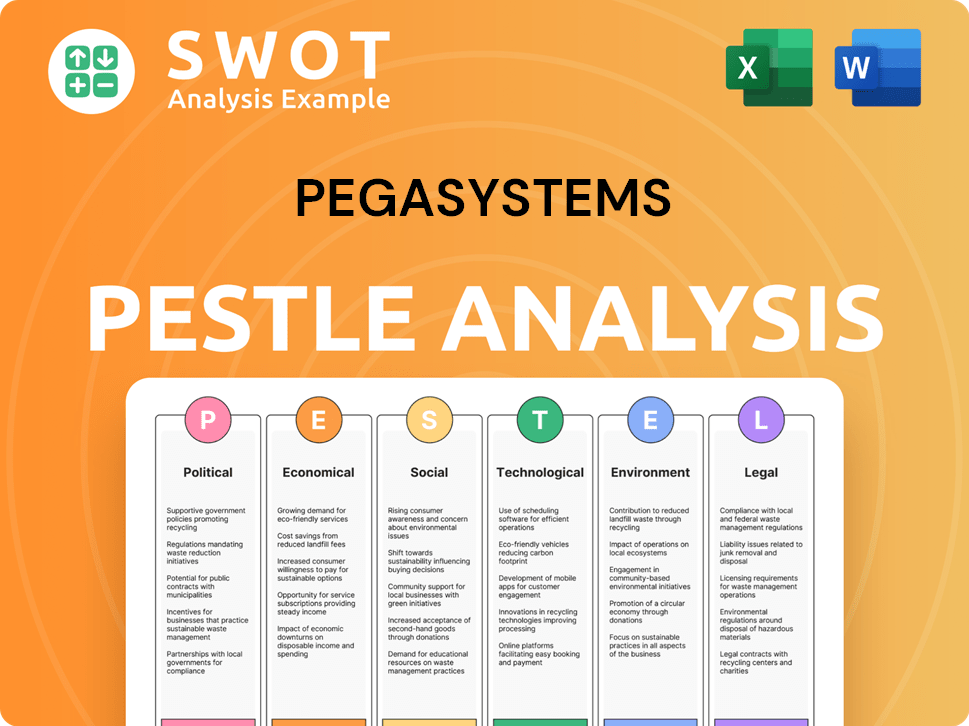

Examines macro factors influencing Pegasystems: Political, Economic, Social, Technological, Environmental, Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Pegasystems PESTLE Analysis

Preview the Pegasystems PESTLE analysis now. The layout and content visible here is exactly what you'll download after purchase. It's fully formatted, professional, and ready for your immediate use. See the final, complete document. No surprises!

PESTLE Analysis Template

Navigate the complexities shaping Pegasystems with our in-depth PESTLE analysis. Uncover key political, economic, social, technological, legal, and environmental factors. Learn how these trends impact the company's strategic decisions and market position. Gain insights into potential opportunities and risks facing Pegasystems. Access a detailed, ready-to-use analysis crafted for actionable strategies. Get the full, insightful breakdown now.

Political factors

Government regulations on data privacy and security significantly affect Pegasystems. Compliance with frameworks like GDPR and CCPA is crucial for its software. In 2024, Pega must adapt to evolving legal standards. Stricter rules increase development costs and impact market entry.

Global political stability and geopolitical events significantly impact business confidence and investment in enterprise software. Uncertainties, such as those seen with ongoing conflicts, can lead to delayed purchasing decisions. Pegasystems, like other tech firms, faces market shifts due to these factors. For example, geopolitical tensions in 2024/2025 could affect international sales, potentially impacting revenue growth.

Pegasystems heavily relies on government contracts. In 2024, the U.S. federal government's IT spending reached approximately $100 billion. This sector's digital transformation efforts are crucial for Pega's sales. Government procurement regulations and budget allocations influence Pega's ability to secure and execute projects effectively. Any shifts in these areas can significantly impact its financial performance.

Trade Policies and Tariffs

Trade policies and tariffs significantly affect Pegasystems. Changes in these areas can increase the cost of operations. This could impact profitability and pricing. For example, in 2024, the U.S. imposed tariffs on certain software imports.

- Tariffs can increase costs by 10-25% depending on the product.

- Trade wars have reduced global trade by 5-10% in 2024.

Government Support for Digital Transformation

Government backing significantly influences Pegasystems' market position. Initiatives promoting digital transformation, AI, and automation create opportunities. These initiatives boost demand for Pegasystems' solutions across sectors. Such support can lead to increased adoption and growth.

- In 2024, the U.S. government allocated $2.8 billion for AI research and development.

- The EU's Digital Decade policy aims to ensure that 75% of European companies use cloud computing, AI, and big data by 2030.

- India's Digital India initiative has spurred a 30% increase in digital transactions.

Political factors, including data privacy laws like GDPR and CCPA, mandate compliance for Pegasystems, impacting development costs, especially in 2024/2025. Geopolitical stability directly affects investment; uncertainties could delay purchasing decisions, influencing Pega's sales. Government contracts, integral to Pega's business, are influenced by procurement regulations and budget allocations; the U.S. government IT spending in 2024 was around $100 billion.

Trade policies, encompassing tariffs, can increase operational expenses, potentially impacting profitability and pricing. Government initiatives, promoting digital transformation, AI, and automation, bolster demand for Pegasystems' solutions; for instance, the U.S. allocated $2.8 billion to AI R&D in 2024. EU's Digital Decade aims to have 75% of firms using cloud, AI, big data by 2030.

| Political Factor | Impact on Pegasystems | Data/Example (2024/2025) |

|---|---|---|

| Data Privacy Laws | Increased compliance costs | GDPR, CCPA compliance efforts. |

| Geopolitical Events | Delayed purchasing decisions | Conflicts, trade wars affect sales. |

| Government Contracts | Influences sales/revenue | U.S. gov IT spending $100B. |

Economic factors

Global economic health significantly impacts IT spending. High inflation and recession risks, like those observed in late 2023 and early 2024, cause budget constraints. Gartner projects a 6.8% increase in IT spending in 2024, yet uncertainty persists. Economic downturns often lead to delayed or reduced software investments.

Currency exchange rate volatility significantly affects Pegasystems. As of Q1 2024, fluctuations altered reported revenues. A stronger US dollar could reduce the value of international sales. This impacts profitability due to currency conversions. Pegasystems needs to manage currency risk.

Pegasystems benefits from a thriving enterprise software market, especially in AI and automation. The global AI market is forecasted to reach $1.81 trillion by 2030, with a CAGR of 36.8% from 2023. This offers substantial growth opportunities for Pega. The increasing demand for digital transformation fuels market expansion.

Client Spending and Investment

Client spending on digital transformation and automation is pivotal for Pegasystems. Pegasystems must showcase a strong ROI to attract investments from clients. In 2024, the global digital transformation market was valued at $761.3 billion, with expected growth to $1.4 trillion by 2029. This growth is a direct indicator of potential client investments. Pegasystems' financial success hinges on clients' willingness to invest.

Competition and Pricing Pressure

The enterprise software market is fiercely competitive, creating pricing pressures. Pegasystems must carefully manage its pricing to stay competitive. This includes ensuring its pricing reflects the value delivered to clients while preserving its profitability. The global enterprise software market was valued at $672.5 billion in 2023, and is projected to reach $897.7 billion by 2025.

- Market competition influences pricing strategies.

- Pegasystems must balance value and cost.

- Profitability is crucial for long-term success.

- The enterprise software market is expanding.

Economic conditions affect IT spending and Pegasystems. Global IT spending is expected to grow in 2024, with possible fluctuations. Currency exchange rate volatility presents both risks and opportunities for Pegasystems, which impacts revenues.

| Factor | Impact | Data |

|---|---|---|

| IT Spending Growth | Influences demand for Pega | Gartner projects 6.8% increase in 2024 |

| Currency Fluctuations | Affects revenue reporting | USD impact on int'l sales |

| Market Size | Growth opportunity for Pega | Enterprise software market $897.7B by 2025 |

Sociological factors

Changing customer expectations are reshaping business strategies. Pegasystems' solutions are crucial as customers seek personalized, seamless experiences. Investments in customer engagement tech are rising, with a 2024 global CRM market valued at over $69 billion. Pegasystems helps businesses adapt to these demands.

Automation and AI reshape work. This drives demand for Pegasystems' solutions. Companies must address workforce impacts. The global AI market is projected to reach $200 billion by 2025, indicating significant growth. Pegasystems' revenue in 2024 was $1.36B.

Digital literacy and tech adoption rates are crucial. In 2024, global internet penetration reached 67%, with significant regional variations. Higher literacy and faster adoption ease Pegasystems' software implementation.

Privacy Concerns and Trust in Technology

Societal focus on data privacy and AI ethics impacts how people view Pegasystems' offerings. Trust is key, especially with rising concerns about data breaches and misuse. A 2024 survey showed 79% of people worry about their data privacy. Addressing these issues is crucial for market acceptance.

- 79% of people worry about data privacy (2024).

- Data breach costs reached $4.45 million globally in 2023.

- AI ethics concerns are growing.

Industry-Specific Needs and Trends

Sociological trends significantly shape industry needs. Pegasystems' software addresses these shifts. In healthcare, patient experience is crucial; in finance, personalization matters. The company tailors solutions to meet these demands. For example, 75% of healthcare providers prioritize patient experience improvements.

- Healthcare spending in the U.S. reached $4.5 trillion in 2022.

- Personalized financial services market is projected to reach $15 billion by 2025.

- 70% of financial institutions are investing in personalization technologies.

Public concern over data privacy and AI ethics are growing, with 79% of people worried about data privacy in 2024. Data breaches continue to be costly; globally, breach costs reached $4.45 million in 2023. These concerns necessitate robust cybersecurity measures for companies like Pegasystems.

| Aspect | Details | Data |

|---|---|---|

| Data Privacy Concerns | Percentage of people worried about data privacy | 79% (2024) |

| Data Breach Costs | Average global cost of data breaches | $4.45M (2023) |

| AI Ethics Impact | Growing importance | Significant, 2024/2025 |

Technological factors

Pegasystems is significantly influenced by rapid AI and machine learning advancements. The company is actively integrating generative AI and other AI technologies into its platform. This strategic move aims to improve its services and introduce innovative solutions. In Q1 2024, Pegasystems reported that AI-driven enhancements boosted customer engagement. The investment in AI is reflected in their product development roadmap for 2024/2025.

Pegasystems thrives on cloud computing, a major tech trend. Pega Cloud services fuel company expansion. In Q4 2023, cloud revenue grew significantly. Pega Cloud's annual contract value (ACV) is rising. This growth is set to continue in 2024 and 2025.

Low-code/no-code platforms are transforming software development. Pegasystems, with its low-code solutions, benefits from this shift. The global low-code development platform market is projected to reach $69.7 billion by 2027. This enables quicker app creation. In Q1 2024, Pegasystems' revenue was $326.7 million.

Hyperautomation and Workflow Automation

Hyperautomation, combining technologies like AI and robotic process automation (RPA), is central to Pegasystems' business. Pegasystems excels in workflow automation, which is increasingly vital for businesses. The global hyperautomation market is projected to reach $756.5 billion by 2030, showcasing significant growth potential. This growth underscores the importance of Pegasystems' solutions.

- Market growth: The hyperautomation market is forecasted to hit $756.5B by 2030.

- Core business: Pegasystems' core is workflow automation, critical for hyperautomation.

- Demand: Organizations are increasing their focus on efficiency through automation.

Data Security and Cybersecurity Threats

Data security and cybersecurity are paramount with the growing use of digital systems and cloud services. Pegasystems must prioritize the security of its platform to protect client data effectively. Cyberattacks are rising; in 2024, the average cost of a data breach was $4.45 million globally, as reported by IBM. Pegasystems' clients need robust data protection to avoid such financial and reputational damage. It's crucial for the company to invest in advanced security measures.

- Global data breach costs reached $4.45 million in 2024.

- Cybersecurity Ventures predicts global cybercrime costs will hit $10.5 trillion annually by 2025.

- Pegasystems' clients need strong data protection to avoid financial losses.

Technological factors highly influence Pegasystems. AI and cloud computing are critical. Cybersecurity is crucial, given rising data breach costs; IBM reported a $4.45M average breach cost in 2024. Low-code/no-code platforms continue growing, and hyperautomation will hit $756.5B by 2030.

| Technology | Impact | Data Point |

|---|---|---|

| AI Integration | Enhances platform, boosts customer engagement | AI-driven enhancements improved engagement in Q1 2024 |

| Cloud Computing | Drives company expansion and revenue growth | Cloud revenue saw growth in Q4 2023 and is rising in 2024/2025. |

| Cybersecurity | Protects client data from breaches | Average data breach cost $4.45 million in 2024 (IBM). |

Legal factors

Pegasystems navigates strict data privacy rules like GDPR and CCPA, which heavily influence how it and its clients manage personal data. Compliance is crucial, affecting product development and operational strategies. The global data privacy market is projected to reach $13.3 billion by 2025. Pegasystems must stay updated to avoid legal issues and maintain customer trust, especially in the EU, where GDPR fines can reach up to 4% of global revenue.

Pegasystems must protect its intellectual property, including software and methodologies, to maintain its competitive edge. The company faces legal risks, particularly in patent disputes and trade secret violations. The Appian lawsuit is a key example, with significant financial and reputational implications. In 2024, such litigation could impact Pegasystems' financials, potentially influencing its market position.

Pegasystems operates in sectors like finance, healthcare, and government, each bound by strict regulations. Its software must comply with these rules to avoid penalties. For instance, financial institutions face stringent data privacy laws like GDPR, impacting Pegasystems' offerings. Healthcare providers must adhere to HIPAA, requiring data security. The global regulatory landscape is constantly changing, with updates expected in 2024-2025.

Tax Laws and Regulations

Pegasystems faces impacts from tax law changes globally, affecting its financials. For instance, the US corporate tax rate, at 21%, directly influences its tax liabilities. Furthermore, international tax reforms, like those from the OECD's BEPS project, reshape how multinational firms are taxed. These changes can lead to higher or lower effective tax rates and necessitate adjustments in financial planning.

- US corporate tax rate: 21%

- BEPS project impacts: Affects international tax strategies

Contract Law and Client Agreements

Pegasystems operates within a complex legal landscape. Contract law dictates software licensing, cloud service agreements, and client contracts, which are crucial for its operations. Compliance is vital to minimize legal risks and maintain client trust. In 2024, the software market saw $670 billion in revenue, highlighting the importance of legally sound contracts.

- Licensing agreements must protect intellectual property.

- Cloud service contracts need to address data privacy.

- Client agreements should clearly define scope and terms.

Pegasystems complies with data privacy laws like GDPR; the global data privacy market is forecast at $13.3B by 2025. Intellectual property protection is vital due to risks like the Appian lawsuit that can affect financial and market positioning in 2024. They must navigate tax law changes, such as the US corporate tax rate which is currently at 21%.

| Legal Area | Impact | Data Point |

|---|---|---|

| Data Privacy | Compliance Costs, Reputational Risk | GDPR fines up to 4% of global revenue |

| Intellectual Property | Litigation, Competitive Edge | Software market revenue $670B (2024) |

| Taxation | Tax Liabilities, Financial Planning | US corporate tax rate: 21% |

Environmental factors

Pegasystems, like other tech firms, is under scrutiny regarding environmental sustainability. Data centers' energy use and carbon footprint are key concerns. For example, the global data center market is projected to reach $628.04 billion by 2030. Reducing environmental impact is becoming a business imperative.

Client demand for sustainable solutions is growing. Pegasystems faces pressure to show its environmental commitment. This includes reducing carbon footprint and using eco-friendly practices. According to a 2024 survey, 68% of clients prefer sustainable tech providers. Aligning with client values is crucial for Pegasystems' market position.

Pegasystems, though software-focused, considers its supply chain's environmental impact. This includes hardware procurement and office operations, which contribute to its carbon footprint. Addressing these areas is crucial for broader environmental sustainability efforts. In 2024, the tech industry faced scrutiny, with data centers consuming vast energy; Pegasystems must navigate these challenges.

Regulatory Focus on Environmental Reporting

Pegasystems faces growing regulatory demands for environmental impact and sustainability reporting. These regulations, driven by global initiatives, require detailed disclosures. Failure to comply can lead to penalties and reputational damage. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), effective from 2024, affects a wide range of companies.

- Companies in the EU with over 250 employees and €40 million in revenue must comply.

- Non-compliance can result in fines and legal issues.

- The market for ESG reporting software is projected to reach $2 billion by 2025.

Business Continuity and Climate Change Impacts

Climate change presents indirect risks to Pegasystems and its clients, primarily through extreme weather events. These events can disrupt data center operations and client business continuity, potentially impacting service delivery. Pegasystems needs to ensure its infrastructure and client solutions are resilient. This includes disaster recovery plans and strategies to mitigate climate-related risks. For instance, in 2024, the global cost of climate disasters reached $350 billion.

- Data center resilience is key to business continuity.

- Climate change impacts can cause operational disruptions.

- Disaster recovery plans are crucial for mitigation.

- The cost of climate disasters is steadily increasing.

Pegasystems addresses environmental factors via sustainability initiatives due to regulatory pressures. Client demand for sustainable solutions is a key driver. These factors include energy usage and climate risks.

| Aspect | Details | Impact |

|---|---|---|

| Data Centers | Market forecast $628.04B by 2030 | High energy consumption and carbon footprint. |

| Client Demand | 68% prefer sustainable tech. | Requires aligning with eco-friendly practices. |

| Regulatory | EU's CSRD effective from 2024 | Companies must report and comply. |

PESTLE Analysis Data Sources

The Pegasystems PESTLE Analysis utilizes data from governmental publications, reputable market research firms, and tech-industry news sources to ensure an accurate and insightful analysis.