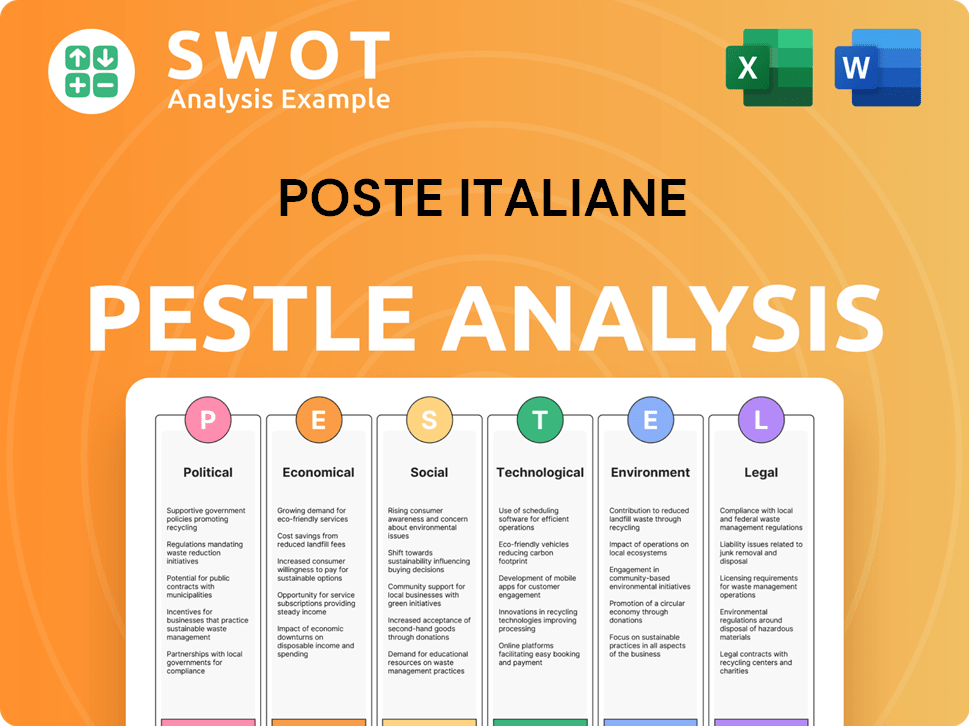

Poste Italiane PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Poste Italiane Bundle

What is included in the product

Evaluates the external factors affecting Poste Italiane. It provides reliable, insightful evaluations with relevant data.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Poste Italiane PESTLE Analysis

We’re showing you the real product. This Poste Italiane PESTLE analysis, fully detailing political, economic, social, technological, legal, and environmental factors, is yours after purchase.

PESTLE Analysis Template

Navigating Poste Italiane's complex environment? Our PESTLE analysis dissects the forces shaping its future. Uncover crucial political, economic, and social impacts. Identify technology's role and legal hurdles. Learn about environmental considerations affecting the firm. Gain a competitive edge - download the full analysis now!

Political factors

Poste Italiane, significantly influenced by the Italian Republic, operates with a dual role: corporate and social. The government's substantial ownership impacts its strategies as Italy's universal postal provider. In 2023, the Italian government held about 29.3% of Poste Italiane's shares. Privatization plans, if enacted, could reshape its structure, potentially affecting its operations and market positioning. The government's influence is vital for ensuring universal service and managing its extensive distribution network.

The European postal sector, including Italy, is governed by a unified regulatory framework. Poste Italiane, the universal service provider, complies with these rules. These regulations ensure consumer protection and social provisions. The 2020-2024 service contract covered universal service losses. In 2023, Poste Italiane's revenue was €12.3 billion.

Poste Italiane's financial and insurance services are heavily influenced by regulatory shifts. The Bank of Italy's corporate governance rules for BancoPosta are crucial. Solvency II impacts capital and risk management. The EU's DORA, effective January 2025, enforces digital resilience. In 2024, Poste Italiane's insurance segment saw a premium income of €4.5 billion.

National Recovery and Resilience Plan (NRRP)

The National Recovery and Resilience Plan (NRRP) significantly influences Poste Italiane. The Polis Project, part of the NRRP Complementary Plan, is crucial. It supports economic and social cohesion, especially in smaller Italian municipalities. This project aims to bridge the digital divide.

- Polis Project investment: Over €1 billion.

- Target: 7,000 post offices by 2026.

- Services: Public administration and digital services.

Geopolitical Instability

Geopolitical instability presents risks to Poste Italiane's operations. The company's 2024 annual report highlights the impact of global instability. Conflicts affect the economy and geopolitics, influencing its business segments. This includes potential disruptions to international mail and financial services. Poste Italiane must navigate these uncertainties.

- 2024: Poste Italiane's international mail revenue saw fluctuations due to geopolitical events.

- 2024: The company's financial services faced indirect impacts from economic shifts linked to global tensions.

- 2024: Poste Italiane's risk assessments include scenarios for geopolitical disruptions.

Political factors profoundly shape Poste Italiane's operations. Government ownership and regulatory frameworks from Italy and the EU significantly affect strategy. The National Recovery and Resilience Plan (NRRP) with its Polis Project influences service expansion, particularly in smaller municipalities.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Government Influence | Ownership & Regulation | 29.3% government stake (2023); compliance with Italian & EU laws |

| NRRP: Polis Project | Digital service expansion | Over €1 billion investment; 7,000 post offices by 2026 |

| Regulatory Changes | Compliance with EU DORA | DORA effective January 2025 |

Economic factors

Poste Italiane's financial health is closely tied to Italy's economic climate. Its diverse structure offers some protection against economic downturns. Overall revenue remains stable, but growth is affected by the economy. Italy's GDP grew by 0.7% in 2023, and forecasts for 2024 predict modest growth.

Financial and insurance services significantly boost Poste Italiane's revenue. Inflation, interest rates, and global events affect these sectors. Despite challenges, these units show robust performance. For instance, postal savings deposits saw growth, indicating stability. In 2024, Poste Italiane's financial services generated substantial income, underpinning overall financial health.

The parcel market's expansion is fueled by e-commerce, offsetting declines in traditional mail. Poste Italiane is adapting its logistics to benefit from this trend. Parcel revenues are targeted to increase within the Mail & Parcel segment. The Italian CEP market is predicted to keep growing, with a 9% growth in 2024.

Interest Rate Environment

The interest rate environment significantly influences Poste Italiane's financial performance. Low interest rates, as seen in recent years, can squeeze profit margins on investment products and savings accounts. This necessitates exploring alternative, potentially riskier, investment avenues to maintain returns. Conversely, rising interest rates can benefit Poste Italiane's banking sector, boosting profitability through increased interest income on loans and other financial products.

- In 2024, the European Central Bank (ECB) maintained a benchmark interest rate that impacted financial institutions like Poste Italiane.

- Rising rates could improve net interest margins in the banking sector.

- Low rates can lead to decreased profitability in investment products.

Investment in Infrastructure and Digitalization

Poste Italiane is heavily investing in infrastructure and digitalization. This involves automating logistics and moving services to the cloud. These efforts aim to boost efficiency and enhance customer experiences. Such investments are crucial for adapting to market changes, partly supported by the EIB.

- Investment in digital transformation reached €1.2 billion in 2023.

- Cloud migration is expected to save 15% on IT costs.

- Automated logistics increased parcel processing by 20%.

Italy's economy influences Poste Italiane's performance, with financial services and e-commerce playing significant roles. Despite economic challenges, Poste Italiane adapts through strategic investments and digital transformation. Inflation and interest rates also pose challenges and opportunities. Italian GDP grew by 0.7% in 2023; the European Commission projects 0.9% for 2024.

| Economic Factor | Impact on Poste Italiane | Data Point |

|---|---|---|

| GDP Growth | Influences revenue and profitability | Italy's GDP growth of 0.7% in 2023 |

| Interest Rates | Affects banking and investment margins | ECB benchmark rate impacts financial products |

| Inflation | Influences operational costs and consumer behavior | Inflation rates impact postal and financial services |

Sociological factors

Italy faces a substantial aging population, boosting demand for health and life insurance. Poste Italiane adapts by offering products like long-term care. In 2024, nearly 24% of Italy's population was over 65, highlighting the need for services tailored to older adults. This demographic shift is reshaping Poste Italiane's product development.

Consumer preferences are evolving, prioritizing digital interactions and personalized services. Poste Italiane must invest in digital platforms, mobile apps, and data analytics to meet these demands. E-commerce growth necessitates digital transformation in logistics and payments. In 2024, digital transactions grew by 15%, reflecting this shift. Poste Italiane's investment in digital initiatives reached €500 million.

Poste Italiane is a major employer in Italy, fostering socio-economic development. It has a vast network, crucial for citizens' access to services. Social inclusion is supported, especially in smaller towns. In 2024, it employed around 120,000 people. Initiatives like the Polis Project enhance this role.

Public Perception and Trust

Poste Italiane, as a national institution, generally enjoys public trust, crucial for its diverse services. Maintaining this trust is vital for its postal, financial, and insurance products. The company's focus on fraud prevention and service quality is vital for positive public perception. In 2024, Poste Italiane reported a customer satisfaction rate of 85% across its services. Effective communication and transparency are key to sustaining this positive image.

- Customer satisfaction rate of 85% in 2024.

- Focus on fraud prevention.

- Transparency in operations.

Workforce Transformation and Management

Poste Italiane faces workforce shifts due to tech and market changes. They're retraining staff and using flexible contracts, impacting labor costs. In 2024, they invested heavily in digital skills training. Adapting is key for efficiency and to stay competitive. The company's 2024 report showed a 3% rise in training expenditure.

- Training programs focused on digital skills and new technologies.

- Flexible work arrangements to manage operational needs.

- Strategies to mitigate rising labor costs.

- Focus on employee adaptation and skill enhancement.

An aging population drives demand for Poste Italiane’s insurance. Digital shifts demand digital platforms and data analytics, crucial for customer needs. As a major employer, Poste Italiane fosters social inclusion and public trust, impacting the national socio-economic environment.

| Factor | Details | 2024 Data |

|---|---|---|

| Aging Population | Demand for health and life insurance | 24% of population over 65 |

| Digital Transformation | Growth in digital transactions, emphasis on digital platforms. | 15% growth in digital transactions |

| Public Trust | Importance for all services; focus on service quality. | Customer satisfaction rate of 85% |

Technological factors

Poste Italiane's digital transformation focuses on efficiency and customer experience. They are investing in digital platforms. This includes a SuperApp with a digital payment wallet, and AI. In 2024, digital transactions increased by 20%.

Poste Italiane is automating logistics to handle rising parcel volumes and boost efficiency. New automated parcel sorting centers are being set up. Technology is used for tracking assets, optimizing networks, and using predictive algorithms. In 2024, e-commerce in Italy reached €54.2 billion, driving automation needs.

The Italian market has seen a surge in mobile banking and digital payment systems. This trend is driving significant growth in the digital payments sector. Poste Italiane's emphasis on payments, including its digital wallet within the SuperApp, is vital. In 2024, mobile payments in Italy reached €25 billion, up 20% YoY, showing strong adoption.

Technological Advancements in Telecommunications

Poste Italiane's telecommunications arm faces significant technological shifts. The rollout of 5G networks is crucial, with Italy aiming for nationwide coverage. Integrating AI and IoT enhances service delivery and operational effectiveness. These advancements necessitate ongoing investment in infrastructure. Poste Italiane must adapt to remain competitive.

- 5G coverage in Italy reached 95% of the population by late 2024.

- Poste Italiane invested €800 million in digital transformation in 2023.

- AI is used to optimize customer service and network management.

Cybersecurity Risks

Poste Italiane faces escalating cybersecurity risks as it expands its digital services. The company must prioritize robust cybersecurity measures to protect customer data and maintain trust. The EU's DORA regulation, effective from January 2025, mandates stringent digital operational resilience. Poste Italiane's IT spending in 2024 was approximately €800 million, with a significant portion allocated to cybersecurity.

- DORA compliance requires continuous monitoring and incident response capabilities.

- Cyberattacks, such as data breaches, can lead to significant financial losses and reputational damage.

- Investment in advanced threat detection and prevention systems is crucial.

- Training employees on cybersecurity best practices is essential.

Poste Italiane is leveraging tech to enhance efficiency and customer experience. Investments in digital platforms, including a SuperApp, are key. Automation and AI are being integrated to manage rising parcel volumes and optimize service delivery. Digital payments are booming in Italy; Poste's digital wallet is strategically vital.

| Technological Aspect | Details | 2024/2025 Data |

|---|---|---|

| Digital Transformation Investment | Focus on digital platforms, AI, automation | €800 million spent on IT in 2024, including cybersecurity. |

| Digital Payments Growth | Emphasizing the digital wallet via SuperApp. | Mobile payments in Italy reached €25 billion in 2024, up 20% YoY. |

| 5G Rollout and Adoption | Expansion of 5G infrastructure | Italy achieved 95% population coverage by late 2024. |

Legal factors

Poste Italiane faces extensive legal obligations due to national and EU regulations. These laws cover postal, financial, insurance, and telecom services. Compliance includes directives on market openness, consumer safeguards, and data privacy, such as GDPR. It must also adhere to financial stability rules like Solvency II. The company's legal costs in 2024 were approximately €150 million.

Poste Italiane faces strict oversight from the Bank of Italy and IVASS. These regulatory bodies enforce rules on corporate governance and capital adequacy. Compliance is crucial for maintaining financial stability and consumer trust. In 2024, regulatory fines within the financial sector in Italy totaled approximately €120 million, reflecting the rigorous environment.

Labor laws and regulations significantly affect Poste Italiane, given its large workforce. Changes in employment contracts, working conditions, and collective bargaining influence costs. In 2024, labor expenses were a substantial part of overall costs. Compliance with evolving regulations impacts operational flexibility.

Government Privatization Plans

Government plans for Poste Italiane's privatization directly affect its legal and operational framework. These decisions, linked to wider economic strategies, reshape ownership and governance. In 2024, the Italian government explored selling a portion of its 29.26% stake. This move aimed to reduce public debt.

- Legal changes: privatization may lead to amendments in the company's statutes.

- Ownership structure: a change in ownership affects stakeholder relations.

- Governance: the composition of the board and management may change.

- Compliance: Poste Italiane must adhere to new regulations.

Legal Framework for Universal Postal Service

Poste Italiane's universal postal service is legally bound, with service terms and compensation set by government contracts. Any shifts in this legal structure or contract conditions can affect its mail operations. These contracts are crucial for revenue. For 2023, the Italian government allocated about €1.2 billion for universal service obligations. Changes could affect this funding.

- Legal mandates significantly shape Poste Italiane's postal service offerings.

- Service contracts with the government dictate the operational terms.

- Compensation levels for universal service are contractually defined.

- Amendments to contracts can create financial uncertainty.

Poste Italiane's legal landscape involves adherence to national and EU rules across sectors. Regulatory compliance, especially regarding data and finance, drives costs, with about €150 million in 2024. Labor laws significantly impact its workforce management.

Government actions, such as privatization, alter operational and governance structures. Contracts regarding universal postal service and compensation are crucial. In 2023, funding was approximately €1.2 billion.

| Legal Aspect | Impact | Data Point (2024) |

|---|---|---|

| Regulatory Compliance | Increased operational costs. | Approx. €150M in legal costs. |

| Privatization | Changes in governance. | Govt. considered stake sale. |

| Postal Service Contracts | Financial uncertainty. | €1.2B (2023) for obligations. |

Environmental factors

Poste Italiane aims for carbon neutrality by 2030, echoing global climate goals. This means significant changes in how they operate, focusing on greening buildings and transport. For example, in 2023, they invested €100 million in sustainable logistics. This commitment also involves using more renewable energy.

Poste Italiane focuses on fleet renewal with low-emission vehicles, a core environmental strategy. This shift significantly cuts CO2 emissions, supporting sustainable logistics. By 2024, the company had over 8,000 electric vehicles, showcasing progress. The firm plans to further electrify its fleet, aiming for a 40% reduction in emissions by 2025.

Poste Italiane focuses on energy efficiency to cut emissions. This includes solar panel installation and smart building tech. In 2023, they reduced energy use by 3.4% through these initiatives. The goal is to lower their carbon footprint and operating costs.

Integration of ESG Factors in Business and Investments

Poste Italiane actively incorporates Environmental, Social, and Governance (ESG) factors into its business practices, including investment and insurance products. This integration supports sustainability goals and promotes eco-friendly actions across its operations. For example, Poste Italiane's 2023 Integrated Report highlights its commitment to reducing environmental impact. This involves initiatives such as transitioning to electric vehicles and promoting sustainable supply chains.

- Reduced CO2 emissions by 40% by 2023 compared to 2017.

- Invested €1.5 billion in green bonds by the end of 2023.

- Aimed to have 65% of suppliers meeting sustainability criteria by 2024.

Impact of Climate Change and Natural Disasters

Poste Italiane acknowledges climate change's economic impacts and rising extreme weather events and natural disasters. This is especially pertinent for insurance, affecting logistics and infrastructure. Adaptation and risk management are crucial strategies. Recent data shows a rise in climate-related disasters; Italy experienced over €1 billion in damages in 2023. The company is adapting its strategies to mitigate these risks.

- Italy's 2023 climate-related damages exceeded €1 billion.

- Adaptation and risk management are vital for Poste Italiane.

Poste Italiane prioritizes sustainability, aiming for carbon neutrality by 2030. They're greening operations via renewable energy and eco-friendly vehicles. By 2025, the company aims to reduce emissions by 40% and invested €1.5B in green bonds by the end of 2023.

| Environmental Factor | Initiative | Data |

|---|---|---|

| Carbon Neutrality Target | Reduce Emissions | Aim for 2030; 40% emissions cut by 2025. |

| Sustainable Investments | Green Bonds | €1.5B invested by the end of 2023. |

| Climate Risk | Risk Management | Italy had over €1B damages in 2023. |

PESTLE Analysis Data Sources

The PESTLE analysis relies on current data from the European Commission, Italian government sources, and financial reports. Additional insights stem from global economic outlooks and consumer trend analyses.