PulteGroup Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PulteGroup Bundle

What is included in the product

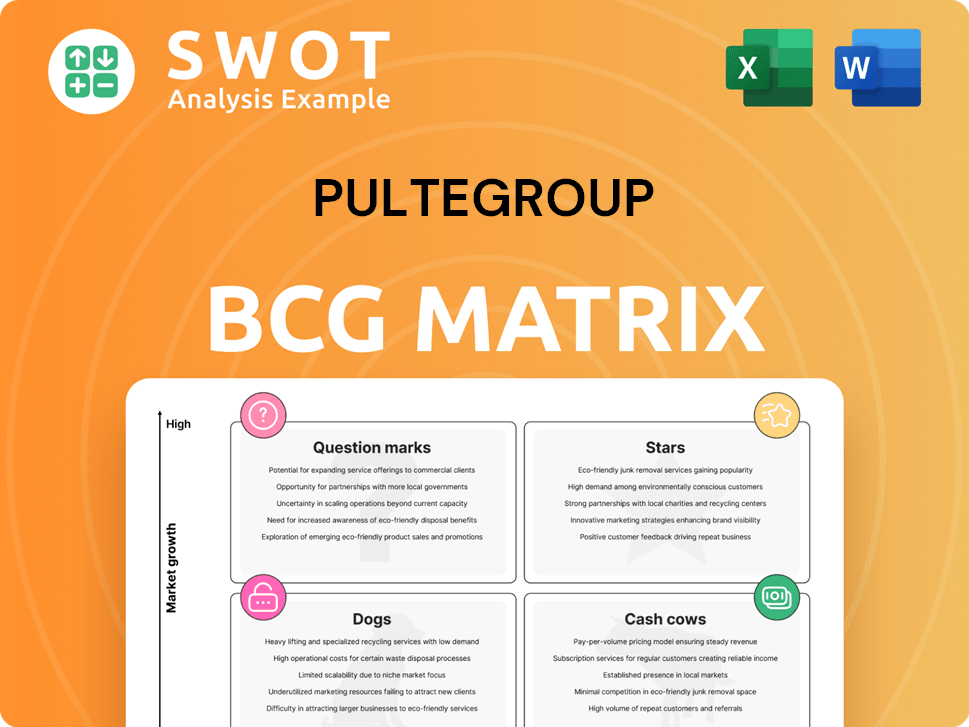

PulteGroup's BCG Matrix provides clear descriptions and strategic insights for its various business units.

Optimized PulteGroup BCG Matrix enables data-driven decisions, saving time and resources for strategic analysis.

Delivered as Shown

PulteGroup BCG Matrix

The preview shows the complete PulteGroup BCG Matrix report you'll receive. Downloadable immediately after purchase, the full document is print-ready and designed for clear strategic insights. It’s the same expertly crafted analysis, ready for your use.

BCG Matrix Template

Understanding PulteGroup's market positioning is key. The BCG Matrix categorizes its offerings into Stars, Cash Cows, Dogs, and Question Marks. This framework reveals where to invest, milk, or divest. This snapshot offers a glimpse, but strategic depth is crucial.

Dive deeper into the full BCG Matrix report. Uncover quadrant placements, insightful recommendations, and a roadmap for smart decisions and competitive advantage.

Stars

Move-up homes remain a strong performer for PulteGroup. This segment represented a substantial share of closings in 2024, contributing to revenue. Investing in land acquisition and development will fuel future growth. These homes, featuring larger layouts and premium amenities, boost PulteGroup's profitability.

PulteGroup's strategic land investments, especially in high-growth areas, are a star in its portfolio. In 2024, the company allocated significant resources to land acquisition and development, bolstering its lot pipeline. This proactive approach ensures a consistent land supply for upcoming projects. These investments are vital for maintaining construction activity and increasing market share in important regions. In Q3 2024, PulteGroup's land spend was $1.1 billion.

The Pulte Homes brand, a "star" in PulteGroup's portfolio, shines due to its strong brand recognition. It excels in the move-up buyer segment, fostering customer loyalty. In 2024, PulteGroup's revenue reached approximately $16.7 billion, reflecting its market strength. Its focus on design and customer experience solidifies its position.

Financial Services

PulteGroup's financial services, including mortgage financing and title services, are a key revenue driver. The mortgage capture rate is strong, reflecting a successful integration with homebuilding. Streamlining processes and improving customer experience can enhance financial services performance. These services provide convenience and boost PulteGroup's profitability.

- In 2024, PulteGroup's financial services segment generated a substantial portion of overall revenue.

- The mortgage capture rate consistently remained above 70% in 2024, indicating strong in-house financing uptake.

- Focusing on digital tools and faster loan processing times helped improve customer satisfaction.

- Financial services contributed significantly to the company's net income in 2024.

Built-to-Order Homes

PulteGroup's built-to-order homes are a star in its portfolio, allowing buyers to customize their living spaces. This strategy boosts customer satisfaction by catering to individual preferences and design choices. The expansion of design options and online tools can further enhance this segment's appeal and profitability. This approach likely contributes to higher margins. In 2024, PulteGroup's revenue grew by 10%, reflecting strong demand for its tailored home offerings.

- Customization drives higher customer satisfaction.

- Expansion of design options and online tools increases appeal.

- Built-to-order homes potentially offer higher margins.

- Revenue in 2024 grew by 10%.

PulteGroup's stars include move-up homes, strategic land investments, and the Pulte Homes brand, driving strong revenue. Built-to-order homes further boost customer satisfaction and margins. Financial services, with a high mortgage capture rate, contribute significantly to net income.

| Category | Description | 2024 Data |

|---|---|---|

| Move-Up Homes | Larger homes with premium amenities | Substantial share of closings. |

| Land Investments | Strategic land acquisition | Q3 2024 Land Spend: $1.1B. |

| Pulte Homes Brand | Strong brand recognition | Revenue: $16.7B. |

Cash Cows

Del Webb, a PulteGroup brand, is a cash cow, focusing on active adult communities. These communities enjoy steady demand and a loyal customer base. Minimal marketing investment is needed. In 2024, PulteGroup's revenue was over $15 billion, with Del Webb significantly contributing to this. The brand provides lifestyle-focused communities, generating consistent cash flow with limited additional investment.

PulteGroup's operational efficiency is a cash cow, fueled by streamlined processes. In 2024, they focused on cost management. Efficient land management and construction boosted profit margins. They're investing in tech for further gains. This maximizes profits without major new spending.

PulteGroup's geographic diversification, spanning over 45 markets, solidifies its cash cow status. This wide presence reduces dependence on specific areas, mitigating risks effectively. In 2024, PulteGroup's revenue reached $16.7 billion, showcasing the stability derived from its diverse market reach. Monitoring market conditions and adjusting investment strategies are key for optimizing returns. The broad presence guarantees stable revenue streams, even with fluctuating regional cycles.

Repeat Buyers

PulteGroup's repeat buyers form a crucial cash cow, consistently boosting revenue due to their prior positive experiences. This loyal segment significantly cuts marketing expenses, providing a steady income stream. Enhanced customer service and loyalty programs further solidify this group. These repeat buyers already trust PulteGroup, leading to reduced costs and reliable revenue.

- In 2024, repeat buyers accounted for a significant portion of PulteGroup's sales.

- Loyalty programs offer exclusive benefits, encouraging repeat purchases.

- Customer satisfaction scores directly impact repeat business rates.

- Reduced marketing spend on repeat buyers boosts profitability.

Land Option Agreements

PulteGroup strategically uses land option agreements, acting as a cash cow by reducing capital expenditure and risk. These agreements offer flexibility in acquiring land as needed without substantial upfront capital investment. This approach improves capital efficiency and allows PulteGroup to control land without significant initial outlays, boosting cash flow. In 2024, PulteGroup's focus on option agreements continues to be a key strategy for financial health.

- Reduced capital expenditure through land option agreements.

- Flexibility in acquiring land as needed.

- Improved capital efficiency.

- Enhanced cash flow from controlled land assets.

PulteGroup's cash cows generate consistent profits with low investment, bolstering financial stability. Geographic diversification and repeat buyers provide reliable revenue streams. Land option agreements and operational efficiency further enhance cash flow.

| Cash Cow | Description | 2024 Impact |

|---|---|---|

| Del Webb | Active adult communities with steady demand. | Significant revenue contribution, over $15B. |

| Operational Efficiency | Streamlined processes, cost management. | Boosted profit margins; tech investments. |

| Geographic Diversification | 45+ markets, mitigating risks. | $16.7B in revenue, stable despite cycles. |

Dogs

Entry-level homes in declining markets are often categorized as dogs, facing affordability issues and weak demand. PulteGroup might see these struggle in areas like Detroit, where home values have fluctuated. Strategic moves, such as smaller homes or incentives, are crucial. For example, in 2024, Detroit's median home price was around $80,000, signaling this challenge.

High-density urban projects, potentially dogs, struggle in competitive markets. They might need heavy marketing and incentives, especially with slower sales. Careful analysis and differentiation are critical. In 2024, urban housing starts were down, showing market saturation. Pulte's 2024 Q3 report highlighted strategic challenges in these areas.

Outdated home designs, a potential "Dog" in PulteGroup's BCG matrix, face buyer disinterest. These homes often need costly renovations, impacting profitability. Market research is crucial to stay relevant. Stale designs can decrease sales. In 2024, remodeling spending reached $492 billion, highlighting the cost of outdated looks.

Unprofitable Joint Ventures

Unprofitable joint ventures, like those that drain resources with minimal returns, fit the "Dogs" category in PulteGroup's BCG matrix. These ventures can significantly underperform. For example, a poorly performing project could contribute to a decrease in overall profitability. Strategic restructuring or divestiture becomes essential to improve financial performance. Proper due diligence and clear performance metrics are vital for joint ventures.

- Joint ventures failing to meet projected revenue targets are prime examples.

- Restructuring efforts might include renegotiating terms or seeking new partners.

- Divestiture could involve selling the venture to another company.

- In 2024, PulteGroup's focus was on profitable ventures.

Spec Homes in Oversupplied Areas

Spec homes in oversupplied areas can be "dogs" for PulteGroup. These homes, if unsold, tie up capital and increase holding costs, potentially leading to financial losses. Inventory management and strategic price adjustments are crucial for these properties. In 2024, the National Association of Home Builders reported rising inventory levels in some markets.

- Oversupply leads to increased holding costs.

- Price reductions may be needed to sell.

- Careful inventory management is vital.

- Unsold homes tie up capital.

Unprofitable ventures and projects with poor returns are categorized as dogs within PulteGroup's BCG matrix. These ventures drain resources with minimal returns. Strategic action is required to cut losses. For example, underperforming projects could lead to a decrease in profitability.

| Risk Factor | Impact | 2024 Data |

|---|---|---|

| Unprofitable Ventures | Reduced profitability | PulteGroup's focus on profitable ventures in 2024 |

| Poor Returns | Resource drain | Underperforming projects contribute to lower profits |

| Strategic Action | Restructuring/Divestiture | Divestiture of ventures in 2024 |

Question Marks

New sustainable homes are a question mark for PulteGroup. They target a growing niche. Marketing and education are key to increase adoption, with a focus on eco-conscious buyers. PulteGroup's 2024 investments and market strategies will determine their success. These initiatives align with the rising demand for eco-friendly housing, as seen in the increasing number of LEED-certified homes.

Emerging PropTech integrations represent a question mark for PulteGroup. These technologies, like AI-driven design tools and smart home features, promise enhanced efficiency and customer satisfaction. However, their impact remains uncertain, necessitating pilot programs and careful evaluation. For instance, in 2024, the PropTech market saw a 15% YoY growth, but adoption rates vary. Their effectiveness is still being assessed.

Expanding into new geographic markets with low brand recognition is a question mark for PulteGroup in a BCG matrix. These markets necessitate considerable investment in research and marketing. Success hinges on choosing the right markets and adapting to local preferences. Entry into new territories carries high risk, demanding substantial investment to build brand awareness. PulteGroup's 2024 revenue was approximately $16.7 billion, and market expansion strategies would impact this.

Affordable Housing Solutions (Innovative Models)

Affordable housing solutions, like modular construction, are question marks in PulteGroup's BCG Matrix. These innovative models tackle a pressing need, yet face regulatory and market acceptance hurdles. Partnering with government and community stakeholders is key to success. They could alleviate housing shortages, but their future is uncertain. The U.S. needs 3.8 million new homes to meet demand, according to the National Association of Home Builders.

- Modular construction costs can be 10-20% less than traditional builds.

- Micro-homes average 200-400 square feet, offering affordability.

- Regulatory approvals can delay projects significantly.

- Market acceptance depends on overcoming perceptions of quality.

Custom Home Building Division

A custom home building division within PulteGroup functions as a question mark in the BCG Matrix, given its potential for high margins but also its specific demands. This segment targets high-end clients, which could lead to increased profitability, yet it requires specialized skills and marketing strategies. The success of this division hinges on a thorough assessment of market demand and the competitive landscape. PulteGroup needs to carefully evaluate whether the investment in this area will yield significant returns.

- High-end clients typically have more disposable income, potentially leading to higher profit margins.

- Requires specialized expertise in design, construction, and client relationship management.

- Targeted marketing is essential to reach the desired clientele.

- Market demand analysis and competition assessment are critical for success.

PulteGroup's question marks face uncertain futures, demanding strategic evaluation.

Investments must be weighed against market risks, like regulatory hurdles and customer acceptance.

Success depends on tailored strategies, such as partnering, marketing, and geographic expansion.

| Question Mark | Risk | Opportunity |

|---|---|---|

| Sustainable Homes | Adoption rates and competition | Growing niche market |

| PropTech | Integration challenges, high costs | Efficiency gains, customer satisfaction |

| New Markets | Brand recognition challenges | Expansion & revenue growth |

BCG Matrix Data Sources

PulteGroup's BCG Matrix leverages financial statements, market share data, industry reports, and analyst evaluations.