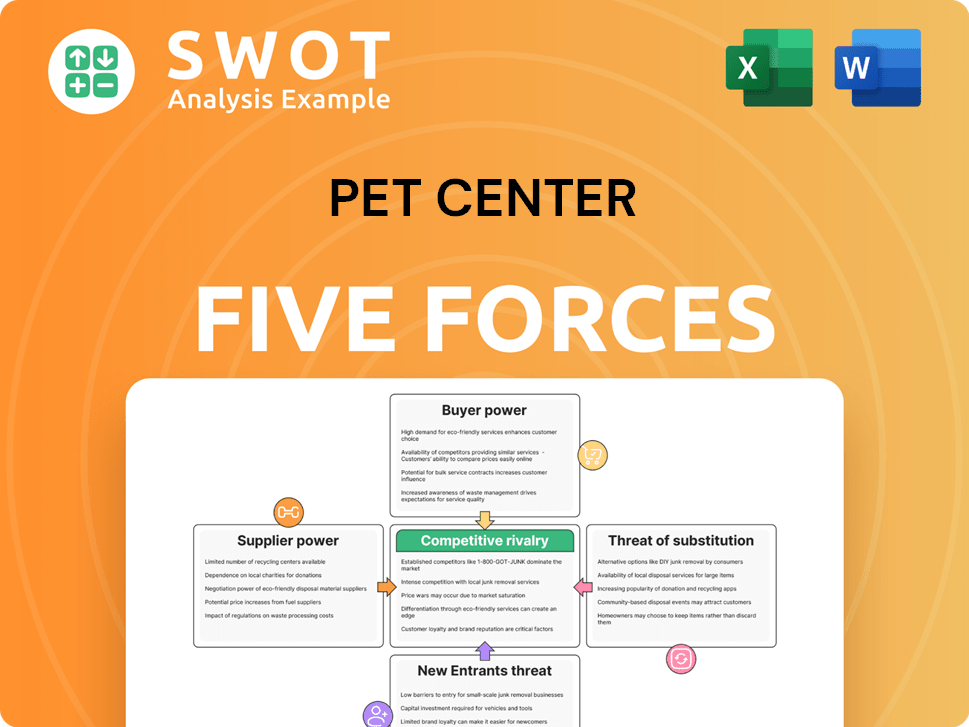

Pet Center Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pet Center Bundle

What is included in the product

Analyzes competition, customer power, and new entry risks within Pet Center's market.

Easily adjust force levels based on current pet market dynamics.

Same Document Delivered

Pet Center Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for the Pet Center. The same well-researched document, ready for immediate use, will be available to you instantly after purchase. It includes detailed insights into the competitive landscape. You'll get the full analysis, without any changes, right away.

Porter's Five Forces Analysis Template

Pet Center's profitability hinges on understanding its competitive landscape. Buyer power, driven by consumer choice and online retailers, presents a moderate challenge. Threat of new entrants, while present, is tempered by established brands and logistical complexities. Substitute products, such as direct-to-consumer options, pose a moderate risk. Supplier power, influenced by raw materials and specialized vendors, is generally low. Rivalry among existing competitors is intense, with multiple players vying for market share.

Unlock key insights into Pet Center’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Supplier concentration significantly impacts Pet Center's operations. A few dominant pet food manufacturers, like Mars Petcare and Nestlé Purina PetCare, control a large market share. For example, Mars Petcare held about 20% of the global pet food market in 2024. This gives these suppliers leverage in negotiations.

Suppliers with unique products wield more influence. Premium pet food brands, like those offering organic or therapeutic options, can set higher prices. In 2024, the pet food market reached nearly $50 billion, highlighting the value of specialized products. These suppliers often have stronger negotiating positions due to their distinct offerings. This differentiation allows them to dictate terms more favorably. Ultimately, it impacts Pet Center's cost structure and profitability.

Petz's ability to switch suppliers significantly impacts supplier power. High switching costs, from long-term contracts or specialized supplies, increase supplier leverage. For example, if Petz relies on unique, patented ingredients, suppliers gain more control. Conversely, readily available alternatives limit supplier power. In 2024, the pet food industry saw a shift, with major brands like Purina facing supply chain disruptions, highlighting how crucial supplier flexibility is for companies like Petz.

Supplier's Threat of Forward Integration

Suppliers' bargaining power increases if they can integrate forward, becoming competitors. This is especially true for branded suppliers with strong distribution. For example, Mars Petcare, a major supplier, could theoretically open its own retail stores. In 2024, the pet food market was valued at over $120 billion, providing significant incentive for suppliers to control more of the value chain.

- Mars Petcare's 2023 revenue was approximately $17 billion.

- The pet industry is expected to grow by 5-7% annually.

- Amazon's private-label pet food sales increased by 10% in 2024.

Impact of Raw Material Costs

Fluctuations in raw material costs, like grains and meat, significantly impact supplier power in the pet industry. Suppliers often try to pass these increased costs onto retailers, particularly if pet product demand stays high. For instance, in 2024, the American Pet Products Association (APPA) reported that pet industry spending reached $146.8 billion, showing strong demand. This allows suppliers some leverage.

- Raw material price volatility directly affects profitability.

- Strong demand enables suppliers to maintain pricing power.

- Pet food makers face margin pressures.

- Retailers may absorb some costs to stay competitive.

Supplier concentration and product uniqueness give suppliers like Mars Petcare leverage, holding about 20% of the global pet food market in 2024. High switching costs, such as those related to specialized supplies, also boost supplier power. Furthermore, forward integration by suppliers, like Mars Petcare, poses a competitive threat, influencing Pet Center’s costs.

| Factor | Impact | Example |

|---|---|---|

| Supplier Concentration | Higher leverage | Mars Petcare's market share (20% in 2024) |

| Product Uniqueness | Pricing power | Premium pet food brands |

| Switching Costs | Increased supplier control | Specialized ingredient contracts |

Customers Bargaining Power

Customer price sensitivity significantly impacts bargaining power. If pet owners are highly price-conscious, they may switch to cheaper brands, pressuring Petz to maintain competitive pricing. In 2024, the pet care industry saw a shift towards value brands due to inflation. Around 30% of pet owners are actively seeking cheaper options, affecting pricing strategies.

Customers' power increases with substitute availability. Pet owners can switch brands, stores, or even make their pet food, reducing loyalty. For example, in 2024, the pet food market saw over 100 brands, giving buyers choices. This competition limits Pet Center's pricing power.

Customer loyalty significantly diminishes buyer power. Petz's strong customer loyalty, potentially fostered by superior services or loyalty programs, makes customers less sensitive to price fluctuations. Data from 2024 indicates that companies with robust loyalty programs experience 15% higher customer retention rates. This reduces the impact of competitors' pricing strategies.

Customer Information Availability

Informed customers wield significant bargaining power. Online reviews, price comparison sites, and accessible product details enable smarter choices and better price negotiations. For example, in 2024, 70% of consumers research products online before buying, highlighting the impact of information on purchasing decisions. This trend is especially noticeable in pet supplies, where customers can easily compare prices and product features. This increased transparency challenges pet stores to offer competitive pricing and value.

- 70% of consumers research products online before buying (2024).

- Price comparison websites and reviews empower customers.

- Customers negotiate better deals.

- Pet stores must offer competitive pricing.

Concentration of Buyers

The bargaining power of customers in pet retail is influenced by market concentration. Online platforms and large pet owner communities amplify this power, enabling them to negotiate better deals. For instance, Chewy.com and Amazon have captured a significant market share, putting pressure on traditional retailers. In 2024, online pet product sales reached approximately $18 billion, increasing customer bargaining power. This shift impacts pricing strategies and customer loyalty programs.

- Online sales have increased customer price sensitivity.

- Large pet owner groups can collectively bargain for discounts.

- Retailers must offer competitive pricing and value-added services.

- Market concentration shifts the balance of power to the consumer.

Customer bargaining power is affected by price sensitivity and availability of substitutes. Around 30% of pet owners seek cheaper options (2024). Online research (70% of consumers in 2024) and market concentration impact pricing.

| Factor | Impact | Data (2024) |

|---|---|---|

| Price Sensitivity | High sensitivity increases power | 30% seek cheaper options |

| Substitute Availability | More options increase power | 100+ pet food brands |

| Online Research | Empowers customers | 70% research online |

Rivalry Among Competitors

The Brazilian pet retail market's competitive intensity rises with more players. Petz contends with major retailers, local shops, and online platforms. In 2024, Petz saw revenues of BRL 3.6 billion, facing rivals like Cobasi and emerging e-commerce competitors. This crowded landscape fuels price wars and innovation.

Slower industry growth often intensifies competitive rivalry. The Brazilian pet market, including companies like Petz, is maturing. In 2024, the Brazilian pet market is projected to grow by about 8% after a period of rapid expansion. This slowdown forces companies to compete more aggressively for market share.

In the pet industry, low product differentiation intensifies rivalry. When pet food or toys are similar, businesses compete on price and convenience, impacting profitability. For example, in 2024, the pet food market saw intense price wars. This is driven by the similarity of products across brands. The intense competition can lead to reduced profit margins for pet retailers.

Switching Costs

Switching costs in the pet retail industry are generally low, intensifying competitive rivalry. Pet owners can often easily switch between different pet stores or online retailers, making it crucial for Petz to differentiate itself. This ease of switching forces Petz to compete aggressively on price, product selection, and customer service to retain and attract customers. The average customer lifetime value in pet retail is about $1,500 to $2,000, showing the importance of customer retention.

- Low switching costs lead to intense competition.

- Petz must focus on differentiation.

- Price and service are key competitive factors.

- Customer lifetime value is crucial for profitability.

Exit Barriers

High exit barriers significantly increase rivalry among pet retailers. If leaving the market is tough or expensive, businesses might keep operating at a loss. This situation intensifies competition, pressuring other players like Petz. Such barriers often involve significant investments in specialized assets or long-term contracts. In 2024, the pet industry saw a 7.5% growth, but increased competition squeezed profit margins.

- High fixed costs, such as store leases, make exiting expensive.

- Specialized assets (e.g., grooming equipment) have limited resale value.

- Long-term supply contracts can be hard to terminate.

- Emotional attachment to the business may delay decisions.

Competitive rivalry in Brazil's pet retail sector is high, fueled by numerous competitors. The market's growth slowdown intensifies competition, pressuring margins. Low switching costs and product similarity further exacerbate rivalry, making differentiation vital for survival.

| Factor | Impact | 2024 Data |

|---|---|---|

| Competitors | High competition | Petz, Cobasi, Online Retailers |

| Market Growth | Slower growth intensifies rivalry | Projected 8% growth |

| Differentiation | Key for success | Focus on service & selection |

SSubstitutes Threaten

The threat of substitutes for Petz is real, stemming from options like homemade pet food or supplies from general retailers. In 2024, the pet food market reached $123 billion, with online sales growing 15%. DIY pet care services also pose a threat. For example, the market for pet sitting services is estimated to be $1.5 billion.

If substitute products offer similar benefits at a lower cost, the threat to a company rises. For instance, in 2024, the homemade pet food market grew by 7%, showing that consumers sought cheaper, healthier options. Pet owners might switch to homemade food if it's seen as a better deal, reducing the demand for commercial brands.

Low switching costs amplify the threat of substitutes. Pet owners can easily opt for competitors or alternative pet care solutions. This forces Petz to differentiate, like PetSmart's 2023 focus on grooming services, which generated substantial revenue. To retain customers, Petz must enhance offerings and foster loyalty. For example, Chewy's 2024 subscription model aims to lock in customers.

Perceived Value of Substitutes

The threat from substitutes for Petz depends significantly on how pet owners perceive the value of alternatives. If substitutes like homemade pet food, which saw a 15% increase in popularity in 2024, or other pet care services are seen as better, customers might switch. This shift impacts Petz's market share and profitability. The availability and attractiveness of substitutes directly affect Petz's pricing power and competitive position.

- Homemade pet food popularity increased by 15% in 2024.

- Alternative pet care services are a growing substitution threat.

- Petz's pricing power is affected by substitute availability.

- Perceived value of substitutes dictates customer choices.

Innovation in Substitutes

The threat of substitutes is a key consideration for Pet Center. Ongoing innovation in substitute products or services can increase their attractiveness. For instance, in 2024, subscription services for pet food saw a 20% growth in market share, potentially drawing customers away from traditional retailers. Mobile grooming services also expanded, indicating a shift in consumer preferences. These trends highlight the need for Pet Center to adapt and innovate to stay competitive.

- Subscription services for pet food grew by 20% in 2024.

- Mobile grooming services are expanding, changing consumer habits.

- Pet Center needs to innovate to keep up with these changes.

The threat of substitutes significantly impacts Pet Center. In 2024, homemade pet food grew by 7% and subscription services saw a 20% market share increase, indicating consumers seek alternatives. These shifts affect Pet Center’s profitability. They must innovate to stay competitive.

| Substitute Type | 2024 Market Growth | Impact on Pet Center |

|---|---|---|

| Homemade Pet Food | 7% increase | Reduces demand for commercial brands |

| Subscription Services | 20% market share increase | Draws customers away |

| Mobile Grooming | Expanding | Changes consumer preferences |

Entrants Threaten

High barriers to entry significantly diminish the risk posed by new competitors. Pet Center faces considerable capital needs for physical stores, estimated at $500,000 to $1 million per location in 2024, plus e-commerce and brand-building costs. Establishing a robust online presence and brand recognition demands substantial marketing investments, possibly exceeding $200,000 annually. These financial hurdles make it challenging for new firms to enter the market quickly.

If Petz, a major player, leverages economies of scale, new rivals face a tough price battle. For example, major pet food makers like Nestlé Purina operate at high volumes. In 2024, Nestlé's pet care sales reached over $18 billion globally. Smaller entrants can't match these cost advantages.

Strong brand loyalty significantly impacts new entrants in the pet retail market. Established retailers like Petco and PetSmart benefit from customer trust, making it hard for newcomers to compete. In 2024, these two giants controlled about 60% of the pet specialty retail sales. New entrants face challenges in building similar brand recognition and consumer trust, hindering their ability to capture market share quickly.

Regulatory Requirements

Stringent regulatory requirements significantly influence the threat of new entrants in the Brazilian pet market. These regulations, focusing on pet food safety, veterinary services, and animal welfare, raise the bar for new businesses. Compliance increases costs and operational complexities, potentially deterring new entrants. The Brazilian pet food market was valued at BRL 37.2 billion in 2023, indicating a substantial market.

- Food safety standards mandated by MAPA (Ministry of Agriculture, Livestock, and Supply) require rigorous testing and certification, impacting production costs.

- Veterinary service regulations dictate facility standards and personnel qualifications, adding to initial investment and operating expenses.

- Animal welfare laws necessitate specific care protocols and ethical practices, influencing operational procedures and costs.

Access to Distribution Channels

New pet supply businesses face hurdles accessing established distribution networks. Petz, for example, has a strong advantage with its physical stores and online platform. These existing channels make it difficult for new companies to reach customers effectively. The challenge is intensified by the need for efficient logistics and brand recognition to compete.

- PetSmart operates over 1,600 stores across North America, showcasing a vast distribution network.

- Chewy.com, the online giant, demonstrates the power of e-commerce distribution, with $11.1 billion in net sales in 2023.

- Smaller startups struggle to match the scale and efficiency of these established players.

- Building a comparable distribution network requires significant investment and time.

The threat of new entrants in the pet retail market is moderate due to various barriers. High initial capital, around $500,000 per store, is a deterrent. Established brands like Petco and PetSmart, holding 60% of market share, make it tough for newcomers.

| Barrier | Impact | Example |

|---|---|---|

| Capital Needs | High | $500,000+ per store |

| Brand Loyalty | Strong | Petco, PetSmart dominance |

| Distribution | Challenging | Chewy's $11.1B sales (2023) |

Porter's Five Forces Analysis Data Sources

We used a combination of market reports, financial statements, and industry surveys to build the analysis.