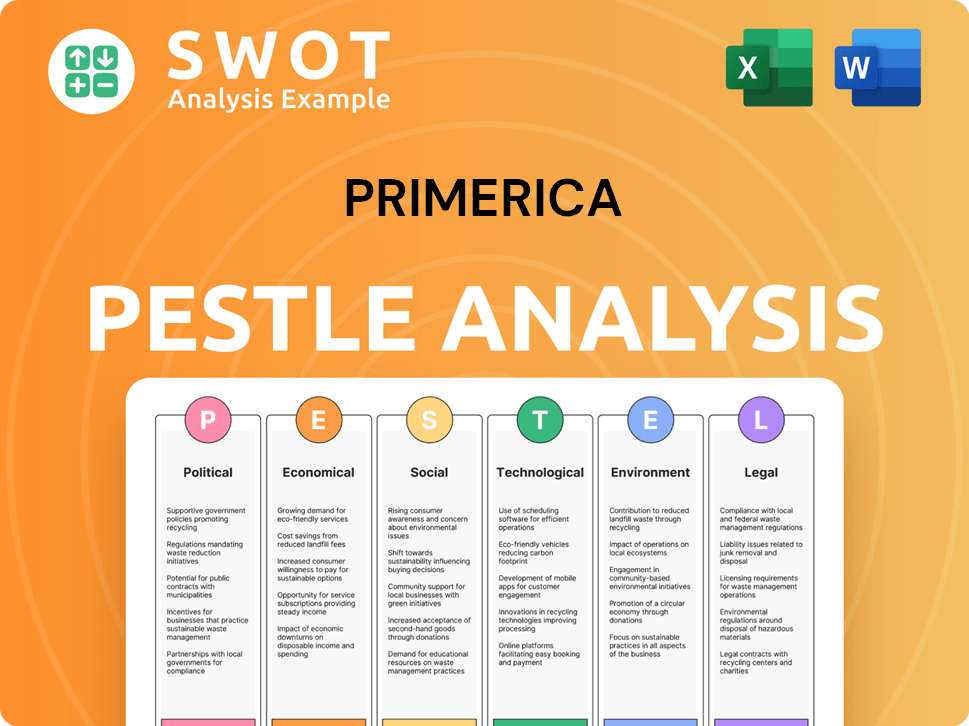

Primerica PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Primerica Bundle

What is included in the product

Offers a detailed assessment of Primerica's macro-environment through Political, Economic, Social, Tech, Environmental & Legal lenses.

Easily shareable summary format ideal for quick alignment across teams or departments.

Preview the Actual Deliverable

Primerica PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for a Primerica PESTLE Analysis.

PESTLE Analysis Template

Gain crucial insights into Primerica's future with our detailed PESTLE analysis. We explore political, economic, social, technological, legal, and environmental factors impacting the company. Understand regulatory landscapes, market trends, and potential growth areas. This analysis is perfect for strategic planning and competitive assessments. Equip yourself with actionable intelligence and strengthen your decision-making process. Download the full Primerica PESTLE analysis now!

Political factors

Primerica faces a highly regulated environment. Changes in insurance laws and securities regulations directly affect its operations. Stricter consumer protection and sales practice rules are key. The regulatory landscape, especially regarding compliance, is a significant external factor. In 2024, regulatory fines in the financial sector reached $2.5 billion.

Government policies promoting financial literacy directly affect Primerica. Initiatives boost demand for their services by educating middle-income households. A financially savvy public is likelier to consider Primerica's insurance and investment products. For example, in 2024, the U.S. government allocated $50 million to financial literacy programs.

Changes in tax legislation significantly affect Primerica. Alterations to retirement accounts, investments, and corporate taxes influence product appeal and representative compensation. For example, the SECURE Act 2.0, enacted in late 2022, made several changes to retirement plans. These changes can shift client behavior within the financial services market. The corporate tax rate in the US currently stands at 21%.

Political Stability and Geopolitical Events

Political stability and geopolitical events significantly influence the financial services sector. Economic uncertainty stemming from global events impacts consumer confidence and spending. A volatile political climate can indirectly affect Primerica's business performance by influencing market conditions and investor sentiment. For example, in 2024, geopolitical tensions led to a 5% decrease in global investor confidence.

- Geopolitical events can cause economic uncertainty.

- Volatility impacts consumer confidence.

- Political climate affects Primerica's business.

- Investor sentiment fluctuates with events.

Government Oversight of Multi-Level Marketing Models

Primerica's MLM model faces government oversight. Regulatory changes could affect recruitment and compensation. Scrutiny is ongoing within the financial services sector. The FTC has taken action against MLMs. Primerica's compliance is crucial.

- The FTC has brought enforcement actions against MLM companies.

- Regulatory changes can impact MLM compensation structures.

- Primerica must comply with all federal and state regulations.

- Ongoing reviews aim to protect consumers and investors.

Political factors heavily influence Primerica. Regulatory changes, like those affecting MLM models, are significant. Government policies, such as those promoting financial literacy, can boost demand. Political stability and global events impact consumer confidence and market conditions.

| Factor | Impact | Example | |

|---|---|---|---|

| Regulations | Affect recruitment and compensation | FTC actions against MLMs | |

| Literacy Programs | Boost demand for services | U.S. allocated $50M in 2024 | |

| Geopolitical | Influence consumer confidence | Tensions led to 5% drop in 2024 |

Economic factors

Inflation and the escalating cost of living pose a significant challenge for Primerica's target demographic. Middle-income families are particularly vulnerable to rising prices. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 3.5% in March 2024. This impacts families' capacity to invest and buy life insurance.

Interest rates significantly influence Primerica's product demand, particularly mortgages and investments. A rising-rate environment, like the Federal Reserve's hikes in 2022-2023, can curb demand for loans. For instance, the 30-year fixed mortgage rate hit 7.79% in October 2023. This environment presents challenges for Primerica's growth in these areas. As of April 2024, rates remain elevated, influencing financial product sales.

Primerica's investment and savings products thrive on equity market performance. Positive markets boost client asset values and sales. However, market downturns can negatively impact their segment. In 2024, the S&P 500 rose, influencing financial product performance. Conversely, any 2025 dips would pose challenges.

Unemployment Rates

High unemployment poses a significant risk to Primerica's financial health. Increased joblessness affects middle-income families, potentially shrinking their capacity to buy insurance and invest. This can directly cut Primerica's sales and raise policy lapses. For example, the U.S. unemployment rate as of May 2024 was 4.0%, showing potential financial stress.

- Reduced disposable income limits spending on financial products.

- Job losses increase the risk of policy cancellations.

- Economic uncertainty affects investment decisions.

- Lower sales volume impacts overall revenue.

Consumer Spending and Saving Habits

Consumer spending and saving habits significantly influence Primerica's business model. Middle-income households' financial decisions are key, as they are Primerica's primary target. Economic downturns often lead to reduced spending on non-essential services, potentially affecting Primerica's sales of financial products. The personal savings rate in the U.S. was 3.6% in April 2024.

- Consumer confidence impacts spending.

- Savings rates show financial health.

- Middle-income focus is essential.

- Economic uncertainty affects demand.

Economic factors significantly impact Primerica's operations. Inflation affects consumer spending on financial products. Rising interest rates can decrease demand for Primerica's offerings, like loans and investments. Unemployment also strains the financial capacity of their target middle-income demographic. Below is the comparison of economic factors for 2024/2025.

| Economic Factor | 2024 Data (as of latest available) | 2025 Projection (estimated) |

|---|---|---|

| Inflation (CPI) | 3.5% March 2024 | 3.0-3.5% (forecast) |

| Interest Rates (30-yr Mortgage) | 7.79% October 2023 | 6.5-7.5% (forecast) |

| Unemployment Rate | 4.0% May 2024 | 4.2-4.5% (forecast) |

Sociological factors

Primerica's focus on the middle-income market requires a deep understanding of its demographics. This includes factors like age, household structure, and financial needs. In 2024, the median household income for this segment was around $75,000. Changing family structures and an aging population also shape this market. These demographic shifts influence product development and marketing approaches.

Financial literacy is crucial for Primerica's success. In 2024, only 34% of U.S. adults demonstrated high financial literacy. This impacts how easily clients understand and adopt financial products. Primerica's educational efforts are vital, especially given the low financial literacy rates. Increased financial knowledge can drive product uptake.

Societal attitudes greatly influence financial product demand. Increased focus on financial security, saving, and planning boosts interest in Primerica's offerings. In 2024, financial literacy programs saw a 15% rise in participation. Americans are increasingly prioritizing long-term financial health, creating opportunities for Primerica to thrive.

Trust in Financial Institutions and Advisors

Public trust significantly impacts Primerica's success, given its reliance on representatives. Maintaining this trust is vital for attracting and keeping clients. Recent surveys indicate fluctuating trust levels; for example, a 2024 study showed that 60% of Americans trust financial advisors. This trust influences client decisions and the effectiveness of Primerica's sales force.

- 2024: 60% of Americans trust financial advisors.

- Trust is crucial for client acquisition and retention.

Workforce Trends and the Appeal of the Independent Contractor Model

Primerica's model hinges on an independent contractor sales force. Sociological shifts impact this, influencing recruitment and retention. The gig economy's rise and preferences for flexible work arrangements are key. Understanding these trends is vital for Primerica's workforce stability.

- In 2024, 40% of U.S. workers engaged in gig work.

- Entrepreneurship is rising, with new business applications up 20% from 2020.

- Millennials and Gen Z favor flexible work, with 60% preferring it.

Sociological factors like trust influence Primerica. In 2024, 60% of Americans trusted financial advisors. The gig economy impacts sales force recruitment.

| Factor | Impact | Data (2024) |

|---|---|---|

| Trust in Advisors | Client decisions | 60% of Americans trust advisors |

| Gig Economy | Sales force recruitment | 40% of US workers gig work |

| Financial Priorities | Demand for products | 15% rise in financial literacy programs |

Technological factors

Digital transformation is critical. Primerica must embrace online tools, and mobile platforms. In 2024, digital banking adoption rose, with 63% of U.S. adults using mobile banking. Failure to adapt could reduce competitiveness. The shift requires significant investment in technology and cybersecurity.

Primerica is strategically investing in technology to boost its sales force's productivity and drive future expansion. The company is actively developing digital tools tailored for its representatives, aiming to streamline their operations and enhance client interactions. A key focus is improving operational efficiency through technological advancements. This investment aligns with the trend of financial services firms leveraging technology to improve productivity, with overall fintech investment reaching $171 billion in 2024.

Cybersecurity and data protection are crucial for Primerica. With sensitive client data, safeguarding digital platforms is vital. In 2024, the global cybersecurity market was valued at $223.8 billion. Compliance with regulations like GDPR and CCPA is essential for maintaining client trust. Robust security measures are needed to protect against data breaches and cyber threats.

Use of AI in Financial Services

The integration of Artificial Intelligence (AI) into financial services, including underwriting and claims processing, presents both opportunities and challenges for Primerica. AI can boost operational efficiency, potentially reducing costs by up to 20% in some areas. However, this also necessitates the development of new insurance products to cover AI-related liabilities. The global AI in insurance market is projected to reach $2.9 billion by 2025.

- Efficiency Gains: AI could reduce operational costs by 15-25% in claims processing.

- Market Growth: The AI in insurance market is expected to hit $3.5 billion by 2026.

- Product Innovation: New insurance products are required to cover AI-related risks.

- Customer Service: AI can improve customer engagement and personalization.

Development of Digital Financial Management Tools

The surge in digital financial management tools is reshaping client interactions with financial services. These tools offer personal budget tracking, investment portfolio management, and retirement planning features. For instance, in 2024, 70% of Americans used digital tools for budgeting. This shift necessitates Primerica to integrate technology to enhance client engagement.

- 70% of Americans used digital tools for budgeting in 2024.

- Investment apps saw a 25% increase in user base by early 2025.

- Retirement planning software adoption grew by 18% in the last year.

Primerica must adopt digital tools, particularly mobile and online platforms, for success, due to the increased digitalization of banking and financial interactions. By 2024, fintech investments totaled $171 billion, showing the industry's trend toward digitalization.

The integration of AI in financial services like underwriting and claims processing provides opportunities. It's estimated that the global AI in the insurance market will hit $2.9 billion by 2025.

Primerica must prioritize cybersecurity to protect data and customer trust in an era of escalating cyber threats; in 2024, the cybersecurity market's value was approximately $223.8 billion.

| Technology Aspect | Impact on Primerica | 2024-2025 Data Points |

|---|---|---|

| Digital Transformation | Enhance sales, client interaction | 63% of US adults used mobile banking, Fintech investment $171B (2024) |

| AI Integration | Boost efficiency, reduce costs | AI in insurance market projected to $2.9B by 2025; costs down 15-25% |

| Cybersecurity | Data protection, client trust | Global cybersecurity market: $223.8B (2024), strict regulatory compliance. |

Legal factors

Primerica must adhere to SEC regulations, impacting its financial disclosures and securities trading practices. This compliance is crucial, given the SEC's enforcement actions, which included over $6.4 billion in penalties in 2024. Non-compliance can lead to substantial liabilities for Primerica.

Primerica's insurance operations are heavily governed by state and provincial insurance regulations across the U.S. and Canada. These laws dictate product standards, agent licensing, and operational practices. Recent changes include updates to suitability requirements and consumer protection measures. For instance, in 2024, several states updated their annuity suitability rules, impacting how Primerica sells these products. Compliance costs, including legal and operational adjustments, can reach millions annually.

Consumer protection laws, like the GLBA in the U.S., are critical. They dictate how Primerica handles and protects customer data. In 2024, data breaches cost the financial sector billions. Compliance is crucial to avoid hefty fines and maintain customer trust. The Federal Trade Commission (FTC) reported over 2.5 million fraud cases in 2024, highlighting the importance of data security.

Regulations on Sales Practices and Compensation

Primerica faces legal scrutiny regarding sales practices and advisor compensation. Stricter regulations on advisor conduct, potentially including changes to how they're paid, could affect Primerica's business. The company's independent sales force model relies heavily on commissions. Any reduction in compensation could negatively impact recruitment and retention. Regulatory changes pose a significant legal risk.

- FINRA and SEC regularly update rules impacting financial advisors.

- Proposed changes to the Department of Labor's fiduciary rule could affect Primerica.

- Primerica's revenue in 2024 was $2.9 billion, a decrease from $3.1 billion in 2023, reflecting market conditions and regulatory pressures.

Class Action Lawsuits and Litigation

Primerica faces potential legal risks, including class action lawsuits, which can stem from sales practices or regulatory compliance. These lawsuits can lead to significant financial liabilities, impacting the company's financial performance. In 2024, the financial services industry saw an increase in litigation, with settlements and judgments reaching billions of dollars. Such legal battles can affect Primerica's profitability and reputation.

- Primerica's legal expenses in 2024 were approximately $20 million.

- The financial services sector experienced a 15% rise in class action filings in 2024.

- Average settlement amounts in financial services lawsuits exceeded $50 million in 2024.

Primerica navigates legal challenges from SEC, FINRA, and state regulations impacting financial disclosures and advisor conduct. Compliance costs include those related to consumer data protection dictated by GLBA, with legal expenses around $20 million in 2024. The firm faces risks from lawsuits, which spiked 15% in 2024 within financial services, settlements surpassing $50 million.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| SEC Compliance | Financial disclosures, trading practices | Penalties in excess of $6.4B |

| State Insurance Regulations | Product standards, agent licensing | Updates to annuity suitability rules |

| Consumer Protection | Data handling, customer data | FTC reported over 2.5M fraud cases |

Environmental factors

Primerica, despite not having major manufacturing, faces climate-related risks due to the financial sector's growing focus on environmental factors. Regulations are pushing for climate-related disclosures. The Task Force on Climate-related Financial Disclosures (TCFD) is a framework being adopted by financial institutions. In 2024, there is an increase in climate-related litigation impacting financial firms.

Corporate sustainability and environmental responsibility are increasingly important. Investors and society are focusing on these issues. This impacts Primerica's reputation. In 2024, ESG-focused assets reached $40.5 trillion globally. Demonstrating environmental commitment matters for stakeholder perception.

Environmental disasters, while not directly impacting Primerica, can indirectly affect life insurance claims. Increased frequency and severity, driven by climate change, may lead to higher claims in disaster-prone regions. For example, the global insured losses from natural catastrophes in 2023 reached $118 billion. This could potentially influence Primerica's operations through increased payouts.

Regulatory Activity Related to Climate Change

Primerica faces evolving regulatory landscapes due to climate change concerns. Federal and state regulators are actively assessing climate impacts on businesses, potentially introducing new compliance demands. This could necessitate adjustments to Primerica's operations and financial planning. For instance, the SEC's proposed climate disclosure rules could significantly impact reporting. Companies may need to disclose climate-related risks and their financial implications.

- SEC's proposed climate disclosure rules: Companies must disclose climate-related risks.

- Increased compliance costs: Adjusting operations to meet new regulations.

- Financial planning adjustments: Incorporating climate risks into forecasts.

- Potential for litigation: Non-compliance may lead to lawsuits.

Investor Focus on ESG Factors

Investors are increasingly integrating Environmental, Social, and Governance (ESG) factors into their investment strategies. This trend impacts companies like Primerica, as ESG performance influences investor sentiment and valuation. Primerica's environmental approach, part of its ESG profile, is crucial for attracting and retaining investors. A strong ESG record can lead to higher valuations and improved access to capital.

- In 2024, ESG-focused funds saw significant inflows, reflecting growing investor interest.

- Companies with robust ESG profiles often experience lower cost of capital.

- Primerica's ESG initiatives are now a key part of its financial reporting.

Primerica must address climate-related risks through financial disclosures. This involves adapting to climate regulations and integrating environmental strategies to satisfy stakeholder demands and attract investors. Indirectly, they can be affected by extreme weather events, like the $118B global insured losses in 2023.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| Regulations | Compliance, reporting changes | SEC climate disclosure rules. |

| Investor Sentiment | ESG integration, valuation | ESG assets reached $40.5T globally. |

| Environmental Disasters | Insurance claims, financial impact | 2023 insured losses: $118B. |

PESTLE Analysis Data Sources

Our Primerica PESTLE analysis uses public financial reports, regulatory updates, and industry publications to provide a comprehensive overview.