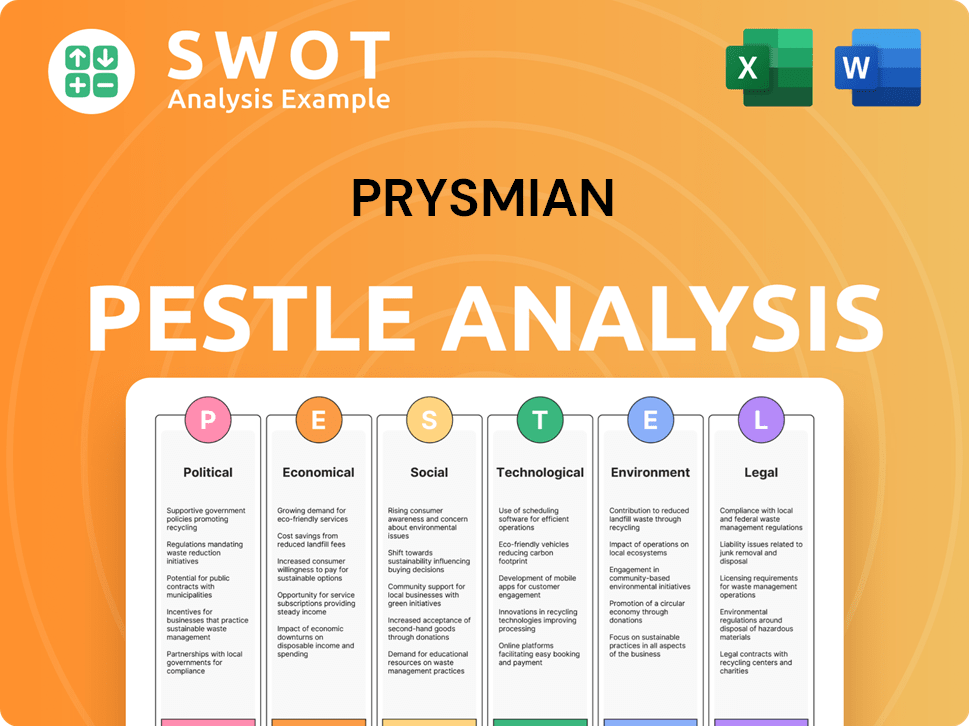

Prysmian PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Prysmian Bundle

What is included in the product

Analyzes Prysmian's external macro-environmental influences. It spans Political, Economic, Social, Tech, Environmental & Legal aspects.

Helps facilitate streamlined and well-informed strategic decision-making based on current global landscapes.

Preview Before You Purchase

Prysmian PESTLE Analysis

The preview showcases the complete Prysmian PESTLE analysis document.

What you’re viewing is the actual file you’ll receive instantly after purchasing.

It's fully formatted and ready for immediate use and download.

There are no surprises—the structure and content are identical.

Begin working with the complete analysis right away!

PESTLE Analysis Template

Navigate Prysmian's future with our in-depth PESTLE Analysis. Discover the political, economic, social, technological, legal, and environmental forces impacting its strategy. We break down the external landscape, identifying key risks and opportunities.

Our analysis helps investors, strategists, and researchers to anticipate future trends. This fully researched report offers actionable intelligence and expert-level insights.

Uncover Prysmian's external challenges and unlock strategic foresight with our analysis. Download now for a comprehensive understanding of the market!

Political factors

Prysmian benefits greatly from government infrastructure spending, particularly in energy and telecommunications. Investment in offshore wind farms and grid modernization boosts demand for their products. In 2024, global infrastructure spending is projected to reach $4.5 trillion. Political decisions heavily influence project timelines and budgets.

Prysmian, as a global player, faces trade policy impacts. Tariffs on materials like copper can raise costs, potentially impacting profitability. Trade agreement shifts alter market access and supply chains. For instance, the EU's tariff policies directly affect Prysmian's costs and market reach. In 2024, trade tensions saw copper prices fluctuate, affecting Prysmian's financials.

Prysmian, a global entity, faces political risks across its diverse operational landscape. Political instability can disrupt supply chains and project timelines. For example, in 2024, political tensions impacted infrastructure projects in certain regions. These disruptions can lead to financial losses and operational setbacks. Prysmian's risk assessments include political stability evaluations.

Geopolitical risks and conflicts

Geopolitical risks and conflicts pose significant challenges to Prysmian. These tensions can disrupt supply chains and increase raw material costs, impacting project timelines and profitability. Prysmian's large-scale projects are vulnerable to geopolitical considerations and security concerns, especially in unstable regions. These factors can lead to project delays or cancellations, affecting revenue forecasts. In 2024, the company reported that geopolitical uncertainty was a key factor influencing their operational environment.

- Supply chain disruptions: increased raw material prices by 10-15% in Q1 2024 due to conflict zones.

- Project delays: estimated 5-10% of projects delayed in 2024 due to geopolitical instability.

- Operational costs: increased security and insurance costs by 5-7% in regions with high geopolitical risk.

Government support for renewable energy

Government backing for renewable energy, like offshore wind, fuels demand for Prysmian's cables. Policies and incentives are key political drivers. The level of support significantly impacts Prysmian's growth. Regulatory frameworks for renewables are crucial.

- EU aims for 42.5% renewable energy by 2030, boosting cable demand.

- U.S. Inflation Reduction Act offers tax credits for renewables, affecting Prysmian.

- China's focus on wind power expansion creates opportunities.

Political factors critically influence Prysmian’s performance. Infrastructure spending and renewable energy policies are major growth drivers. Trade policies, such as tariffs, directly impact costs and market access. Geopolitical risks pose operational challenges, including supply chain disruptions.

| Area | Impact | 2024 Data |

|---|---|---|

| Infrastructure Spending | Boosts Demand | Global infrastructure spending reached $4.5T in 2024. |

| Trade Policy | Affects Costs | Copper price fluctuations increased costs by 5-7% in 2024. |

| Geopolitical Risk | Operational Challenges | Supply chain disruptions increased material prices by 10-15% in Q1 2024. |

Economic factors

Prysmian's success is closely linked to global economic health. Strong economic growth drives demand for its cables in energy and telecom sectors. In 2024, global GDP growth is projected at 3.2%, influencing Prysmian's order book. Recessions can hinder projects and reduce demand. The company's performance is sensitive to economic cycles.

Prysmian is heavily reliant on raw materials, especially copper. Copper price swings directly affect production costs. In 2024, copper prices saw fluctuations, impacting Prysmian's margins. The company actively hedges against such volatility. This is crucial for stable pricing and profitability.

Prysmian, operating globally, faces currency exchange rate risks. Fluctuations in rates can significantly affect financial results. For example, a strong Euro could make Prysmian's exports less competitive. In 2024, currency impacts were a key focus for the company. Consider the Euro's movements against the USD and other currencies.

Interest rates and access to financing

Interest rates significantly affect Prysmian's borrowing costs and its customers' investment decisions. Increased rates can make financing infrastructure projects more expensive, possibly reducing demand. Prysmian relies on accessible, favorable financing for its investments and acquisitions. In Q1 2024, the European Central Bank maintained key interest rates, impacting Prysmian's financial planning.

- ECB's interest rate decisions directly affect Prysmian.

- High rates might slow infrastructure project investments.

- Financing is key for Prysmian's growth through acquisitions.

Market demand in key sectors

Prysmian's economic success hinges on market demand, especially in energy and telecom. Demand for its products is influenced by grid modernization, renewable energy, and digital transformation needs. For example, the global market for submarine cables is expected to reach $10.5 billion by 2025. Responding effectively to these trends is crucial for Prysmian's economic performance.

- Renewable energy projects are boosting demand for power cables.

- Digital transformation is driving telecom cable sales.

- Grid modernization efforts are increasing.

Prysmian’s economic health relies on global growth; 2024 GDP is projected at 3.2%. Fluctuating copper prices directly impact production costs and margins. Currency exchange rates and interest rates, particularly from the ECB, affect its operations and financing.

| Economic Factor | Impact on Prysmian | 2024/2025 Data |

|---|---|---|

| GDP Growth | Influences demand, order book | 2024 Global GDP: 3.2% growth |

| Copper Prices | Affects production costs & margins | Fluctuations observed, hedging used |

| Currency Exchange Rates | Impacts financial results | Euro vs USD: key focus |

Sociological factors

The global population is growing, with projections estimating it will reach nearly 10 billion by 2050, according to the UN. Urbanization is also increasing, with over 55% of the world's population living in urban areas as of 2024. This creates demand for Prysmian's products. Prysmian's cables are essential for energy and communication infrastructure.

Consumer behavior is shifting towards digital, boosting demand for high-speed data. This trend, driven by increased data consumption, benefits Prysmian. In 2024, global data traffic grew significantly, supporting fiber optic network investments. Prysmian's telecom segment thrives on this digital infrastructure demand.

Prysmian depends on skilled labor for its operations. The availability and retention of qualified staff significantly impact its ability to fulfill projects. In 2024, the demand for skilled technicians in the energy sector increased by 7%, impacting hiring. The company's success hinges on effective workforce management.

Social responsibility and community engagement

Prysmian faces growing societal demands for corporate social responsibility (CSR). This involves ethical labor practices, community involvement, and local development support where they operate. Positive community relationships are crucial, impacting brand reputation and operational licenses. Prysmian's CSR efforts are increasingly scrutinized by stakeholders.

- In 2024, Prysmian invested €10 million in community projects.

- Prysmian's sustainability report showed a 15% increase in CSR-related activities.

Health and safety standards

Prysmian Group prioritizes health and safety across its operations, especially in manufacturing and installation. Stringent safety standards and a strong safety culture are crucial for employee well-being and reputation. In 2024, the company invested €10 million in safety programs. This focus aligns with the industry's trend towards enhanced worker protection.

- 2024 Investment: €10 million in safety programs.

- Focus: Employee well-being and reputation.

Growing global population and urbanization drive infrastructure needs. Shifting consumer digital habits boost demand for Prysmian's data solutions.

The company’s CSR commitment and community engagement are crucial, demonstrated by recent investments. Employee well-being and safety get strong focus.

| Factor | Impact | Data |

|---|---|---|

| CSR Investment | Enhances Brand Reputation | €10M community projects (2024) |

| Safety Programs | Protects workforce | €10M in safety (2024) |

| Digital Shift | Boosts Telecom segment | Data traffic growth (2024) |

Technological factors

Prysmian must keep up with cable tech advancements. Continuous innovation in materials, design, and manufacturing is vital. This involves creating superior, efficient, and sustainable cable solutions. In 2024, the global cable market was valued at $210 billion, expected to reach $280 billion by 2029.

The shift toward smart grids and digital networks significantly impacts Prysmian. This transformation requires sophisticated cables to manage vast data flows and integrate new technologies. Prysmian's focus on advanced cable solutions is crucial. In 2024, the global smart grid market was valued at approximately $30 billion, projected to reach $60 billion by 2029.

Automation and digitalization boost efficiency, cut costs, and elevate product quality in manufacturing. Prysmian's embrace of advanced technologies is crucial. In 2024, the global industrial automation market was valued at $190 billion, expected to reach $310 billion by 2029. Prysmian's investments in smart factories reflect this trend.

Subsea cable installation technology

For Prysmian, subsea cable installation technology is crucial for its transmission business, particularly in offshore wind projects. Specialized vessels and techniques directly influence project feasibility and cost-effectiveness. The global subsea cable market is projected to reach $27.8 billion by 2025, with significant growth expected in offshore wind. Prysmian has invested €140 million in its new cable-laying vessel, "Leonardo da Vinci," to enhance its installation capabilities.

- Market growth drives the need for advanced installation.

- Specialized vessels reduce project costs and timelines.

- Investments in technology enhance competitiveness.

- Offshore wind projects are a key growth area.

Integration of renewable energy technologies

The integration of renewable energy is a significant technological factor for Prysmian. The growth of solar, wind, and other renewable sources demands advanced cabling. Prysmian's cables are crucial for connecting these energy sources to the grid. This positions Prysmian well in a market expected to grow substantially. The global renewable energy market is projected to reach $1.977.6 billion by 2025.

- Prysmian's cables are essential for renewable energy projects.

- The renewable energy market is rapidly expanding.

- Prysmian's expertise aligns with market demands.

Technological advancements like smart grids, automation, and subsea cable tech significantly influence Prysmian. Advanced cable solutions are vital due to digital networks. The smart grid market is set to hit $60 billion by 2029. Prysmian invested €140 million in its cable-laying vessel. Renewable energy drives demand, with the global market reaching $1.977.6 billion by 2025.

| Technological Factor | Impact on Prysmian | Data (2024/2025) |

|---|---|---|

| Cable Tech Advancements | Continuous innovation needed for materials, design, manufacturing | Global cable market valued at $210B in 2024, expected to hit $280B by 2029. |

| Smart Grids & Digital Networks | Requires sophisticated cables to manage data | Smart grid market was valued at $30B in 2024, projecting to reach $60B by 2029. |

| Automation & Digitalization | Boosts efficiency, cuts costs, elevates product quality | Industrial automation market valued at $190B in 2024, projected to reach $310B by 2029. |

| Subsea Cable Installation | Crucial for transmission business, offshore wind projects | Subsea cable market projected to reach $27.8B by 2025; Prysmian invested €140M in "Leonardo da Vinci." |

| Renewable Energy Integration | Drives demand for advanced cabling | Global renewable energy market projected to reach $1.977.6B by 2025. |

Legal factors

Prysmian faces intricate international trade regulations. Compliance with export controls, sanctions, and customs is crucial. Non-compliance could lead to substantial penalties. These regulations impact operations globally, especially in regions like the EU and the Americas, where Prysmian has significant business. In 2024, trade-related legal issues cost companies billions.

Prysmian faces stringent environmental laws, affecting manufacturing and product design. Compliance necessitates investment in cleaner technologies. The company's 2024 Sustainability Report highlights its commitment to reducing its environmental footprint. In 2024, Prysmian invested €50 million in sustainable initiatives. These regulations drive costs but also innovation.

Prysmian, as a cable manufacturer, must comply with rigorous industry-specific standards and certifications. These include international standards like IEC and regional ones like those from UL or CE. Compliance ensures product quality, safety, and performance, which are crucial for market access. In 2024, Prysmian invested €120 million in R&D, partly to meet evolving standards. Maintaining these certifications is vital for customer trust and regulatory compliance.

Labor laws and regulations

Prysmian Group's global footprint means they must adhere to varied labor laws. These laws cover wages, work hours, and employee benefits across different countries. For example, in 2024, minimum wage laws varied greatly, from $7.25/hour in the US to higher rates in European nations. Maintaining positive industrial relations is also key.

- Compliance costs can be significant, affecting operational expenses.

- Non-compliance may lead to legal issues, fines, and reputational damage.

- Union negotiations and labor disputes can disrupt production.

Antitrust and competition laws

Prysmian, as a leading cable manufacturer, must adhere to antitrust and competition laws globally. These laws, like those enforced by the European Commission, aim to prevent monopolies and ensure fair market practices. Failure to comply could result in significant penalties, including substantial fines. For example, in 2023, the European Commission fined several cable companies for antitrust violations. Mergers and acquisitions are also scrutinized to ensure they don't stifle competition.

- Antitrust investigations can lead to significant financial penalties.

- Compliance is crucial for international operations.

- Mergers and acquisitions are subject to regulatory review.

- Legal challenges can disrupt business operations.

Prysmian's global reach means navigating complex trade rules; 2024 saw billions in penalties for trade violations.

Stringent environmental and industry-specific regulations demand constant compliance, increasing costs like the €50M sustainable initiatives and €120M R&D spend in 2024.

Antitrust laws, seen with 2023’s fines, alongside diverse labor laws and varying wages (like $7.25/hr US), shape operations.

| Legal Factor | Impact | 2024/2025 Relevance |

|---|---|---|

| Trade Regulations | Compliance Costs | Focus on sanctions and customs regulations. |

| Environmental Laws | Investment needs, sustainable design | Updated sustainability reports, initiatives. |

| Industry Standards | Ensuring Quality and Trust | Compliance needs to stay up-to-date |

Environmental factors

Climate change and decarbonization are key drivers for Prysmian. Their cables support renewable energy and grid upgrades. The global renewable energy market is projected to reach $2 trillion by 2030. Prysmian benefits from increased demand for sustainable infrastructure.

The environmental impact of sourcing raw materials like copper and plastics is significant. Prysmian emphasizes sustainable sourcing practices to mitigate these effects. In 2024, the company increased its use of recycled materials. This approach aligns with growing environmental regulations and consumer demand for eco-friendly products.

Waste management and recycling are crucial environmental factors for Prysmian. The company faces challenges managing manufacturing waste and cable end-of-life disposal. Prysmian is focusing on circular economy models. They aim to boost recycling rates. In 2024, the global waste management market was valued at $2.2 trillion.

Impact of operations on biodiversity and ecosystems

Prysmian's operations may affect biodiversity and ecosystems. They assess and reduce these impacts, especially in sensitive areas. This is crucial for subsea cable installations. The company's efforts align with growing environmental concerns and regulations. Prysmian's commitment to sustainability is evident in its environmental initiatives.

- In 2024, Prysmian invested €15 million in environmental sustainability projects.

- Subsea cable projects require detailed environmental impact assessments.

- Prysmian aims to reduce its carbon footprint by 42% by 2030.

Energy consumption and efficiency

Prysmian prioritizes reducing energy consumption and boosting efficiency across its operations. They invest in energy-saving tech and aim to increase renewable energy use in their facilities. This focus aligns with global sustainability trends and regulatory pressures. In 2023, Prysmian reduced its Scope 1 and 2 emissions by 15% compared to 2022, demonstrating progress in energy efficiency. Furthermore, the company plans to increase its renewable energy sourcing to 70% by 2025.

- 15% reduction in Scope 1 and 2 emissions in 2023.

- Target of 70% renewable energy sourcing by 2025.

Environmental factors are crucial for Prysmian's sustainability. The firm is committed to cutting its carbon footprint and boosting the use of renewable energy, targeting a 70% renewable energy sourcing by 2025. Prysmian's commitment is clear, with an investment of €15 million in 2024. This includes reducing emissions, with a 15% decrease in Scope 1 and 2 emissions in 2023.

| Metric | Data | Year |

|---|---|---|

| Investment in Environmental Projects | €15 million | 2024 |

| Renewable Energy Sourcing Target | 70% | 2025 |

| Scope 1 & 2 Emissions Reduction | 15% | 2023 vs. 2022 |

PESTLE Analysis Data Sources

The Prysmian PESTLE Analysis relies on financial reports, government publications, and industry specific research for each factor.