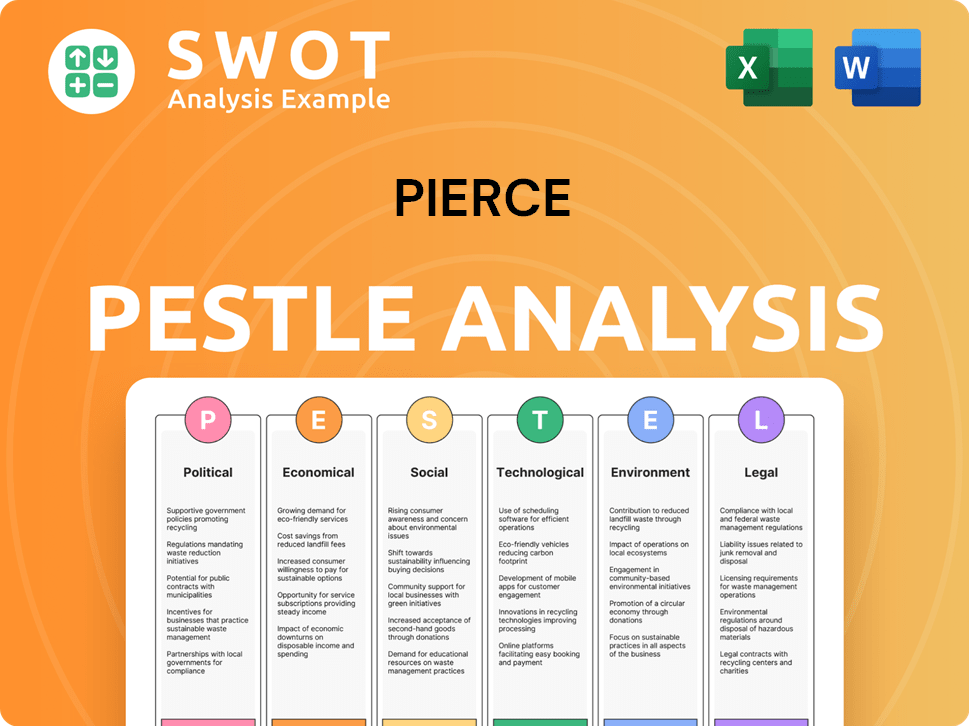

Pierce PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pierce Bundle

What is included in the product

Pinpoints external forces impacting Pierce via Political, Economic, etc. for strategic insights.

Provides actionable insights in a readily usable format for prompt identification and resolution of potential risks.

What You See Is What You Get

Pierce PESTLE Analysis

What you're previewing is the complete Pierce PESTLE Analysis. You'll get this exact, ready-to-use document immediately. It's fully formatted & professionally structured for immediate application. No hidden extras—it’s the whole file. Analyze everything in this ready-made document.

PESTLE Analysis Template

Unlock a deeper understanding of Pierce's external environment with our PESTLE Analysis. We dissect the key Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. This analysis provides crucial insights for strategic planning and market evaluation.

Political factors

Political stability is vital for Pierce Group's European operations. Government policy shifts on e-commerce, trade, and taxes directly affect the company. For example, in 2024, changes in VAT regulations across EU nations impacted online retailers. Monitoring political climates in key markets is essential for strategic planning. Recent data shows a 5% fluctuation in e-commerce sales due to policy changes.

Pierce Group, as an e-commerce entity in Europe, faces impacts from trade regulations and tariffs. The EU's trade policy, including agreements and potential tariffs, directly influences import costs. In 2024, the EU's total trade in goods was valued at over €4.8 trillion. Changes in these policies can reshape pricing and profitability, affecting Pierce's market position.

E-commerce regulations are intensifying across Europe, impacting businesses like Pierce. Consumer protection, data privacy (GDPR), and online advertising are key areas. In 2024, GDPR fines reached €1.4 billion. Compliance is crucial to avoid legal issues and maintain customer trust, impacting operational costs. New Digital Services Act (DSA) in 2024 added further compliance layers.

Taxation Policies

Taxation policies are crucial for Pierce Group, especially regarding e-commerce and international trade. Varying tax laws, like VAT and import duties, across different countries significantly affect financial outcomes. For instance, in 2024, the EU's e-commerce VAT rules have seen adjustments. Corporate tax changes also play a role.

- E-commerce VAT rules in the EU

- Import duties impacting international trade

- Corporate tax adjustments in key markets

Political Risk in Operating Regions

Political risks, especially in Europe, are crucial for Pierce Group. Unstable political climates in key markets can disrupt operations. Consider the impact of Brexit, which, as of early 2024, continues to affect trade dynamics. Any shift in government policies on taxation or trade tariffs can significantly alter profit margins.

Pierce Group's operational strategies should include contingency plans. These should address potential disruptions. Instability in any country impacts consumer confidence.

Political risk assessment is vital for Pierce Group. The company should monitor political stability in its markets, including those with substantial customer bases. The European Union's economic forecast for 2024 showed a slow growth of 0.8%, which is subject to political stability.

- Brexit's ongoing impact on European trade.

- Fluctuations in government policies.

- Consumer confidence levels affected by political situations.

- EU economic forecasts and political influence.

Political factors significantly shape Pierce Group's operational landscape in Europe. Trade regulations, such as tariffs and agreements, directly influence costs and market competitiveness. E-commerce regulations, including consumer protection and data privacy laws, increase compliance costs and can affect customer trust. Taxation policies and political stability, with ongoing Brexit effects and the EU's 2024 slow economic growth of 0.8%, require careful risk assessment.

| Political Factor | Impact on Pierce Group | Relevant Data (2024/2025) |

|---|---|---|

| Trade Regulations | Influences import costs & market position | EU total trade in goods valued over €4.8T in 2024; 5% e-commerce sales fluctuation due to policy changes. |

| E-commerce Regulations | Increases compliance costs & affects customer trust | GDPR fines reached €1.4B in 2024. New DSA regulations added further layers. |

| Taxation Policies/Political Stability | Affects financial outcomes and operational stability | EU's slow 0.8% growth in 2024; Ongoing Brexit impact, potential shifts in government policies |

Economic factors

Economic growth in Europe, impacting consumer spending, is crucial for motorcycle and snowmobile gear sales. Higher disposable income boosts demand for discretionary items like these. In 2024, EU GDP growth is projected at 0.9%, influencing consumer spending patterns. This impacts sales of related accessories.

Inflation is a key factor for Pierce Group. Rising inflation can increase costs for materials, shipping, and operations. This can squeeze profit margins if not managed effectively. In 2024, the US inflation rate was around 3.1%, impacting consumer spending. This may lead to decreased demand or a shift towards lower-priced products.

Pierce Group's European operations face exchange rate risks. Currency shifts affect import costs and sales revenue in various currencies. For example, a 10% Euro appreciation versus the USD boosts import costs. In 2024, EUR/USD fluctuated, impacting profitability.

Unemployment Rates

Unemployment rates significantly influence consumer behavior and demand. High unemployment often curtails consumer spending, especially on discretionary items like recreational vehicle accessories. Conversely, low unemployment typically signals a robust economy, potentially boosting sales. The U.S. unemployment rate was 3.9% in April 2024. This rate is a key economic indicator.

- April 2024 U.S. Unemployment Rate: 3.9%

- High unemployment reduces consumer spending.

- Low unemployment supports higher sales.

- Economic health is closely tied to employment.

Disposable Income Levels

Disposable income significantly impacts Pierce Group. Rising disposable income in key markets like North America and Europe, where motorcycling and snowmobiling are popular, could boost sales. Conversely, economic downturns reducing disposable income might lead to decreased discretionary spending on these recreational vehicles. For instance, in 2024, the U.S. disposable personal income was approximately $18.8 trillion, a key indicator for the company's financial health.

- U.S. disposable personal income in 2024: ~$18.8 trillion.

- Consumer spending on recreational goods is sensitive to income changes.

- Economic forecasts predict varied disposable income growth rates across Pierce Group's markets.

Economic growth in key regions influences Pierce Group's sales of recreational goods; EU's projected 0.9% GDP growth in 2024 impacts consumer spending. Inflation rates, like the US's 3.1% in 2024, can affect material costs and consumer demand. Currency fluctuations and unemployment also present significant risks to Pierce's financial performance, which impacts buying decisions.

| Economic Factor | Impact | 2024 Data Point |

|---|---|---|

| GDP Growth (EU) | Influences Consumer Spending | Projected 0.9% |

| Inflation (US) | Affects Costs & Demand | 3.1% |

| Unemployment (US, April 2024) | Impacts Consumer Behavior | 3.9% |

Sociological factors

Analyzing rider demographics and trends is key. The median age of motorcycle owners in 2024 was around 52 years. Income levels vary, but many riders have disposable income for gear and experiences. Lifestyle choices, like adventure or commuting, influence gear preferences. Snowmobile riders show similar demographic patterns, with an emphasis on outdoor lifestyles.

Lifestyle shifts and recreational choices significantly shape market dynamics. Increased interest in outdoor activities and motorsports directly boosts demand for Pierce Group's offerings. Data from 2024 shows a 15% rise in outdoor recreation spending. This trend reflects a growing consumer preference for adventure and leisure.

Consumer preferences in apparel and gear are heavily influenced by fashion trends and changing styles. Pierce Group must closely monitor these trends to cater to its varied customer base. The global apparel market is projected to reach $2.25 trillion by 2025, highlighting the need for adaptability. In 2024, online apparel sales accounted for 33% of total sales, showing digital trend importance.

Online Shopping Habits

Online shopping habits are crucial for Pierce Group. Consumer trust in e-commerce is growing. Providing a smooth online experience is vital. In 2024, e-commerce sales hit $11.7 trillion globally. This indicates a strong online market.

- E-commerce sales increased 8% in 2024.

- Mobile commerce now makes up 72.9% of all e-commerce sales.

- 93% of consumers have bought online.

- Average online spending per person is $2,500.

Social Influences and Community

The strong community bonds within the motorcycle and snowmobile industries significantly affect buying behavior. Riders often rely on peer recommendations and online forums when choosing products. Marketing strategies that actively engage with these communities can yield high returns. For example, the powersports market in North America is projected to reach $23.8 billion by 2025.

- Online forums and social media groups are key for brand visibility.

- Word-of-mouth marketing remains highly effective.

- Community events and sponsorships boost brand loyalty.

- Peer reviews greatly influence purchase decisions.

Sociological factors include lifestyle, fashion trends, and community influence.

Outdoor recreation fuels demand, with spending up 15% in 2024. The apparel market could reach $2.25T by 2025.

Community bonds affect buying, boosted by forums and events; North American powersports may hit $23.8B by 2025.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Lifestyle Trends | Drives demand for outdoor/motorsports. | Outdoor spending +15% (2024), Projected powersports market (2025): $23.8B |

| Fashion | Shapes gear & apparel preferences. | Apparel market to $2.25T (2025), Online apparel sales = 33% (2024) |

| Community | Influences buying via word-of-mouth. | E-commerce sales increase 8% (2024), North American powersports projected at $23.8B (2025) |

Technological factors

Maintaining a strong e-commerce platform is essential, focusing on website speed, mobile-friendliness, secure payments, and personalized experiences. In 2024, e-commerce sales are projected to reach $6.3 trillion globally, highlighting the need for a reliable online presence. Mobile commerce accounted for 72.9% of all e-commerce sales in Q1 2024. This emphasizes the importance of mobile compatibility.

Digital marketing, including SEO and social media, is crucial for customer engagement. In 2024, digital ad spending reached $225 billion, reflecting its importance. Data analytics tools provide insights into consumer behavior. Effective digital strategies can boost brand awareness and sales, driving revenue growth. For instance, companies using data-driven marketing see a 15% increase in ROI.

Logistics and supply chains leverage technology for efficiency. Warehouse management systems, inventory control, and shipping rely on tech. Enhancements boost operations. E-commerce sales reached $1.11 trillion in 2023, showing tech's impact. Projected growth is 9.3% in 2024.

Data Security and Privacy

Data security and privacy are critical in e-commerce. Protecting customer data and ensuring transaction security are top priorities. Cybersecurity investments are vital for trust and regulatory compliance. The global cybersecurity market is projected to reach $345.7 billion in 2024. Breaches can lead to significant financial and reputational damage.

- Cybersecurity spending is expected to reach $345.7 billion in 2024.

- Data breaches cost companies an average of $4.45 million in 2023.

Emerging Technologies (AI, VR, etc.)

Exploring and adopting emerging technologies like Artificial Intelligence for personalized recommendations or Virtual Reality for product visualization could enhance the online customer experience and provide a competitive edge. The AI market is projected to reach $200 billion by 2025, showing massive growth potential. These advancements can transform customer interactions, boosting engagement and sales. Integrating these technologies may require significant upfront investment but promises long-term gains in efficiency and customer satisfaction.

- AI market projected to hit $200B by 2025.

- VR can boost customer engagement.

- Increased investment for long-term gains.

Technological factors drive e-commerce growth through platforms, digital marketing, and logistics, significantly impacting businesses. The e-commerce sector is projected to hit $6.3 trillion in 2024, underscoring the need for tech-driven strategies. Investing in tech, from secure payments to data analytics, can boost ROI and customer experience.

| Technology Area | 2024 Data/Projection | Impact |

|---|---|---|

| E-commerce Sales | $6.3T Globally | Essential for online presence and growth |

| Digital Ad Spending | $225B | Drives customer engagement and brand awareness |

| Cybersecurity Market | $345.7B | Protects customer data, ensures trust |

Legal factors

Pierce Group must adhere to diverse consumer protection laws across Europe. These laws dictate product quality standards, warranty obligations, and return policies. For example, EU consumer law mandates a minimum two-year warranty for new products. Non-compliance can lead to hefty fines and reputational damage. In 2024, the European Commission reported a 15% increase in consumer complaints related to online purchases.

Adhering to GDPR and similar regulations is crucial for businesses managing EU resident data. This means securing explicit consent for data usage, ensuring data protection, and giving customers control over their personal information. Fines for non-compliance can reach up to 4% of global annual turnover. In 2024, the average fine was about $1.4 million, showing the importance of compliance.

Product safety is paramount for Pierce Group. Motorcycle and snowmobile gear must adhere to strict safety standards. Compliance is critical across all markets. For instance, in 2024, the US CPSC recalled over 400,000 unsafe products. Failure to comply can lead to significant legal and financial repercussions.

E-commerce Specific Legislation

E-commerce-specific legislation focuses on online contracts, electronic signatures, and distance selling, shaping how Pierce operates. Compliance is crucial to avoid legal issues and maintain customer trust. The e-commerce market is booming, with global sales expected to reach $8.1 trillion by 2026.

- Regulations on data privacy and security (e.g., GDPR, CCPA) are essential for customer data protection.

- Laws regarding consumer protection, including return policies and warranties, must be clearly communicated.

- Compliance with digital advertising laws and regulations is important.

Import and Export Regulations

Import and export regulations are critical. Businesses must navigate customs, duties, and international trade laws. Compliance is essential to avoid penalties and delays. The World Trade Organization (WTO) reported a 1.7% increase in global merchandise trade volume in 2023.

- Customs procedures vary by country, impacting delivery times and costs.

- Duties and tariffs significantly affect profitability and pricing strategies.

- Non-compliance can lead to fines, shipment seizures, and legal issues.

- Understanding trade agreements like the USMCA is key for favorable terms.

Pierce Group must navigate various legal factors to ensure operational integrity. Compliance with data privacy regulations, like GDPR, is crucial for protecting customer information and avoiding penalties; in 2024, the average GDPR fine was about $1.4 million. Adherence to consumer protection laws, which mandate product quality and warranties, is also critical to build customer trust, with EU consumer law requiring a minimum two-year warranty.

| Regulation Type | Impact on Pierce Group | Recent Data (2024) |

|---|---|---|

| Consumer Protection | Product quality, warranty, returns | 15% rise in online purchase complaints in EU |

| Data Privacy (GDPR) | Data usage consent, protection | Avg. GDPR fine: ~$1.4M |

| Product Safety | Adherence to strict safety standards | US CPSC recalled >400K unsafe products |

Environmental factors

Consumer preference is shifting toward sustainable options. In 2024, the global market for sustainable packaging reached $400 billion, projected to hit $550 billion by 2026. Pierce Group should prioritize eco-friendly packaging and efficient shipping to meet these expectations. This reduces environmental impact and potentially lowers costs.

Environmental regulations are crucial for Pierce's operations. Compliance with waste disposal and energy consumption rules is essential. Stricter rules may increase costs, like the EU's 2024 waste framework. Failure to comply can lead to substantial fines, potentially impacting profitability. Sustainable practices can also boost brand image, as shown by rising consumer demand for eco-friendly products.

Product lifecycle and disposal are key environmental factors. Consumers and regulators increasingly focus on the entire product journey, from production to waste. Offering recycling programs or designing durable products are crucial. The global waste management market is projected to reach $2.8 trillion by 2025, according to Statista.

Climate Change Impacts

Climate change poses significant risks to Pierce's operations. Altered seasonality, like shorter snowmobiling seasons, could hurt demand. Extreme weather events, such as floods or storms, may disrupt supply chains. Businesses must adapt to these environmental shifts to remain resilient.

- In 2024, the US experienced 28 weather/climate disasters exceeding $1 billion each.

- The global cost of climate change impacts is projected to reach $560 billion annually by 2030.

Corporate Social Responsibility and Sustainability

Corporate Social Responsibility (CSR) and sustainability are increasingly vital for Pierce Group. Demonstrating environmental commitment boosts brand image, attracting eco-conscious consumers. Investments in green technologies and sustainable practices can reduce operational costs. This is important because, in 2024, sustainable investments hit $40 trillion globally.

- 2024: Sustainable investments reached $40 trillion globally.

- Consumers increasingly favor eco-friendly brands.

- Green tech investments reduce long-term costs.

- CSR enhances brand reputation and loyalty.

Environmental factors significantly affect business strategies. Sustainability is now vital, with the sustainable packaging market hitting $400 billion in 2024. Companies must adapt to regulations and consider product lifecycles, as the waste management market will reach $2.8 trillion by 2025.

Climate change poses risks, requiring resilience; in 2024, the U.S. had 28 billion-dollar weather disasters. Corporate Social Responsibility boosts brand image, attracting eco-conscious consumers. This is especially relevant, given that $40 trillion globally went into sustainable investments in 2024.

| Environmental Factor | Impact | 2024/2025 Data |

|---|---|---|

| Consumer Preferences | Demand for sustainable products | Sustainable packaging: $400B (2024), rising. |

| Environmental Regulations | Compliance costs & risks | EU Waste Framework impacting costs. |

| Product Lifecycle/Disposal | Product design & waste management | Global waste management: $2.8T by 2025. |

| Climate Change | Operational & supply chain disruptions | US: 28 billion-dollar disasters (2024). |

| Corporate Social Responsibility | Brand image & consumer loyalty | Sustainable investments: $40T globally (2024). |

PESTLE Analysis Data Sources

Our analysis integrates data from market research, government, and global sources for accuracy and relevant business insights.