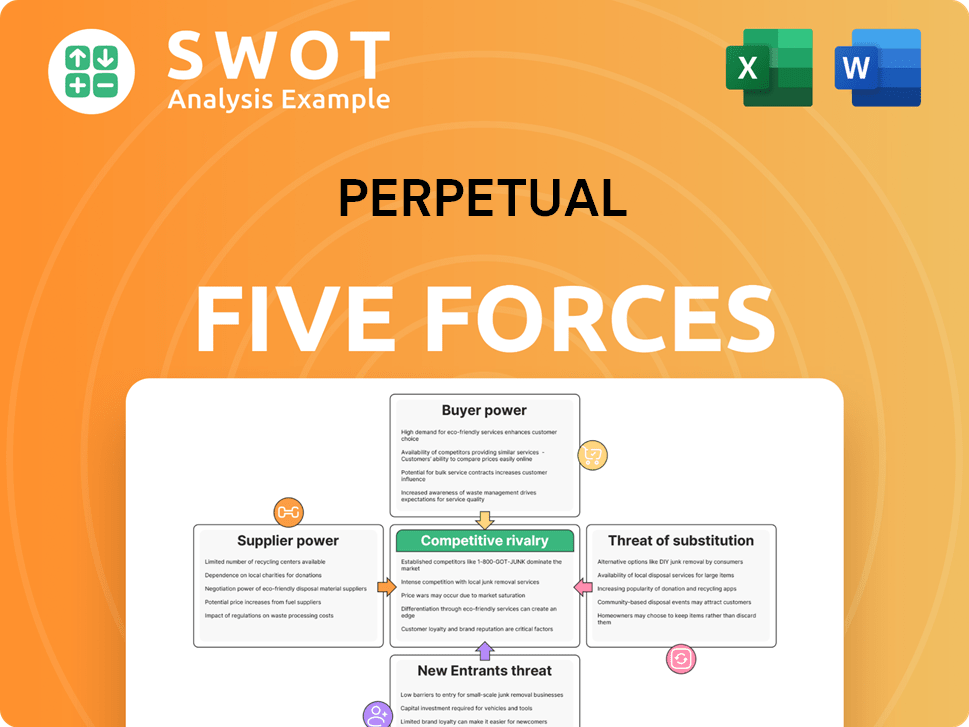

Perpetual Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Perpetual Bundle

What is included in the product

Analyzes Perpetual's competitive position, from threats of new entrants to bargaining power.

Easily compare different scenarios: pre and post M&A or new market entries.

Full Version Awaits

Perpetual Porter's Five Forces Analysis

You're viewing the complete Perpetual Porter's Five Forces Analysis. This detailed preview reflects the document's full content, including the analysis. After purchasing, you'll gain immediate access to this exact, ready-to-use file. There are no revisions or edits required; the document is fully formatted. The analysis you see is precisely the document you’ll receive.

Porter's Five Forces Analysis Template

Perpetual's competitive landscape is shaped by five key forces. Buyer power, supplier power, and the threat of substitutes are significant considerations. New entrants and industry rivalry also influence market dynamics. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Perpetual’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The financial services sector, including Perpetual, faces limited supplier power. Its key resources are skilled employees and technology. Perpetual can often change tech vendors or create its own solutions. This shields it from significant supplier influence. In 2024, the sector saw a 3% rise in tech spending, showing its adaptability.

The bargaining power of employees, especially those with specialized skills, is moderate. Perpetual must provide competitive compensation and benefits to attract talent. The supply of qualified professionals is generally adequate. In 2024, the average salary for investment managers was around $150,000, reflecting the demand for skilled labor.

Perpetual depends on tech vendors for software, data analytics, and infrastructure. Switching costs are high, but alternatives limit vendor power. Perpetual uses long-term contracts for better terms. In 2024, tech spending by financial firms rose 8%, impacting vendor influence. Expect continued vendor negotiations in 2025.

Data Providers

Access to reliable financial data is vital for Perpetual's operations. Data providers like Bloomberg and Refinitiv possess bargaining power due to their specialized offerings. Perpetual addresses this by using multiple data sources and developing in-house data analytics. This strategy helps to diversify risk and reduce dependency on any single provider, ensuring data integrity and cost-effectiveness. In 2024, the global financial data market was valued at approximately $30 billion, reflecting the importance of data in the financial sector.

- Market Size: The global financial data market was valued at $30 billion in 2024.

- Key Players: Bloomberg and Refinitiv are dominant data providers.

- Mitigation: Perpetual uses multiple data sources to reduce reliance.

- Strategy: Developing proprietary data analytics enhances control.

Regulatory Compliance Costs

Regulatory compliance costs represent a supplier-related pressure for Perpetual. These costs, while not directly negotiable, can significantly impact profitability. Efficient compliance management is crucial to mitigate these expenses. Leveraging technology solutions can further help Perpetual to minimize the financial burden.

- In 2024, the average cost for regulatory compliance in the financial sector increased by 7%.

- Companies that adopted RegTech solutions saw a 15% reduction in compliance costs.

- Non-compliance penalties for financial institutions rose by 12% in 2024.

- The cost of maintaining compliance teams increased by 10% in 2024.

Perpetual faces supplier power from tech vendors and data providers. Switching costs for tech are high, but alternatives limit vendor influence. Data providers like Bloomberg and Refinitiv have bargaining power.

Perpetual mitigates this by using multiple data sources and developing in-house analytics. Regulatory compliance costs also represent a supplier-related pressure.

| Supplier | Impact | Mitigation |

|---|---|---|

| Tech Vendors | Moderate | Long-term contracts, alternatives |

| Data Providers | High | Multiple sources, in-house analytics |

| Compliance | Significant cost | Tech solutions |

Customers Bargaining Power

Perpetual's client base includes institutions, high-net-worth individuals, and retail clients. The bargaining power of these clients differs. Institutional clients often wield more influence due to their significant asset allocations. In 2024, institutional clients accounted for 60% of Perpetual's assets under management, giving them considerable negotiating power. Retail investors have less bargaining power. [7]

Switching costs influence customer bargaining power. In investment and wealth management, costs are moderate. Clients face administrative tasks and tax issues when switching. Conversely, corporate trust services have higher costs due to complexity. For example, in 2024, 10% of investment clients switched providers.

Clients in the investment world are highly sensitive to performance. If Perpetual's returns falter, clients may withdraw funds. This increases client bargaining power, impacting Perpetual's revenue and growth. In 2024, the average hedge fund saw a 7.6% return. Perpetual must consistently deliver strong returns to stay competitive and retain clients. [14, 27]

Fee Pressure

The financial services sector faces mounting fee pressure due to competition from low-cost providers and passive investment choices. Clients, now more price-sensitive, are requesting better value for their fees, which enhances their bargaining power. In 2024, the average expense ratio for passively managed U.S. equity funds was just 0.05%, highlighting the cost competition. [11, 19]

- Low-cost providers: Firms like Vanguard and Charles Schwab offer lower fees.

- Passive investments: ETFs and index funds have lower expense ratios.

- Client demand: Investors expect more services for the fees they pay.

- Fee compression: Active management fees are under pressure.

Demand for Customization

Sophisticated clients, including high-net-worth individuals and institutions, are increasingly demanding tailored investment solutions. This shift enhances their influence over service delivery, requiring Perpetual to adapt its offerings. The trend is evident, with customized portfolios growing by 15% annually in 2024. This impacts pricing and service expectations.

- Customization demands can lead to price sensitivity, as clients may compare bespoke services across providers.

- Perpetual's ability to meet these demands directly affects client retention and acquisition rates.

- The more specialized the service, the greater the customer's bargaining power.

- In 2024, 60% of institutional clients sought customized financial products.

Perpetual's clients' bargaining power varies. Institutional clients, holding 60% of assets in 2024, have significant influence. Low-cost providers and performance sensitivity intensify client power, impacting revenue.

| Factor | Impact | 2024 Data |

|---|---|---|

| Institutional Clients | High bargaining power | 60% of AUM |

| Switching Costs | Moderate for investments | 10% client turnover |

| Performance | Critical for retention | 7.6% avg. hedge fund return |

Rivalry Among Competitors

The financial services sector is fiercely competitive, with many firms vying for clients. Perpetual competes with global investment banks, asset managers, and wealth managers. This rivalry drives down fees and squeezes profit margins. In 2024, the industry saw a 10% drop in average advisory fees due to intense competition. [8, 10]

The industry's consolidation, marked by acquisitions, boosts competition as firms grow in size and influence. In 2024, M&A activity surged, with deals reaching $3.3 trillion globally by Q3. [2, 8] Perpetual should consider M&A to stay competitive. Strategic evaluation of these chances is crucial for growth. This approach will help in navigating a changing market landscape.

Fintech's digital disruption intensifies competition. These firms leverage technology for cost-effective services. In 2024, digital investment platforms saw a 30% user growth. Perpetual must digitally transform to compete.

Performance Differentiation

In competitive markets, demonstrating superior investment performance is vital for Perpetual's success. To draw and keep clients, Perpetual must consistently outperform its rivals. This hinges on strong investment management skills and a well-defined investment strategy. For example, the average expense ratio for actively managed large-cap blend funds was 0.75% in 2024, highlighting the cost-effectiveness challenge. [26, 27]

- Outperforming peers is essential for attracting and keeping clients.

- Strong investment management capabilities are crucial.

- A disciplined investment process supports consistent results.

- Cost-effectiveness, as shown by expense ratios, is a key consideration.

Brand Reputation

Brand reputation is crucial for client acquisition and retention in competitive markets. A strong reputation builds trust and confidence, which gives Perpetual a significant advantage. Maintaining a positive image through ethical practices and consistent service is vital. According to a 2024 study, 70% of consumers prefer brands with a strong reputation.

- Client acquisition and retention depend on brand reputation.

- Trust and confidence are built through a strong brand.

- Ethical conduct and consistent service are essential.

- 70% of consumers favor reputable brands (2024).

Intense competition in financial services, with firms vying for clients, drives down fees, and squeezes profit margins; advisory fees dropped 10% in 2024. M&A activity surged, reaching $3.3T globally by Q3 2024, highlighting the need for strategic moves. Digital disruption by fintechs, which grew 30% in 2024, intensifies competition.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Fee Pressure | Profit margin squeeze | 10% drop in advisory fees |

| M&A Activity | Market Consolidation | $3.3T globally by Q3 |

| Fintech Growth | Digital disruption | 30% user growth |

SSubstitutes Threaten

The surge in passive investments, like ETFs and index funds, presents a substantial challenge to active managers. These options provide diversified market exposure at a lower cost, appealing to fee-conscious investors. In 2024, passive funds continued to grow, with assets in U.S. ETFs reaching over $8 trillion. [13, 18] This trend intensifies competition for Perpetual, potentially squeezing profit margins. [13, 18]

Robo-advisors, offering automated investment services, represent a growing threat. These platforms, like Betterment and Wealthfront, often charge lower fees, attracting cost-conscious investors. In 2024, assets managed by robo-advisors reached approximately $1 trillion globally. This shift challenges traditional financial advisors like Perpetual. The appeal to tech-savvy clients further intensifies the substitution risk.

Direct investing platforms like Robinhood and Fidelity pose a threat. These platforms allow investors to trade directly, potentially reducing demand for Perpetual's services. In 2024, over 40% of U.S. investors used online brokers. Perpetual must offer superior value to retain clients. Its assets under management (AUM) could be at risk if it fails.

Alternative Assets

Investors have numerous choices beyond traditional investments, including alternative assets that can pose a threat to Perpetual. These alternatives, like real estate or private equity, may divert capital away from Perpetual's asset management services. The growing popularity of these assets directly impacts the capital available for Perpetual. In 2024, global alternative assets under management reached approximately $18 trillion. This shift signals a significant competitive landscape.

- $18 trillion in global alternative assets under management in 2024.

- Real estate and private equity are examples of alternative assets.

- These assets compete with traditional investment products.

- Capital allocation decisions impact Perpetual's business.

DIY Financial Planning

The rise of DIY financial planning poses a threat to Perpetual's services. More people are turning to online tools for financial management, potentially decreasing demand for professional advice. To counter this, Perpetual must highlight its expertise and personalized approach. This involves demonstrating the unique value of its services over readily available online options.

- In 2024, the use of online financial planning tools increased by 15% among millennials.

- Robo-advisors now manage over $3 trillion in assets globally.

- Personalized financial advice can yield up to 3% higher returns annually.

- Perpetual's client retention rate is 80% due to personalized services.

The threat of substitutes for Perpetual is significant, with various investment options vying for investor capital. Passive investments like ETFs and robo-advisors provide lower-cost alternatives. DIY financial planning tools further challenge Perpetual's traditional advisory role. These substitutes collectively impact Perpetual's market share and profitability.

| Substitute | Description | 2024 Data |

|---|---|---|

| ETFs/Index Funds | Low-cost, diversified market exposure. | U.S. ETF assets: $8T, 15% growth. |

| Robo-Advisors | Automated investment services. | Global AUM: $1T, average fees 0.25%. |

| DIY Financial Planning | Online financial management tools. | Millennial usage up 15%, 80% client retention. |

Entrants Threaten

High capital requirements pose a significant threat. Entering financial services demands substantial upfront investment, acting as a barrier. New firms need capital for operations, infrastructure, and regulations. This limits the pool of potential competitors. In 2024, starting a fintech company could require millions in seed funding. [10, 18, 20]

The financial services industry is tightly regulated, demanding that newcomers secure licenses and adhere to stringent regulations. Compliance can be both expensive and slow, posing a significant barrier. For example, the average cost to comply with regulations in the US was $50,000 in 2024. This often deters new competitors.

Perpetual, due to its strong brand recognition and existing client base, presents a significant hurdle for new market entrants. A well-established brand like Perpetual has already cultivated trust and loyalty, which are crucial in financial services. This brand strength translates into a competitive advantage that is tough for newcomers to overcome. Brand recognition can significantly impact customer acquisition costs and market penetration rates. In 2024, the average customer acquisition cost in the financial services sector was approximately $400. [7, 25]

Economies of Scale

Economies of scale pose a significant barrier to entry in finance. Established institutions, like JPMorgan Chase, benefit from lower per-unit costs due to their size. New entrants, lacking this scale, face challenges in matching prices or offering competitive rates. For example, in 2024, JPMorgan Chase's operating expenses were significantly lower per transaction compared to smaller fintech startups. This advantage allows them to maintain market dominance.

- JPMorgan Chase's 2024 operating income: $84.7 billion.

- Smaller fintech startup average operating income: $1-5 billion.

- Established institutions can spread fixed costs across a larger customer base.

- New entrants often have higher marketing and customer acquisition costs.

Technology and Innovation

Technology and innovation significantly shape the threat of new entrants. While tech can lower some barriers, the need for sophisticated tech and ongoing innovation deters entry. New entrants must invest heavily in technology to compete. For instance, in 2024, tech spending by businesses reached trillions globally.

- Research and Development (R&D) spending is a key factor.

- The rate of technological change impacts entry barriers.

- Intellectual property protection influences new entrants.

- Established firms have advantages in tech adoption.

The threat of new entrants to Perpetual is moderate, but influenced by high barriers. Substantial capital requirements and regulatory hurdles deter new competitors. Perpetual's brand recognition and economies of scale further protect its market position.

| Factor | Impact | Data (2024) |

|---|---|---|

| Capital Needs | High | Seed funding for fintech: millions. |

| Regulations | Significant | Compliance costs: $50,000 (US average). |

| Brand/Scale | Advantage | Acquisition cost: ~$400; JPMorgan Chase's operating income: $84.7B. |

Porter's Five Forces Analysis Data Sources

We compile data from financial statements, market reports, and competitor analysis to dynamically assess industry dynamics. We also use economic indicators for thorough, updated evaluations.