Petco Health and Wellness Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Petco Health and Wellness Company Bundle

What is included in the product

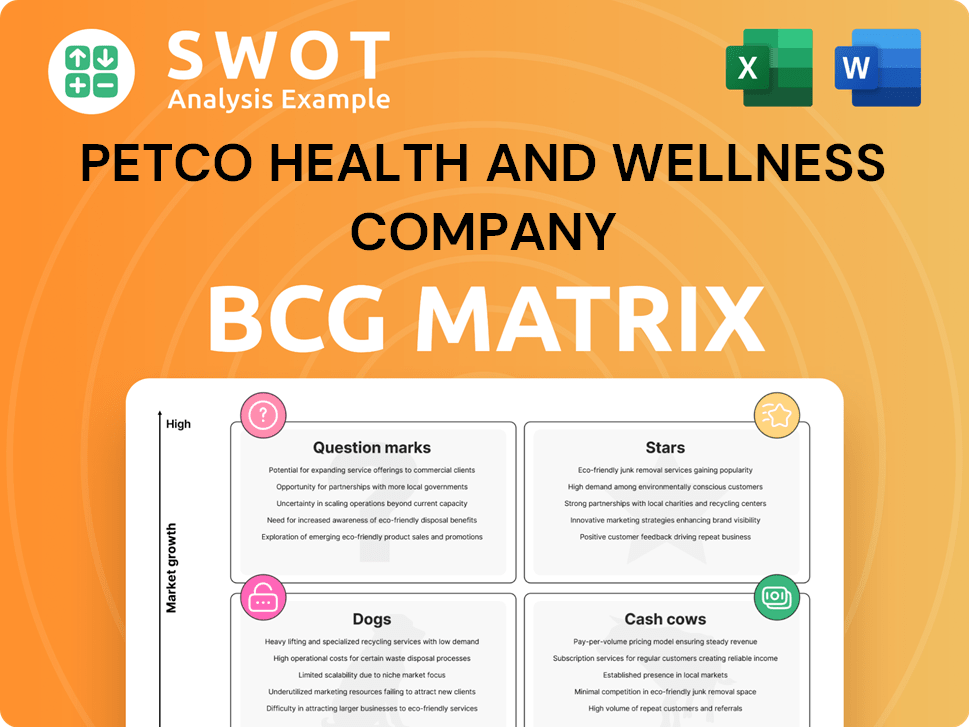

Petco's BCG matrix reveals strategic insights for its diverse portfolio, aiding resource allocation.

Export-ready design for quick drag-and-drop into PowerPoint, enabling swift presentation creation.

Full Transparency, Always

Petco Health and Wellness Company BCG Matrix

The BCG Matrix preview mirrors the complete document you'll receive after purchase. It’s the same fully-formed analysis, ready for your immediate use. No edits or alterations; download the full report with ease.

BCG Matrix Template

Petco's diverse product range, from food to grooming, creates a complex BCG Matrix. Analyzing these offerings reveals high-growth potential areas alongside established cash generators. Understanding this helps with strategic resource allocation. This sneak peek gives you a taste, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Petco's veterinary services, like Vetco Total Care, show strong growth. Revenue for pet healthcare in 2024 is projected to reach $20B. This segment is a leader within Petco. Expect further market leadership through investment and expansion.

Premium Pet Nutrition, a star in Petco's BCG matrix, thrives on the rising demand for superior pet food. Petco's emphasis on health and wellness perfectly matches the trend toward natural and organic options. This focus on high-quality nutrition products boosts customer loyalty. In 2024, the pet food market is projected to reach $123.6 billion, showing strong growth.

Petco's digital transformation and omnichannel strategy are pivotal. E-commerce is vital; in 2024, online pet product sales rose by 12%. Investments in digital platforms and customer experiences are key. This helps gain market share; Petco's digital sales grew by 15% in Q3 2024.

Exclusive and Trend-Forward Collections

Petco's exclusive collections, like Draper James and Jupiter, highlight its trendsetting approach. These lines distinguish Petco, drawing in customers looking for unique, premium pet products. This focus on stylish, high-quality items boosts Petco's brand and customer loyalty. Product innovation remains key for maintaining this competitive edge.

- Petco's revenue for fiscal year 2023 was $6.7 billion.

- Gross profit for 2023 was $2.6 billion.

- Petco's private brand sales grew to 33% of total sales in 2023.

Petco's Vital Care Membership Program

Petco's Vital Care program is a star in its BCG matrix, designed to boost customer loyalty and recurring revenue. This program offers discounts on various services and monthly rewards, enhancing customer retention. Vital Care's value and convenience significantly improve customer spending and engagement. In 2024, Petco's membership program saw impressive growth.

- Vital Care memberships grew, with over 3.3 million members by Q3 2024.

- The program contributed significantly to Petco's overall revenue.

- Members spend more than non-members.

- Petco's focus on pet wellness drives program success.

Petco’s Stars include Veterinary Services and Premium Pet Nutrition, fueled by market demand. Digital transformation and omnichannel strategies like e-commerce also shine, with 12% growth in online sales in 2024. Exclusive collections further enhance this category, with a focus on customer loyalty through Vital Care.

| Star Category | Key Features | 2024 Data Highlights |

|---|---|---|

| Veterinary Services | Vetco Total Care | Projected $20B revenue in pet healthcare. |

| Premium Pet Nutrition | Focus on health and wellness | Pet food market projected at $123.6B. |

| Digital & Omnichannel | E-commerce growth | Online pet product sales rose 12%. |

| Exclusive Collections | Draper James, Jupiter | Driving brand appeal and customer loyalty. |

| Vital Care Program | Membership program | Over 3.3M members by Q3 2024. |

Cash Cows

Petco's consumables, especially pet food, are a cash cow. This segment offers a consistent revenue stream, even with recent declines. In Q1 2024, consumables accounted for a significant portion of sales. Optimizing product offerings can boost profitability.

Petco's grooming services are a cash cow, generating substantial revenue. Demand is boosted by the focus on pet health. Its established salons and skilled staff offer a competitive edge. In Q3 2024, services revenue increased 2.1% to $316.1 million, showing strong performance. This growth highlights the value of grooming.

Petco's Petco Love adoption events boost its image and community ties. These events bring in customers and help pets find homes. Petco aligns with pet adoption trends, solidifying its role as a caring retailer. In 2024, Petco's initiatives supported over 400,000 pet adoptions. This drives store traffic and enhances brand loyalty.

Private Label Brands (e.g., EveryYay, So Phresh)

Petco's private label brands, like EveryYay and So Phresh, are cash cows. They provide quality and value, appealing to cost-conscious shoppers while ensuring profitability. These brands differentiate Petco's offerings, boosting customer loyalty. In 2024, private label sales are expected to contribute significantly to overall revenue. They will likely continue to be a key growth area for Petco.

- Private label brands offer good margins.

- They enhance customer stickiness.

- Petco can control product quality.

- These brands boost overall profitability.

Partnerships with Established Brands

Petco's partnerships with brands like DoorDash and Lowe's are key. These alliances boost customer access and convenience. They create extra distribution and cross-promotion avenues. Such collaborations help increase revenue and attract new customers.

- DoorDash partnership: Petco offers same-day delivery.

- Lowe's collaboration: Petco stores are inside some Lowe's locations.

- Cross-promotion: Joint marketing efforts to reach more consumers.

- Revenue growth: Partnerships drive sales and market share.

Petco's cash cows are its stable, high-profit segments, like consumables and grooming services. Private label brands and strategic partnerships enhance profitability. These areas generate reliable revenue, supporting investment in other segments.

| Cash Cow | Key Feature | 2024 Data/Impact |

|---|---|---|

| Consumables (Pet Food) | Consistent Revenue Stream | Significant portion of sales, boosting profit |

| Grooming Services | Strong Revenue Generation | Q3 2024 Services revenue up 2.1% to $316.1M |

| Private Label Brands | Good Margins & Loyalty | Expected sales to contribute significantly to revenue |

Dogs

Petco's small animal sales, including rabbits, have faced ethical scrutiny. Petco ended rabbit sales, prioritizing animal welfare. This could impact revenue from this segment. In 2023, Petco's sales were about $6.6 billion, with adjustments ongoing.

Petco plans to close 20-30 net locations in 2025, highlighting underperforming stores. These closures aim to boost profitability, as some stores struggle to meet targets. In Q3 2024, Petco's net sales were $1.56 billion, a slight decrease, indicating the need for strategic adjustments. Closing underperforming locations can improve efficiency and focus resources on stronger areas.

The removal of traditional rawhide products due to digestibility concerns could moderately affect Petco's short-term sales. This move, prioritizing pet health, necessitates the introduction of alternative, profitable chews. Efficient inventory management and smooth product transitions are critical. In 2024, Petco's net sales were approximately $6.1 billion, demonstrating the scale of potential impact.

Commoditized Pet Supplies

Commoditized pet supplies represent a "Dog" in Petco's BCG matrix due to intense price competition. Petco faces challenges competing with giants like Amazon and Walmart in this segment. To counter this, Petco needs to differentiate itself, focusing on value-added services. This includes premium products and personalized experiences to maintain profitability.

- Price wars with Amazon and Walmart erode profit margins.

- Petco's gross profit margin was 40.4% in Q3 2023, down from 42.1% in Q3 2022.

- Focusing on premium products and services offers higher margins.

- Petco's "Vital Care" program offers subscription services for recurring revenue.

Outdated Marketing Strategies

Outdated marketing strategies at Petco represent a "Dog" in the BCG matrix, due to their limited effectiveness. Reliance on traditional methods hinders growth in the digital age. To improve, Petco must adopt innovative strategies, like social media and personalized experiences. Adapting to consumer shifts is key. In 2024, Petco's marketing spend was around $200 million, emphasizing the need for efficient allocation.

- Ineffective traditional methods limit reach.

- Digital engagement and personalization are essential.

- Changing consumer preferences must be met.

- Marketing spend needs strategic allocation.

In Petco's BCG matrix, the "Dogs" category highlights intense price competition in commoditized pet supplies. Amazon and Walmart's dominance erodes profit margins in this area. To counter this, Petco should focus on premium products and services.

| Metric | Q3 2023 | Q3 2022 |

|---|---|---|

| Gross Profit Margin | 40.4% | 42.1% |

| Marketing Spend (2024) | $200 million | $180 million |

| Net Sales (2024) | $6.1 billion | $6.6 billion |

Question Marks

Petco's expansion into rural markets is a question mark in its BCG matrix. The company is testing small-town retail concepts, a strategy with potential for growth. Tailoring product assortments to rural pet owners could boost sales. Yet, success hinges on market research and adapting to local demands. Petco's 2023 revenue was $6.7 billion, with rural expansion being a key focus.

Pet health insurance is a question mark for Petco. The pet insurance market is expanding, with a projected value of $7.8 billion in 2024. Petco partners with Nationwide. Competition is tough, and Petco needs to stand out. Petco's strategy is uncertain.

Subscription services are a 'question mark' for Petco. Chewy's Autoship shows subscription potential. Petco must scale its membership program. A user-friendly subscription model is key. In 2024, subscription revenue in the pet market is projected to reach $1.5 billion.

AI and Analytics in Marketing

AI and analytics are key for personalized marketing at Petco. Their Wharton AI & Analytics Initiative collaboration shows interest in this. The impact on sales and engagement is still unfolding. Petco's digital sales grew, representing over 20% of total sales in 2024.

- Personalized marketing uses AI to tailor efforts.

- Petco partnered with Wharton for AI insights.

- Sales and engagement results are still being assessed.

- Digital sales accounted for over 20% of total sales in 2024.

New Store-in-Store Concepts

Petco's store-in-store concepts, like the one with Lowe's, represent a "Question Mark" in its BCG matrix. This expansion offers a potential growth avenue, but its success hinges on seamless integration and effective promotion. The partnership's viability depends on how well these collaborations resonate with customers and drive sales. As of 2024, Petco's strategy includes these partnerships to enhance its market presence.

- Lowe's partnership aims to boost Petco's market reach.

- Integration and cross-promotion are crucial for success.

- Viability depends on customer response and sales.

- This strategy aims to increase Petco's footprint in 2024.

Petco's "Question Marks" include rural expansion, pet health insurance, subscription services, AI-driven marketing, and store-in-store concepts.

These ventures offer growth potential but face uncertainties in market acceptance and scalability.

The outcomes of these strategies will significantly impact Petco's future performance and its position in the competitive pet care market.

| Initiative | Description | Market Context |

|---|---|---|

| Rural Expansion | Small-town retail concepts | 2023 revenue: $6.7B. Focus on adapting to local demands. |

| Pet Health Insurance | Partnership with Nationwide | 2024 Market Value: $7.8B, competitive. |

| Subscription Services | Scaling membership programs | 2024 Subscription Revenue (Pet Market): $1.5B. |

BCG Matrix Data Sources

The BCG Matrix for Petco uses company financials, market analyses, competitor reports, and industry projections to build strategic quadrants.