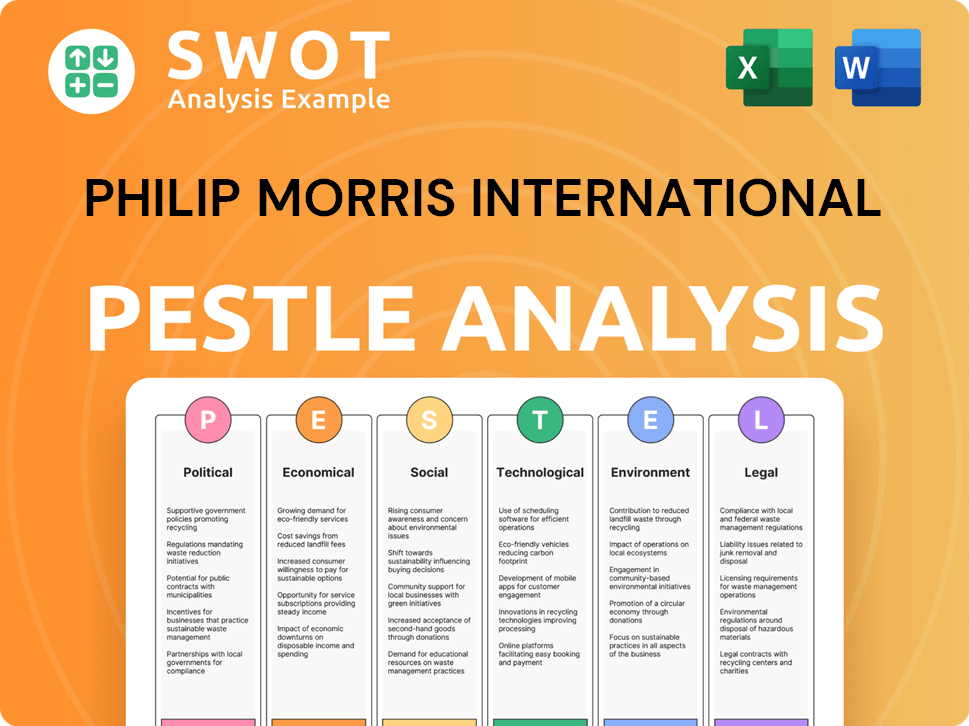

Philip Morris International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Philip Morris International Bundle

What is included in the product

The analysis examines Philip Morris' macro-environment through Political, Economic, etc. lenses.

Helps support discussions on external risk and market positioning during planning sessions.

Preview Before You Purchase

Philip Morris International PESTLE Analysis

This Philip Morris International PESTLE Analysis preview is the complete document you'll receive. It’s fully formatted and contains all sections upon purchase. Get the same high-quality analysis as previewed! You’re ready to download and use this final, professional work.

PESTLE Analysis Template

Uncover the complex external factors shaping Philip Morris International's trajectory with our PESTLE analysis. Explore the company's landscape through political, economic, social, technological, legal, and environmental lenses. This concise overview is the perfect starting point for understanding global trends. Get the full analysis for in-depth strategic insights.

Political factors

Governments globally are tightening tobacco regulations, influencing Philip Morris International's (PMI) operations. Higher excise taxes and marketing restrictions reduce revenue and raise costs. The WHO indicates widespread smoke-free laws' impact. In 2024, PMI faced increased excise taxes across key markets. These measures affect profitability, requiring strategic adaptation.

Governments are shifting policies, differentiating between traditional cigarettes and reduced-risk products. This opens doors for PMI's smoke-free options, potentially allowing marketing with reduced-risk claims. However, regulations for these products vary wildly by country. In 2024, PMI's smoke-free products represented over 40% of its net revenues.

Philip Morris International (PMI) navigates complex international trade regulations globally. Import tariffs and regulatory restrictions in different countries affect PMI's operations, limiting market access. For example, in 2024, excise taxes on tobacco products increased in several European countries. These barriers can increase manufacturing costs, impacting the supply chain and profitability. In 2024, PMI's revenue from the European Union accounted for approximately 30% of its total revenue.

Geopolitical Tensions

Geopolitical instability poses a significant risk to Philip Morris International (PMI). Conflicts and political tensions can disrupt the company's global supply chains. Market exits due to geopolitical events, like the 2022 exit from Russia, led to substantial revenue losses. PMI must navigate these challenges to maintain its financial performance.

- 2022: Russia's exit caused a $1.4 billion net loss.

- Geopolitical risks lead to supply chain disruptions.

- Market access limitations in certain regions.

- PMI's ability to adapt to political instability is crucial.

Lobbying and Policy Influence

Philip Morris International (PMI) is deeply involved in lobbying efforts. They actively shape EU policies on taxation and product regulation. PMI focuses on public health aspects of tobacco use. The company aims to influence tobacco legislation. They advocate for policies supporting business transformation.

- In 2024, PMI spent approximately $7.8 million on lobbying in the EU.

- PMI's lobbying efforts focus on regulations for smoke-free products.

- The company supports policies that encourage a shift from cigarettes.

PMI faces strict tobacco regulations like increased taxes and marketing curbs worldwide, affecting profits. Differentiated policies between cigarettes and reduced-risk products create new opportunities for smoke-free items, crucial for revenue. Trade regulations, tariffs, and geopolitical instability further complicate operations.

| Regulation Type | Impact | Data (2024) |

|---|---|---|

| Excise Taxes | Reduced revenue | Increased in EU & Asia; contributed to operational cost increases |

| Product Regulations | Market access impact | Varied policies globally for smoke-free products |

| Geopolitical Risks | Supply chain issues | Exit from Russia caused a $1.4B net loss |

Economic factors

Excise tax increases pose a considerable threat to Philip Morris International. Higher taxes on tobacco products often translate to increased consumer prices. This can lead to decreased sales volumes, impacting PMI's revenue. For example, in 2024, various countries implemented or proposed excise tax hikes on tobacco. Discriminatory tax policies that don't distinguish between cigarettes and smoke-free products can also negatively impact PMI's profitability.

Economic growth significantly influences PMI's sales across diverse markets. During economic downturns, consumers may reduce spending on non-essential items like tobacco. For instance, in 2024, global inflation and economic slowdowns in Europe and Asia impacted consumer behavior and sales volumes. PMI's performance closely correlates with overall economic health and consumer confidence levels.

Unfavorable currency exchange rates and devaluations pose risks to Philip Morris International (PMI). These fluctuations can diminish reported revenues and profitability. In 2023, currency headwinds reduced PMI's net revenues by $1.2 billion. This can hinder the company's ability to bring profits back from its global operations.

Cost of Raw Materials

Philip Morris International (PMI) faces risks from fluctuating raw material costs, especially tobacco, impacting production expenses and profitability. Adverse shifts in tobacco prices, availability, or quality directly affect PMI's manufacturing costs and potentially its pricing decisions. These changes can squeeze profit margins, requiring strategic adjustments to maintain competitiveness. The company actively manages these risks through supply chain diversification and hedging strategies.

- In 2024, tobacco prices saw volatility due to weather and geopolitical events.

- PMI's cost of sales in Q1 2024 increased by 3% due to higher raw material costs.

- The company aims to mitigate cost increases through efficiency programs.

- PMI's hedging strategies partially offset the impact of fluctuating commodity prices.

Intense Competition

Philip Morris International (PMI) operates in a highly competitive market, contending with established tobacco firms and emerging players in the reduced-risk products sector. This competition significantly impacts PMI's market share, pricing strategies, and overall profitability. The rise of vaping and other alternatives intensifies this pressure, requiring PMI to innovate and adapt to maintain its position. For example, in 2024, the global tobacco market faced intense competition, with major players vying for market dominance.

- Market share fluctuations were observed, with PMI's competitors gaining ground in certain regions.

- Price wars and promotional activities are common, affecting profit margins across the industry.

- The reduced-risk product market is seeing rapid growth, attracting new entrants and intensifying competition.

Excise taxes and economic slowdowns significantly impact Philip Morris International's financials. Fluctuating currency rates also pose risks to reported revenues and profitability. Furthermore, raw material cost volatility, especially for tobacco, affects production costs and the firm's bottom line.

| Economic Factor | Impact | Data Point (2024-2025) |

|---|---|---|

| Excise Taxes | Increased prices, reduced sales | Excise tax hikes in several countries projected to continue in 2025. |

| Economic Growth | Impacts sales volumes | Global inflation and recession concerns in Europe, affecting consumer spending. |

| Currency Fluctuations | Reduced revenue, profitability | Currency headwinds decreased PMI's revenues by $1.2B in 2023. Continued volatility in 2024-2025. |

Sociological factors

Growing health consciousness and anti-smoking sentiment significantly impact Philip Morris International (PMI). Globally, smoking rates have been declining. For instance, in the U.S., adult smoking rates fell to 11.5% in 2023. This shift boosts demand for reduced-risk products. PMI's focus on smoke-free alternatives aligns with this trend, with these products now representing a substantial portion of their revenue. The company's success hinges on adapting to evolving consumer preferences.

Social acceptance of alternatives like heated tobacco and e-cigarettes is growing in some areas. This shift aids PMI's smoke-free products. For example, in 2024, the global heated tobacco unit volume increased. This indicates a move away from traditional cigarettes. The acceptance is also boosted by changing consumer views on harm reduction.

Smoking traditions significantly impact Philip Morris International (PMI). High smoking prevalence in Asia-Pacific, driven by cultural norms, shapes market dynamics. This region's social acceptance of smoking influences consumer behavior and PMI's strategies. For example, in 2024, approximately 30% of adults in some Asia-Pacific countries smoke. This impacts PMI’s marketing.

Consumer Spending Trends and Preferences

Consumer spending habits are shifting, which directly affects PMI's product demand. Economic conditions and social trends heavily influence these changes. PMI must adjust its product offerings and marketing to meet these evolving preferences. For example, in 2024, premium cigarette sales are experiencing a slight decline, as consumers seek value. This requires PMI to innovate and diversify its product portfolio.

- Shift towards reduced-risk products (RRPs) is accelerating.

- Health consciousness and wellness trends impact consumer choices.

- Economic downturns lead to a focus on value and affordability.

- Social media and digital marketing play a crucial role in influencing consumer preferences.

Misinformation and Public Perception of Innovation

Misinformation and public skepticism significantly impact the acceptance of innovations like reduced-risk tobacco products. Social media often fuels public perception, influencing consumer behavior and regulatory decisions. A 2024 study indicated that 45% of adults mistakenly believe vaping is as harmful as smoking. This misperception hinders product adoption.

- Misinformation campaigns can lead to decreased trust in scientific findings.

- Public perception shapes regulatory landscapes, affecting product approvals.

- Consumer hesitancy can limit market growth for innovative products.

- Educational efforts are crucial to correct misconceptions.

Shifting consumer preferences and health consciousness influence PMI. Decline in traditional smoking and rise of smoke-free alternatives impact sales. Evolving social norms and misinformation create challenges.

| Factor | Impact | Example (2024) |

|---|---|---|

| Health Trends | Demand for RRPs increases | Heated tobacco units volume + growth |

| Misinformation | Affects product acceptance | 45% wrongly believe vaping is like smoking |

| Social Norms | Impacts product adoption | Decline in premium cigs sales |

Technological factors

Technological factors significantly influence Philip Morris International's (PMI) product innovation in smoke-free alternatives. PMI invests heavily in R&D to enhance products like IQOS and vaping devices. In 2024, PMI allocated approximately $1.3 billion to R&D, driving advancements in aerosol science and device technology. These advancements are vital for attracting health-conscious consumers and achieving its smoke-free future goals.

Philip Morris International (PMI) heavily invests in research and development to stay ahead. This focus is crucial for creating new nicotine delivery systems and vaping tech. In 2024, PMI allocated approximately $1.2 billion to R&D. This investment strengthens their market position through constant innovation.

Philip Morris International (PMI) leverages advancements in manufacturing, such as automation and precision engineering, to boost production efficiency. These technologies enable cost reduction and improved product quality. PMI invested approximately $400 million in digital transformation in 2023. This includes smart factories. These factories optimize operations.

Developing Sophisticated Tracking and Personalization Technologies

Philip Morris International (PMI) heavily invests in advanced technologies to understand consumer behavior. AI and machine learning are central to analyzing consumer data, enabling tailored marketing. This approach is crucial for product development and distribution. PMI's tech investments reached $270 million in 2024.

- AI-driven systems analyze consumer interaction data.

- Machine learning algorithms enhance marketing strategies.

- Personalization is key for product development.

- $270 million invested in tech in 2024.

Digital Transformation and E-commerce

Philip Morris International (PMI) must embrace digital transformation to move towards a business-to-consumer model and enter new markets. This transformation involves digitizing applications and leveraging technology to support a large customer base. PMI's focus on digital channels is evident in its financial reports, with e-commerce sales showing growth. Digital initiatives are key for PMI's future.

- In 2024, PMI's digital platforms saw increased engagement.

- E-commerce sales increased by approximately 20% in the first half of 2024.

- PMI is investing heavily in digital marketing and data analytics.

- The company plans to expand its digital presence in Asia by late 2024.

PMI prioritizes R&D for smoke-free alternatives, investing around $1.3B in 2024. Automation and smart factories optimize production, with about $400M in digital transformation in 2023. Digital strategies drive e-commerce growth. In H1 2024, e-commerce sales rose ~20%.

| Technology Area | Investment (2023/2024) | Impact |

|---|---|---|

| R&D (Smoke-Free) | $1.3B (2024) | Product innovation & consumer appeal |

| Digital Transformation | $400M (2023) | Efficiency & Cost Reduction |

| Digital Marketing | $270M (2024) | Data analytics, e-commerce, sales increase ~20% in H1 2024 |

Legal factors

Philip Morris International (PMI) navigates a complex web of legal factors. Increasing marketing and regulatory restrictions worldwide limit communication with adult consumers. These restrictions affect product bans in certain markets, reducing competitiveness. In 2024, PMI's revenue was $35.7 billion, influenced by these regulations. The company spends significantly on compliance, impacting profitability.

Philip Morris International (PMI) faces ongoing litigation tied to tobacco and nicotine use, incurring substantial legal expenses and potential financial obligations. PMI actively works to resolve long-standing lawsuits. In 2023, PMI's legal costs were $379 million. Recent settlements and court decisions are key factors impacting PMI's financial outlook for 2024 and beyond.

The regulatory landscape for reduced-risk products (RRPs) is dynamic, with significant country-specific variations. Regulations and taxation that fail to distinguish RRPs from cigarettes can impede their market uptake and hinder PMI's transformation. For instance, in 2024, the European Union updated its Tobacco Products Directive, impacting RRPs. Such regulatory frameworks influence PMI's market access and profitability. In 2023, PMI's smoke-free product net revenues reached $10.7 billion, highlighting the stakes involved in regulatory outcomes.

International Trade Policies and Sanctions

International trade policies and sanctions significantly affect Philip Morris International (PMI). National and international regulations, including trade agreements and tariffs, directly impact PMI's global supply chain and production expenses. Economic sanctions can restrict market access and disrupt operations. These factors create intricate legal hurdles for a worldwide company like PMI.

- In 2024, PMI faced increased scrutiny due to evolving trade policies.

- Tariffs and trade barriers impacted the cost of raw materials and finished goods.

- Sanctions against certain countries limited PMI's market reach.

- PMI actively manages its legal and compliance risks.

Intellectual Property Rights

Philip Morris International (PMI) heavily relies on intellectual property rights to protect its innovations. These rights are vital for safeguarding its products and technologies. Legal battles over patents and trademarks can affect PMI's ability to introduce new products. Recent data indicates that PMI invests billions annually in R&D, highlighting the importance of protecting these investments. The company's success hinges on its ability to defend its intellectual property globally.

- PMI's R&D spending was approximately $850 million in 2023.

- Patent filings and enforcement are crucial for maintaining market position.

- Intellectual property disputes can lead to significant financial and reputational risks.

Philip Morris International's legal landscape is shaped by strict global regulations, including those restricting marketing and impacting product availability. The company faces ongoing litigation related to tobacco and nicotine use, leading to considerable legal expenses; in 2023, legal costs hit $379 million. Intellectual property rights are crucial for protecting innovations amid substantial R&D investments.

| Aspect | Details |

|---|---|

| Regulatory Restrictions | Marketing bans, product restrictions impact competitiveness. |

| Legal Costs (2023) | $379 million for litigation and compliance. |

| R&D Investment (2023) | Approximately $850 million in R&D. |

Environmental factors

Environmental regulations are intensifying worldwide, impacting Philip Morris International (PMI). Stricter rules on emissions, waste, and sourcing force changes in manufacturing and supply chains. PMI must invest in cleaner tech and sustainable methods to comply. For instance, in 2024, PMI invested over $100 million in sustainable initiatives globally.

Climate change poses significant risks to Philip Morris International (PMI). Agricultural productivity could be affected, potentially raising production costs. Water scarcity and biodiversity threats also loom. PMI's 2023 sustainability report highlights these concerns, underscoring the need for proactive measures. Specifically, PMI's 2023 report indicated that the company is actively assessing climate-related risks across its value chain.

Resource management is crucial for Philip Morris International (PMI). PMI focuses on efficient use of resources like water and energy. In 2024, PMI invested $100 million in sustainable initiatives. This included reducing water usage by 15% and energy consumption by 10% in its factories.

Waste Management

Waste management is crucial for Philip Morris International (PMI). Proper disposal and recycling of tobacco waste, like cigarette butts and packaging, are major environmental issues. PMI faces increasing pressure to manage its waste responsibly. This includes initiatives to reduce litter and promote recycling programs.

- Globally, cigarette butts are a leading source of litter.

- PMI's efforts include investments in waste collection and recycling.

- The company's environmental reports detail waste reduction goals.

- Regulatory changes impact waste management practices.

Sustainable Sourcing and Agricultural Practices

Philip Morris International (PMI) is increasingly focused on sustainable sourcing and agricultural practices to ensure a stable supply of high-quality tobacco. This involves promoting the efficient use of natural resources and protecting biodiversity within its supply chain. For instance, PMI has invested $80 million in agricultural sustainability programs. The company aims to source 100% of its tobacco from sustainable sources by 2025. These efforts are crucial for mitigating environmental risks and maintaining operational resilience.

- $80 million invested in agricultural sustainability programs.

- Target to source 100% sustainable tobacco by 2025.

PMI faces stricter environmental regulations globally, necessitating investments in sustainable practices like cleaner tech. Climate change poses production risks, prompting PMI's proactive assessment and mitigation efforts across its value chain. Efficient resource and waste management are key, with substantial investments made in 2024. By 2025 PMI aims for 100% sustainable tobacco sourcing.

| Initiative | Investment/Target | Year |

|---|---|---|

| Sustainable Initiatives | $100M | 2024 |

| Agricultural Sustainability | $80M | Ongoing |

| Sustainable Tobacco Sourcing | 100% | 2025 Target |

PESTLE Analysis Data Sources

The PESTLE analysis relies on a diverse array of sources, including financial reports, market research, government publications, and industry-specific databases.