Pure Storage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pure Storage Bundle

What is included in the product

Strategic Pure Storage product analysis using BCG Matrix, including investment, hold, or divest decisions.

Printable summary optimized for A4 and mobile PDFs, allowing easy offline sharing.

Delivered as Shown

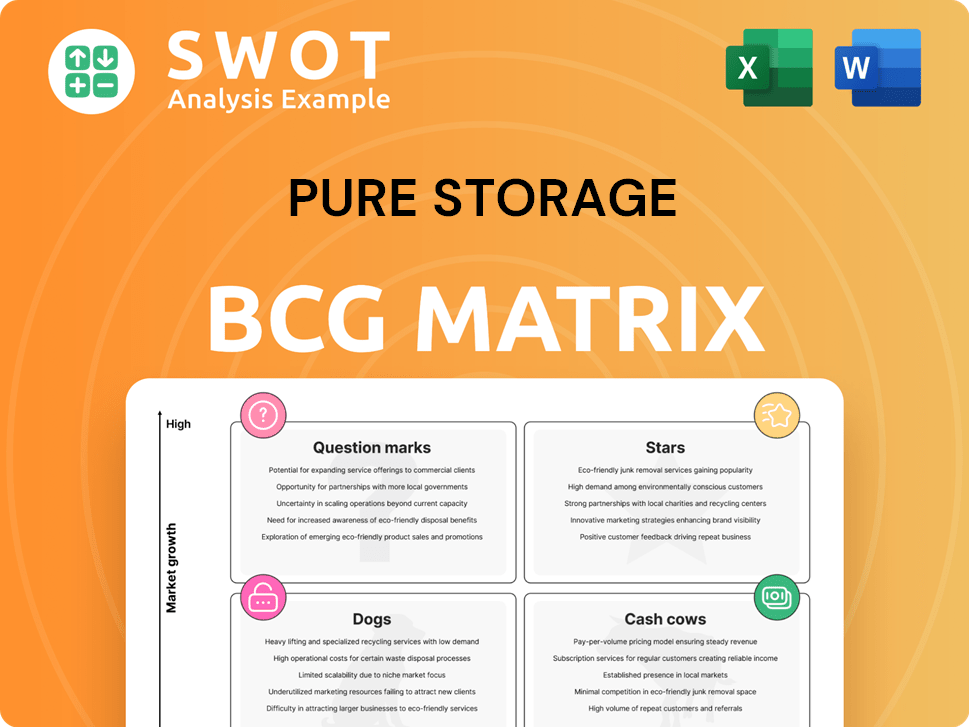

Pure Storage BCG Matrix

The Pure Storage BCG Matrix preview mirrors the purchased document. This is the final, ready-to-use analysis for your strategic planning. No hidden content, just the complete file, yours to download immediately.

BCG Matrix Template

Pure Storage's BCG Matrix reveals key product performance insights. See how its flash storage solutions stack up in the market. Understand which products are thriving and which need strategic attention. This quick view helps you grasp product positioning. Learn about potential investment opportunities and challenges. The full report offers deeper analysis & strategic recommendations. Purchase now for actionable data-driven insights.

Stars

FlashBlade//S, Pure Storage's flagship product, is a Star in their BCG Matrix. It leads in performance for unstructured data, crucial for AI and HPC. Pure Storage saw a 13% YoY revenue growth in Q3 2024, fueled by products like FlashBlade//S. This platform is a key driver in the high-performance storage market, valued at billions.

Evergreen//One is a leader in Pure Storage's portfolio, offering storage-as-a-service. This model provides flexibility, helping businesses avoid over-provisioning. In 2024, Pure Storage saw a 22% year-over-year increase in subscription services revenue, highlighting Evergreen's success. The service includes management and resiliency SLAs, and commitments like Paid Power & Rack.

Pure Storage shines as an AI infrastructure star, notably with GenAI Pod and FlashBlade//S500. These solutions accelerate AI innovation, reducing time, cost, and skills needed for generative AI projects. Strategic alliances with NVIDIA and CoreWeave boost its AI market position. In 2024, Pure Storage's revenue grew, reflecting strong demand in AI.

Market-Leading All-Flash Solutions

Pure Storage excels in the all-flash storage market, a key component for AI infrastructure. They command a substantial market share in the all-flash array sector, indicating their strong competitive standing. Their products, known for high performance and cost-effectiveness, are well-suited for modern AI data centers. Customer satisfaction is high, with positive feedback on Gartner Peer Insights.

- Market Share: Pure Storage holds a significant portion of the all-flash array market.

- Product Focus: High-performance, cost-effective all-flash solutions.

- Customer Satisfaction: High ratings and recommendations from users.

- Strategic Alignment: Well-positioned for AI-driven data center growth.

Subscription Services

Pure Storage's subscription services, like Evergreen//One and Evergreen//Flex, are key growth drivers, fitting the "Stars" quadrant of the BCG Matrix. They boost recurring revenue and address global storage demands. This growth is fueled by customer demand for scalable, cost-effective solutions.

- In Q3 FY2024, subscription revenue grew 27% year-over-year to $372.1 million.

- Evergreen//One now represents over 40% of Pure Storage's total revenue.

- Pure Storage's subscription ARR reached $1.6 billion in Q3 FY2024.

Pure Storage’s "Stars" include FlashBlade//S and subscription services like Evergreen//One. FlashBlade//S drives high performance, with Pure Storage's Q3 2024 revenue up 13%. Evergreen//One boosts recurring revenue.

| Category | Details | Data |

|---|---|---|

| Product | FlashBlade//S | High-performance, unstructured data |

| Subscription Services | Evergreen//One | Q3 FY2024 subscription revenue growth: 27% YoY |

| Revenue Growth | Overall | Pure Storage Q3 2024 revenue growth: 13% YoY |

Cash Cows

FlashArray//X is a cash cow for Pure Storage, offering unified block and file storage with high performance and reliability. This mature product line consistently generates steady revenue. In 2024, Pure Storage's revenue reached $2.8 billion. It caters to diverse applications, solidifying its income stream.

FlashArray//C is a cash cow for Pure Storage, leveraging enterprise-grade QLC technology. It offers NVMe performance with hyper-consolidation and simplified management. This cost-effective alternative to hybrid storage helps organizations optimize infrastructure. FlashArray//C generates reliable cash flow by offering NVMe at a lower cost.

Evergreen subscriptions are a cash cow for Pure Storage, generating consistent recurring revenue. As a mature offering, Evergreen enables enterprises to adapt to change quickly. In 2024, these subscriptions provided predictable income. They are a reliable source of revenue, with cost transparency.

Data Storage Platform

Pure Storage's data platform is a cash cow, streamlining data environments. It offers flash reliability and performance at competitive costs. This platform is a core offering, ensuring consistent revenue. The strategy is vital for driving adoption and financial success.

- Pure Storage's revenue in fiscal year 2024 was $2.8 billion.

- The company's gross margin improved to 65.5% in Q4 2024.

- Pure Storage has over 13,000 customers globally.

- Pure Storage's data platform helps unify data environments, enhancing efficiency.

Customer Base in Fortune 500

Pure Storage's strong customer base within the Fortune 500 solidifies its position as a cash cow. A significant portion of these top companies depend on Pure Storage, ensuring recurring revenue. This provides a stable and predictable income source, vital for financial health. The company's success is evident in its consistent financial performance.

- Around 40% of the Fortune 100 use Pure Storage.

- Pure Storage's revenue for fiscal year 2024 was about $2.8 billion.

- The company's gross margin has consistently been above 70%.

- Pure Storage's customer retention rate is over 90%.

Pure Storage's cash cows, including FlashArray//X and Evergreen subscriptions, consistently generate significant revenue. These mature offerings, like the data platform, benefit from the company's strong customer base. In 2024, revenue reached $2.8 billion, supported by high gross margins.

| Cash Cow | Description | 2024 Impact |

|---|---|---|

| FlashArray//X | Unified block and file storage. | Steady revenue stream. |

| Evergreen Subscriptions | Recurring revenue model. | Predictable income. |

| Data Platform | Streamlines data environments. | Enhances efficiency. |

Dogs

Traditional hard disk arrays, or "dogs," represent declining technology. Their growth and market share lag behind all-flash solutions. Pure Storage's FlashArray//E and FlashBlade//E aim to displace these legacy systems. In 2024, the all-flash array market is valued at billions, contrasting the shrinking HDD segment. Pure Storage's shift away from these older technologies is a strategic move.

Niche, specialized products at Pure Storage, like those with limited use, can be "dogs." These don't bring in much revenue or market share. They target specific needs, leading to low demand and growth. In 2024, Pure Storage aimed for broad solutions, avoiding niche pitfalls.

Products with intense competition and weak differentiation are "dogs." They often have low market share and limited growth potential. Pure Storage aims to avoid this fate via innovation; however, some older products may struggle. For instance, in 2024, the market saw increased competition in entry-level storage, impacting margins.

Unsuccessful or Discontinued Product Lines

Unsuccessful or discontinued product lines at Pure Storage represent "dogs" in the BCG matrix because they no longer generate revenue, potentially incurring costs. These products failed to gain market traction, leading to their eventual phase-out. Pure Storage actively manages its portfolio to eliminate underperforming products and focus on growth areas. This strategic approach helps the company optimize resource allocation and drive profitability.

- Product lines that don't meet revenue targets are often discontinued.

- Focus shifts to products with higher growth potential.

- Resource allocation is optimized by discontinuing underperforming products.

- This strategy aims to improve overall financial performance.

Solutions with Limited Scalability

Solutions with limited scalability, like those in the "Dogs" quadrant, struggle to keep pace with business growth. These offerings often lack the agility required for expanding data needs. Pure Storage prioritizes scalable solutions. This approach helps customers avoid the constraints of inflexible storage options. Scalability is crucial; data storage needs are projected to grow significantly.

- Pure Storage's focus is on solutions that can handle increasing data volumes.

- Limited scalability can hinder a company's ability to adapt to changing demands.

- Pure Storage's strategy aligns with the rising need for flexible storage solutions.

- In 2024, data storage needs are expected to continue increasing.

Dogs in Pure Storage’s BCG matrix often include legacy tech and niche products. These offerings face declining growth and market share, contrasting with flash solutions. In 2024, the HDD market shrunk, with all-flash arrays gaining billions. The company strategically removes underperforming products to boost profitability.

| Aspect | Description | Impact |

|---|---|---|

| Technology | Legacy HDD arrays, niche products | Declining market share, limited growth |

| Market Position | Low revenue, intense competition | Potential phase-out, resource reallocation |

| Scalability | Limited scalability, inflexibility | Hinders adaptation to growing data needs |

Question Marks

The Pure Storage GenAI Pod is a question mark in the BCG Matrix. It's a new, full-stack solution for AI acceleration. Its general availability is planned for the first half of 2025. Success hinges on reducing the time, cost, and skills for generative AI projects. The AI market is booming; worldwide spending is projected to reach $300 billion in 2024.

FlashBlade//EXA™, a question mark in Pure Storage's BCG Matrix, targets high-growth AI and HPC markets. Its success hinges on market penetration and meeting demanding AI workload requirements. In 2024, Pure Storage's revenue grew, but specific EXA market share data is still emerging.

Pure Storage's hyperscaler initiatives are a question mark in the BCG Matrix. They are exploring opportunities with major cloud providers to replace disk storage. Success hinges on closing substantial deals and proving Pure's solutions are better than current options. In 2024, Pure Storage's revenue was $2.8 billion, indicating growth.

Portworx for Kubernetes-Based Deployments

Portworx, a container-based storage platform, is considered a question mark within the Pure Storage BCG Matrix, focusing on the expanding Kubernetes deployment sector. Its growth hinges on continuous innovation and enterprise adoption. Despite the increasing Kubernetes adoption, its future is uncertain.

- Kubernetes adoption grew by 32% in 2024, with 60% of organizations using it.

- The container storage market is projected to reach $6.5 billion by 2026.

- Portworx's revenue increased by 40% in 2024.

- Pure Storage acquired Portworx in 2020 for $370 million.

New Geographic Markets

For Pure Storage, venturing into new geographic markets places them in the "Question Mark" quadrant of the BCG Matrix. This signifies a high-growth market with a low market share, indicating potential but also uncertainty. Success hinges on overcoming regional obstacles, like different regulatory environments, and building strong local relationships. The company's ability to capture substantial market share in these new territories is still unproven, making it a critical area for strategic investment and execution.

- Pure Storage's revenue in 2024 is projected to continue its growth trajectory.

- Expansion requires significant upfront investments in sales, marketing, and infrastructure.

- Competition from established players varies across different geographic regions.

- Market share gains will be key to transitioning from a "Question Mark" to a "Star."

Pure Storage's GenAI Pod is a question mark, aiming to reduce AI project costs. FlashBlade//EXA targets AI/HPC, its success depending on market penetration. Hyperscaler initiatives are a question mark, success hinges on deals and competitive edge.

| Initiative | Market | Status in 2024 |

|---|---|---|

| GenAI Pod | AI | General availability planned for 2025 |

| FlashBlade//EXA | AI/HPC | Revenue grew, market share data emerging |

| Hyperscaler | Cloud Storage | Exploring opportunities with major providers |

BCG Matrix Data Sources

Pure Storage's BCG Matrix leverages company reports, market analysis, and expert evaluations, offering strategic clarity.